Get in touch →

- WHAT WE DO

- INDUSTRIES

- CASE STUDIES

- Our Approach

- About Us

- Insights

- Get in touch

A finance-focused medium business in Latin America needed an efficient platform to connect small businesses with investors for direct loan transactions. Our team developed a platform enabling companies to receive online loans from investors while allowing investors to invest funds and earn returns. Computools assisted in streamlining the process, ensuring reliable KYC, verification, and integration with financial services, significantly enhancing the client’s business operations and customer satisfaction.

The platform facilitates the connection between investors and businesses or individuals in Latin America, enabling them to negotiate and finalise loan agreements directly. With a minimum savings threshold of COP $500,000, individuals can join the platform and choose the interest rate they want to invest.

Companies and individuals engaging with the service undergo a formal credit evaluation process, providing necessary guarantees, and are subject to monitoring by a debt recovery firm in the event of payment delays. This stringent process ensures safety and reliability in the loan transactions conducted through the platform.

Recent successes include facilitating over 1,000 business transactions in the past five years and establishing a solid operational presence across South America. With a rigorous credit evaluation process and monitoring by a debt recovery firm, Invest Latam ensures safety and reliability in all loan transactions, providing a trustworthy environment for both investors and businesses.

Small businesses in Latin America struggled to secure loans through traditional banking channels, encountering lengthy processes, stringent criteria, and limited access to funding. This created a substantial barrier to growth and development for these businesses. At the same time, investors were seeking alternative opportunities for direct investment that offered meaningful returns.

Invest Latam recognised the untapped potential in addressing these issues and sought to build a first-of-its-kind platform to match lenders and businesses in Latin America. The primary objectives were to ensure reliable KYC, verification, and creditworthiness check processes and to link to integrated payment mechanisms via a secure interface. By developing this platform, Invest Latam aimed to create a more efficient, accessible, and inclusive financial ecosystem.

