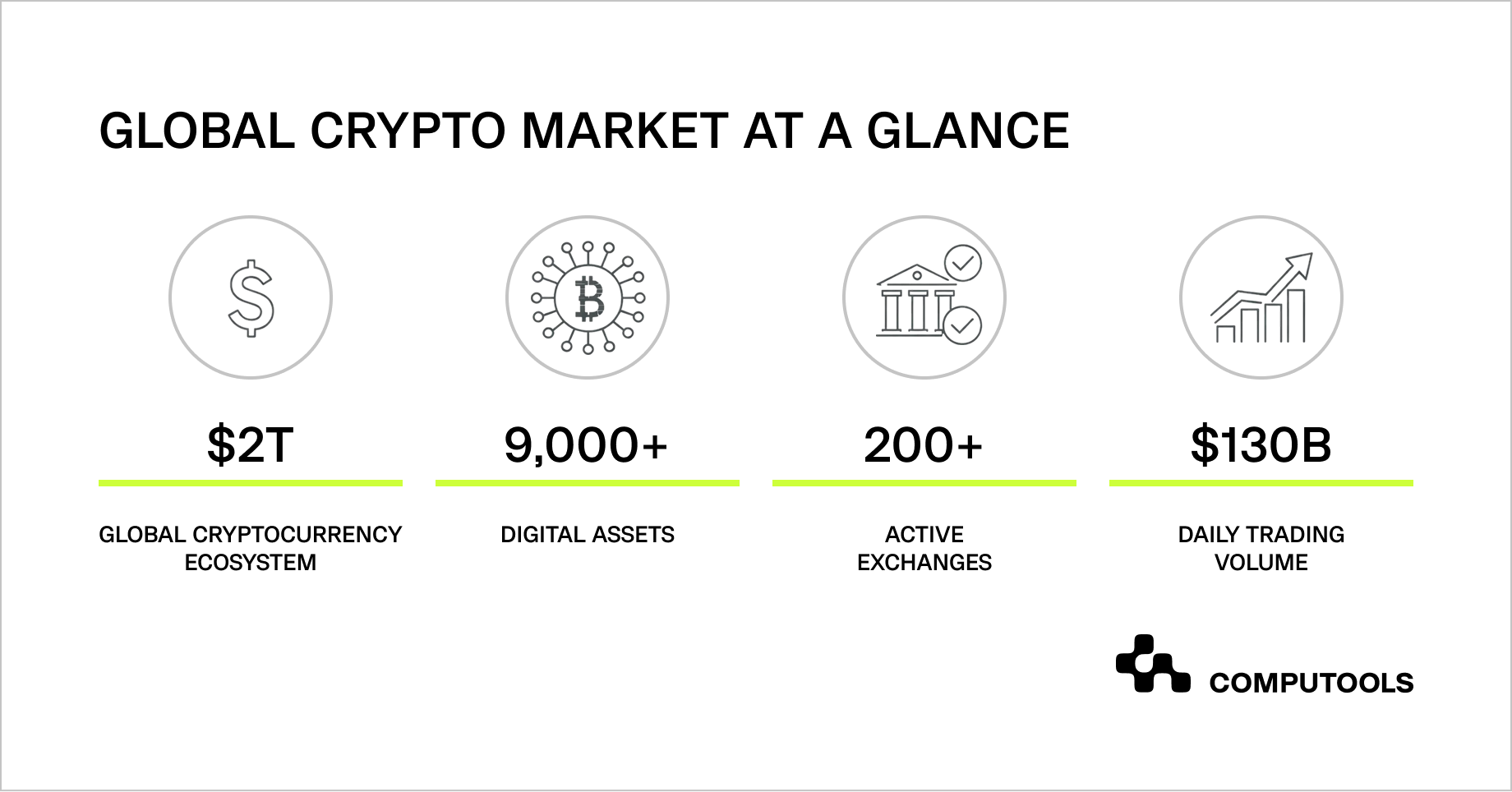

To build cryptocurrency exchange platforms in 2026 is a strategic response to a saturated and rapidly maturing market. According to Gartner, the global cryptocurrency ecosystem remains valued at around $2 trillion, with more than 9,000 digital assets and nearly 200 active exchanges processing over $130 billion in daily trading volume.

