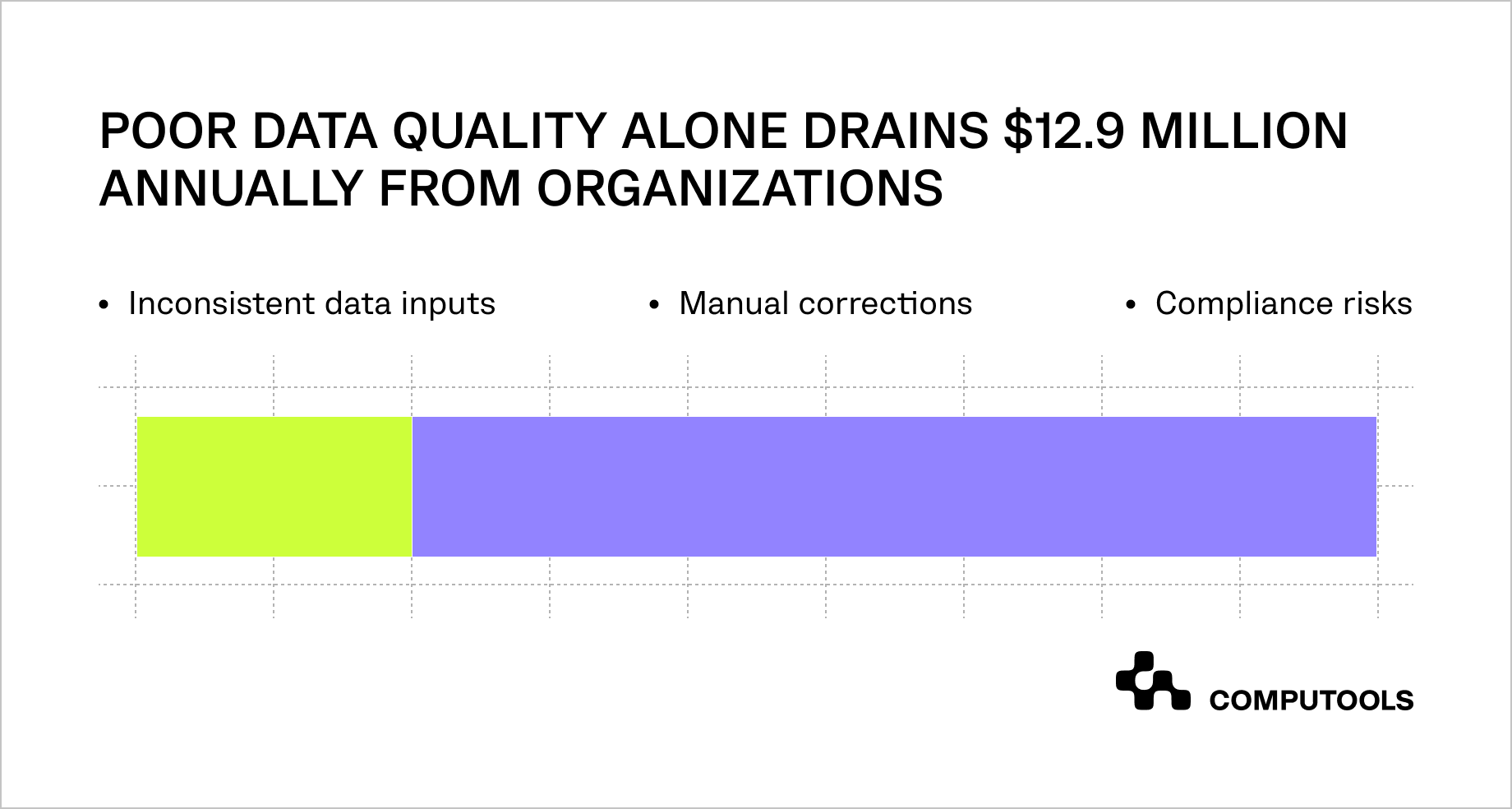

Retail marketplaces consistently underestimate the real marketplace data platform cost. Gartner claims that poor data quality alone costs organizations $12.9 million annually, driven by inconsistent data inputs, manual corrections, and compliance risks.

