Legacy financial apps decrease productivity and increase operational risk. According to McKinsey, banks spend up to 70% of their IT budgets on maintaining outdated systems, and overall, spending on legacy technology in the financial sector is expected to grow from $36.7 billion in 2022 to $57.1 billion by 2028.

For staff, this results in slower workflows, more errors, and frustration; for organizations, it leads to compliance gaps, higher costs, and reduced client trust.

Computools, a global IT consulting and engineering company, helps financial institutions tackle these challenges through its financial software development services. We redesign legacy systems into secure, intuitive, and productivity-focused tools that optimize workflows, improve compliance, and restore client confidence.

With experience across 400 projects worldwide, especially 20+ financial companies, we bring technical depth and user-centered design to ensure measurable business outcomes and future-ready digital ecosystems. Our UX design services ensure that redesigned applications operate smoothly for internal teams and end clients who value speed and simplicity.

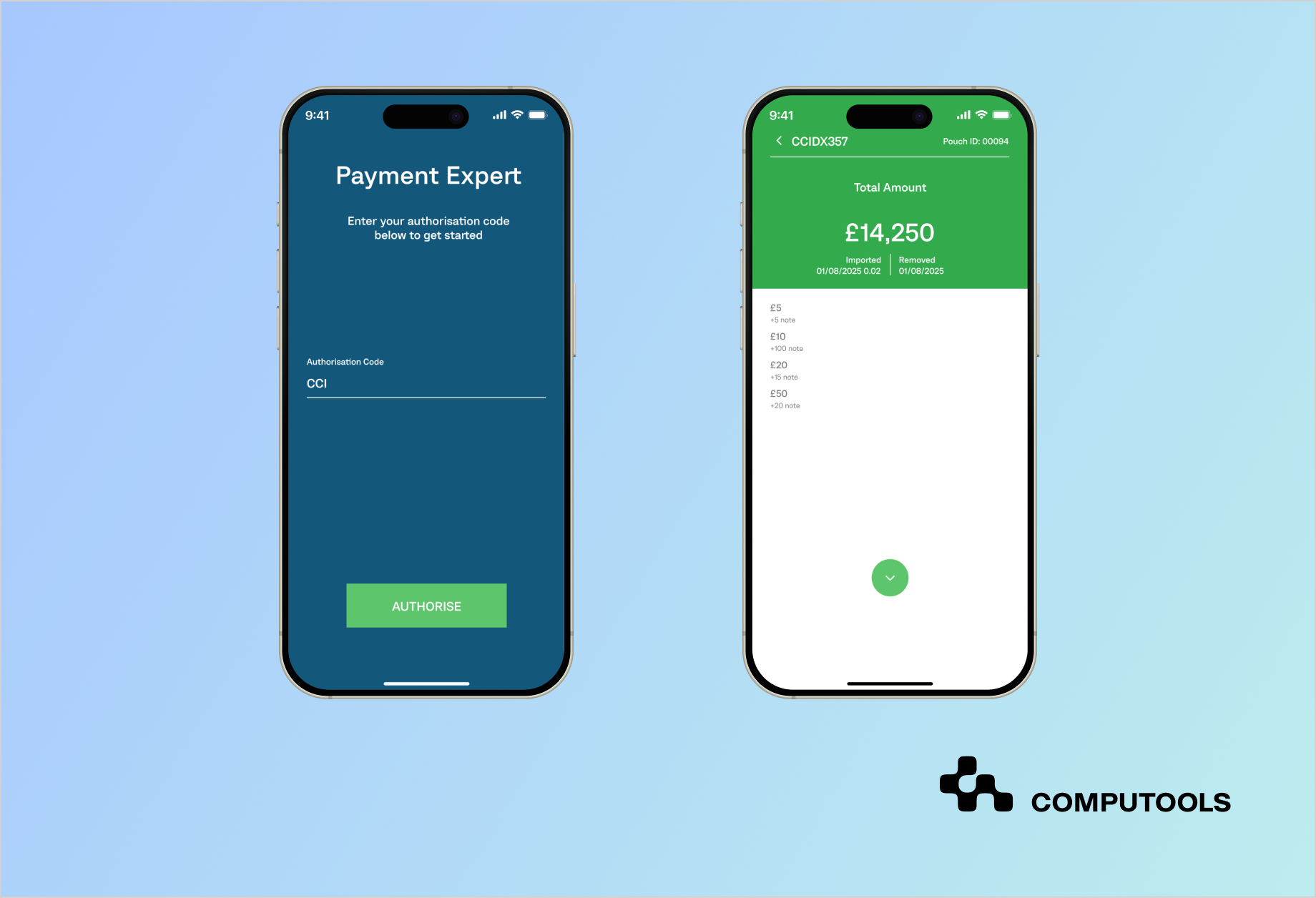

We brought this expertise to life in collaboration with a worldwide provider of cash-handling equipment, successfully redesigning their financial app into a faster, more user-friendly, and future-ready solution.