While Bitcoin continues to dominate liquidity, institutional participation is growing, regulation is becoming clearer across major regions, and crypto products increasingly mirror traditional financial services. In this environment, basic trading functionality is no longer enough to stand out.

Exchange operators now face a consistent set of challenges: high user acquisition costs, low post-registration engagement, limited monetization beyond fees, and declining differentiation between platforms. Traders expect more than charts and order books; they look for context, signals, discussion, and validation around decisions.

Much of this interaction still happens outside exchanges, weakening retention and product control. As a result, building a custom crypto exchange platform with embedded social and community features has become a practical way to drive engagement, trust, and long-term value, rather than an optional enhancement.

How Computools applied social and community principles in a real-world crypto exchange

The shift toward social and community-driven crypto platforms becomes far more complex once it moves from theory into real product delivery. We encountered this complexity firsthand while working on the Crypthusiast project, a platform we helped shape and deliver, not as a conventional exchange with add-on social features, but as a social trading cryptocurrency exchange where interaction, forecasting, and discussion were embedded into the trading experience from day one.

Unlike traditional exchange projects, our primary challenge was not transaction speed or asset coverage, but designing systems capable of supporting trust, visibility, and user participation at scale. We needed to enable traders to share predictions, evaluate signal accuracy, and engage with market narratives without compromising performance, security, or regulatory compliance.

This positioned the project much closer to investment software development than to a standard crypto-trading application and required tight alignment among product logic, data flows, and user behavior.

From an engineering perspective, this meant going beyond reusable exchange templates. We implemented extensive custom web development to integrate real-time market data, user-generated signals, reputation mechanics, and discussion layers into a single cohesive system.

Social features were treated as core product components, not peripheral modules, and were designed to coexist with core exchange functionality without creating bottlenecks, data inconsistencies, or moderation blind spots.

How to build a cryptocurrency exchange with social and community features: a step-by-step practical guide

Building a social-first crypto exchange isn’t just about adding chats or leaderboards to trading screens. It needs a different product mindset, an architectural focus, and a different development order.

Here, we detail the process based on real-world experience launching a community-focused crypto platform in a competitive market.