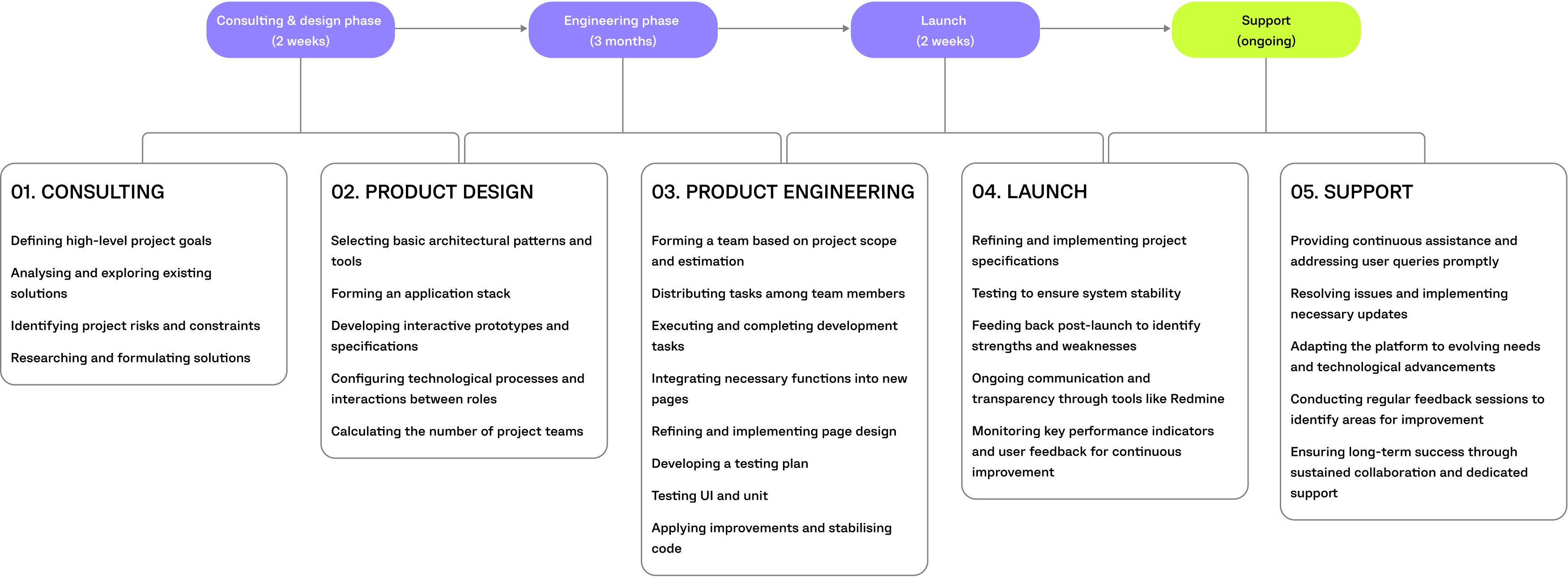

Our team broke down the platform’s concept into detailed user journeys and design prototypes. These prototypes focused on providing a quick visual summary for lenders and businesses, enhancing the user experience. The platform was developed according to a comprehensive implementation plan. We conducted A/B testing of several design decisions to ensure the most effective and user-friendly interface.

The platform integrates seamlessly with financial services interfaces, ensuring reliable Know Your Customer (KYC) processes, verification, and creditworthiness checks. Additionally, we linked the platform to secure payment mechanisms, providing a smooth and secure transaction experience.

Computools’ platform and product engineering expertise was pivotal in transforming the client’s vision into a functional and user-friendly platform. Our team created intuitive and visually appealing designs that simplify the process for both lenders and businesses. We ensured the platform’s reliability and security by integrating essential financial services and conducting thorough testing.

The platform enabled over 1,000 business lending transactions within five years, significantly boosting the client’s business volume and demonstrating the platform’s effectiveness in connecting investors with small businesses.

The development of a fully functional platform within four months, including a visually attractive summary of businesses, their history, and credit requirements, increased the number of clients.

The client chose Computools as their digital transformation partner for several compelling reasons. From the initial consulting stage, Computools demonstrated a deep understanding of the client’s needs and objectives. The expertise and experience of Computools’ team members, carefully selected for their knowledge and skills, ensured a robust project team.

Small businesses in Latin America struggled to secure loans through traditional banking channels, which involved lengthy processes, stringent criteria, and limited access to funding. Additionally, investors sought alternative opportunities for direct investment with meaningful returns but lacked a dedicated platform to facilitate such transactions. Invest Latam embarked on a search for a solution that could bridge this gap, providing an efficient and reliable platform to connect small businesses with investors.

The client carefully considered different companies to help them build their investment platform. After considering factors like technical skills and experience, they chose Computools because we had extensive experience creating similar platforms for finance and investment. Our team had the right mix of skills needed for the project. The constant communication, new technologies, and flexible project management approach made the client confident in their choice.

Computools acted both as generalists and specialists. Our team focused on:

We identified inefficiencies in the user journey and redesigned the flow to provide a seamless experience for both investors and businesses. This included creating visually attractive summaries of companies, their histories, and credit requirements. By analysing user behaviour and investment patterns, we customised matchmaking algorithms based on lenders’ criteria, enhancing the accuracy and efficiency of pairing investors with suitable businesses.

Design development was carried out according to the client's stipulated requirements and needs. The basics of user experience were laid out at the stage of interactive prototyping. In the future, the user interface will be actively refined to create the most convenient and intuitive design of the pages.

