The global peer-to-peer (P2P) lending market reached USD 7.29 billion in 2025 and is projected to grow to USD 33.81 billion by 2034, with a 19.1% CAGR.

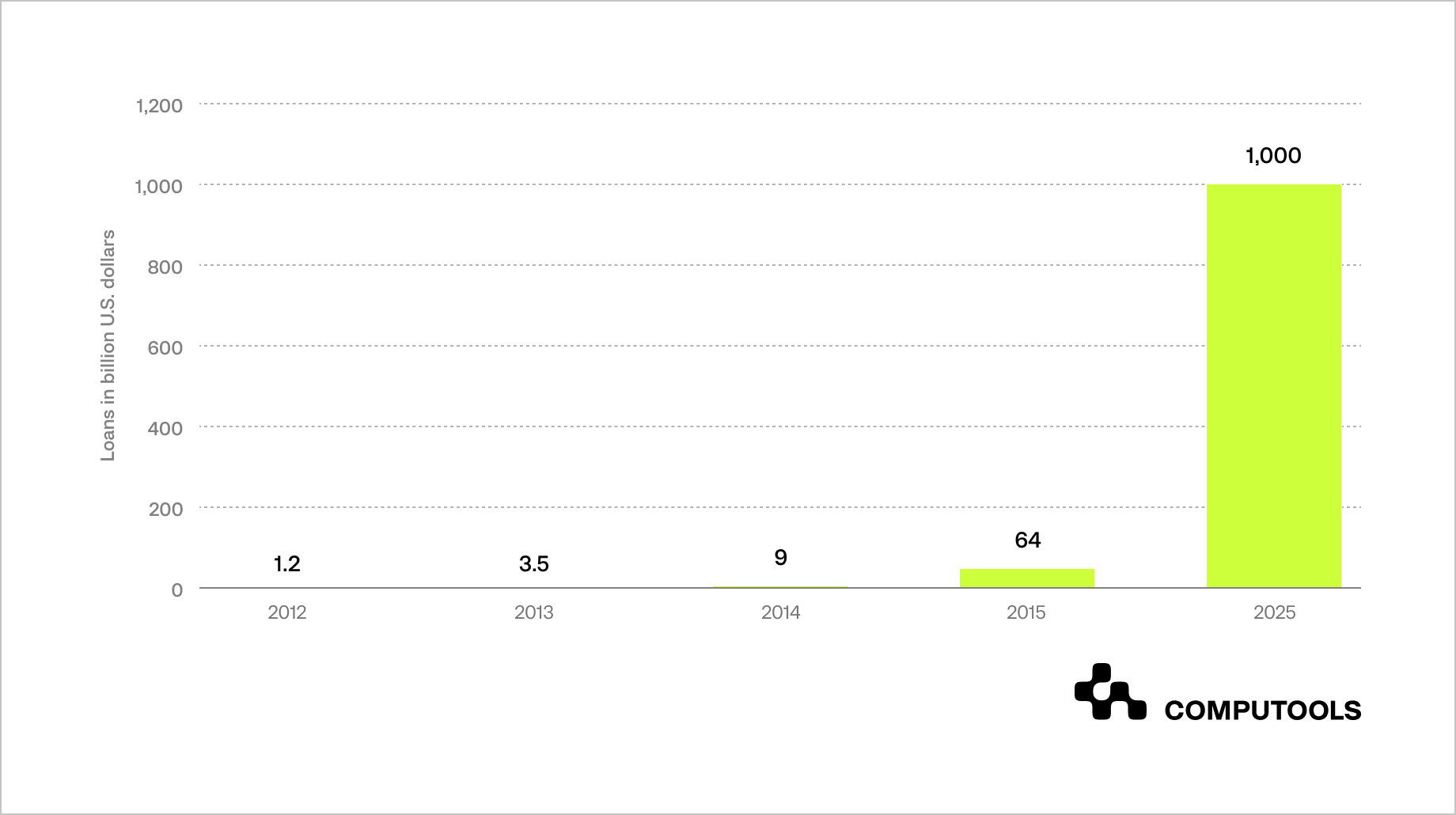

As fintech companies seek to build peer-to-peer lending platforms that can scale beyond saturated markets, historical data shows how rapidly this model has evolved from USD 3.5 billion in global volume in 2013 to a mainstream digital financing channel within a decade.

