Neobanks are financial institutions that operate entirely online, offering banking services via mobile apps and web platforms — without any physical branches. Their core value lies in intuitive digital interfaces, real-time operations, lower fees, and personalized financial services.

Challenger banks often function under full or partial banking licenses and typically leverage cloud infrastructure, embedded finance, and API-first systems to rival traditional banks in both speed and efficiency. The shift to digital is now mainstream: by 2026, over 70% of global consumers are expected to use some form of mobile banking — making the role of neobank app development companies more critical than ever.

This digital model has been gaining significant traction across both developed and emerging markets. Businesses, particularly in ecommerce, are actively seeking custom fintech application development to integrate banking services directly into their customer journeys.

According to Fortune Business Insights, the global neobanking market was valued at USD 142 billion in 2023, and is expected to grow to USD 3.4 trillion by 2032, with an impressive CAGR of over 40%.

18 Best Neobank & Challenger Bank App Development Companies:

1. Computools

2. Empat

3. AppMakers USA

4. Developer Bazaar Technologies

5. Camber – The App Agency

6. Topflight Apps

7. Supersourcing

8. LeanCode

9. Ailleron

10. ThinkUp

11. Suffescom Solutions Inc

12. FINANTEQ

13. KindGeek

14. Chili Labs

15. Synodus

16. hedgehog lab

17. DigiTrends

18. WDI

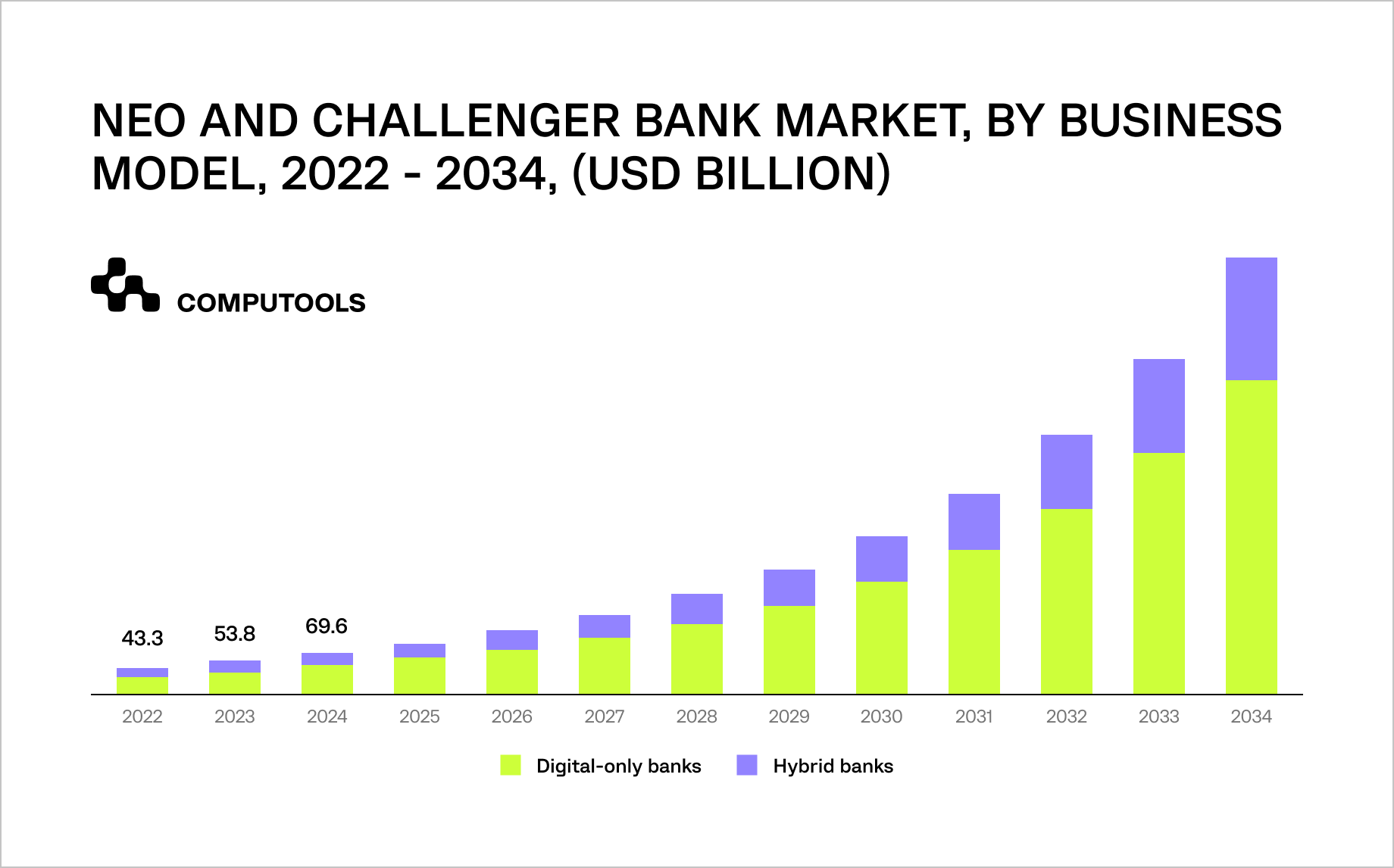

Another report by Global Market Insights projects that the broader neobank and challenger bank market will hit USD 698 billion by 2034, as the demand for Banking-as-a-Service app developer services and fintech infrastructure increases.

This includes tools like AI-driven KYC, real-time onboarding, and lending APIs — all of which are core deliverables offered by top neobank app development companies.

Revenue and user adoption metrics also confirm the market’s maturity. In 2023 alone, neobanks generated more than USD 33.5 billion, with regional players such as Nubank, Chime, and Monzo leading in customer acquisition. These apps rely on seamless mobile UX, personalized data flows, and deep integrations — core tasks for any digital banking app developer.

Regionally, Asia-Pacific leads with over 41% of the world’s neobank users, followed by Europe (32–34%) and North America (26%). While Middle East & Africa represent smaller market shares, mobile-first ecosystems are rapidly evolving there, supported by rising demand for challenger bank software solutions.

Companies today increasingly partner with neobank software development firms to build secure, scalable platforms with integrated features like e-wallets, biometric login, credit analytics, and in-app compliance workflows. These are particularly vital for ecommerce, which benefits from embedded payments and loyalty-based digital finance.

Selection criteria: how we chose the leading neobank app development companies