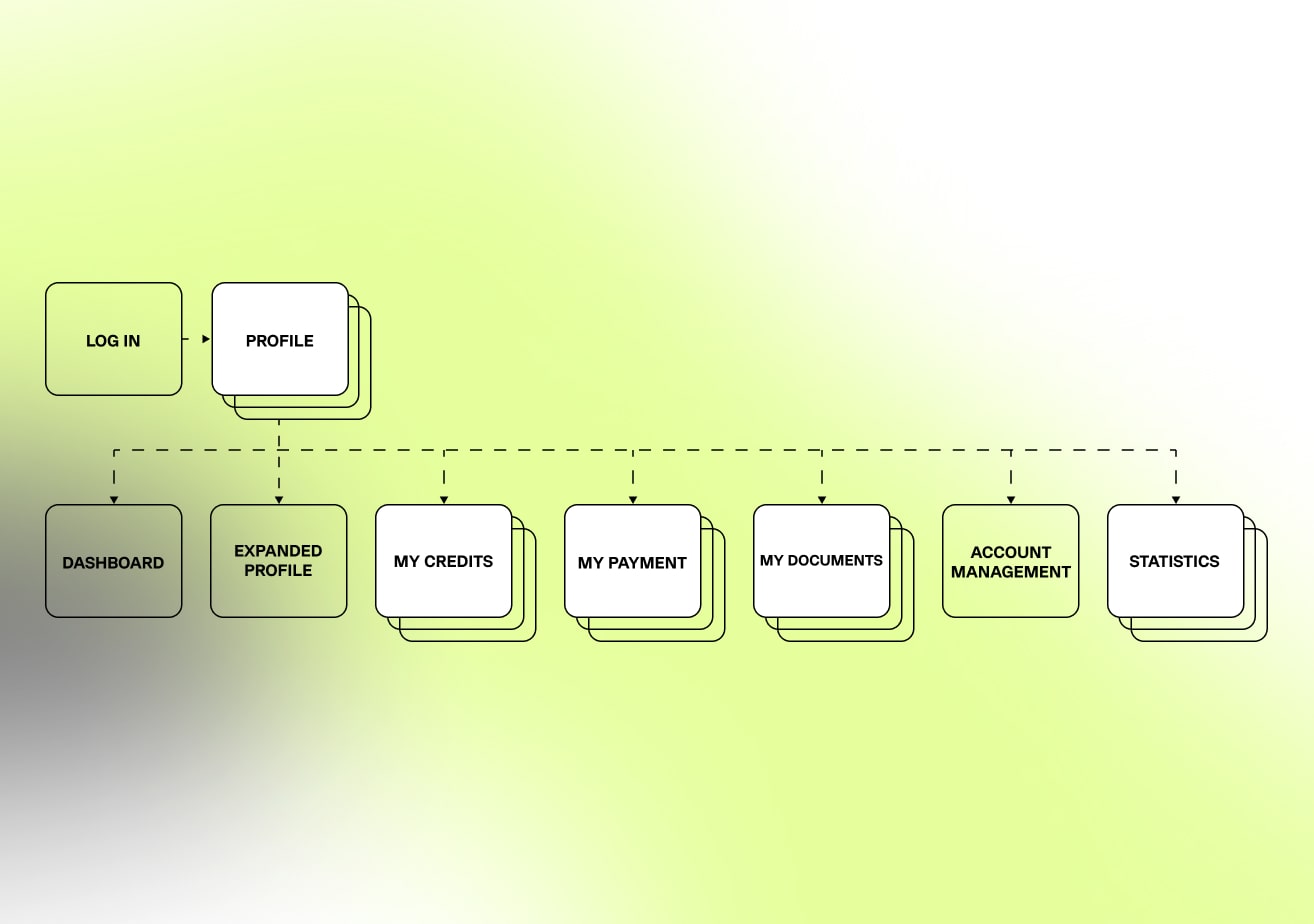

Detailed profile of a typical user, informing design decisions

Visual representation of website structure and navigation hierarchy

Basic skeletal outlines depicting layout and functionality without design details

The visual elements and interactive components enhance the user experience

Entity Framework

This ORM (Object-Relational Mapper) was chosen for its ability to streamline database operations by allowing developers to work with data using .NET objects. This eliminates the need for most of the data-access code developers typically write. Entity Framework ensures efficient data management and seamless integration with the MS SQL database.

React

We selected React for its powerful and flexible front-end capabilities. React allows for creation of a dynamic and responsive user interface, providing an excellent user experience. Its component-based architecture ensures that the platform is maintainable and scalable, significantly improving the application's performance through its virtual DOM.

