Digital wallets cover a payment system market share while putting forward a comfortable way to pay in-store, online, and in-app. It leverages your phone to pay instead of using cash or a physical credit/debit card, as it contains digital versions of your cards stored in wallet apps on your device.

Despite its growing popularity, developing a digital wallet from the ground up requires considerable time and effort since it’s inevitable to address legal aspects and integrate a payment system that supports payments for physical and digital goods.

As a result, limited regulatory harmonization within the Fintech ecosystems implies multiple operational challenges in the integration of digital wallets.

Since the cardholder’s information must be protected wherever it’s stored, digital wallet development involves having a certified storage method in compliance with the Payment Card Industry Data Security Standard (PCI DSS).

In this article, we’ll find out why digital wallets will take a leading role among fintech industry trends in 2023, as well as highlight the peculiarities of digital wallet app development. Let’s start with the digital wallet overview.

WHAT IS A DIGITAL WALLET?

Wallets don’t serve themselves as accounts or payments, instead, they are one of the available tools for accessing accounts or making payments. Digital wallet is considered one of the most sophisticated payment systems to be executed under strict adherence to the General Data Protection Regulation (GDPR), which entails further legal and security risks.

Also, there are several types of digital wallets, such as:

• Closed Wallet: a payment method that allows users to make transactions through an application or website where users can only use the funds stored in the wallet to complete transactions with the wallet’s issuer. It does not allow users to make payments outside the wallet’s issuer.

• Semi-Closed Wallet: a payment method that ensures transactions at certain merchants with the wallet’s issuer’s contract or agreement.

• Open Wallet: secures any type of transaction, allowing users to transfer funds online and in-store at any time easily.Recent research by InsightAsia shows the use of digital wallets exceeds other payment positions such as bank transfers (25%), cash (50%), Buy Now, Pay later (20%), debit cards (17%), and virtual account transfers (17%).

Recent research by InsightAsia shows the use of digital wallets exceeds other payment positions such as bank transfers (25%), cash (50%), Buy Now, Pay later (20%), debit cards (17%), and virtual account transfers (17%).

• Over 30% of digital wallet users leverage 3+ digital wallets at once.