This gap is most visible in emerging markets, where millions of individuals and small businesses remain excluded from traditional banking due to limited credit histories, high interest rates, and slow approval processes.

While global P2P lending continues to expand, conventional models often fail to address the realities of low-data environments, fragile trust, and evolving regulation, creating both a challenge and an opportunity for purpose-built platforms.

To illustrate how these principles work in practice, we now turn to a real-world case that demonstrates how we delivered lending web solutions tailored to the constraints of an emerging market.

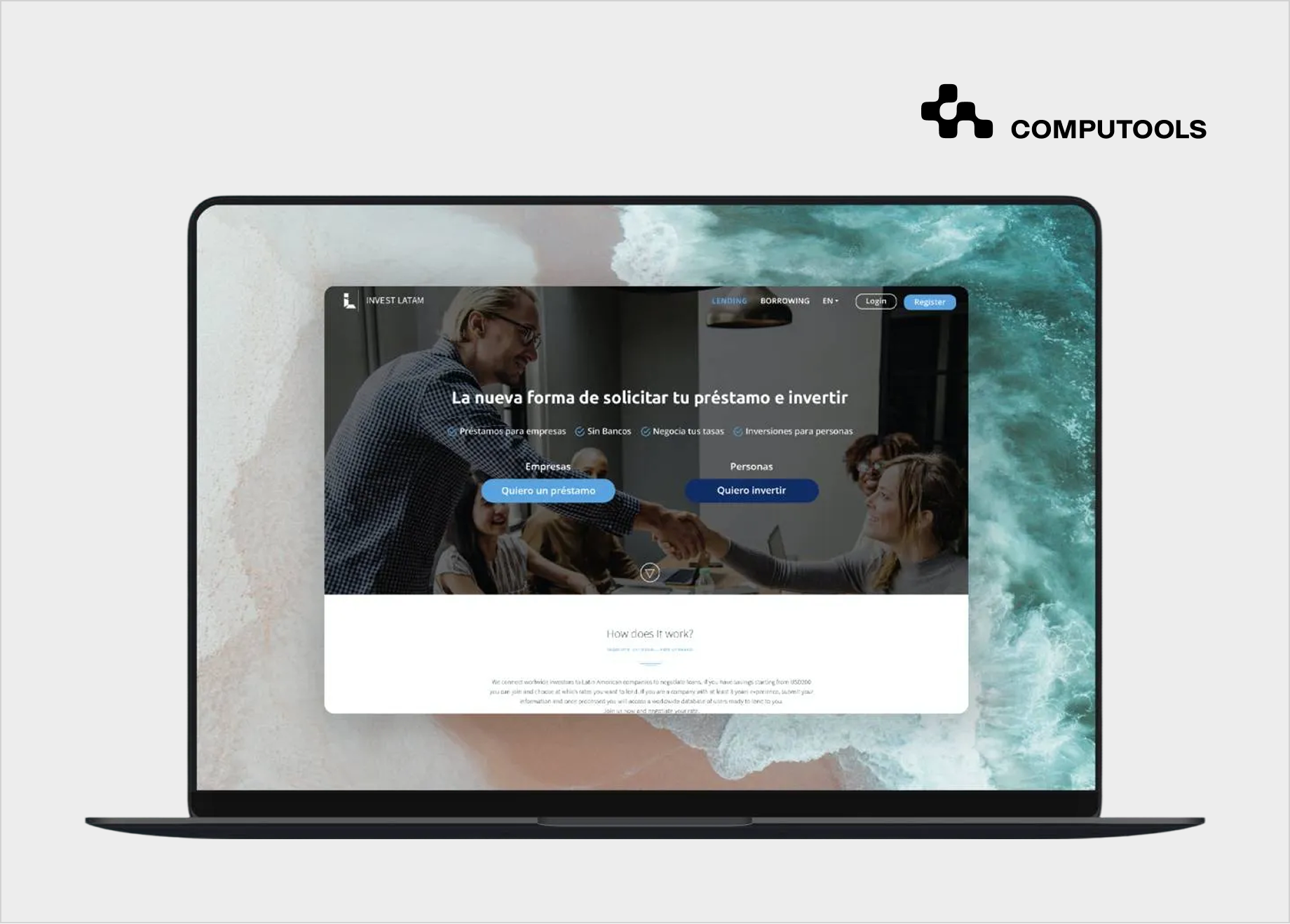

How Computools built a P2P lending platform for Invest Latam

To address limited access to traditional financing for small businesses in Latin America, Computools partnered with Invest Latam to design and deliver a peer-to-peer lending platform tailored to the region’s regulatory, operational, and trust constraints. The goal was to create a secure digital environment where investors and businesses could negotiate and finalize loan agreements directly, without relying on slow and restrictive banking processes.

Working closely with the client’s founders, our team translated the business vision into a structured product architecture. We focused on building clear user journeys for both investors and businesses, ensuring transparency around loan terms, interest rates, credit requirements, and expected returns.

Particular attention was paid to usability, as trust and clarity were critical for onboarding users with varying levels of financial literacy.

From a functional perspective, the platform was designed to support reliable KYC and verification workflows, structured credit evaluation, and seamless integration with payment and financial services.

Businesses and individuals entering the platform undergo a formal credit assessment and provide required guarantees, while ongoing monitoring mechanisms help manage payment delays and reduce default risks. These safeguards were essential for building confidence on both sides of the marketplace.

The development process followed a phased implementation plan, supported by interactive prototypes and A/B testing of key interface decisions. This allowed the team to validate assumptions early, refine the UX, and avoid overengineering while still delivering a scalable foundation.

Leveraging Computools’ experience in fintech software development services, the platform was built to remain adaptable to regulatory changes and future market expansion across South America.