When evaluating top-tier neobank app development companies, we applied a strict set of criteria focused on real business outcomes — particularly for enterprises in fintech and ecommerce sectors.

These indicators reflect the actual expectations of CTOs, product leaders, and founders looking to launch or scale secure, user-centric digital banking products. Every company in our listing demonstrates strong alignment with these factors, making them reliable partners in a rapidly evolving financial landscape.

Our methodology was also shaped by the question: “How to choose a neobank app development company?” The answer lies in selecting partners with both technical depth and product-driven strategy. Below are the key evaluation dimensions we used.

1. Product & Platform Expertise

Top vendors must showcase real experience in fintech product development — not just building mobile apps, but launching full-fledged digital banks. This includes cross-platform logic, custom modules (e.g., budgeting, credit scoring), and rapid scaling under high compliance loads. Companies with end-to-end neobank software development services are prioritized.

2. Architecture & Scalability

Leading companies rely on cloud-native, modular, API-first infrastructures — essential for robust integrations with payments, lending, and KYC/AML providers. Microservices architecture also ensures that platforms can evolve without full rebuilds, which is critical for both neobanks and challenger bank app developer needs.

3. UX/UI Excellence

Customer adoption heavily depends on intuitive design. That’s why we assessed vendors based on their neobank UX/UI design services — including their ability to create seamless onboarding, actionable dashboards, and personalized financial interfaces across mobile and web platforms.

4. Security, Compliance & Licensing Support

Fintech products operate in highly regulated environments. Providers must understand region-specific regulations (e.g., PSD2, GDPR, SOC2) and offer built-in compliance modules, essential for any neobank software development firm.

5. Ecommerce & Embedded Finance Integration

Given the growing demand for embedded wallets, credit options, and loyalty programs, we highlighted teams that support integrations with ecommerce platforms. Strong neobank platform development is vital for online marketplaces and retailers looking to embed financial layers into their ecosystems.

6. Post-launch Support & Growth Vision

Successful neobank apps are never “done” — they require frequent updates, security patches, and new feature iterations. That’s why we looked for firms with a track record of delivering long-term mobile banking app development support, analytics-driven roadmaps, and scalable upgrade cycles.

Why do these criteria matter? Each factor we analyzed is tied directly to the success metrics of modern digital banks: time-to-market, user engagement, compliance efficiency, and long-term ROI.

For example:

• A lack of UX clarity leads to higher churn, especially in mobile onboarding.

• Weak API architecture limits a company’s ability to launch new services like P2P payments or cross-border transfers.

• Gaps in compliance support can delay launches or lead to regulatory penalties.