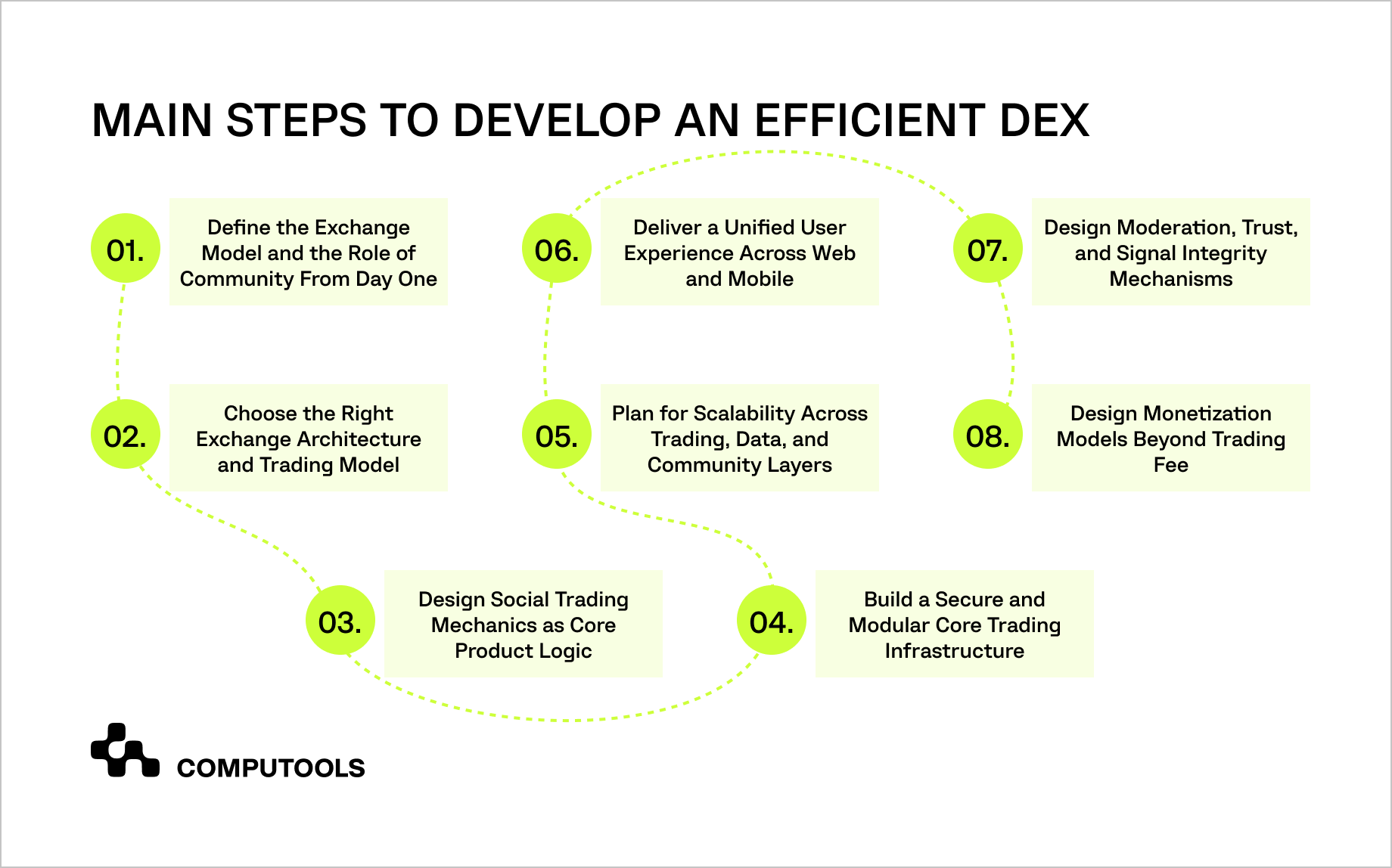

Step 1. Define the Exchange Model and the Role of Community From Day One

Before software architecture, technology, or even feature lists, the most critical decision is what kind of exchange you are building and how deeply community interaction is embedded into its core. A crypto exchange with community features can take many forms: from a traditional centralized exchange with social add-ons to a product where social interaction actively shapes trading behavior.

At this stage, teams must clearly answer several foundational questions: Is the platform designed primarily for individual traders or collaborative decision-making? Are social signals advisory, competitive, or monetizable? Will users follow other traders, copy strategies, or simply discuss assets? Without clarity here, social features risk becoming isolated widgets rather than drivers of engagement and retention.

In the Crypthusiast project, this step defined the entire roadmap. The platform was positioned as a social environment for crypto enthusiasts, with trading, forecasting, and discussion tightly integrated.

What usually goes wrong at this stage: Teams treat community features as optional add-ons instead of defining how social interaction directly influences trading decisions, which later leads to fragmented UX and low engagement.

Step 2. Choose the Right Exchange Architecture and Trading Model

Once the product vision is defined, the next decision concerns the underlying trading model and system structure. Teams typically choose between centralized, hybrid, or decentralized approaches, each with implications for performance, compliance, and user control. From a delivery perspective, this decision directly impacts the scope of blockchain exchange software and the complexity of integrations.

While decentralized cryptocurrency exchange development offers transparency and user-custody benefits, it also introduces constraints on latency, liquidity aggregation, and advanced social mechanics. For platforms focused on real-time interaction, signal accuracy, and high-frequency engagement, hybrid or centralized models often provide more flexibility at scale.

In practice, Crypthusiast required a structure that could support fast transactions while simultaneously processing social signals, predictions, and user-generated data.

What usually goes wrong at this stage: Architecture is selected based on ideological preference rather than on latency, liquidity, and social interaction requirements, creating performance and scalability bottlenecks early on.

Step 3. Design Social Trading Mechanics as Core Product Logic

Social trading features create value only when embedded directly into how users make decisions, not when they exist as parallel communication channels. This is why social features in crypto platforms must be designed as part of the trading logic itself, shaping how information is surfaced, evaluated, and acted upon in real time.