As marketplaces scale and onboard more sellers, the volume of data sources, formats, and integration points grows exponentially, making ingestion, governance, and BI the primary cost drivers. These components determine accuracy, resilience, and the platform’s ability to scale without operational failures.

The main question of this article is how much does it cost to build a marketplace data platform for retailers, and what factors the price will depend on.

How we optimized a marketplace data platform for a global retailer

Through advanced eCommerce software solution development and large-scale data engineering, Computools helped a global US-based retailer with more than $500bn in annual revenue transform how it collects, processes, and analyzes marketplace data.

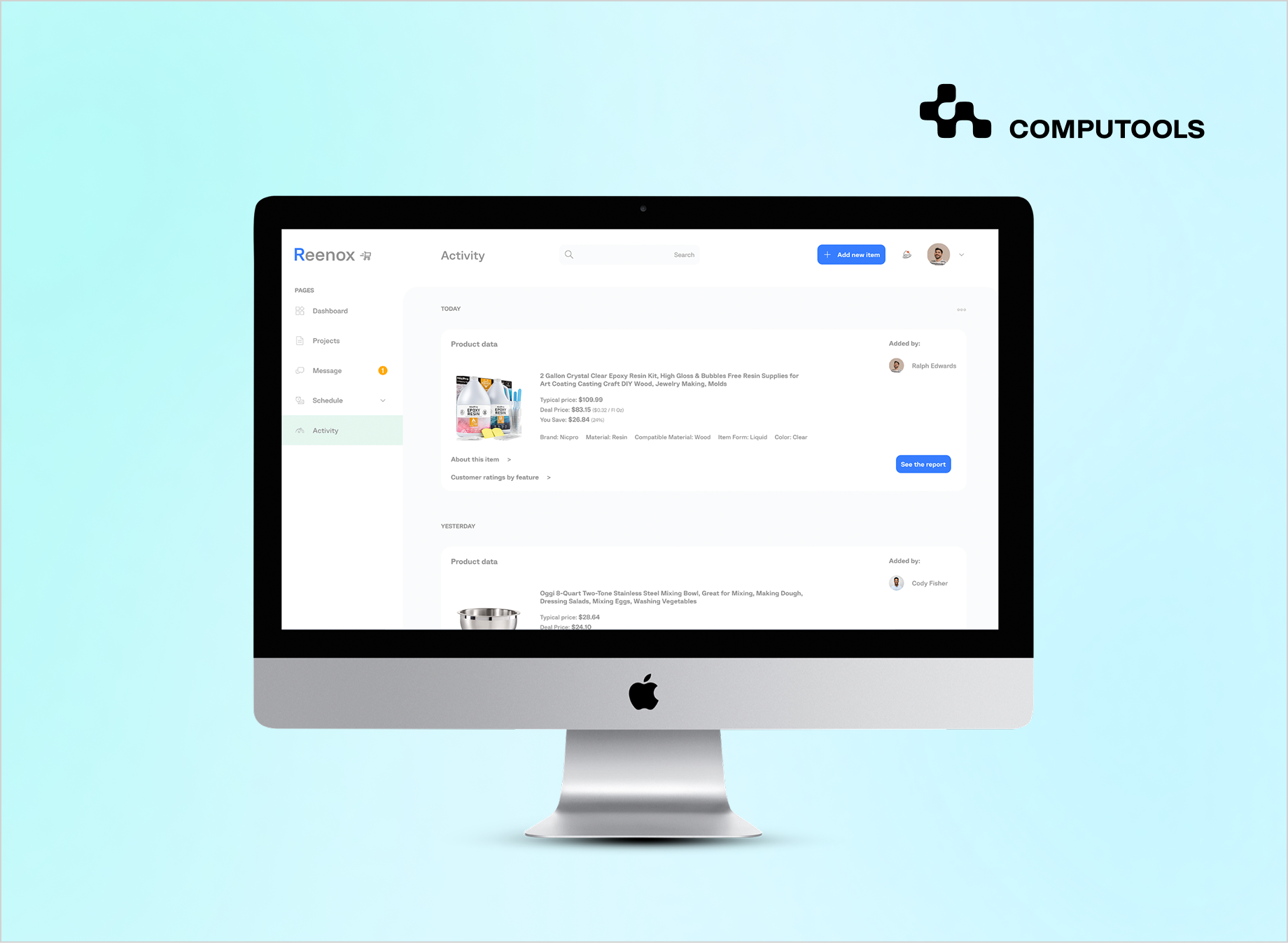

The Reenox platform became a unified environment that replaced manual spreadsheets, disconnected tools, and inconsistent data streams with a central workspace for product management, analytics, and marketplace trading.

By consolidating ingestion pipelines, establishing strong data governance, and enabling real-time BI, the client gained visibility across marketplace operations, improved decision-making, and significantly reduced operational overhead. This is a critical factor in understanding the true cost of data platform development for retail and the operational efficiency it enables.

The solution involved seamless data connectivity between retail systems, third-party sellers, and marketplace workflows. Inventory, pricing, product data, and seller metrics were synchronized automatically, eliminating manual corrections and errors. All teams used a single, accurate data source.

This sped up marketplace operations, improved team and seller collaboration, and raised productivity by 20%. Better data accuracy helped prevent stock issues, and real-time insights allowed the client to optimize product mix. The case shows that a well-designed marketplace data system enhances operations and highlights where investment delivers the highest retail ROI.

That’s why we’re sharing this article: we’ve built, tested, and scaled complex marketplace data platforms, and we understand the technology, architecture, and cost structure required to create a retail data platform that delivers measurable, long-term results.

In the next section, we break down retail data platform pricing in detail, explaining what actually drives the cost, where hidden expenses appear, and which factors retailers should prioritize when planning their investment.

What is the true cost of a marketplace data platform for retail (ingestion, governance, BI)?

When retailers ask about the marketplace data platform cost, they rarely want a random number; they want to understand what they are actually paying for. A marketplace data platform is not a single product; it’s a stack of ingestion, governance, BI, infrastructure, integrations, architecture, and long-term support decisions that unfold over several years, not sprints.

