Understanding FinOps extends beyond the mere technical management of cloud resources, requiring organisations to adopt new cultural norms to balance innovation with cost control.

Gartner predicts that by 2025 about 65% of corporate budgets will be invested in cloud technologies, emphasising the critical role of financial Software Engineering in navigating complex market dynamics and staying competitive.

This article delves into the key aspects of FinOps, highlighting its core principles and fundamental phases that contribute to its effectiveness.

What Is FinOps?

The FinOps definition outlines a dynamic philosophy and cultural practice for effective cloud-based financial management. Its primary goal is to optimise a company’s value in both hybrid and multi-cloud environments.

This forward-thinking methodology combines the realms of finance and DevOps, highlighting the importance of forming a collaborative cross-disciplinary group uniting IT, finance and business teams.

This group is responsible for evaluating workload needs, designing efficient cloud architecture, centrally negotiating optimal cloud pricing, utilising cloud resources from a shared pool and applying best practices for budgeting, procurement, reporting, monitoring and management.

By bringing numerous company departments together, this approach aims to establish robust financial accountability for cloud spending. It also seeks to facilitate data-driven decision-making.

Understanding FinOps is important for businesses aiming to balance financial efficiency and innovation in their cloud operations.

The balance achieved allows businesses to make the most of cloud computing: CloudBolt’s survey across 500 global companies found that 89% consider FinOps the ideal approach for managing the complexities of cloud operations and cost implications.

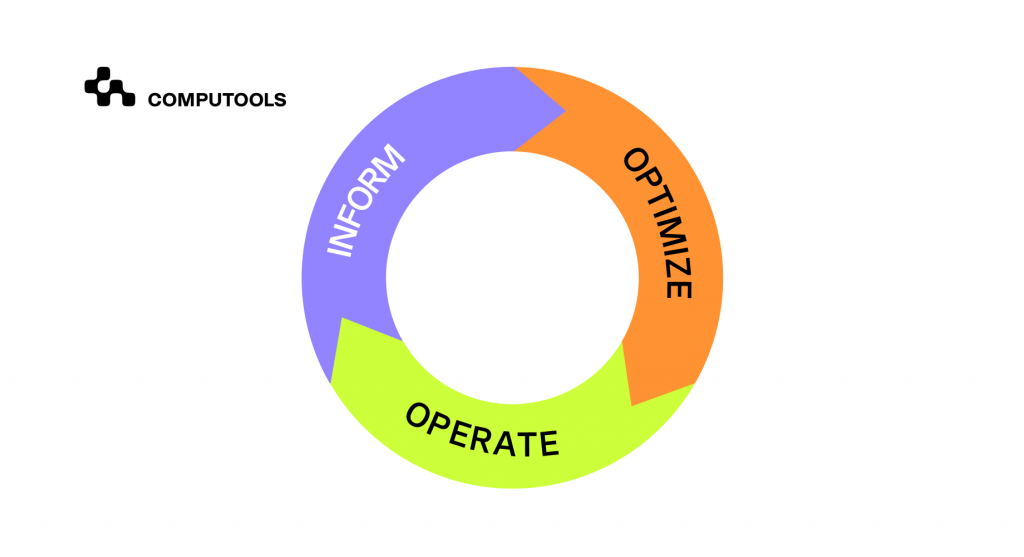

FinOps Framework And Key Phases

FinOps simplifies the way cloud operations work by providing a structured set of principles and phases. Similar to how DevOps enhanced agility in development, financial operations play a key role in maximising commercial value at different stages of cloud usage.

They refer to continually improving framework capabilities through three main phases: Inform, Optimise and Operate.

1. Inform

The first phase, ‘Inform’, emphasises the need to educate organisations and teams. It focuses on essential aspects such as visibility, allocation, benchmarking, budgeting and forecasting.

With the dynamic nature of cloud usage and pricing, clarity and instant visibility become a cornerstone of informed decision-making.

2. Optimise

Moving on to the ‘Optimise’ stage, teams work on maximising their presence in the cloud. Here, they fine-tune their environment for scalability, deactivating unnecessary resources.

The goal is to use cloud resources effectively and prevent excessive expenses.

3. Operate

In the ‘Operate’ phase businesses continually assess and enhance FinOps best practices. They measure and track outcomes based on speed, quality and cost, align cloud strategy with business goals and adjust budgets as needed.

This stage highlights the importance of a collaborative culture, promoting transparency and accountability.

In essence, these phases form an efficient approach for teams to manage their cloud costs, encouraging collaborative efforts and breaking away from traditional models.

