FASTER FINANCIAL OPERATIONS

Achieved through intelligent automation, real-time data processing, and AI-powered decision tools built into custom fintech platforms.

LOWER OPERATING COSTS

Driven by streamlined workflows, automated compliance, and smarter risk management built into every solution.

EXPERTS ON BOARD

100% of our clients choose long-term partnerships to scale innovation, ensure security, and accelerate digital transformation.

PROJECTS DELIVERED GLOBALLY

From neobanks to payment platforms, we build future-ready fintech software trusted by startups, banks, and financial institutions worldwide.

In today’s fast-moving financial landscape, FinTech companies face complex challenges that demand more than off-the-shelf solutions. At Computools, we deliver custom FinTech software tailored to solve the toughest issues in compliance, scalability, security, and user experience.

At Computools, we build RegTech solutions that automate compliance workflows, regulatory reporting, and policy monitoring to help you stay ahead of ever-changing financial regulations while minimizing manual overhead.

Our clients reduce compliance effort and manual reporting time by up to 60%.

We design real-time fraud detection systems and digital ID verification tools that reduce financial crime, protect customer data, and enhance trust across your fintech ecosystem.

Our solutions help reduce fraudulent activity by 40–55% and significantly lower chargeback costs.

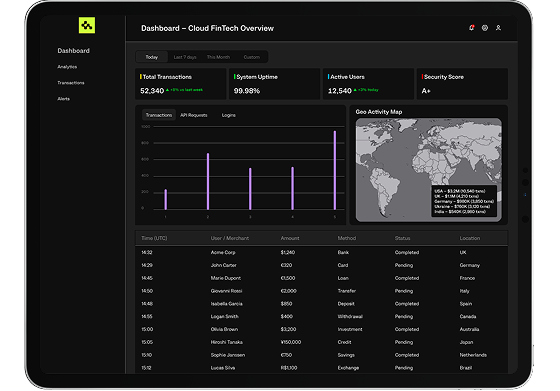

Our team transforms outdated, rigid systems into agile, cloud-native fintech platforms that support rapid innovation, seamless integration, and improved performance.

Legacy modernization with Computools cuts infrastructure maintenance costs by up to 45%.

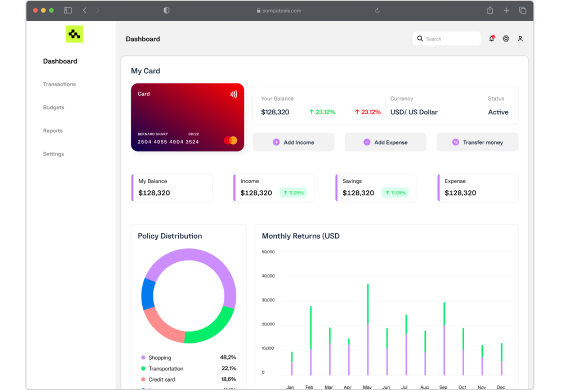

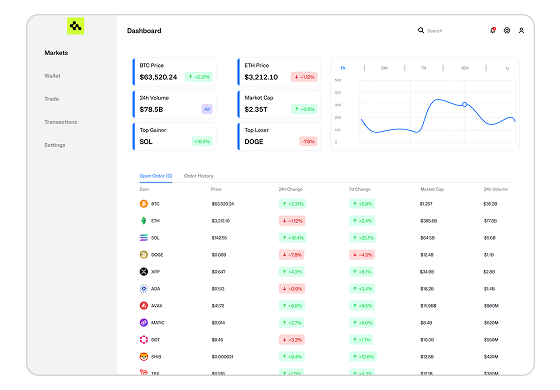

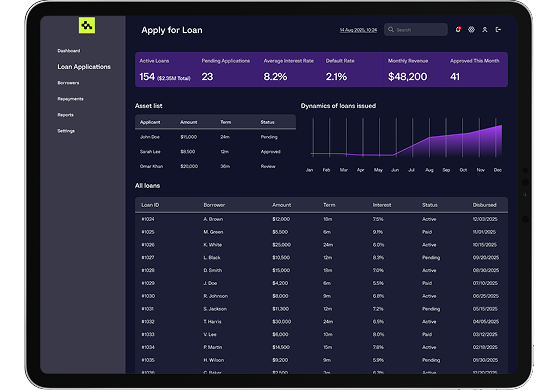

We implement streaming analytics, real-time dashboards, and predictive models to provide instant insights into performance, risk, and growth opportunities.

Our clients experience up to 50% faster decision-making and 30–40% better forecasting accuracy.