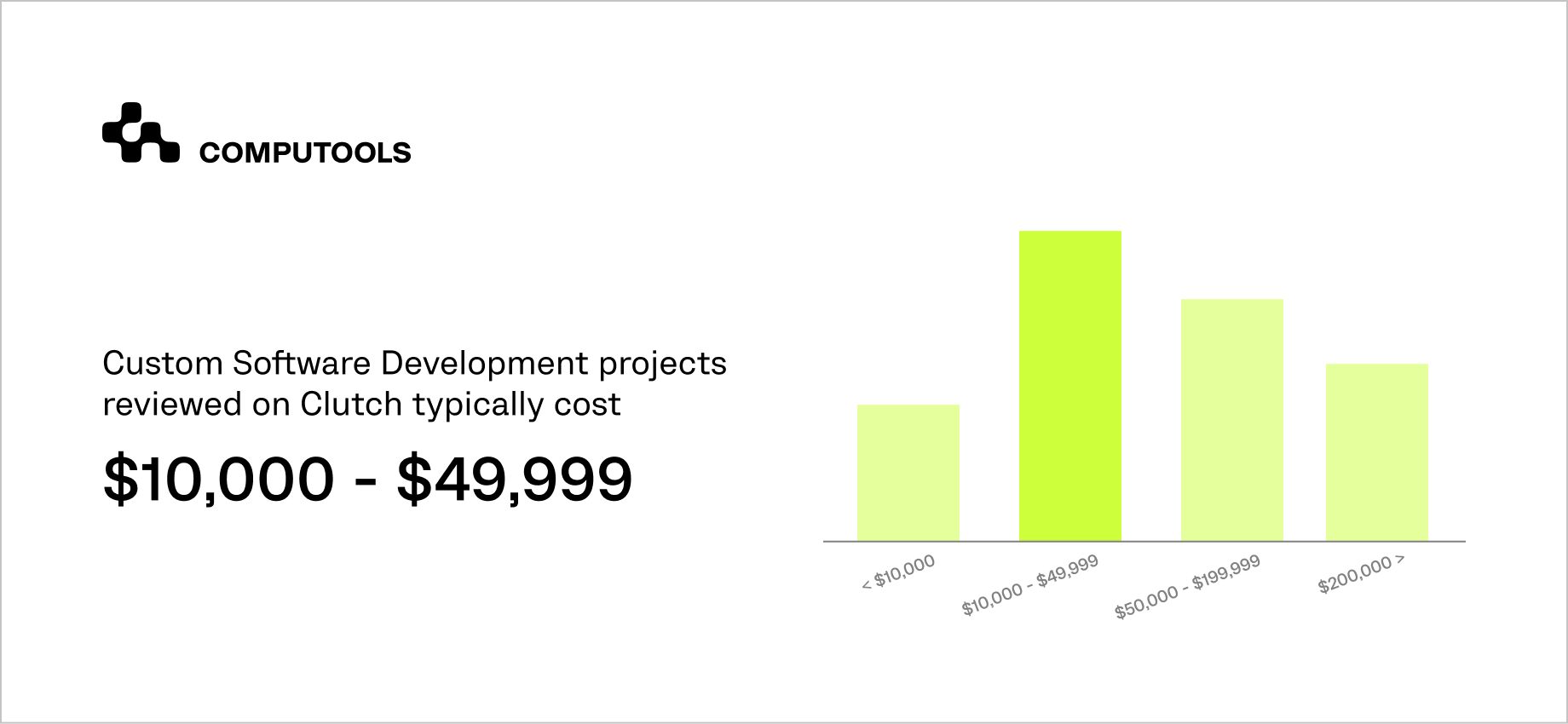

Independent market data shows just how wide the range can be. Clutch’s 2025 pricing guides indicate that most software development and eCommerce vendors charge around $25–$49 per hour, with custom projects starting roughly at $25,000 and going well beyond $200,000 for complex, enterprise-grade platforms.

Specialized marketplace studies show custom multi-vendor builds typically cost $100,000 to $350,000, with advanced implementations exceeding that depending on scope and integrations.

Serious marketplace data platforms operate in the “six figures and up” range, determined by architecture and ambitions. This is ultimately what shapes the cost of a unified retail data platform.

1. Ingestion: the foundation of the price

Ingestion is the first layer that determines whether your marketplace platform quietly works or constantly needs firefighting. This is also the stage at which the data ingestion platform costs begin to diverge, because no two retailers have identical source systems, seller networks, or synchronization requirements.

Here you are paying for:

• Connecting ERP, WMS, OMS, POS, eCommerce engines, and third-party seller systems;

• Normalizing dozens of CSV/JSON/XML flavors into a consistent model;

• Handling batch and streaming ingestion for prices, inventory, orders, and returns;

• Validation rules, throttling, and replay mechanisms so that one bad feed doesn’t corrupt everything.

Data ingestion platform cost grows with:

• The number of systems and sellers you integrate.

• How close to real-time you need updates (hourly vs. sub-minute);

• Data volume per day (tens of thousands vs. tens of millions of events);

• Legacy systems that can’t be changed and require custom adapters.

In the case of Reenox, the ingestion layer gradually became the “backbone” of the platform for a global retailer: the team moved from disparate Excel downloads and manual CSVs to streaming products, prices, and balances from dozens of stores into a single loop.

From a cost perspective, this wasn’t an “expense spike” but a strategic shift typical of marketplace platform development: fewer hours wasted on manual routines and data correction, and more investment directed into stable, scalable pipelines that reliably feed every upper-layer governance, analytics, and automation. Such reallocation is what ultimately ensures long-term efficiency rather than short-term savings.