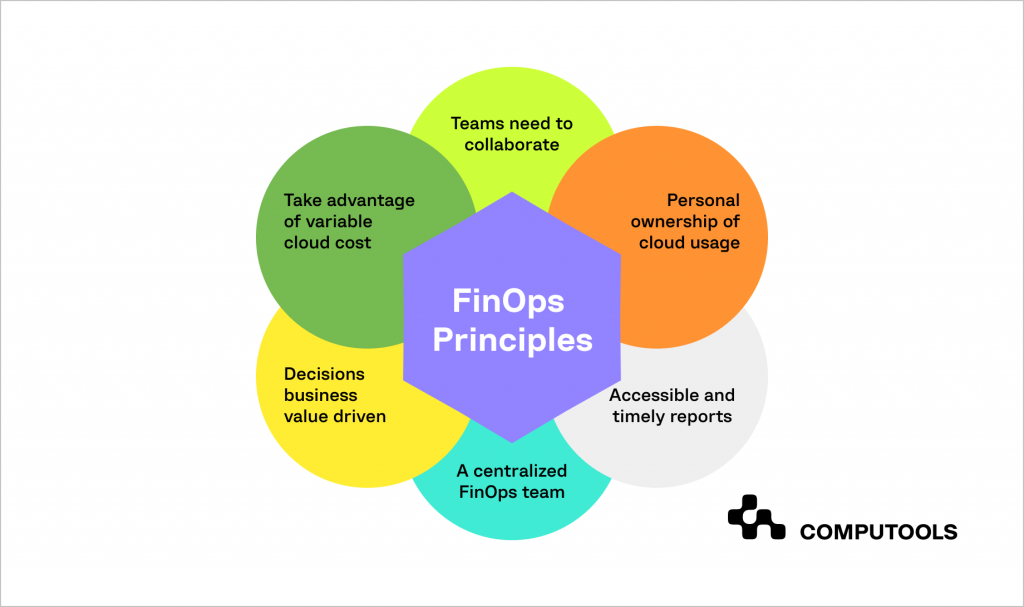

6 Fundamental FinOps principles

Guided by the fundamental FinOps principles, organisations are adopting a transformative approach to manage cloud costs. Let’s break down six key elements of cloud FinOps:

1. Collaboration

This principle emphasises teamwork and communication across departments. When teams collaborate, they can identify cost-saving opportunities and streamline processes in the cloud, contributing to overall financial optimisation.

2. Ownership

The ownership principle encourages everyone to take ownership of their cloud usage against budgets. In this way, teams can identify and eliminate wasteful practices, aligning their actions with financial objectives.

3. Centralised control

While individual ownership is important, a central team should oversee FinOps framework adoption, bringing together expertise from various areas.

4. Reporting and analytics

Timely and accurate reporting is a key part of the framework. Accessible reports provide decision-makers, particularly developers and engineers, with real-time insights into cloud spending, promoting a culture of financial responsibility.

5. Business-driven decision-making

Financial operations go beyond visibility and control, focusing on best practices and cultural shifts around cloud spending.

This principle emphasises evaluating the overall value returned to the business, considering multiple dimensions and trade-offs between speed, cost, quality and more.

6. Variable cost model

This ultimate principle involves leveraging the variable cost model of the public cloud.

Organisations following FinOps aim to minimise unused capacity and align utilisation with business needs, ensuring efficient resource allocation.

Simplifying Cloud Financial Management With FinOps

One of the key FinOps benefits is its promotion of collaboration between finance and technical teams. Such collaboration proves particularly valuable when addressing concerns about high costs from cloud service providers, a common worry for finance departments.

The inclusion of non-technical staff in technology decisions, initially met with resistance by IT and DevOps teams, ultimately proves to be a strategic move for effective cloud financial management.

Beyond simply managing expenses, FinOps solutions include financial oversight, the use of analytics and operational strategies, aiming to boost return on investment (ROI). Let’s discuss these and some other popular FinOps practices.

Computools

Software Solutions

Computools is an IT consulting and software engineering company that delivers innovative solutions to help businesses unlock tomorrow. Our clients represent a wide range of industries, including retail, logistics, finance, healthcare, and others.