At this stage, teams need to move beyond the idea of “letting users talk” and instead define what type of influence social activity has on trading outcomes. This includes deciding which user actions are visible, how forecasts or signals are contextualized, and how historical performance affects credibility. Without these rules, social layers quickly turn into noise that overwhelms less experienced traders rather than helping them navigate the market.

In practice, this requires designing mechanisms such as performance-based reputation, time-weighted signal accuracy, and transparent historical tracking.

On the Crypthusiast platform, social interaction was structured around a signal system where users could publish market forecasts and later see how those predictions performed. This transformed community participation from opinion sharing into measurable contribution, reinforcing trust and long-term engagement.

Equally important is protecting the system from abuse. Without proper reputation weighting and historical validation, social trading mechanics become vulnerable to coordinated manipulation, where visibility is driven by activity volume rather than accuracy. From a product perspective, this risk must be anticipated early, as retrofitting trust mechanisms after launch is significantly more complex and disruptive.

What usually goes wrong at this stage: Teams launch social trading features without clear validation rules, allowing popularity and posting frequency to outweigh accuracy, which rapidly erodes trust and discourages serious traders from participating.

Step 4. Build a Secure and Modular Core Trading Infrastructure

Once social trading mechanics are defined, the platform must support them under real market conditions without compromising stability or security. At this stage, crypto trading platform development shifts from feature delivery to system design, where trading, wallets, market data, and social activity must operate as coordinated but isolated domains.

A secure cryptocurrency exchange architecture requires strict separation between components that handle financial execution and those that process user-generated content. Order matching, wallet management, and balance calculations must remain insulated from social layers such as signals, comments, and reputation scoring. This modularity allows teams to evolve community features without introducing unintended risk into core trading flows.

In the Crypthusiast project, this separation was treated as a non-negotiable design principle. Market execution logic was isolated from forecasting and discussion modules, ensuring that increased social activity — spikes in predictions, comments, or notifications — could not degrade transaction performance or expose sensitive systems. This approach also simplified security audits and made future feature expansion significantly safer.

Beyond system stability, architecture plays a direct role in mitigating manipulation risks. Social influence over trading decisions introduces new attack surfaces that must be addressed at the infrastructure level. Treating social manipulation as a systemic threat — rather than solely a moderation problem – allows detection and containment mechanisms to be embedded into data flows, logging, and access control from the start.

What usually goes wrong at this stage: Teams tightly couple social features with trading and wallet services, making even minor updates to community functionality risky and increasing the likelihood of performance issues or security incidents during periods of high user activity.

For a deeper look at how security, compliance, and risk isolation are implemented across regulated financial platforms, see How to Implement Enterprise Cybersecurity for Financial Services Companies.

Step 5. Plan for Scalability Across Trading, Data, and Community Layers

As social interaction becomes a core driver of engagement, scalability challenges extend far beyond transaction throughput. A scalable crypto exchange infrastructure must account for the compound effects of trading activity, real-time data processing, and continuous community interaction.

On community-focused platforms, load patterns change. While market volatility causes trading spikes, social dynamics add surges with predictions, discussions, reactions, and notifications from collective behavior, not just price movements. Infrastructure focused only on order execution often fails under these conditions, even with normal trading volumes.

In the Crypthusiast platform, scalability planning explicitly included community-driven workloads. Social activity, forecasting updates, and engagement signals were processed asynchronously, ensuring that increased interaction did not interfere with core trading operations. This separation allowed the platform to support rapid user growth and sustained engagement without degrading performance during peak periods.

Effective scalability at this stage depends on architectural decisions that prioritize elasticity and fault isolation. Event-driven pipelines, independent scaling of social and trading services, and clear data boundaries enable teams to absorb unpredictable traffic patterns while maintaining system stability. Ignoring these factors early often leads to reactive fixes, costly refactoring, and user-facing outages as the platform gains traction.

What usually goes wrong at this stage: Teams design for peak trading volume but underestimate the load generated by community activity, causing notification systems, feeds, and real-time data streams to become bottlenecks long before the trading engine reaches its limits.

Step 6. Deliver a Unified User Experience Across Web and Mobile

As crypto products mature, users increasingly expect to trade, analyze, and interact across multiple devices without friction. Crypto exchange app development should not simply mirror web functionality on mobile, but adapt social and trading workflows to different usage patterns, attention spans, and interaction models.