2. Governance: making data trustworthy

A marketplace without governance quickly collapses into chaos: duplicate SKUs, conflicting prices, inconsistent stock levels across systems, and a lack of a reliable single source of truth.

This is the stage where data quality turns from an abstract concept into a real budget line, because governance shapes both the complexity of your data model and the level of control required.

Naturally, this is where the data governance platform cost begins to manifest as an ongoing operating model rather than a one-time tool setup.

Costs rise with the scale and depth of required controls:

• Catalogs and business glossaries covering thousands of product attributes

• Role-based access for HQ, regional offices, and seller teams

• Quality rules (completeness, uniqueness, cross-system consistency)

• Privacy, retention, and audit policies aligned with GDPR/CCPA

Gartner’s long-term observations confirm that mature enterprises continuously invest in governance — year after year — meaning the actual cost is less about licensing and more about sustaining the process, maintaining quality, and adapting to new regulatory and operational needs.

In the Reenox project, governance wasn’t a standalone “module”; it naturally developed as a set of rules: unified catalogs, access controls, standardized attributes across sellers and networks. This foundation enabled the client to scale analytics and promo automation without frequent structural data patches.

3. BI & analytics: from reports to retail decisions

Once ingestion and governance are in place, retailers finally want insight: seller contribution, category margins, click-to-purchase conversion, stock-out risk, promotion performance, and demand patterns.

At this stage, the retail BI platform pricing depends primarily on how far a retailer wants to go from daily dashboards to real-time forecasting and AI-driven recommendations.

Cost drivers include:

• The number of active users (category managers, buyers, finance, and marketplace ops)

• Concurrency requirements (occasional access vs. hundreds of parallel sessions)

• Analytical depth: descriptive dashboards vs. elasticity models, forecasting, ML

• Freshness expectations: next-day KPIs vs. live monitoring of campaigns and SLA

Market benchmarks show dramatic pricing variability because BI vendors use different models: per-user, per-compute-hour, per-query, or combinations of all three. This is why the right question is not “How much does BI cost?” but “Which decisions should BI support and how many people need them daily?”

In the Reenox platform, the initial focus was on operational reporting, stock levels, demand patterns, and seller productivity. Still, the same stack easily scales to ML forecasting or customer segmentation when the business is ready to invest in more advanced layers.

4. Infrastructure and the marketplace data backbone

Under every marketplace platform lies a dense infrastructure layer: data warehouses or lakehouses, pipelines, storage, networking, monitoring, and access management. The total marketplace data infrastructure costs depend heavily on deployment choices and performance needs, especially for retailers processing millions of events daily.

Typical cost drivers:

• Cloud provider, regions, and availability zones

• Storage volume and retention windows

• Compute demand for ingestion, transformation, and analytics

• Reliability requirements (multi-AZ, multi-region, DR clusters)

• Whether the team uses managed services or maintains its own components

Public cloud pricing guides show that infrastructure budgets for enterprise-grade data platforms routinely reach mid- to high six-figure levels annually, including compute, storage, observability, and engineering time.

In the Reenox case, the backbone combined BigQuery, Kafka, and distributed services to ensure stable ingestion and scalable analytics. The focus was on building resilient infrastructure capable of withstanding growth, particularly during seasonal peaks, rather than on cheap infrastructure.

5. Integrations & marketplace-specific logic

Marketplace environments rely on dozens of interconnected systems: seller APIs for catalogs, prices, and inventory; payment providers; tax engines; delivery and return services; CRM and promo tools. This is where the marketplace data integration cost grows steadily, not due to a single feature, but because integrations accumulate over time and require continuous evolution.