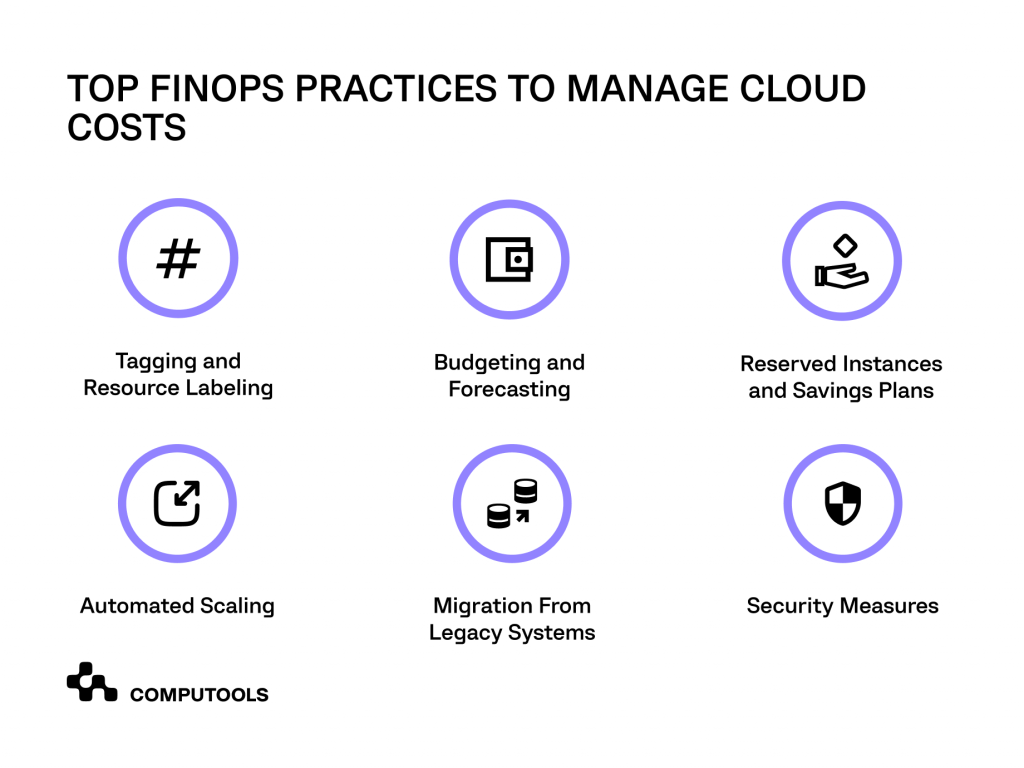

FinOps Practices

• Tagging and resource labelling are essential tools for tracking costs, managing cloud platforms, monitoring migration processes and improving security by clearly identifying the owners of specific resources.

• Budgeting and forecasting help plan for the financial impact of adopting new cloud technologies, migrating systems and implementing or upgrading security measures.

• Reserved instances and savings plans are used for stable workloads to reduce costs. These are especially helpful for organisations with consistent and predictable cloud usage patterns.

• Automated scaling is a core feature integral to cloud FinOps. Automated scaling based on demand ensures efficient resource usage, scaling up or down according to real-time demand to optimise costs.

• Migration from legacy systems to the cloud, along with careful monitoring and control of resource usage, is also a critical part of the FinOps approach.

Effective planning and execution of these migrations are paramount for organisations to harness the full potential of cloud technology while maintaining control over their operational expenditures.

• Security measures in dynamic and complex cloud financial operations ensure that financial practices adhere to ever-changing security protocols and standards for mitigating cybersecurity risks.

FinOps Challenges and Solutions

Despite numerous FinOps benefits, implementing these new practices also requires the overcoming of several key challenges.

1. Capacity planning

Challenge: For organisations, especially those experiencing rapid growth, balancing current capacity with future demand may be problematic.

Solution: Data-driven forecasting uses predictive analytics and data modelling to accurately anticipate future needs. Investing in scalable cloud infrastructure that can adjust to fluctuating demands ensures that organisations can swiftly adapt to changes.

2. Compliance with regulations

Challenge: Ensuring that cloud-stored data complies with various laws and regulations.

Solution: Automated compliance tools can greatly aid in monitoring and adhering to compliance standards. Implementing data sovereignty. FinOps solutions help manage data storage by geographic legal requirements.

Additionally, conducting regular compliance training for staff keeps everyone updated on their responsibilities regarding regulatory changes.

3. Technical difficulties

Challenge: Executing changes, from optimising infrastructure cost data to managing access and migrations.

Solution: Crucial to overcoming these technical issues is fostering collaboration between finance, IT and operations teams to align FinOps software modifications with business value.

Implementing effective resource tagging and management strategies also aids in efficient resource allocation.

Exploring Certifications

Recognising the critical importance of cloud financial management, some companies have started creating dedicated roles in this domain.

These positions are often filled by specialists certified with specific qualifications such as Certified Practitioners and Certified Professionals in financial management.