The result was a fully functional P2P lending platform delivered within four months. Over the following five years, it facilitated more than 1,000 lending transactions, helping Invest Latam establish a stable operational presence and a trusted reputation among investors and small businesses.

By combining robust risk controls with intuitive design, the solution demonstrated how custom P2P lending solutions can unlock access to capital in emerging markets while maintaining transparency, security, and scalability.

8-step guide: how to build a peer-to-peer lending platform for emerging markets

Drawing on our hands-on experience delivering peer-to-peer lending platforms in emerging markets, we created this guide to share a practical, step-by-step approach to building a compliant, scalable lending marketplace. Let’s walk through each step and examine the core considerations behind building a reliable P2P lending platform.

Step 1. Discovery and Market Validation

In peer-to-peer lending platform development, discovery is the stage where you validate feasibility before writing code, covering demand, regulatory constraints, ecosystem readiness, and unit economics.

In the Invest Latam case, this phase helped confirm that SMBs faced long bank approval cycles and strict eligibility rules. Investors needed a transparent, low-risk way to fund businesses directly, which led the platform to become a lending marketplace rather than a traditional loan product.

To structure this stage in practice, the discovery phase can be divided into several specific steps, beginning with identifying the platform’s target users and the problem it addresses.

1. Define the target segment and use case

Start by narrowing the scope: borrower type (SMB, microbusiness, individuals), loan purpose (working capital, invoice financing, equipment), and lender profile (retail investors, communities, HNWIs). This prevents the creation of a generic marketplace that fails to satisfy either party.

2. Map the local lending ecosystem (infrastructure check)

Emerging markets differ by payment rails and identity/credit infrastructure, so discovery must confirm what you can rely on:

• payments (bank transfers, cards, wallets, escrow capabilities)

• identity/KYC options (local ID databases, vendors, document verification)

• credit data availability (bureaus, alternative data sources, open banking, where applicable)

• collections options (processes and partners for overdue management)

At Invest Latam, the end-to-end flow relied on reliable verification and structured credit evaluation, with defined procedures for handling delays in the debt recovery process.