In community-centric exchanges, fragmented experiences quickly undermine participation. If discussions, signals, or reputation indicators behave differently across platforms, users lose context and trust. Consistency in how information is presented — from market data to social signals — is essential to maintaining coherent conversations and sustained engagement.

On the Crypthusiast platform, particular attention was paid to aligning core interaction flows across devices. Social signals, forecasting tools, and user activity were surfaced in a way that preserved context, whether users accessed the platform via desktop or mobile. This ensured that community-driven insights remained actionable regardless of where or how users engaged.

Beyond interface design, a unified experience depends on shared logic beneath the surface. Common design systems, synchronized state management, and consistent notification behavior prevent divergence as features evolve. Without these foundations, teams often struggle to scale community features without fragmenting the user experience.

What usually goes wrong at this stage: Social and trading flows are implemented inconsistently across web and mobile, fragmenting discussions, duplicating logic, and reducing long-term community engagement.

Step 7. Design Moderation, Trust, and Signal Integrity Mechanisms

Once social interaction becomes a core part of trading workflows, moderation and trust can no longer be treated as operational concerns handled after launch. In a community-driven crypto exchange, these mechanisms must be designed as product features that directly influence visibility, credibility, and user behavior.

Effective trust systems go far beyond content moderation. They include performance-based reputation models, signal validation rules, abuse detection, and transparent feedback loops that explain why certain forecasts, users, or discussions gain prominence. Without this clarity, users struggle to distinguish insight from noise, and confidence in community-driven features quickly erodes.

In the Crypthusiast platform, trust was built through measurable outcomes rather than popularity. User forecasts were tracked over time, allowing accuracy and consistency to shape influence organically. This approach reduced incentives for spam and short-term manipulation while encouraging meaningful participation from experienced traders.

Equally important is scalability. Manual moderation and basic reporting tools do not survive growth. As the community expands, coordinated behavior, gaming of visibility, and subtle manipulation patterns become harder to detect. Embedding trust logic into data pipelines, analytics, and access controls enables platforms to respond proactively rather than reactively.

What usually goes wrong at this stage: Teams rely on manual moderation or simple reporting mechanisms, which fail to scale and allow low-quality content or coordinated manipulation to undermine trust as user activity increases.

Step 8. Design Monetization Models Beyond Trading Fees

As competition between exchanges intensifies, relying solely on trading fees becomes increasingly fragile. Fee compression, incentive-driven trading, and liquidity migration make this model difficult to scale sustainably, especially for platforms investing heavily in community and social features. For social-first exchanges, monetization must be aligned with participation, subject matter expertise, and trust, not just transaction volume.

At this stage, teams should rethink monetization as a layered system rather than a single revenue stream. From our experience delivering complex blockchain development services, we find that monetization strategies are most sustainable when tightly integrated with product logic, data transparency, and user trust mechanisms rather than bolted on after launch.

Social trading environments open up new opportunities: premium access to advanced signals, visibility boosts tied to proven performance, subscription-based analytics, or tools that help users validate and monetize their own insights. When carefully designed, these models reward contributions rather than encouraging excessive trading.

On the Crypthusiast platform, monetization was directly tied to user value creation. Forecasting tools and signal systems allowed experienced users to monetize their accuracy, while premium features provided others with deeper market context and structured insights. This approach reduced reliance on pure trading volume and generated recurring revenue through subscriptions, driving strong early adoption of premium plans.

Crucially, monetization should strengthen rather than weaken trust. Pay-to-win mechanics, opaque promotion of signals, or monetized visibility without performance backing quickly erode credibility. Successful platforms embed monetization rules into reputation and validation systems, ensuring that paid features enhance decision quality rather than distort it.

What usually goes wrong at this stage: Teams introduce monetization late or copy fee-based models from traditional exchanges, missing the opportunity to monetize expertise, community contribution, and long-term engagement, and often damaging trust in the process.

For teams looking to accelerate iteration without losing control over core logic, read the article: What Every Insurer Should Know, explains where low-code approaches fit.

Build with clarity from day one. Request an expert estimation for a crypto exchange that combines performance-grade trading with social engagement at scale.

Why invest in social & community-driven crypto exchanges?