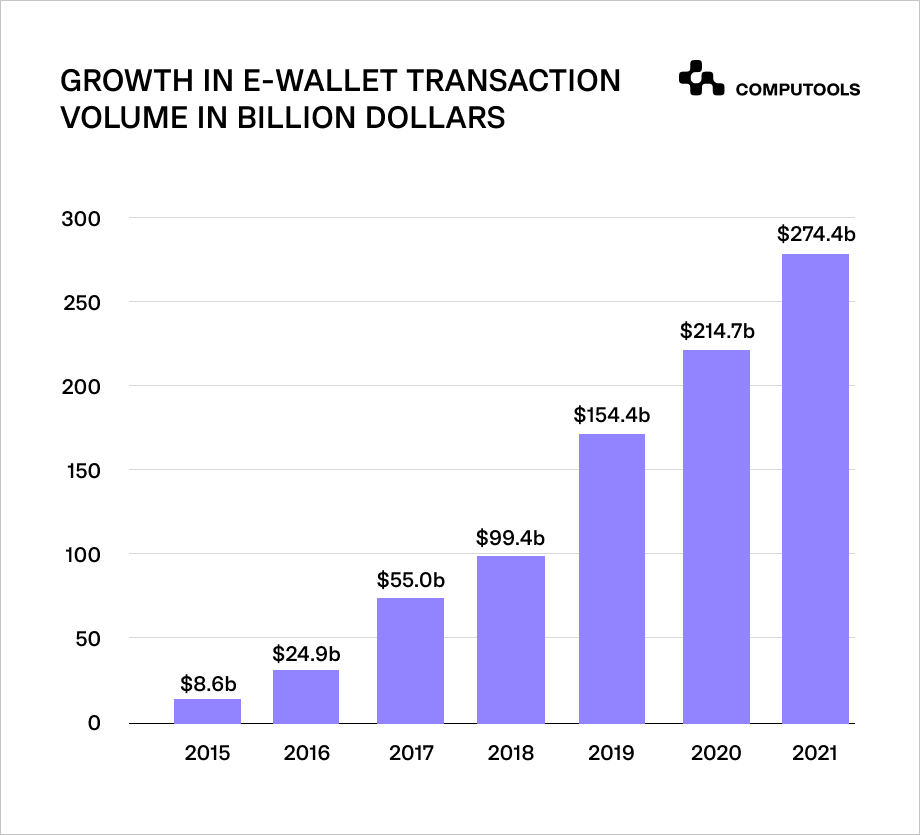

• In 2020, e-wallet-based transactions raised by 7% globally.

• By 2024, digital wallets are expected to account for over half of all eCommerce payments worldwide.

• Up to 70% of merchants accept contactless payments at point-of-sale terminals.

WHAT IS NEXT FOR THE FINTECH INDUSTRY TREND IN 2023?

Each year there are over 500 innovative tech solutions in the financial industry, along with renowned AI, ML technologies, and big data analytics. However, the progressive fintech industry should focus on digital wallet project. The payments sector has always been in the foreground of innovation. While the global challenge is securing high-profile protection and transparency, we should encourage innovation that will allow the industry to provide efficient payment solutions consumers want.

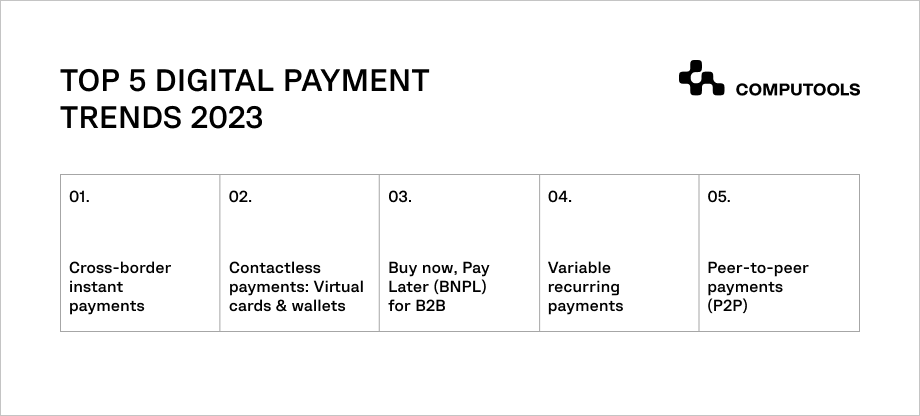

As per the study on New Digital Payment Methods, the contactless versions of cards are booming since the Covid-19 pandemic and still lead the trends. Mobile payment alternatives, such as digital wallets and apps, hit the rate of preferred payment methods discovered. Respondents noted the rapid turnaround, convenience, and ease of use. Let’s have a closer look at the top trends in digital wallets in 2023.

1. Growing Popularity of the Buy Now, Pay Later Method

As per Statista, with BNPL, customers are able to make purchases without threatening their monthly spending plan or adding to their credit card debt. With installment payment alternatives, online shoppers favor the BNPL option in their digital wallet solutions.

2. Social Retailing

Smartphone users look through social networking applications for a sizable portion of their waking hours, enabling brands to grow sales. Digital wallets are crucial for providing payment gateways and social purchasing options.

3. Biometric Authentication

The number of transactions conducted via digital wallet systems has arisen. As a result, many fintech companies, banks, and e-wallet platforms integrate biometric authentications for all transactions. Digital wallets can use decentralized identification apps to store and distribute these data points as necessary.

4. Blockchain Wallets

Even with market downturns, cryptocurrency wallet users have significantly increased over the last few years. Major world governments and banks have shown a tendency to adopt digital currency as a legal payment form and will continue to do so over the next few years. When storing crypto, one looks for the opportunity to keep it safe while hitting the balance between overall functionality and security.