3. Regulatory and compliance screening (go/no-go constraints)

Before architecture decisions, identify constraints that shape the product: licensing requirements, KYC/AML obligations, investor eligibility rules, data retention, auditability, and reporting.

Even if legal counsel finalizes specifics later, Discovery must identify what is non-negotiable to avoid the platform being designed into a compliance dead end.

For Invest Latam, KYC, verification, and creditworthiness checks were treated as core workflows from the outset.

4. Competitive and benchmark analysis

Evaluate how existing platforms operate in the same region or comparable markets, focusing on:

• onboarding friction and drop-off drivers

• risk presentation to investors (default transparency, borrower grading, portfolio tools)

• collections approach and borrower accountability mechanisms

• monetization structure (origination/servicing fees, investor fees, subscriptions)

These benchmarks help define what must be matched to be credible and where differentiation is realistic.

5. Validate business model and unit economics

Discovery should produce a draft model for how the marketplace sustains itself, including the expected fee structure; KYC and verification costs per user; operational costs (support, reviews, dispute handling); expected funding velocity (time-to-fund); and default assumptions (including any reserves or guarantees).

At Invest Latam, the economic logic was tied to risk control and trust-building processes to support repeat investor participation.

6. Define MVP scope and measurable success criteria

Finish Discovery with a clear MVP boundary and measurable outcomes:

• core roles and workflows (borrower/investor/admin)

• required integrations for first launch (KYC, payments, credit checks)

• non-functional requirements (security, audit logs, uptime targets)

• success metrics (KYC pass rate, activation, time-to-fund, repayment performance indicators)

Invest Latam used this structure to align stakeholders early and move into prototyping and implementation without scope drift.

Step 2. Business Model and Risk Logic Design

Once discovery confirms feasibility, the next step is to define how the platform will operate and be financially managed. P2P lending software development at this stage focuses on translating market insights into enforceable rules: how loans are priced, how risk is assessed and shared, how defaults are handled, and how the platform generates sustainable revenue without distorting incentives for borrowers or investors.

1. Define the lending and investment mechanics

This includes setting loan types, tenors, interest calculation methods, repayment schedules, and minimum/maximum ticket sizes. Decisions here directly affect liquidity and investor behavior.

In the Invest Latam case, the platform supported direct negotiations within predefined rules, with a minimum investment threshold to ensure investor commitment while keeping access open to a broad audience.

2. Design risk allocation and default scenarios

Risk logic must be explicit and system-enforced: borrower eligibility criteria, credit evaluation inputs, approval thresholds, and actions triggered by late payments or defaults. These scenarios should be modeled before development to avoid manual workarounds later.

For Invest Latam, structured credit evaluation and predefined monitoring paths, including escalation to a debt recovery process, were built into the platform logic to protect investors and maintain marketplace trust.

3. Establish pricing and monetization

The platform’s revenue model should focus on long-term sustainability rather than short-term growth. Typical methods include origination fees, servicing fees, or investor-side commissions.

During Invest Latam’s design phase, fees were structured to cover operational costs, such as verification and monitoring, without penalizing either side of the marketplace or encouraging risky lending behavior.

4. Define transparency and disclosure rules

Investors need clear visibility into borrower profiles, loan terms, and risk indicators, while borrowers must understand repayment obligations and consequences. These requirements influence data models and UI structure later.

In Invest Latam, this led to standardized borrower summaries and consistent disclosure of credit requirements and loan status across the platform.

5. Translate rules into system requirements

The outcome of this step is a set of unambiguous functional rules ready for implementation: how rates are calculated, how eligibility is enforced, how funds move, and how exceptions are handled. This prevents logic gaps during development and ensures the product scales consistently as volume grows.

By completing this step, teams aiming to build a peer-to-peer lending platform move from a validated concept to a clearly defined financial system, ready for UX architecture and technical design without having to rework core assumptions later.