For companies planning to build cryptocurrency exchange products in today’s market, differentiation relies on creating ecosystems for learning, collaboration, and decision-making, offering business advantages beyond just engagement metrics.

• Higher retention and lifetime value. Social interaction creates habitual usage. When traders follow other users, track forecasts, or participate in discussions, the platform becomes part of their daily decision-making process rather than a transactional tool. Leading platforms such as Binance (with social trading features and copy strategies) or eToro (with investor feeds and performance-based visibility) demonstrate how community dynamics directly increase retention and lifetime value.

From a product standpoint, these outcomes are enabled by flexible blockchain exchange software that can support real-time data flows, user-generated signals, and reputation systems without compromising trading performance.

• Faster user onboarding and trust formation. Community-driven platforms reduce the learning curve for less experienced users. Social signals, transparent performance history, and peer discussion provide context that static charts cannot. This accelerates onboarding while increasing confidence in trading decisions, a critical factor in markets defined by volatility and information overload.

Platforms that successfully balance transparency and control often combine centralized execution with selective elements inspired by decentralized cryptocurrency exchange development, leveraging openness where it adds trust without sacrificing usability or compliance.

• Monetization beyond transaction volume. Social and community features unlock revenue streams that are less sensitive to market cycles. Subscriptions, premium analytics, signal access, and performance-based visibility allow platforms to monetize expertise and participation rather than relying solely on trading fees. In the Crypthusiast case, the project introduced premium features and signal-based tools as part of subscription plans, driving strong adoption of paid offerings and supporting recurring revenue.

Delivering these models sustainably typically requires custom investment software development, ensuring that monetization logic, trust mechanisms, and product analytics evolve together instead of being layered on post-launch.

• Stronger network effects and defensibility. Community-driven exchanges benefit from compounding value. As more users contribute insights, forecasts, and discussions, the platform becomes increasingly difficult to replicate. Unlike pure trading interfaces, social ecosystems create proprietary data, behavioral patterns, and reputation graphs that form long-term competitive moats.

Social and community features are no longer experimental additions. They are a proven way to increase retention, diversify revenue, and build defensible crypto products in a crowded market. Platforms that treat these capabilities as core product logic, rather than surface-level enhancements, are better positioned to scale sustainably and adapt as regulations, user expectations, and market structures continue to evolve.

Many engagement principles discussed here apply across financial products — The Ultimate Checklist for Improving Digital Customer Engagement in the Banking Industry offers a structured view of how financial platforms drive sustained user interaction.

Why choose Computools to build cryptocurrency exchange for social & community-driven crypto exchanges

Building a cryptocurrency exchange with social and community features requires more than technical execution. It demands a deep understanding of financial workflows, trust mechanics, and how user-driven interaction impacts trading behavior at scale. This is where our experience in regulated fintech environments makes a measurable difference.

What sets our approach apart

• Product-first architecture for social trading. We create crypto platforms that integrate trading, community, and signals into a unified ecosystem rather than separate modules. This allows social features to enhance decision-making without introducing instability or manipulation risks.

• Proven fintech delivery experience. With over 250 engineers and 400+ delivered projects, our fintech software development services are shaped by real-world constraints: market volatility, regulatory pressure, and the need for transparent, auditable systems.

• Custom-built, not template-based. Social crypto platforms rarely fit off-the-shelf solutions. Through custom finance software development, we tailor architecture, monetization models, and data pipelines to specific business goals as demonstrated in platforms like Crypthusiast, where community trust and forecasting accuracy were core to the product.

• Security and trust by design. We embed security, compliance, and traceability into the system from the earliest design stages. This includes isolating trading logic from social layers, designing for moderation at scale, and ensuring that trust is earned through performance rather than visibility.

• Scalability for community-driven growth. We build systems that scale not only with transaction volume but also with user interactions, discussions, signals, notifications, and the reputation dynamics that define community-centric exchanges.

Our role goes beyond development. We assist companies with product decisions, architectural trade-offs, and growth challenges in launching and scaling social crypto platforms, keeping systems resilient as markets, regulations, and user expectations change.

If you are planning to build a social or community-driven cryptocurrency exchange and are looking for a technology partner with deep fintech expertise, write to us at info@computools.com

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”