Cost increases with:

• The number of sellers, countries, and currencies

• Edge cases in taxes, discounts, rounding, and regional rules

• Monitoring and testing scenarios for every integrated partner

• Compliance layers required for payments and invoicing

In Reenox, integrations delivered the largest business impact: combining several retail networks into a unified flow and providing partners with consistent APIs. But technically, integrations also proved the longest-lasting investment; they require updates whenever a partner changes a schema, a tax rule shifts, or a new seller joins the ecosystem.

6. Architecture and operating model

Architecture defines how expensive or efficient your future platform will be. The modern retail data architecture cost reflects tools and the structural decisions: modular vs. monolithic services, domain-driven boundaries, event-driven ingestion vs. batch, and multi-tenant vs. single-tenant setups.

These choices impact:

• Time-to-market for new marketplace features

• Infrastructure efficiency (over- vs under-provisioning)

• Peak-load stability (e.g., Black Friday)

• The ability to add new business models (B2B marketplace, cross-border trade, drop-shipping)

In the Reenox project, the architecture relied heavily on event-driven flows and decoupled services, enabling the team to scale without breaking what was already live.

7. Vendor, geography, and delivery model

Beyond the technology stack, the total investment is shaped by the team behind the platform. Global market analyses consistently show that software and eCommerce engineering rates fall into a broad mid-range, and custom marketplace builds can vary from modest five-figure engagements to complex six-figure programs.

This spread is exactly what influences data marketplace software pricing: geography, seniority, and proven marketplace expertise often determine more than the tools themselves.

The biggest differentiators are:

• Vendor location (North America vs. Western Europe vs. Central/Eastern Europe)

• Proven expertise in marketplace and retail data platforms

• Collaboration model: end-to-end delivery, staff augmentation, or hybrid

• Whether the partner provides architecture development, governance, and cost-optimization consulting or just development “hands.”

In the Reenox case, the value came from an iterative approach: starting with stabilizing operations and data flows, then moving toward advanced analytics and marketplace growth tooling.