Step 3. Product Scope and UX Architecture

Once the business and risk logic are defined, the focus shifts to shaping the product itself—what users will see, how they will interact with the platform, and which workflows are essential for the first release. Designing a P2P lending platform for emerging markets requires balancing functional completeness with clarity, because complexity and ambiguity directly undermine trust and adoption.

1. Define core user roles and journeys

At this stage, the platform is broken down into concrete user roles—borrowers, investors, and administrators with clearly mapped end-to-end journeys. Each journey must answer a single question: what does success look like for this user, and how many steps does it take to get there?

In the Invest Latam project, the primary focus was on two critical flows: enabling businesses to submit loan requests with clear requirements and allowing investors to assess opportunities and commit funds without unnecessary friction quickly.

2. Establish MVP boundaries and feature priorities

Product scope decisions are made deliberately to avoid overbuilding. The goal is to launch a usable, compliant marketplace that supports real transactions, not a feature-heavy platform that delays market entry. Core features typically include onboarding, profile management, loan listing and review, investment actions, payment tracking, and administrative controls.

For Invest Latam, the MVP scope prioritized transparency and operational reliability, ensuring that every feature directly supported lending, verification, or trust-building.

3. Design information architecture and data presentation

Financial decisions depend on how information is structured and displayed. UX architecture must define what data is shown, in what order, and at what level of detail for each role. Poor hierarchy or unclear terminology can stall decision-making.

In practice, this meant designing standardized summaries that highlighted borrower history, credit parameters, and loan conditions upfront, allowing investors on Invest Latam to evaluate opportunities efficiently without navigating deep menus or dense reports.

4. Reduce cognitive load and friction

In emerging markets, users may have varying levels of financial literacy and inconsistent access to reliable connectivity. UX decisions should minimize form length, avoid unnecessary steps, and clearly explain obligations and risks.

During Invest Latam’s design phase, iterative prototyping and validation helped simplify complex financial concepts into intuitive screens, reducing hesitation during onboarding and investment flows.

5. Align UX decisions with future scalability

Even at the MVP stage, UX architecture must anticipate growth: additional loan types, new risk indicators, or expanded geographic coverage. This requires consistent patterns and reusable components rather than one-off screens.

By the end of this step, the product has a clearly defined scope, validated user flows, and a UX structure ready for technical design and development. This alignment between business rules and user experience prevents costly redesigns later and sets the foundation for secure, scalable implementation.

Step 4. Architecture, Security, and Compliance Design

With the product scope and UX architecture defined, the next step is translating business rules and user flows into a reliable technical foundation that meets financial and regulatory constraints. Fintech lending platform development focuses on building a system that enforces trust through its architecture, data handling, and security, rather than relying on manual oversight.

1. Define the core system architecture

The platform architecture is typically structured around a central lending engine supported by modular services for user management, risk evaluation, payments, and reporting. Clear separation of concerns is critical to avoid tightly coupled logic that becomes difficult to change as regulations or business rules evolve.

In the Invest Latam project, the architecture was designed to keep lending logic, verification workflows, and payment orchestration independent, allowing each component to evolve without disrupting the overall system.

2. Embed security as a baseline requirement

Security decisions are made at the architectural level, not added later. This includes role-based access control, encrypted data storage and transmission, audit logs, and secure credential handling. Financial platforms must assume that every transaction and user action may require tracing.

For Invest Latam, auditability and controlled access were essential, as both investors and administrators required visibility into loan status changes, verification outcomes, and transaction history.

3. Design compliance-driven workflows

KYC, AML, and credit checks must be integrated directly into user journeys so that compliance is enforced automatically. This affects how onboarding is structured, when funds can move, and which actions require manual review.

In our case, workflows ensured that borrowers could not proceed to funding unless they passed verification and credit evaluation, while investors interacted only with approved, validated loan requests.

4. Plan data models and reporting requirements

Regulatory and operational reporting needs shape how data is stored and related. Loan states, repayment schedules, verification statuses, and transaction records must be consistently modeled to support audits, monitoring, and analytics.