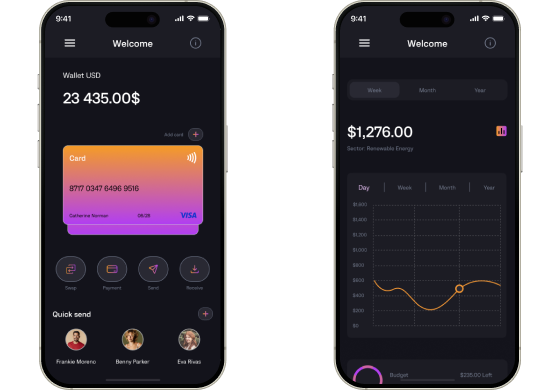

At Computools, we design secure, scalable mobile and web banking platforms with features like P2P payments, digital wallets, and integrated KYC/AML to deliver the high-speed, on-demand experiences your users expect.

Our platforms boost user retention by 25% and reduce app abandonment by up to 35%.

We build robust, secure APIs and connectors that simplify integration with KYC/AML providers, third-party fintech services, and open banking ecosystems.

Our clients reduce integration time by 40% and gain faster ecosystem connectivity.

Our engineers design resilient, auto-scaling cloud environments and CI/CD pipelines that support high transaction volumes without service interruptions.

We help clients achieve 99.99% uptime and reduce latency by 30–50% during peak loads.

We automate back-office processes including compliance checks, reporting, and onboarding to reduce operational costs and free up internal resources for high-value work.

Our automation solutions cut operational costs by 20–30% and accelerate internal workflows by 50%.

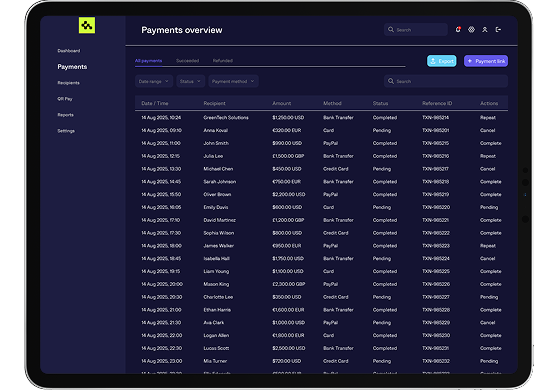

Computools delivers custom payment gateways with multi-currency support, FX conversion, and cross-border settlement to simplify global transactions and compliance.

Our clients see up to 35% faster transaction speeds and a 20% increase in payment success rates.

We develop mobile-first, behavior-driven fintech apps that deliver personalized insights, improve engagement, and increase customer lifetime value.

Our user-centric apps enhance engagement by 30% and improve customer satisfaction scores by up to 40%.

At Computools, we build RegTech solutions that automate compliance workflows, regulatory reporting, and policy monitoring to help you stay ahead of ever-changing financial regulations while minimizing manual overhead.

Our clients reduce compliance effort and manual reporting time by up to 60%.

We design real-time fraud detection systems and digital ID verification tools that reduce financial crime, protect customer data, and enhance trust across your fintech ecosystem.

Our solutions help reduce fraudulent activity by 40–55% and significantly lower chargeback costs.

Our team transforms outdated, rigid systems into agile, cloud-native fintech platforms that support rapid innovation, seamless integration, and improved performance.

Legacy modernization with Computools cuts infrastructure maintenance costs by up to 45%.

We implement streaming analytics, real-time dashboards, and predictive models to provide instant insights into performance, risk, and growth opportunities.

Our clients experience up to 50% faster decision-making and 30–40% better forecasting accuracy.

At Computools, we design secure, scalable mobile and web banking platforms with features like P2P payments, digital wallets, and integrated KYC/AML to deliver the high-speed, on-demand experiences your users expect.

Our platforms boost user retention by 25% and reduce app abandonment by up to 35%.

We build robust, secure APIs and connectors that simplify integration with KYC/AML providers, third-party fintech services, and open banking ecosystems.

Our clients reduce integration time by 40% and gain faster ecosystem connectivity.

Our engineers design resilient, auto-scaling cloud environments and CI/CD pipelines that support high transaction volumes without service interruptions.

We help clients achieve 99.99% uptime and reduce latency by 30–50% during peak loads.

We automate back-office processes including compliance checks, reporting, and onboarding to reduce operational costs and free up internal resources for high-value work.

Our automation solutions cut operational costs by 20–30% and accelerate internal workflows by 50%.

Computools delivers custom payment gateways with multi-currency support, FX conversion, and cross-border settlement to simplify global transactions and compliance.

Our clients see up to 35% faster transaction speeds and a 20% increase in payment success rates.

We develop mobile-first, behavior-driven fintech apps that deliver personalized insights, improve engagement, and increase customer lifetime value.

Our user-centric apps enhance engagement by 30% and improve customer satisfaction scores by up to 40%.