8. Putting it all together

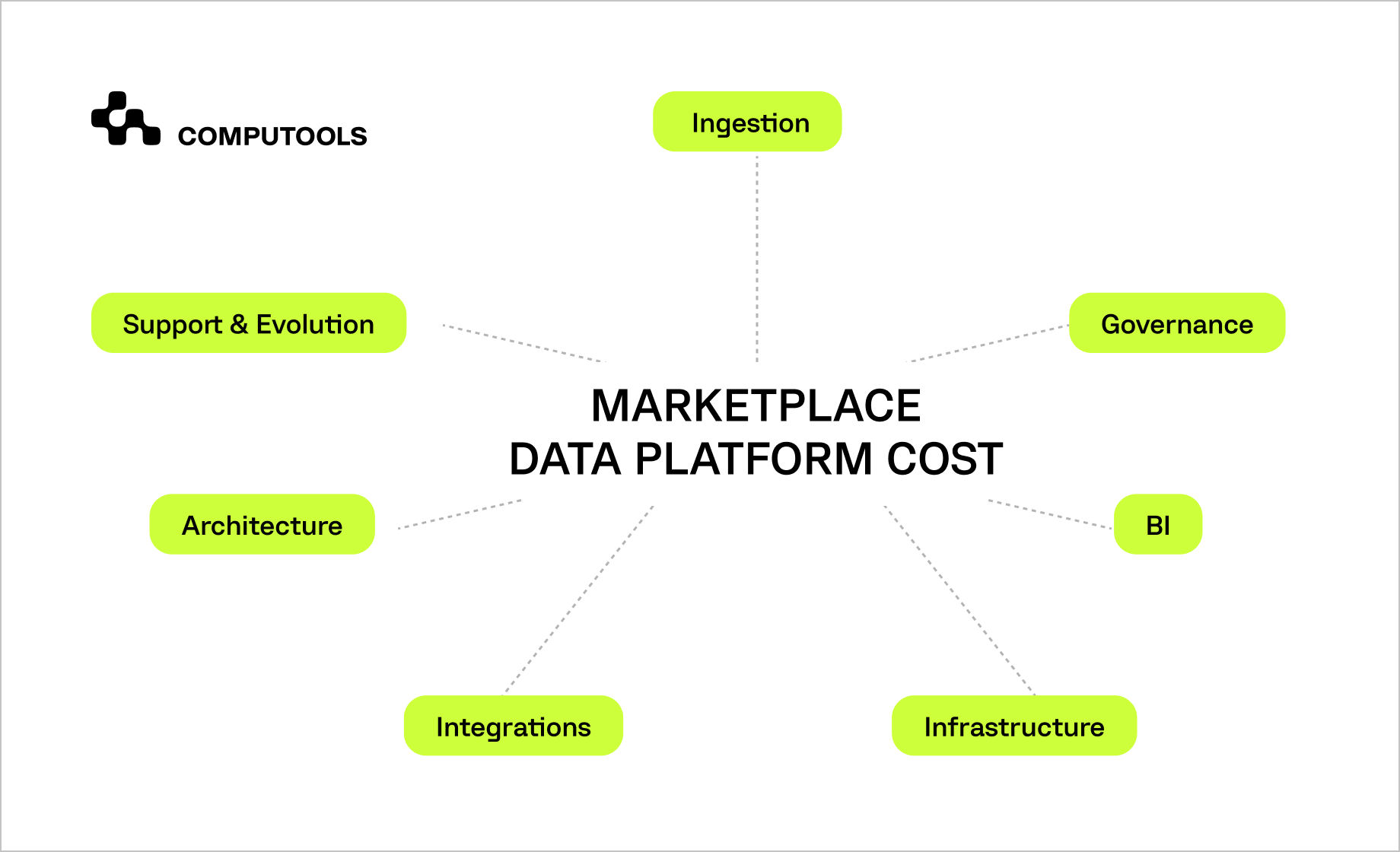

When all layers are combined, the cost of a unified retail data platform becomes a sum of:

• Ingestion, governance, and BI foundations

• Infrastructure, storage, and observability

• Integrations and partner management

• Architectural design and ongoing reviews

• Support, incident handling, and continuous evolution

The key question concerns the platform’s total cost and how it changes at each stage, from an MVP to a fully operational retail data engine supporting marketplace, eCommerce, and in-store activities.

Learn the essential cost drivers of retail data platforms and how to align spending with measurable business impact.

Cost of the marketplace data platform stack

To consolidate all findings into a single view, the table below summarizes the full cost structure of a modern marketplace data platform. Each layer introduces its own technical responsibilities, operational patterns, and scaling dynamics, together forming the total cost of ownership over the platform’s lifecycle.

This framework helps retailers evaluate where investment creates long-term value and which elements require the highest degree of architectural discipline.

| Layer | Scope in Retail Data Platforms | Primary Cost Drivers |

| Ingestion | Multi-source collection from ERP, WMS, OMS, POS, eCommerce engines, seller APIs; normalization and validation across heterogeneous formats. | Number of systems & sellers, data formats, real-time vs. batch, data volume |

