The ever expanding regulatory system drives businesses to increase governance, regulation, and compliance (GRC) budgets and adopt RegTech solutions. While some financial institutions still doubt the efficiency and potential time savings, others are reaping the benefits of compliance software.

RegTech Implementation. Financial Institutions’ Perspective

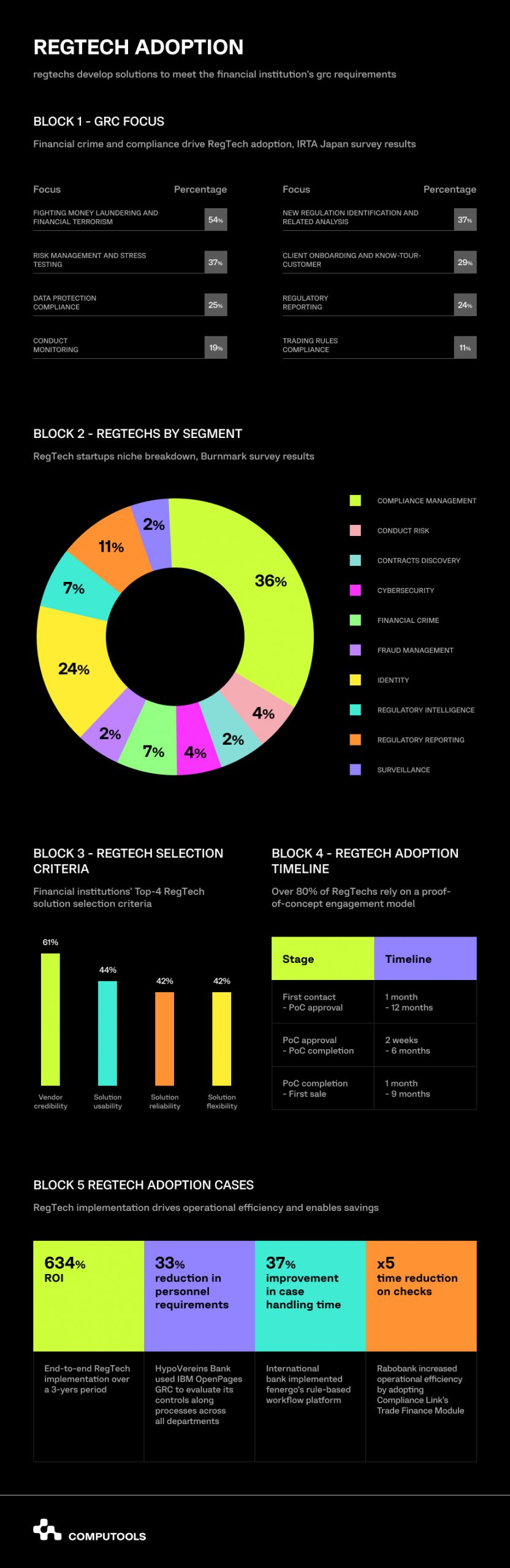

According to International RegTech Association survey results, the businesses identified financial crime, such as money laundering and terrorism financing, as their top concerns in 2018. Identification of new regulations, their impact analysis, as well as stress testing and regulatory risk management are among Top-3 GRC considerations for financial institutions.

Despite their obvious benefits, RegTech solutions come up against multiple adoption challenges, as businesses do not :

– Possess a clear GRC strategy ready for multiple point solutions;

– Wish to let sensitive information outside the company;

– Trust RegTech vendors to be secure and efficient;

– Find suitable RegTech solutions to fulfil their needs;

– Want to rely on third-party services and lose control over GRC.

Mistrust is the main issue preventing full-scale RegTech adoption. Survey results demonstrate that financial institutions are more worried about vendor credibility than solution usability and flexibility. When given the choice between existing partners and emerging RegTechs, all responders opt for established partnerships.

RegTech Implementation. Startups’ Perspective

The emergence of RegTech startups creates new niches and highly-specialized solutions for a plethora of segments, from cybersecurity and fraud management to regulatory intelligence and reporting. Automated compliance software offers multiple business benefits for banks and other financial institutions, including:

– Cost and time savings;

– Better and faster compliance;

– Ability to innovate;

– New business opportunities.

Considering businesses’ reservations concerning the adoption of new technologies, RegTech startups struggle to attract clients. Most of them have up to 5 successful cases under their belts, with proof of concept being their preferred engagement model. However, recently RegTech landscape saw a shift towards product licensing, services, and sandbox adoption engagement models.

Lengthy bureaucratic sales process is among the critical challenges startups face when dealing with banks and other financial institutions. Multiple silos within banks can also slow down the RegTech solution adoption across all branches. Some vendors struggle with in-house IT teams, understanding the context of financial compliance regulations, and the lack of modern software.

Successful RegTech Use Cases

Despite the bleak picture painted by RegTech adoption challenges for both vendors and businesses, successful cases inspire hope and stir up the interest in GRC software potential. The numbers are astounding: in three years an end-to-end RegTech adoption ROI can reach 634%.

Some of the most promising RegTech use cases include:

1. HypoVereinsbank reduced the GRC personnel needs by 33% through the use of IBM OpenPages. The bank put existing resources to better use and located gaps in controls to solve occurring problems promptly.

2. Fenegro cut down the client’s case handling time by 37%, shaving 28,380 hours off the workload. Efficiencies were gained across all case handling stages, including case assignment, document sourcing, preliminary risk assessment, and more.

3. Rabobank reduced the check time by the factor of five (from 15 to 3 minutes) though the adoption of Trade Finance Module by Compliance Link. The time savings are the result of a clear and efficient workload redistribution.

4. Continental consolidated four risk management systems and six processes into a single solution by IBM. The worldwide risk assessment reduced the number of Corporate-level risks by 75%, as minor threats were addressed at an earlier stage.

5. Citi partnered with Ayasdi to improve annual stress test results, as the bank failed two of the three checks. The partnership reduced the assessment time from nine to three months and lowered the personnel requirements from hundreds of employees to under 100.

These regulatory compliance examples demonstrate the potential benefits of RegTech adoption. Besides time and cost savings, GRС solutions enable financial institutions to streamline their processes and make a shift towards customer-centric approach to generate new business opportunities and drive revenue.

Leave the security concerns of your business and your customers in the past. Computools designs the most sophisticated solutions. Please email us at info@computools.com.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”