FinOps certifications, representing specialised expertise in FinOps services, are currently held by a relatively small group of professionals, as the FinOps philosophy is still gaining momentum in the industry.

These certifications are highly valued in areas like cloud economics, cost optimisation and cloud financial management due to the growing demand for domain knowledge.

The FinOps Foundation, a prominent organisation dedicated to advancing the approach through education and training, predominantly offers these certifications. The certification exam evaluates key FinOps competencies across several domains.

The certification exam assesses critical FinOps skills across various areas, starting with the challenges of cloud computing and distinguishing it from traditional IT.

Candidates need to clearly define FinOps and comprehend the specific roles, skills and structure of specialised teams dedicated to this area.

Additionally, they must have a deep understanding of the FinOps lifecycle, covering phases such as initial planning, cost optimisation and performance monitoring, alongside objectives like cost management and efficiency improvement.

The exam also requires knowledge of specific processes, for example, budgeting, cost allocation, and reporting.

Furthermore, candidates should be versed in key terms related to cloud computing (such as IaaS, CFM, CSPs, RIs), DevOps (including continuous integration and continuous delivery), and finance (like ROI and TCO), as well as details of cloud billing mechanisms.

As of now, FinOps is highly relevant and engages not only IT specialists with technical expertise but also the entire organisational team. As the practice grows, it is anticipated to evolve and establish a more permanent presence in the long term.

Pioneering FinOps: Computools’ Case Studies

FinOps fosters a collaborative approach that encourages partnerships within an organisation and with external structures that share similar principles, bridging cooperation across organisational boundaries.

At Computools, we have embraced the FinOps methodology in several projects, and we are excited to share some of these examples with you.

Finmap Online, a digital platform for managing company finances, faced numerous challenges that impacted its efficiency and user experience. The Computools team upgraded the platform to a cloud-based service, enhancing useability and security. This transition to the cloud, aligned with FinOps principles, not only improved the platform’s appeal but also ensured secure off-device data storage, strengthening client data protection. Consequently, the platform became more stable, significantly boosting customer trust.

In another case, the Caribbean Bank faced difficulties with integrating VISA connectivity within its banking application. Collaborating closely with the bank’s IT department, we made upgrades to the core banking services and mobile application, integrating VISA API microservices. This collaborative effort, rooted in FinOps practices, enabled the client to roll out retail banking services and enter a new market segment.

Kencharts, a start-up in the financial exchanges and data sector, aimed to extend its mobile application to the Android platform, mirroring its existing iOS app. Adopting a FinOps approach, Computools utilised technologies which allowed for code reuse and expedited development. The integration of the MPAndroidChart library also provided diverse charting options and high customisation.

The Future of FinOps in Cloud Financial Operations

Cloud computing is undergoing continuous transformations marked by extensive adoption. In the coming years, four significant trends will shape the trajectory of cloud computing and FinOps in cloud operations:

1. Cloud ubiquity

Gartner predicts a substantial increase in public cloud spending, projected to reach 45% of all enterprise IT spending by 2026, a significant rise from 17% in 2021. This points to a rapid shift towards cloud-centric operational practices.

2. Regional cloud ecosystems

In the same study, Gartner forecasts the emergence of regional and vertical cloud services as companies diversify their cloud strategies, engaging providers from various geographical locations.

This move is part of a strategy to broaden their cloud computing options by working with providers in different parts of the world. The goal is to make cloud systems more flexible and reliable.

3. Sustainability imperatives

With impending sustainability mandates, the environmental consciousness of cloud service providers (CSPs) is gaining prominence in decision-making.

Organisations may increasingly choose providers based on their environmentally friendly initiatives, in line with evolving sustainability requirements.

4. Programmable cloud infrastructure

Another promising trend is the widespread adoption of fully managed, AI-enabled cloud platforms and services provided by CSPs. The advantages include strengthened security, automated configuration management, ability to respond to demand patterns and set rules for scaling the infrastructure.

Conclusion

Unlocking the full potential of your cloud investments requires a customised approach, as there’s no one-size-fits-all solution. Embracing FinOps practices is an ongoing, iterative journey that needs constant adjustments to align with the unique needs of your business and stakeholders.

While the intricacies of this process might seem overwhelming, seeking guidance from experienced external advisers can be highly beneficial. These experts provide valuable insights, helping you pinpoint challenges and make strategic decisions that align with your business objectives.

Actively embracing FinOps for cloud management has the potential to enhance operational efficiency, cut costs and significantly increase the overall value derived from your cloud resources.

Don’t hesitate to contact us at info@computools.com to discuss your financial Software Engineering needs.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”