5. Prepare for regulatory and regional change

Emerging markets often introduce regulatory updates or country-specific requirements over time. Architecture must prioritize configuration over customization, enabling changes to rules, thresholds, and integrations without requiring a platform rebuild.

This approach allowed the Invest Latam platform to remain adaptable as operational scope expanded across South America, without reworking its core structure.

By completing this step, the platform establishes a stable technical foundation in which security, compliance, and scalability are inherent. This foundation enables confident progression into full development and integrations without compromising regulatory readiness or operational control.

If your priority is user trust and adoption, Banking App Design: Ultimate Design Practices To Build Customer Trust breaks down UX and UI decisions that directly influence confidence in financial products.

Step 5. Core Development and Integrations

With architecture and compliance foundations in place, the project moves into full-scale implementation. At this stage, alternative lending platform development focuses on turning validated rules and designs into a stable, production-ready system that supports real lending activity, not just demos or pilots.

1. Implement core lending functionality

Development begins with the core workflows: user registration and authentication, borrower profiles, loan request creation, investor dashboards, investment actions, repayment schedules, and status tracking. Each action must be deterministic and system-driven, leaving no ambiguity in how loans move through their lifecycle.

2. Build administrative and control layers

Alternative lending platforms rely heavily on strong admin capabilities. This includes KYC review queues, loan approval tools, monitoring dashboards, manual override mechanisms, and reporting interfaces. These tools are essential for managing exceptions without breaking automated flows.

For Invest Latam, the admin layer played a critical role in enforcing credit evaluation rules and overseeing borrower compliance, ensuring that operational risk was managed without slowing down the marketplace.

3. Integrate payments and financial services

Payment orchestration is a central element of any lending platform. Integrations typically include bank transfers, payment gateways, and reconciliation logic to track funds across borrower and investor accounts. These integrations must handle edge cases such as failed transfers, partial repayments, and delays.

In our case, secure payment integrations were implemented within the core system, enabling seamless fund movement while maintaining full transaction traceability.

4. Ensure performance and reliability under load

Even at moderate volumes, lending platforms must process concurrent actions reliably—multiple investors funding loans, scheduled repayments, and real-time status updates. Performance considerations, such as asynchronous processing and background jobs, are addressed during development rather than postponed.

This approach allowed the Invest Latam platform to scale transaction volume over time without requiring architectural rework.

5. Maintain alignment with compliance and audit requirements

Throughout development, security controls, audit logs, and data integrity checks are continuously validated. This ensures that compliance assumptions made earlier are reflected in actual system behavior, not just documentation.

For Invest Latam, this alignment was essential to support transparent reporting and maintain trust across all participants in the lending process.

By this point, the platform has evolved from a concept or prototype into a working lending system that can support live users, process real transactions, and oversee operations. This prepares the ground for validation, optimization, and a controlled launch.

Step 6. Testing, Validation, and Iteration

Once the core functionality is implemented, the focus shifts to validating that the platform behaves predictably under real conditions. Fintech software for peer-to-peer lending must be tested not only for technical correctness, but also for trust, clarity, and operational resilience because even small inconsistencies can undermine user confidence in financial products.

1. Functional and integration testing across workflows

Testing process starts with validating end-to-end scenarios: borrower onboarding, KYC approval, loan creation, investor funding, repayment flows, and administrative interventions. Particular attention is paid to transitions between states, as lending platforms rely on precise lifecycle management.

In the Invest Latam platform, this phase ensured that loan statuses, repayment schedules, and investor balances were updated consistently across the system, without delays or discrepancies.

2. Security and compliance validation

Given the sensitivity of financial data, security testing runs in parallel with functional checks. This includes verifying access controls, data encryption, audit logs, and compliance-triggered restrictions on user actions. The goal is to confirm that the platform enforces rules automatically and leaves a clear audit trail.

For Invest Latam, validating KYC compliance and transaction traceability was critical to meeting regulatory expectations and maintaining investor transparency.