How we redesigned a legacy financial app for a global leader in cash handling

Our client, CCI Assistant, is an international manufacturer of cash-handling equipment, securing more than $4 billion daily across banking, retail, and leisure industries. However, the company’s Windows Phone application had become a significant obstacle. It was overloaded with unnecessary features, performed slowly, and lacked support for modern devices. Staff struggled with inefficiencies, and the app could no longer meet growing market demands.

Computools was brought in to transform this situation through its expertise in legacy software modernization. We began with a thorough analysis of how employees actually used the application, identifying critical bottlenecks in navigation and functionality.

Our team rebuilt the solution from the ground up as a cross-platform Android app, applying a clean, ergonomic interface and simplifying workflows to match real user needs. Strong security measures were embedded into every stage, ensuring the new product was safe, compliant, and ready for global adoption.

This legacy financial app redesign delivered immediate improvements. Operations became faster and more reliable, staff productivity increased thanks to intuitive navigation, and the company saw greater adoption across its partner network. What had been an outdated, frustrating tool was turned into a scalable solution that supported both current business demands and long-term growth.

Step-by-step guide: How to redesign legacy financial apps for better UX and staff productivity

Step 1: Analyze the system and define goals

The first step in a financial app UX redesign is clearly understanding the system’s current state and all stakeholders’ needs. This involves deeply analyzing documentation, architecture, user flows, and core functions to uncover inefficiencies and risks. The goal is to separate mission-critical features from outdated ones and identify areas where UX and performance improvements will bring the highest impact.

Equally important is setting clear objectives for the redesign. These include improving usability, shortening transaction times, or making the application mobile-friendly. Establishing measurable success criteria—such as fewer user errors, faster operations, or higher adoption rates—creates a framework for tracking progress. Businesses must also assess how modernization aligns with long-term goals, considering budget, timelines, and potential risks.

In the case of CCI Assistant, our analysis revealed that the Windows Phone application had become a bottleneck. It was overloaded with features, slow on modern devices, and failed to support employees in their daily workflows. By identifying these pain points early, we set the stage for a redesign focused on usability, speed, and scalability, a practical example of applying UX design for financial applications.

Step 2: Conduct user research and define the strategy

Once the current system has been assessed, the next step is to set a clear strategy for modernization. This begins with understanding how enterprise staff actually interact with the application. Unlike consumer users, employees rely on financial apps to perform repetitive, high-stakes tasks where even small inefficiencies create major delays.

Through surveys, interviews, and product workshops, teams can gather insights into user frustrations, hidden workarounds, and expectations for improvement. Mapping user journeys and building personas highlight the most pressing bottlenecks, ensuring the redesign solves real problems rather than assumed ones.

The goal is directly connect research with modernization objectives: higher speed, greater scalability, or streamlined workflows. Effective planning also requires incorporating UX design strategies to improve staff efficiency in financial software, aligning technology upgrades with daily operations.

Early research in the CCI Assistant project revealed that staff had developed time-consuming workarounds to manage basic tasks in the old Windows Phone app. These insights shaped the strategy, helping us build a modernization roadmap centered on speed, simplicity, and cross-platform accessibility.

Step 3: Redesign information architecture and workflows

With strategic goals defined, the focus shifts to reshaping the system’s information architecture. Balance is everything: users expect improvement, not a complete reinvention. Overhauling familiar structures risks creating resistance, so trusted interaction patterns and functional anchors should be preserved while layering modern improvements around them.

This step involves reorganizing menus, simplifying navigation flows, and restructuring forms or actions so staff can complete tasks with fewer clicks and less friction. At the same time, preparation happens in the background: ensuring infrastructure readiness, compliance alignment, and cybersecurity measures to protect sensitive financial operations.