ASP.NET MVC

This framework was chosen for its robust structure, which facilitates the development of scalable and maintainable web applications. ASP.NET MVC supports a clean separation of concerns, making it easier to manage complex projects. It also integrates seamlessly with Entity Framework, providing a cohesive development environment.

MS SQL

For the database layer, MS SQL was selected due to its high performance, reliability, and advanced security features. MS SQL supports complex queries and transactions efficiently, ensuring the platform can securely handle large volumes of data and transactions. Its integration with Entity Framework further enhances data handling capabilities.

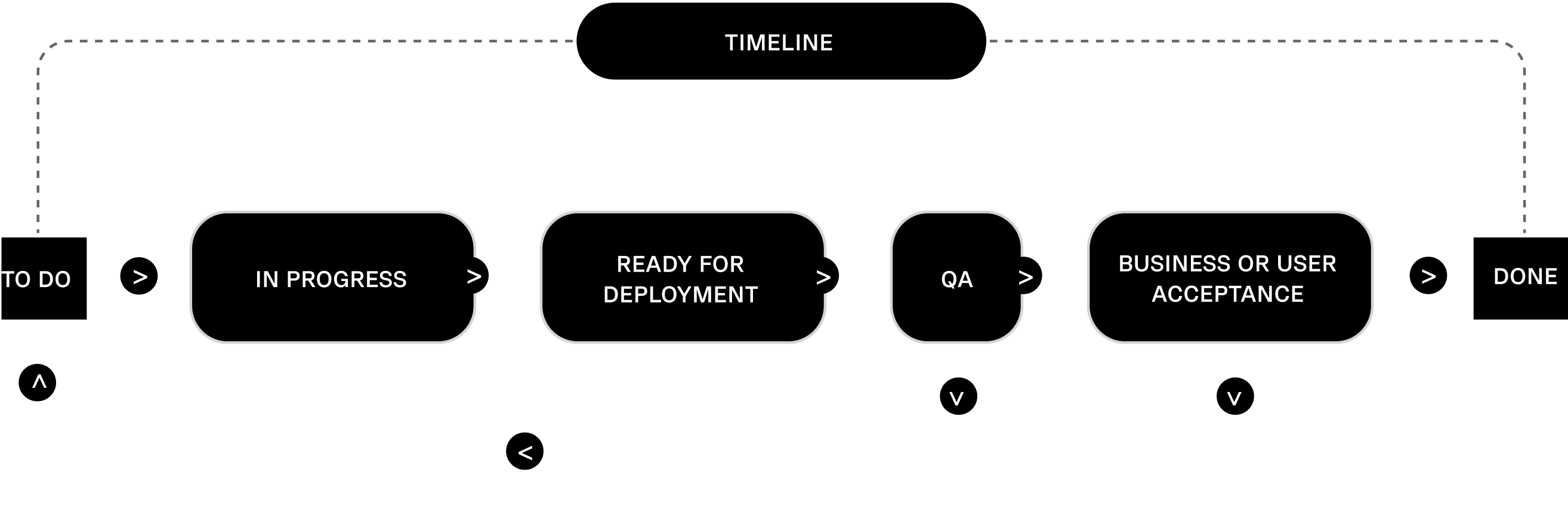

The Kanban methodology was chosen because the work on the project was carried out quickly. This saves time developing pages and applications and improves the team’s efficiency.

Kanban gives the flexibility to build a sustainable competitive advantage and empowers the team to accomplish more and faster. Every project has a backlog of tasks and a series of state processes that a task must pass through before delivery. Using the Kanban board, everyone can instantly see how tasks are moving through the process. The simplicity of the visual presentation enables the PM to spot bottlenecks easily while they are forming.

The most obvious benefit of using Kanban is improved flow efficiency, which occurs shortly after the method is implemented into the project. Visualising your process will quickly highlight areas of inefficiency. The next Kanban benefit is increased productivity. Kanban benefits team productivity by shifting the focus from starting work to finishing work.

Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.