3. UX validation and friction analysis

Beyond technical correctness, the platform must be reliable and easy to understand. UX validation focuses on identifying where users hesitate, abandon flows, or misinterpret financial information. These insights are used to refine copy, layout, and interaction patterns.

During Invest Latam’s validation phase, iterative adjustments helped simplify onboarding and investment steps, reducing friction for first-time users without compromising compliance requirements.

4. Performance and edge-case testing

Lending platforms must handle concurrent activity, delayed responses from third-party services, and partial failures gracefully. Testing covers load scenarios, retry mechanisms, and recovery from failed payments or verification attempts.

This ensured that the Invest Latam platform could continue operating reliably even when external services responded slowly or temporarily failed.

5. Iteration based on validated insights

Testing outcomes feed directly into refinement cycles. Instead of treating testing as a final gate, issues and observations inform adjustments to workflows, data handling, and UI elements before launch.

By the end of this step, the platform is technically stable, compliant, and user-validated. This significantly reduces launch risk and ensures the product is ready for real-world lending rather than controlled test environments.

Step 7. Launch, Scaling, and Operational Growth

After launch, validated lending flows provide the foundation for micro-lending platform development, enabling controlled expansion into smaller-ticket sizes and new segments without redesigning the core system.

1. Controlled production launch

A phased rollout helps reduce risk. This may involve limited user groups, capped transaction volumes, or restricted loan types during the initial release. The objective is to observe real behavior without exposing the platform to uncontrolled financial or reputational risk.

2. Operational monitoring and governance

Once live, the platform must be continuously monitored across multiple dimensions: transaction integrity, repayment behavior, verification performance, and system stability. Dashboards and alerts play a critical role in identifying anomalies early.

In our case, ongoing monitoring helped ensure that credit evaluation rules and payment flows performed as expected, supporting consistent platform reliability over time.

3. Gradual expansion of lending scenarios

After core workflows prove stable, platforms often expand into adjacent use cases—smaller loan amounts, shorter tenors, or new borrower categories. This is where micro-lending capabilities can be introduced without redesigning the core system.

Because Invest Latam’s architecture and workflows were designed for configurability, the platform could evolve incrementally rather than undergo disruptive changes.

4. Scaling user acquisition and liquidity

Growth requires balancing both sides of the marketplace. Scaling borrower acquisition without sufficient investor liquidity or vice versa creates instability. Launch-phase data informs adjustments to onboarding, pricing, and communication strategies.

5. Continuous improvement and regulatory alignment

Post-launch development focuses on refining workflows, improving analytics, and adapting to regulatory updates. Lending platforms that treat compliance and operations as ongoing processes remain resilient as markets and rules evolve.

This approach enabled Invest Latam to sustain more than 1,000 transactions over several years while maintaining a stable operational footprint.

By completing this step, the platform moves beyond an MVP into a living financial system—one that can scale responsibly, support new lending models, and adapt to changing market conditions without sacrificing trust or control.

Step 8. Post-Launch Optimization and Long-Term Evolution

Once a platform is live and stable, it enters a phase where long-term performance matters more than feature velocity. Digital lending platforms for fintech must continuously adapt to real repayment behavior, liquidity dynamics, and regulatory feedback to remain viable financial infrastructure rather than short-lived products.

1. Optimize risk models using live data

Actual repayment patterns reveal gaps that are invisible at the design stage. Post-launch work focuses on refining credit rules, adjusting eligibility thresholds, and improving borrower segmentation based on default risk, repayment delays, and repayment consistency.

2. Improve conversion and marketplace balance

Live operations often surface imbalances between borrower demand and investor liquidity. Optimization efforts focus on onboarding friction, information clarity, and how opportunities are surfaced to investors.

3. Expand analytics and reporting

As volume increases, stakeholders require deeper visibility into performance. This includes portfolio-level analytics, repayment trends, operational KPIs, and compliance reporting.

4. Respond to regulatory and market changes

Regulatory requirements evolve, particularly in emerging markets. Post-launch development often involves updating compliance workflows, disclosures, and integrations with new verification or payment providers.

