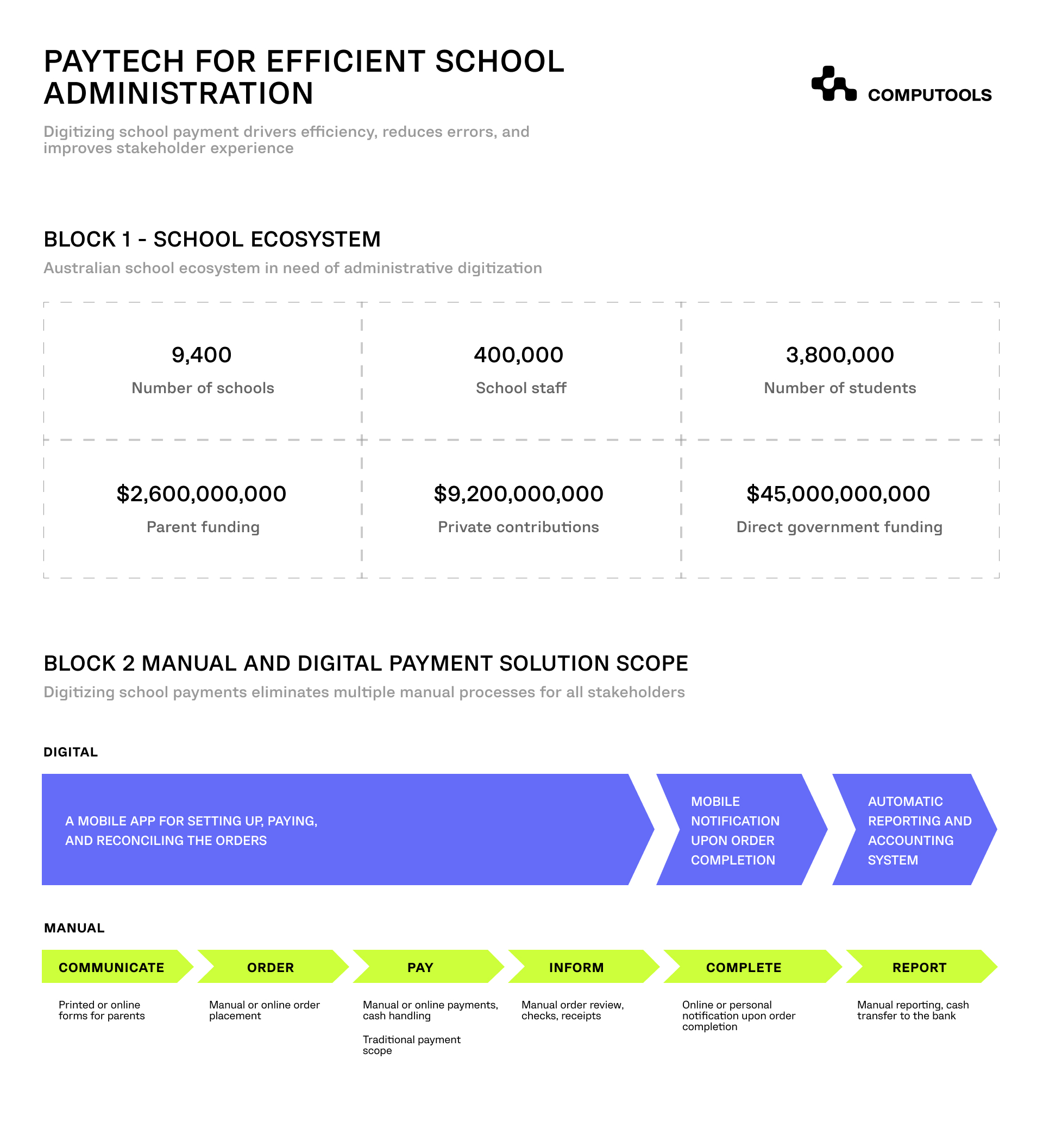

School administrators are seeking ways to transfer successful digitization experience from the classroom to the back office. The need for a transparent, secure, and user-friendly payment solution arises from the complexity of the current school transaction ecosystem. With up to 20% of the funds handled by schools being paid directly by the parents, the existing manual system creates multiple challenges:

- – Significant waste of teachers’ and administrators’ time;

- – Error-prone paper-based record keeping;

- – Increased potential for fraud and theft;

- – Security risks of handling bank card data;

- – Poor user experience for all stakeholders (teachers, administrators, parents, and students).

Payment Digitization Benefits for Schools

Education sector can also benefit from the digital disruption. Adopting cutting-edge PayTech solutions for handling student and parent payments is one of the most promising developments. Implementation of modern payment applications results in significant efficiency increase and savings. There are some schools that rely on card-based payment systems, but they do not realize the full potential of the end-to-end PayTech solutions that benefits all stakeholders. These benefits include:

- – Saving time of teachers. Teachers can concentrate on improving educational value instead of dealing with permission slips, processing, handling, and recording payments.

- – Saving time of administrative staff. Moving payments to the digital level frees school administrators from the tasks for handling cash and processing card payments.

- – Reduced number of late payments. Automated processes save school time spent on chasing late payments.

- – Reduced sensitive data risk. Schools are no longer responsible for credit card data security and timely updating.

- – Improved record keeping. Digitization opens secure storage and tracking capabilities preventing transaction data losses.

- – Superior user experience. PayTech solutions enable busy parents to pay in a comfortable and streamlined way increasing their engagement.

- – Improved security. Digital payments rely on a secure and stable banking infrastructure ensuring safe transactions.

Reduction in the cost of payment processing (by up to 60%) demonstrates enormous saving potential for a sector that suffers underfunding and is continuously facing the challenge of delivering the best educational outcomes without increasing the budget.

The Cost of PayTech Adoption for Schools

PayTech solutions require upfront capital investment and ongoing fees. Most solutions apply a fee based on the transaction value. Beside monetary expenses, schools also have to invest time into promoting the adoption of digitized payments and educating stakeholders on using the chosen PayTech solution. But despite initial time and resources investments, improved efficiency and shortened processing time reduce the overall cost of handling transactions.

Early adopters showcase the impact of custom PayTech solutions on school payment ecosystem without significant expenses and disruptions. Their digitization journeys display following common steps:

- – Existing transaction system assessment. Digitization is most beneficial for schools with a wide variety of transaction types and payment process flows.

- – Ideal outcome and criteria setting. To be efficient, PayTech solutions focus on realizing one or two outcomes and transaction types.

- – PayTech options identification. Multiple payment solution are available, but few meet the desired criteria and outcomes.

- – Options evaluation. Trials testing the performance of PayTech solutions against the outcomes and criteria to identify the best fit.

- – Business case development. High-performing options get compared by cost and expected benefits value.

- – Provider selection. The PayTech vendor offering the best performance and value is selected to fulfill the school’s digitization needs.

Use cases of PayTech solutions, such as Qkr by MasterCard, adopted by schools demonstrate significant time (268 days annually) and cost (60%) savings. Education leaders appreciate the potential and are advising decision-makers on improving school outcomes and rethinking school system at every level.

Our solution for digital payments works best for you. Contact Computools at info@computools.com.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”