| Governance | Enterprise taxonomies, policies, access models, quality rules, lineage, retention, and PII compliance across marketplace stakeholders. | Regulatory scope (GDPR/CCPA, PCI), level of automation, and auditability requirements |

| BI & analytics | Dashboards, semantic layers, forecasting models, operational reporting, ad-hoc analytics, and multi-department access. | Number of users, freshness (real-time vs. daily), advanced analytics/ML |

| Core data infrastructure | Data warehouses/lakehouses, storage layers, compute clusters, orchestration, monitoring, networking, and access security. | Cloud vs. on-prem, region, performance SLAs, redundancy, and resilience |

| Integrations & marketplace APIs | Seller onboarding flows, catalog/pricing/stock sync, order/returns updates, payout logic, tax engines, logistics integrations. | Number of external systems, legacy constraints, third-party tools, and licenses |

| Modern data architecture | Domain-driven boundaries, event-driven streams, microservices/modular design, data contracts, multi-tenant or single-tenant models. | Complexity of domain model, need for multi-region support, multi-cloud/edge scenarios |

| Support & evolution | DevOps services/SRE, reliability management, continuous delivery, incident response, new features, optimization cycles. | 24/7 vs. business-hours support, release tempo, experimentation culture |

Trends influencing costs in marketplace data platforms

Retailers are entering a period in which the cost of data platforms is defined less by “how much the tool costs” and more by how the business uses them. Cloud providers are shifting from simple licensing to hybrid models that mix pay-as-you-go, reserved capacity, committed spend, and multi-region pricing.