VP of Customer Success in Finance

Computools builds mobile and web-based personal finance applications that help users manage budgets, track expenses, monitor savings, and receive AI-driven insights to improve financial wellness and planning.

We create secure and scalable payment solutions that support instant money transfers, peer-to-peer transactions, bill payments, and global payment processing with full PCI DSS compliance.

Our team develops digital wallet applications that support contactless payments, loyalty programs, and multi-currency storage with biometric authentication and bank-grade encryption for maximum security.

We design and implement cloud-native FinTech systems that enable high availability, fast scaling, real-time analytics, and seamless integration with third-party services—ideal for modern financial products.

Computools delivers custom cryptocurrency solutions, blockchain wallets, and tokenization platforms that ensure secure digital asset management, smart contract execution, and seamless crypto payments.

We build intelligent lending platforms that support credit scoring, loan origination, risk analysis, and automated workflows—empowering online lenders, P2P platforms, and microfinance institutions.

“The team was very friendly and had the highest level of competence, engagement, and project management.”

“Computools predicted all possible points of our business growth and implemented them into the project.”

“We were highly satisfied with their deep understanding of our fintech processes and their project management was really superb.”

“Computools is a highly professional company with a skilled and responsive team. Their ability to propose valuable improvements and their dedication to the project made a significant difference.”

“The most noteworthy value that stood out was their exceptional experience in developing AI software solutions.”

“We were deeply impressed with their technical expertise, transparency, and flexibility. The team was highly skilled, easy to work with, and always proactive in solving challenges.“

“Computools offered non-standard solutions and maximized their investment in our business success.“

“Our company is impressed by their client-first approach and deep niche expertise.”

“A very comfortable collaboration and clear communication on every stage of platform development and maintenance.”

“After all these years, Computools never fails to arrive on time and with a quality that never ceases to amaze me. They work well as a team and are adaptable and communicative.”

“Within the first three months of its use, the designed program by Computools significantly reduced meter reading fraud by over 30%. Additionally, we saw a rise in operational effectiveness. Customer comments highlighted greater billing transparency and speedier service delivery, which contributed to an improvement in customer satisfaction levels.”

“They were professional, adapted to our short-notice needs, documented everything, and were transparent.”

“Thanks to Computools, we have seen a 15% growth in sales and a 40% boost in user satisfaction. Our image management has become more efficient, and our diagnostic capabilities have improved. Overall, the team has delivered a high-quality solution that meets our requirements.”

“Computools has significantly improved our LMS. The team holds regular meetings and provides detailed project reports, keeping us well-informed. We communicate via email, and overall, everything has gone smoothly.”

“Computools worked closely with us to understand our challenges. They developed a platform that integrated seamlessly with our existing infrastructure and Automatic Identification Systems (AIS) to capture private vessel data.”

“Computools’ work has had a positive impact on the client’s business. The team is flexible and responsive to the client’s needs. Their expertise has been key to the project’s success. Overall, the engagement has been positive.”

“Due to the platform’s use, the new products’ generated go-to-market timeline improves by 20%, cutting down on plan costs and, most importantly, enhancing the connection between the departments. The availability of near real-time information and the enhancement of the speed of decision-making are truly remarkable.”

“Thanks to Computools, we have successfully implemented our system and reduced the need for manual inspections. The team works in regular sprints and keeps us updated on progress. Their personalized approach, ability to listen, adapt, and continuously refine their methods are truly impressive.”

“Computools’ team truly impressed us with their dedication to the project, their ability to adapt to our processes, and their exceptional hard skills. This allowed us to identify many risks in the initial development stages and address some gaps in our processes. Professionalism, contribution, and flexibility are what define Computools. Based on my experience, I strongly recommend Computools for Dedicated Delivery and outsourcing project services!”

“Computools has delivered a functional solution that helped us increase revenue fivefold, reduce costs, and boost productivity. The team efficiently manages tasks in Jira and keeps us updated through weekly calls. Their productive approach and strong work ethic truly stand out.”

“Computools’ technical knowledge is impressive.They delivered the product on time, within the agreed budget, and fully aligned with our requirements.”

“Thanks to Computools’ efforts, we have seen compliance with deadlines and budget and team scalability as needed. The team has a confident project manager who delivers a professional and organized project. Moreover, Computools has quickly onboarded to the project and delivered fast results.”

“Thanks to the new solution, we’ve significantly reduced manual marketing workflows. Computools manages the project effectively, using Scrum methodology to execute tasks efficiently. Their problem-solving skills and ability to anticipate challenges set them apart from other providers.”