18 best neobank and challenger app development companies to watch

1. Computools

Computools stands at the forefront of neobank app development companies, combining end-to-end fintech software development services with deep domain expertise and strong alignment with ecommerce-driven business models.

Backed by a team of 250+ engineers, ISO-certified development standards, and more than 400 successfully executed projects, Computools delivers the operational reliability and technical depth required for mission-critical fintech products.

The company owns the full product lifecycle: from discovery and UX research to mobile development, complex system integrations, regulatory alignment, and continuous platform evolution.

With 20+ fintech and digital banking app solutions delivered, Computools brings hands-on experience in navigating regulatory constraints, security requirements, and high-expectation user experiences, translating complex financial logic into scalable, resilient applications built for long-term growth.

All these capabilities are reflected in real-world delivery:

• In partnership with Moblet, an emerging challenger bank, Computools built a modern mobile banking application incorporating biometric authentication, real-time expense tracking, and seamless SWIFT, Visa, and Mastercard integrations.

The solution also introduced a streamlined KYC onboarding flow, enabling Moblet to accelerate its entry into the retail banking market while competing more effectively on speed, security, and user experience.

• Computools’ domain expertise is further illustrated through its collaboration with Caribbean Bank, a major financial institution operating across 17 countries. The engagement included the development of a next-generation online and mobile banking platform, a microservices-based integration with Visa, a complete redesign of the digital product interface, and full alignment with PCI DSS standards.

Beyond modernizing the bank’s digital infrastructure and improving operational efficiency, the solution enabled Caribbean Bank to successfully expand into a younger, mobile-first audience, driving a measurable 12% increase in market share among customers aged 18 to 30.

Core Strengths:

• 12+ years of fintech engineering excellence

• Delivery processes align with PCI DSS, SOC 2, GDPR, PSD2, DORA, and KYC/AML requirements

• ISO 9001 & ISO 27001 security approach

• Ranked as a Top 100 Global Outsourcing Company (IAOP)

• Certified Microsoft & AWS partner for reliable, cloud-ready architectures

• Trusted by leaders: Visa, EPSON, Dior, Caribbean Bank, British Council

Best For:

Startups, SMBs, and enterprise financial organizations facing their most complex challenges in building secure, compliant, and high-performance financial products where regulatory adherence, robust cybersecurity, and exceptional customer experience are top priorities.

2. Empat

Overview:

Empat is a versatile mobile and web application development company consistently ranked among the top on Clutch for its work in iOS/Android development, UI/UX design, backend engineering, and integration projects.

With over 300+ successfully delivered products for clients across 20+ markets, Empat has built a strong reputation for technical delivery and team collaboration.

They are known for seamless integration with internal teams, clear communication, and reliable project management, making them an excellent choice for fintech and digital banking applications that require polished and performant user experiences.

Strengths:

• Exceptional project management and client communication with 100% positive reviews on Clutch

• Full‑cycle mobile and backend development, including QA, optimization, and maintenance

• Experience building scalable cross‑platform apps that support complex financial logic

• Strong emphasis on user‑centric UI/UX, making apps intuitive and engaging

Best For:

Fintech startups, digital challengers, and mid‑size banks seeking secure and user‑friendly mobile finance solutions.

3. AppMakers USA

Overview:

AppMakers USA is a US‑based mobile application agency with deep expertise in building high‑quality Android and iOS applications, including those used in financial contexts.

They are recognized for delivering polished, robust mobile experiences that align tightly with client visions.

Their structured development process emphasizes wireframing, prototype and MVP development, and clear roadmapping to ensure alignment from project outset through delivery.

Strengths:

• Strong track record of delivering mobile app projects on time and within budget

• Excellent project planning and communication — often cited in client testimonials

• Cross‑platform development experience, enabling flexible tech choices

• Experience developing performance‑optimized codebases with scalability in mind

Best For:

Startups and mid‑market clients seeking reliable mobile banking app development services with emphasis on UX and roadmap clarity.

4. Developer Bazaar Technologies

Overview:

Developer Bazaar Technologies specializes in mobile app development with strong emphasis on creating intuitive user experiences and responsive interfaces.

Their portfolio spans multiple industries, including financial services, where they deliver apps with solid backend integrations and API connections.

According to Clutch reviews, clients appreciate their responsive project management and collaborative approach, which is crucial for fintech projects that require frequent iteration and alignment with business goals.

Strengths:

• Mobile development across iOS and Android with backend integration expertise

• Emphasis on timely delivery and stakeholder engagement

• Flexible tech stack choices, enabling tailored financial solutions

Best For:

Businesses seeking dependable mobile app engineering with strong communication and delivery track records.