This makes cloud data platform pricing for retailers a moving target: flexible in theory, but volatile without proper FinOps oversight, especially when compute, storage, and network usage scale faster than GMV.

Another major trend is the internal democratization of data. Business teams expect self-service dashboards, instant KPI access, and on-demand insights, not a queue of requests for the data team. As usage explodes, companies must rethink the cost breakdown of retail data platforms (ingestion, governance, BI): each new dashboard, segment, or forecasting model generates additional scans, compute cycles, metadata updates, and governance overhead.

Regulatory pressure is rising as well. Consent management, cross-border data policies, audit trails for ML-driven promotions, and full transparency of data lineage are increasingly mandatory. This elevates the importance of the governance layer, not only tools, but data ownership models, metadata standards, and continuous quality reviews.

Finally, nearly every large retailer is moving from batch to real-time, event-driven architectures. Prices, inventory, promotions, and delivery SLA updates are expected within minutes, not hours. This accelerates investment in streaming pipelines, stateful processing, and scalable service meshes.

Platforms designed with these future requirements in mind often cost more upfront but avoid the far more expensive “tear down and rebuild” cycle once the marketplace outgrows its early MVP.

How Computools guides retailers through the marketplace data platform cost

Computools delivers end-to-end retail software development services, helping retailers build scalable data ecosystems that eliminate fragmentation, streamline operations, and provide full visibility across marketplace workflows. Our work with a global US-based retail chain demonstrated how the right architectural decisions, from integrating multi-source data pipelines to establishing strong governance and BI layers, can transform marketplace performance without driving unpredictable expenses.

Retailers often seek clarity around the average price of data ingestion and governance systems for retail, and our role is to make these cost drivers transparent. We begin by assessing data sources, catalog complexity, real-time requirements, seller eCommerce integration patterns, and scalability needs. Based on this, we design an architecture that aligns with business reality rather than abstract technical ideals, ensuring each investment delivers measurable operational value.

In the Reenox project, we helped the client replace manual processes and disconnected tools with a unified data platform that enabled stable data pipelines, consistent seller data synchronization, and deep analytics. This led to faster marketplace operations, fewer data errors, and strong decision-making support across categories and inventory teams, all achieved without relying on inflated infrastructure costs.

Across projects, our focus remains consistent:

• building stable, scalable ingestion and governance foundations that can handle rapid seller growth,

• designing transparent and predictable architecture, so cost planning is straightforward,

• delivering daily operational impact, from inventory accuracy to strategic analytics.

Computools develops data platforms that solve today’s challenges while giving retailers confidence to scale their marketplace without chaos, bottlenecks, or unexpected costs.

If you need clarity on the cost to build a retail data platform or want expert guidance on designing the right architecture for your business, contact our team at info@computools.com. We’ll help you plan and build a solution that truly fits your goals.

Summary

Building a modern marketplace data platform is never a matter of a single tool or one-time implementation. It is a layered ecosystem where ingestion, governance, BI, infrastructure, integrations, and architecture evolve together and define both capabilities and long-term cost of ownership.

Public benchmarks reveal a pattern: simple setups stay in the lower range, but retail environments with many systems, multi-seller inputs, real-time updates, and regulations push budgets into six figures. The main variability depends on your operational model: the number of integrated systems, update frequency, governance automation, and teams that use analytics daily.

This is why retail data pipeline development pricing depends far more on scope and ambition than on tooling alone.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”