Although, if your information gets lost or damaged, you’ll have no way to recover your assets unless you add an additional security layer. So, in order to opt for the right wallet, you’ll have to understand the distinctions between a “hot” and a “cold” wallet.

• Hot Wallets: Given web-based, mobile, and desktop wallets, web wallets are the least secure, although all blockchain hot wallets are vulnerable to online attacks. With its ease of use, there’s no need to jump between offline and online to make a cryptocurrency transaction.

• Cold Wallets: As a rule, cold storage wallets are secure, as a cold wallet theft would require physical access to the cold wallet. Cold wallets are better suited for long-term storage as most of them have recovery and backup options for a lost password but not for a lost device.

Computools

Software Solutions

Computools is an IT consulting and software engineering company that delivers innovative solutions to help businesses unlock tomorrow. Our clients represent a wide range of industries, including retail, logistics, finance, healthcare, and others.

EVERYTHING YOU SHOULD KNOW ABOUT DEVELOPING DIGITAL WALLETS

Digital wallet application development is undoubtedly challenging. The process complexities, regulation, and compliance laws, in addition to the competitive environment, are the critical pain points in the finance Software Engineering process.

Digital wallet apps are complex systems, so begin with the discovery stage and then move to the wallet development. You must determine the project objectives, identify the risks, and understand the users’ needs. QA, load testing, and penetration testing encompass all activities that help ensure a product meets quality standards and requirements.

The e-wallet app can be considered successful only if the customers rely on the security structure. So, privacy is a top priority when complying with standards and requirements.

If you are thinking about how to create a digital wallet application, focus on the following:

• FDI Regulator’s Requirements: With regard to the transfer of funds, the risks associated with mobile payments, such as data storage or locating data servers in specific regions, should be familiar to financial institutions and their regulators, as the corresponding risk controls are well established.

• Smart Two-Factor Authentication: An additional protection layer is used to ensure the security of accounts by using two unrelated authentication methods to secure an account.

• Tokenization: The complex process of interchanging sensitive data for non-sensitive that can be leveraged in a database without bringing it into scope.

• Point-to-Point Encryption: Standard for cardholder information required by the Payment Card Industry Security Standards Council that aims to encrypt cardholder information after it is read.

THE KEY CHALLENGES OF DEVELOPING A DIGITAL WALLET APP AND MAINTAINING IT

As mentioned above, the key advantage of a high-profile and secure digital wallet is its commodity and ease of use.

Simultaneously, there are an array of risks you may face when deciding to create a digital wallet that can greatly impact product delivery and performance:

Regulatory Compliance: Fulfillment of all legal requirements of the regulator, including data storage, Payment Card Industry Data Security Standard compliance, etc.

• Banking Arrangements: Multilateral standard-setting bodies consistently introduce and establish specific safeguards to secure smooth operational resilience for companies that provide payment services.

• Fraud and Security: Focus maximum efforts on continuous process improvement of the digital wallet security and the risk mitigation related to hacking and security breaches. This approach will help save an organization’s reputation and avoid significant financial losses.

• Promotion and Adoption: With booming digital payment technologies, many potential users still need to learn about their data privacy. For this reason, the popularization investment is inevitable, along with discussing the benefits of this payment method.

• Multiple Platform Support: Multiple app maintenance is vital to enable users to utilize the product across multiple devices on various operating systems.

WRAPPING UP: THINGS TO CONSIDER WHEN DEVELOPING AND INTEGRATING DIGITAL WALLET APPS

With emerging pitfalls when developing the digital wallet, the most challenging is still the aspects related to regulator’s requirements compliance. You will encounter the implementation of processing and licensing for electronic money issue permission, which is necessary for every company wishing to become a part of the network business community.

When launching a digital wallet, think about the functionality and the area of use to determine the most suitable type of app first. Finally, prioritize the customer experience to stimulate people to use their digital wallets. In order to beat the competitors and grasp a greater market share, you must go into holistic planning and strategize every step when developing and launching the product.

Do you have the project you want to create but need help figuring out where to start? Schedule a consultation with Computools’s experts at info@computools.com!

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”