5. Camber – The App Agency

Overview:

Camber is known for delivering premium mobile applications with thoughtful design and technical depth.

Their focus spans iOS and Android platforms, backend engineering, and comprehensive project management across complex app initiatives.

In fintech contexts, Camber’s design sensibility and robust engineering practices help deliver digital banking applications with intuitive interfaces and enterprise‑grade stability.

Strengths:

• High‑quality UX/UI design paired with scalable architectures

• Proven delivery on mobile solutions that require attention to detail and performance

• Strong client communication and project structure

Best For:

Fintech enterprises and challenger banks that prioritize user experience and platform quality.

Examine the strategic foundations of neobank app development that transform financial services into intuitive, always-on digital products.

6. Topflight Apps

Overview:

Topflight Apps focuses on delivering high‑precision, scalable mobile applications with particular expertise in financial services and personal finance.

Their work is noted for architectural clarity, clean codebases, and strong data flow modeling, which are critical for financial apps that must handle transactions, analytics, and user data securely and efficiently.

Strengths:

• Deep experience with data‑intensive applications and financial logic

• Ability to translate complex requirements into well‑structured tech solutions

• Strong focus on app performance and reliability

Best For:

Fintech startups and personal finance applications that need industrial‑strength engineering practices.

7. Supersourcing

Overview:

Supersourcing is a versatile dev partner offering mobile and fintech app development with a focus on high‑quality code and timely releases.

They serve clients across industries including finance, and they are appreciated for adapting team composition to project needs, enabling projects to scale quickly when necessary.

Strengths:

• Adaptive teams scaled to match client demands

• Emphasis on clean development and maintainable solutions

• Support for integration with third‑party APIs and cloud infrastructure

Best For:

Companies seeking flexible development teams that can grow with product complexity.

8. LeanCode

Overview:

LeanCode builds scalable cross‑platform applications, often using Flutter, and is known for its product‑oriented approach to fintech solutions.

Their process blends technical expertise with client collaboration to ensure that mobile and web applications meet both performance and business expectations. They emphasize bringing fintech apps to market quickly without sacrificing quality.

Strengths:

• Strong experience in Fintech app development, including mobile and web stack

• Cross‑platform expertise that accelerates time to market

• Collaborative project management with responsive communication

Best For:

Digital banking initiatives that require rapid delivery and a flexible cross‑platform strategy.

9. Ailleron

Overview:

Ailleron is a seasoned developer in the banking and fintech space, delivering enterprise‑grade systems with reliable backends and integrated features.

Their experience spans customer-facing mobile apps and backend‑oriented financial platforms, making them a strong partner for fully integrated digital banking systems.

Strengths:

• Enterprise experience with financial institutions

• Strong engineering practices for secure and scalable systems

• Balanced expertise in mobile and backend integrations

Best For:

Large fintech and banking organizations seeking robust platform engineering support.

10. ThinkUp

Overview:

ThinkUp is a specialist in secure, feature‑rich financial applications that include account management, bill payment modules, transaction workflows, and other core components of banking platforms.

Their focus on reliability and compliance makes them a suitable choice for organizations building mobile banking app development solutions that require rigorous functionality and secure data handling.

Strengths:

• Experience with complex financial workflows and backend logic

• Emphasis on security and data integrity

• Strong team orientation toward financial systems implementation

Best For:

Banks, lenders, and financial services providers prioritizing secure and complete feature sets.

11. Suffescom Solutions Inc

Overview:

Suffescom Solutions Inc is a globally recognized mobile app and fintech development partner with a strong presence in the US, Dubai, and India.

They specialize in cross‑platform mobile solutions, backend integration, AI‑enabled features, and secure app architecture — all essential for neobank app development. Clients consistently highlight Suffescom’s reliable project management, strong technical delivery, and proactive communication.

The company also brings expertise in blockchain development and emerging technologies, which positions them well for innovative financial software that bridges traditional banking with next‑generation digital services.

Strengths:

• Comprehensive mobile app solutions from ideation to launch

• Expertise in secure, scalable Android and iOS applications

• Integration of advanced tech like AI and blockchain

• Strong Clutch ratings and client satisfaction

Best For:

Organizations seeking versatile app development with robust backend support and modern tech integration.

12. FINANTEQ

Overview:

FINANTEQ is a Poland‑based fintech and mobile app development company with a solid track record in building digital banking applications and mobile financial platforms.

Clients frequently praise FINANTEQ’s ability to deliver high‑quality, user‑centric mobile banking solutions that perform well in app stores and receive strong end‑user feedback.