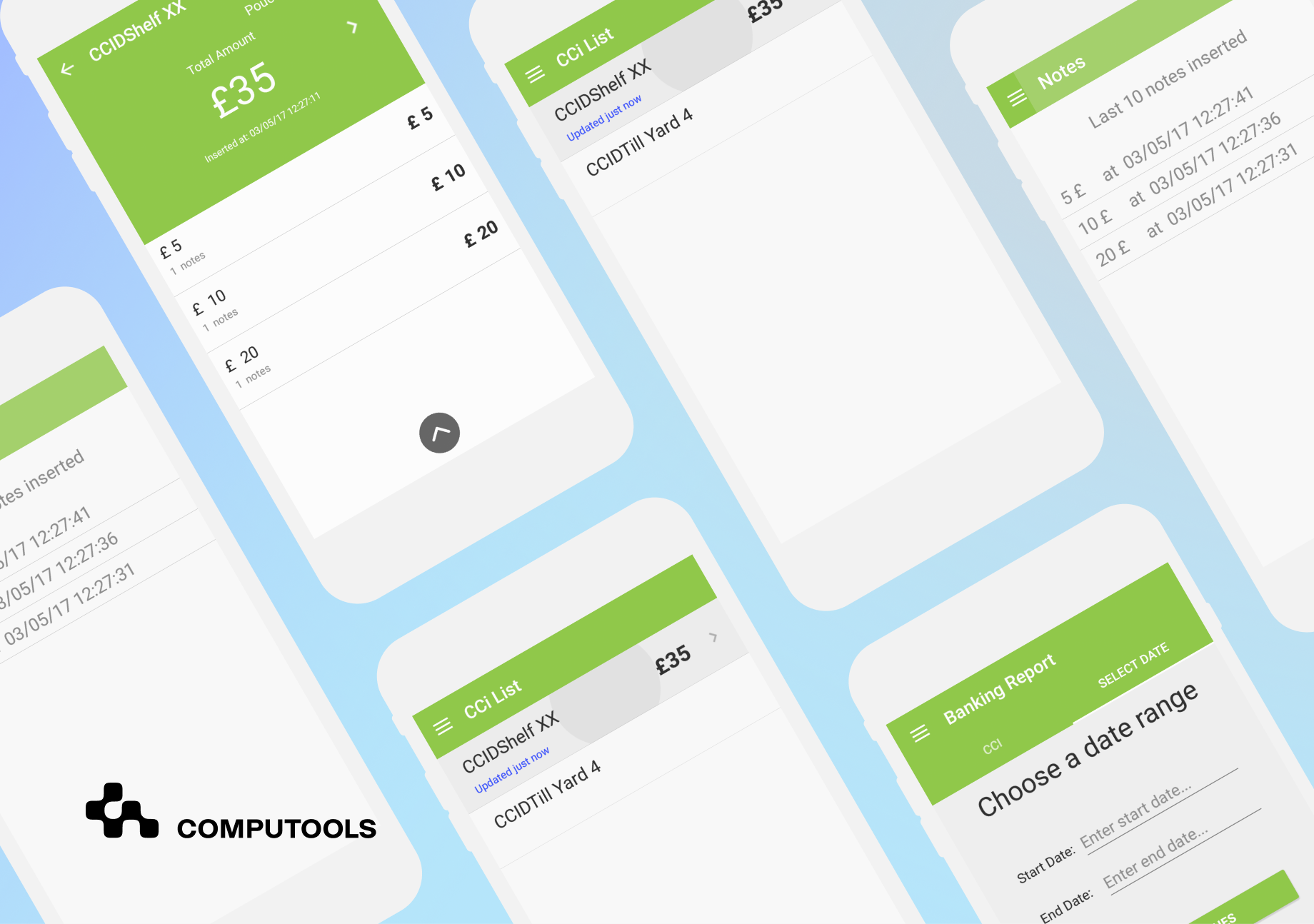

In the CCI Assistant redesign, we had to redesign outdated financial applications logic, where staff previously navigated multiple screens for simple actions. By cutting unnecessary steps and introducing more precise navigation, while keeping familiar patterns intact, we achieved a successful UX redesign for financial applications that improved adoption and boosted productivity without overwhelming users.

Step 4: Create wireframes and prototypes

Once the strategy and workflows are defined, the next step is visualizing the redesigned application. Low-fidelity wireframes help outline layouts, navigation, and key screens, ensuring the design supports actual staff tasks. Interactive prototypes simulate user interactions, allowing teams to collect feedback and iterate before committing resources to full app development. This stage reduces risks and keeps the financial app UX redesign focused on usability and efficiency.