5. Plan strategic product evolution

With a stable core in place, platforms can explore expansion into new loan types, regions, or partnerships. These decisions are evaluated against existing risk controls and system capabilities to ensure sustainable growth.

The Invest Latam platform’s ability to support over 1,000 transactions across several years demonstrates how disciplined post-launch optimization enables long-term scalability.

This final step closes the development lifecycle while opening the path to continuous evolution, an essential characteristic of mature digital lending platforms operating in real-world fintech environments.

“Building a P2P lending platform is not a linear software project; it is a continuous sequence of risk-reduction decisions that extends well beyond launch. From early Discovery and market validation to long-term optimization, each stage determines whether the product becomes a scalable P2P lending platform or struggles with trust, adoption, and regulatory pressures.”

Move from market opportunity to execution with clarity. Request a technical feasibility review and development estimate for your P2P lending initiative.

Key P2P lending challenges and platform-level solutions

| Challenge Area | Impact on the Platform | Platform-Level Solution |

| Credit risk and borrower defaults | Investor losses, declining trust, and lower reinvestment rates | Structured credit evaluation, borrower segmentation, and diversification rules are embedded into online lending platform development from the discovery stage |

| Liquidity risk and cash drag | Idle capital, slower funding cycles, and reduced investor satisfaction | Clear loan lifecycle states, predictable funding flows, transparent investment timelines |

| Fraud and identity abuse | Financial loss, compliance exposure, reputational damage | Mandatory KYC/AML workflows, identity verification, encrypted data handling, behavioral fraud detection |

| Cybersecurity threats | Data breaches, service disruption, loss of confidence | Encryption in transit and at rest, role-based access control, audit logs, and secure authentication mechanisms |

| Regulatory uncertainty | Delayed launches, forced redesigns, and legal risk | Compliance-driven workflocws, configurable rules, and audit-ready data models adaptable to local regulation |

| Platform failure or operational instability | Interrupted repayments, loss of funds, investor churn | Modular architecture, operational monitoring, and transparent fund tracking within P2P loan marketplace software |

| The trust gap between borrowers and investors | Low conversion, high churn, weak marketplace liquidity | Standardized borrower profiles, visible risk indicators, clear disclosure of loan terms and obligations |

| Market competition and commoditization | Margin pressure, reduced differentiation | Clear niche focus, UX clarity, differentiated risk, and transparency mechanisms |

| Economic volatility | Increased default rates, unstable returns | Conservative risk thresholds, continuous portfolio monitoring, and adaptive credit policies |

This table shows P2P risks are systemic, not random. Solutions should be integrated into the product, architecture, and processes, not handled manually afterward. This approach kept the Invest Latam case stable and scalable.

Looking for benchmarks and potential technology partners? Read Top 25 FinTech App Development Companies Worldwide to explore teams with proven experience in building regulated fintech platforms.

Why choose Computools

Building a P2P lending platform requires deep financial domain expertise, risk-aware architecture, and experience delivering compliant products in live markets. Computools delivers financial software development services for banks, fintech companies, insurers, and investment firms.

Our custom-built solutions cover the full lending and investment lifecycle, including risk assessment, loan origination, transaction monitoring, and investment management systems. We design platforms that unify operations and stay resilient as regulations evolve.

For projects that require a mobile-first experience, we also provide custom mobile app development to enable secure, high-performance access to lending platforms across devices.

Clients choose Computools for custom finance software development backed by measurable results:

• 40% faster financial operations

• 40% lower operating costs

• 250+ experts on board

• 12 + years on market

• 20+ finance projects delivered worldwide

If you’re selecting a technology partner for a secure P2P lending system architecture, our team can provide architectural guidance and custom software engineering expertise. Contact us at info@computools.com.

Automation and real-time interaction are increasingly shaping modern lending platforms, and Conversational AI in Finance: Benefits, Challenges, Future Predictions explains where AI-driven communication delivers the most value in fintech.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”