Their agile development practices and attention to detail make them a reliable partner for financial institutions aiming to enhance digital banking offerings.

Strengths:

• Proven mobile banking engineering expertise

• Positive user ratings and low‑bug apps

• Strong communication and project continuity

• Experience with complex features like digital wallets and transactional flows

Best For:

Banks, fintechs, and challenger programs looking for reliable mobile banking app development and performance‑oriented solutions.

13. KindGeek

Overview:

KindGeek is a full‑cycle product development company that supports clients from concept to market, with clear strength in fintech software development services and product‑oriented engineering.

They emphasize design thinking, business consulting, and seamless integration with client teams — especially valuable for neobank ecosystems that demand both UX focus and backend complexity management.

Strengths:

• End‑to‑end development including discovery and business analysis

• UX‑driven solutions that align with financial user expectations

• Strong collaboration with in‑house IT and product teams

Best For:

Emerging digital banks and fintech platforms seeking product fundamentals combined with design excellence.

14. Chili Labs

Overview:

Chili Labs is a boutique mobile and cross‑platform development firm that excels in performance, usability, and responsiveness — core requirements for modern banking and financial applications.

Their streamlined teams deliver efficiency and iterative improvements, making them a solid choice for neobank app development projects that require clean code, strong QA, and user‑first interfaces.

Strengths:

• Mobile and cross‑platform development expertise

• Focus on performance optimization and UX

• Strong Clutch reviews for technical delivery

Best For:

Fintech startups and mid‑market financial product teams focused on polished and performant mobile experiences.

15. Synodus

Overview:

Synodus is a Vietnam‑based development company with high client satisfaction in mobile and software engineering. They have a reputation for delivering scalable solutions across industries, including finance and digital services.

Their ability to work with diverse tech stacks and adapt to client needs makes them a flexible partner for complex digital banking software provider projects.

Strengths:

• High review scores on Clutch

• Ability to scale engineering teams

• Broad mobile and backend development experience

Best For:

Organizations seeking adaptable and cost‑effective development support for fintech apps and platforms.

16. hedgehog lab

Overview:

hedgehog lab is a global product consultancy and development firm that combines mobile strategy consulting with reliable app execution.

They help clients define product visions and engineer secure, scalable applications — particularly valuable for financial service providers, digital banks, and challenger institutions.

Their broad industry experience includes work with high‑profile brands where reliability and security are paramount.

Strengths:

• Strategic product consulting + execution

• Solid technical capabilities for complex apps

• Global delivery teams with fintech exposure

Best For:

Enterprise fintech projects where strategy and execution must be tightly aligned.

17. DigiTrends

Overview:

DigiTrends delivers mobile and fintech development with a balanced approach to UX and backend functionality.

Their focus on delivering functional, user‑friendly mobile apps — along with responsive project communication — makes them suitable partners for growing digital financial products that require adaptability and solid engineering.

Strengths:

• Balanced UX and backend development

• Good cross‑platform capabilities

• Strong client experience and reviews

Best For:

Fintech product companies seeking reliable development execution without heavy enterprise complexity.

18. WDI

Overview:

WDI stands out for combining mobile app development with AI capabilities, offering an edge for fintech solutions that benefit from predictive analytics, personalization, and automation.

Their approach allows apps to incorporate machine learning insights into financial workflows — improving user engagement, fraud detection, and recommendation systems.

Strengths:

• Mobile app delivery + AI integration

• Scalable backend architecture

• Global client experience

Best For:

Fintech innovators and digital banks looking to differentiate their offerings through intelligent features and automation.

Discover the top 20 KYC software development companies driving innovation in identity verification, compliance automation, and fraud prevention for fintech.

Conclusion: choosing the right partner in a rapidly growing market

The neobanking and challenger bank sector is no longer emerging — it’s accelerating. As mobile-first user expectations and embedded finance ecosystems redefine how banking works, choosing the right development partner becomes a strategic decision. The top 18 neobank app development companies featured in this guide stand out not only for their technical excellence but also for their ability to translate complex financial workflows into seamless digital experiences.

Whether you’re an ecommerce platform integrating wallets and lending, or a fintech startup launching a digital bank, the right team can help you reduce risk, scale fast, and stay compliant. Look for proven expertise in UX, compliance, and cloud-native engineering, especially from firms like Computools that deliver end-to-end results.

The companies highlighted here represent the best of what modern Fintech app development companies offer — robust infrastructure, future-ready UX, and a long-term vision for growth. As a trusted digital banking software provider, Computools is ready to support your digital banking journey with strategic insight and technical excellence.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”