For CCI Assistant, our team built clickable prototypes that mirrored the daily workflows of cash-handling staff. Early testing with employees revealed unnecessary steps and confusing navigation, which we streamlined before moving into development.

Step 5: Ensure visual consistency with design systems

In large enterprises, inconsistent design across applications can confuse employees and slow productivity. A Design System addresses this by standardizing UI elements, typography, grid layouts, color schemes, and interaction patterns into a single source of truth for both designers and developers.

A strong Design System also embeds accessibility rules (contrast, font size, button states) and helps enforce compliance with financial industry regulations. Beyond visuals, it reduces design debt and ensures that security- and workflow-related components behave consistently. This step is essential for financial app user experience optimization, making sure staff interact with predictable, reliable interfaces.

In the CCI Assistant project, introducing a design system aligned all interface elements, created a familiar experience across screens, and reduced the employee learning curve.

Step 6: Modernization and deployment

With validated prototypes and a consistent design system, modernization moves into execution. Teams implement the chosen strategy, whether rebuilding, refactoring, or migrating, and ensure quality through CI/CD pipelines, automated testing, and staged rollouts. Data migration must be carefully planned to avoid downtime or loss, while rigorous testing verifies stability and compliance before launch.

For the CCI Assistant, we migrated functionality to a modern Android platform, preserving data integrity and ensuring minimal disruption to business operations. By focusing on improving workflow in financial apps, we delivered a stable, secure, and intuitive solution that staff could adopt immediately.

Step 7: Test and validate the redesign

Before a full rollout, usability and performance testing are critical. Prototypes and pre-release builds must be validated under real-world conditions to ensure the system works smoothly across devices, handles expected loads, and complies with industry standards. This stage reduces the risk of downtime, data loss, or staff frustration during migration.

For the CCI Assistant, iterative pre-launch testing helped refine navigation, eliminate redundant steps, and ensure workflows supported real cash-handling tasks. This validation stage made the solution a strong example of legacy financial system modernization for digital transformation.

Step 8: Embrace mobile-first and accessibility

Modern staff expect seamless mobile access and inclusive design. A mobile-first approach ensures applications deliver consistent performance across devices, while accessibility features like clear fonts, contrasts, and screen-reader support broaden usability.

In our case, mobile-first development turned CCI Assistant into a reliable example of financial services app modernization, extending usability beyond legacy constraints.

Step 9: Optimize performance and visual consistency

After launch, modernization must focus on keeping the application fast, stable, and adaptable. Performance optimization involves minimizing load times, streamlining backend calls, and ensuring smooth operation under high transaction volumes. Scalability requires a modular architecture so new features or integrations can be added without slowing the system down.

In CCI Assistant, optimization meant refining backend queries and caching mechanisms to handle thousands of real-time cash-handling transactions. Coupled with earlier design system work, the app stayed responsive while supporting future growth and a сustom UI/UX for financial applications that scale with the business.

Step 10: Provide training and long-term support

Successful modernization depends on smooth adoption. Clear documentation, staff training, and ongoing support ensure employees adapt quickly to new tools. Well-structured programs reduce resistance and improve staff productivity with app redesign, making the new system an enabler rather than an obstacle.

For CCI Assistant, Computools prepared staff with structured onboarding and continuous support, embedding productivity-focused financial software design into daily workflows.

Step 11: Continuous monitoring and improvement

This is post-launch monitoring. After deployment, applications must be tracked and refined based on live data and staff feedback. Updates, patches, and incremental UX improvements keep the solution future-ready. For our case, continuous monitoring after rollout helped refine workflows further, maintaining the app aligned with evolving business needs.

While this article covers legacy financial app redesign and productivity, design also builds customer trust. For proven approaches, see our article: Banking App Design: Ultimate Design Practices To Build Customer Trust.

Legacy shouldn’t mean liability. Redesign your app into a business value engine.

The 7 R’s of Legacy Modernization: why strategy matters in financial app modernization

A financial app UX redesign is never about “making it prettier.” While usability and staff productivity are critical, lasting success depends on broader modernization choices: software architecture, code structure, integrations, and scalability. UX alone cannot carry a system forward if the foundation remains outdated.

This is where the 7 R’s of legacy modernization come in, a framework that helps organizations align design improvements with technical strategy, ensuring financial app modernization delivers both immediate usability gains and long-term resilience.