“Computools has successfully delivered everything as planned, adding value to the app. The team is highly approachable, tracks progress, and provides real-time updates via Slack. They maintain smooth communication through email and messaging apps, regardless of time zones.”

“Thanks to Computools, we now have an app that integrates 2,000 users into a single platform, significantly reducing the time spent on data exchange between systems and applications. The team manages our collaboration effectively and quickly adapts to changes. Overall, our experience has been highly successful.”

“Computools has been responsible for creating a novel database and front-end solution, incorporating both the development portal for digital standards and a modern shop for the sale of these standards. Throughout the course of the project, we have been consistently impressed by the professionalism exhibited by the Computools team, as well as their detailed understanding of our client’s processes. Their expertise, commitment to our objectives, and consistent delivery of high-quality work are notable aspects of their service.”

“Thanks to Computools, the client saw a 35% increase in daily active users and a 25% rise in user retention rates. The Android app also saw a 20% reduction in load times. User feedback indicated high user satisfaction; the feedback highlighted the product’s enhanced navigation and content linkage.”

“They are some of the best software developers I ever had the privilege to work with. Among other skills, their project scope and time estimation are very good and when wrong will work around the clock to make the date especially if it has business consequences. Not only are they amazing software developers, but they are also great people to work with. I am in awe seeing their devotion.”

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”

“After analyzing our requirements, Computools outlined potential solutions and deadlines for each stage. They designed the user flows and defined the user personas. They built the platform infrastructure and oversaw its implementation. Once we finished development, we conducted usability tests to assess their submitted work. Computools led an organized, agile team that adapted to our evolving needs. They listened to our feedback and managed their time well throughout the project.”

“The application perfectly meets the large-scale demands of the project, with the team creating an effective solution that works well and provides the required level of control. They were communicative, responsive, and proactive throughout the project, demonstrating their experience at all times.”

“The Computools team came to us with ideas, and that’s unusual. I’m satisfied that they gave us the right recommendations which are contemporary and relevant for today’s users. Because with other companies on previous projects, it was like pulling teeth to get them to make suggestions. The product received positive feedback even before being implemented and has led to significant customer and revenue growth.”

“We had to meet a significant increase in the development, so we needed to scale up relatively quickly but cost-effectively. The result definitely meets our expectations. The completed project received positive feedback for features and overall design. They’re very organized from a project management perspective and they’re technically competent. We appreciated their innovativeness, professionalism, and great communication skills. ”

“Their team has given us strong learning opportunities, and their developers are accommodating and collaborative.”

“We’re satisfied with the quality of work Computools deliver. They listen and try to understand our needs instead of finding new ways to charge us. We appreciate their transparent work structure. They kept us up-to-date regarding their progress throughout the entire development cycle. Knowing the system’s status throughout the coding process put my mind at ease.”

“They are very accommodating. They have very talented people. I’ve worked with hundreds of overseas developers and it’s not normal to have such excellent overseas developers. I don’t have to babysit Computools. They speak great English. They’ve also really helped with making suggestions on how to improve the product.

When we first launched our product at the beginning of the year, we were at 30,000 users a month and now we’re at 70,000. The bump in users is a result of the increased option rate and the new toys that Computoolls have built for me.”

“Computools developed software for our business to help automate our processes. Their team is very easy to speak to over Skype, where I can speak directly to a designated client manager, project manager, and the development team.”

“They were able to reduce the customer entry acquisition process from 2–3 weeks to 48 hours and have completely optimized all business processes. They’re a trustworthy company, full of integrity and great principles. They also communicate well in spite of the distance and resolve problems quickly.”

“They have a very positive attitude, which I enjoy a lot, and their technical skills are impressive. During this project, I got acquainted with their VP in charge of technical development, and he’s very impressive. Technologically, they are on the cutting edge of what they do. They use a lot of interesting technologies, which is good.”

We build a wide range of FinTech solutions including digital banking platforms, mobile wallets, payment gateways, lending software, wealth management tools, and AI-driven fraud detection systems. Whether you’re a startup or an enterprise, we tailor software to your business goals and regulatory needs.

Yes. We specialize in FinTech system modernization, migrating outdated platforms to cloud-native, API-first architectures.

Yes. We ensure compliance with essential financial regulations such as GDPR, PCI DSS, PSD2, and region-specific banking laws. Our solutions are designed with security, traceability, and audit readiness to help you stay ahead of evolving requirements.

Absolutely. We specialize in seamless integration with legacy systems, third-party APIs, CRMs, ERPs, and core banking platforms. Our development process enhances your current infrastructure while minimizing disruption.

Timelines depend on project complexity, features, and integration requirements. Most FinTech software development projects take between 3 to 10 months from planning to launch. We follow an agile methodology to deliver results quickly and ensure flexibility as your business evolves.