1. Rehost: move an app to a new environment (often cloud) without code changes; quick but limited in long-term impact.

2. Refactor: restructure code for maintainability, scalability, and UX optimization for financial apps without altering core behavior.

3. Rearchitect: change the system’s architecture (e.g., monolith to microservices) for scalability and resilience.

4. Rebuild: rewrite the application using modern frameworks and financial technology software redesign principles.

5. Replace: switch the old app with a new one that better meets current business needs.

6. Retire: decommission apps with no business value, migrating only essential data.

7. Retain: keep the app as it is when costs outweigh benefits or the system still works well.

Choosing among the 7 R’s is only the first step. The real challenge is quantifying what outdated systems cost and what businesses gain through modernization. Industry data shows how expensive inefficiencies can be, while best practices for financial UX design demonstrate the tangible value of investing in change.

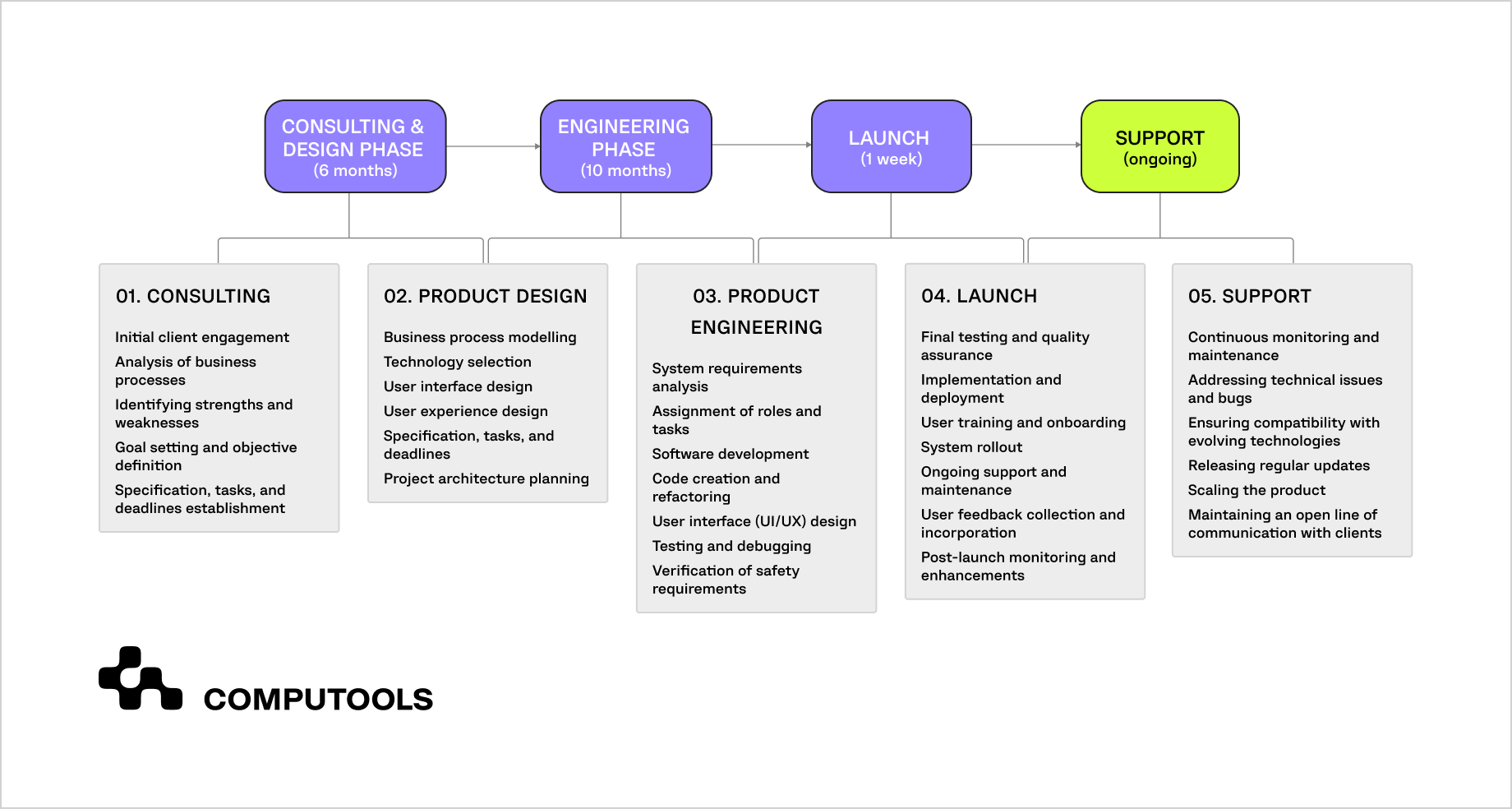

The process of financial app modernization is rarely linear. It evolves across multiple phases, from IT consulting to ongoing support. The diagram below illustrates a typical project timeline, highlighting how planning, design, engineering, launch, and support fit together in a modernization journey.

Challenges vs. benefits of financial app UX redesign

According to IDC, banks will spend over $57.1 billion by 2028 on maintaining outdated payment systems. Meanwhile, Quickbase reports that 70% of employees waste more than 20 hours a week chasing information across disconnected systems.

Firms with ~2,000 staff experience losses of up to $4 million annually due to tech interruptions. These numbers show that poor UX, old architecture, and fragmented workflows represent a massive financial burden. This is why legacy system modernization for finance has become a strategic priority, ensuring institutions replace costly inefficiencies with scalable, user-friendly solutions.

| Challenges | Benefits of a financial app UX redesign | Business Impact |

| Cluttered, complex interfaces. Legacy apps often pack too many features, slowing navigation and increasing error rates. | Streamlined workflows & simplified UI | Faster operations, fewer mistakes, less frustration |

| No mobile readiness. Many systems are still desktop-centric, limiting staff in hybrid or mobile-first environments. | Mobile-first & accessible design | Productivity anywhere, inclusive usability |

| Poor integration with CRM/analytics. Disconnected tools create data silos and force staff to duplicate work. | Cloud-ready, API-based integration | Real-time data flow, smoother decision-making |

| Security & compliance gaps. Outdated apps often lack MFA, encryption, and audit trails, exposing sensitive data. | Embedded MFA, encryption, audit trails | Reduced risks, stronger compliance, customer trust |

| High training overhead. Inconsistent design patterns require long onboarding and extra support. | Unified design system & predictable UX | Faster onboarding, higher adoption, better productivity |

When Computools redesigned the client’s outdated Windows Phone app through its legacy software modernization services, we tackled all five challenges: simplified navigation reduced errors, mobile-first design improved usability, modern integrations streamlined workflows, built-in security ensured compliance, and a unified design system cut training time. The result was higher adoption and measurable productivity gains across global operations.

This case highlights how digital transformation in financial services goes beyond technology upgrades; it reshapes daily workflows and boosts long-term efficiency. By applying UX design services, Computools delivered an intuitive, compliant, and scalable solution. This financial technology software redesign demonstrates how modernization directly impacts staff productivity and customer trust.

How to choose the best partner for financial app redesign and modernization

Redesigning legacy systems requires a partner with proven expertise, industry knowledge, and the ability to deliver measurable results.

A strong software modernization partner should be able to combine UX/UI solutions for legacy financial systems with domain knowledge, ensuring that the final product is both secure and user-friendly. Equally important is their ability to apply the best practices for modernizing outdated financial applications, from planning and architecture to deployment and ongoing support.

Modernization involves incorporating innovation into daily operations through smooth integrations, easy-to-use interfaces, and scalable systems. Vendors offering comprehensive services are best suited to upgrade outdated platforms into tools that boost staff productivity and build customer trust.

Why Computools?

Computools’ expertise spans banking software development , enterprise-grade digital transformation services, and secure mobile app development.

With 250+ experts and 400+ delivered projects worldwide, Computools blends technical excellence with a deep understanding of financial workflows. This combination ensures that modernization efforts translate into real productivity, compliance, and long-term competitiveness improvements.

For practical advice on assessing agencies, check out our guide: How to Find the Right UI/UX Design Agency for Your Business Project.

Final thoughts

Legacy systems weigh down banks and financial institutions with inefficiencies, high maintenance costs, and frustrating user experiences. Modernization changes this reality by transforming outdated tools into secure, intuitive platforms supporting staff and customers. A thoughtful UX redesign updates the interface and improves workflow in financial apps, turning them into engines of productivity and growth.

Businesses can unlock long-term efficiency, scalability, and trust by combining research, strategic planning, and user-focused design. For organizations ready to move forward, modernization is the key to staying competitive in a fast-changing digital economy.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”