Today’s insurers face growing pressure from customers who expect fast, transparent, and personalized digital experiences, while many insurers still rely on fragmented legacy systems that slow quoting, underwriting, and claims decisions. To stay competitive, insurers and brokers must build insurance platform capabilities that combine accurate risk pricing, real-time quotes, and data-driven recommendations into a single workflow.

The stakes are high: Deloitte reports that personalized insurance experiences can increase customer retention by 5–10%, while McKinsey shows that insurers using advanced analytics in pricing achieve up to 15% higher profitability through more accurate risk assessment. At the same time, customer tolerance for friction is shrinking.

83% of U.S. consumers say they would switch insurers after a poor claims experience, making speed, accuracy, and trust critical throughout the entire insurance lifecycle, starting with the first quote.

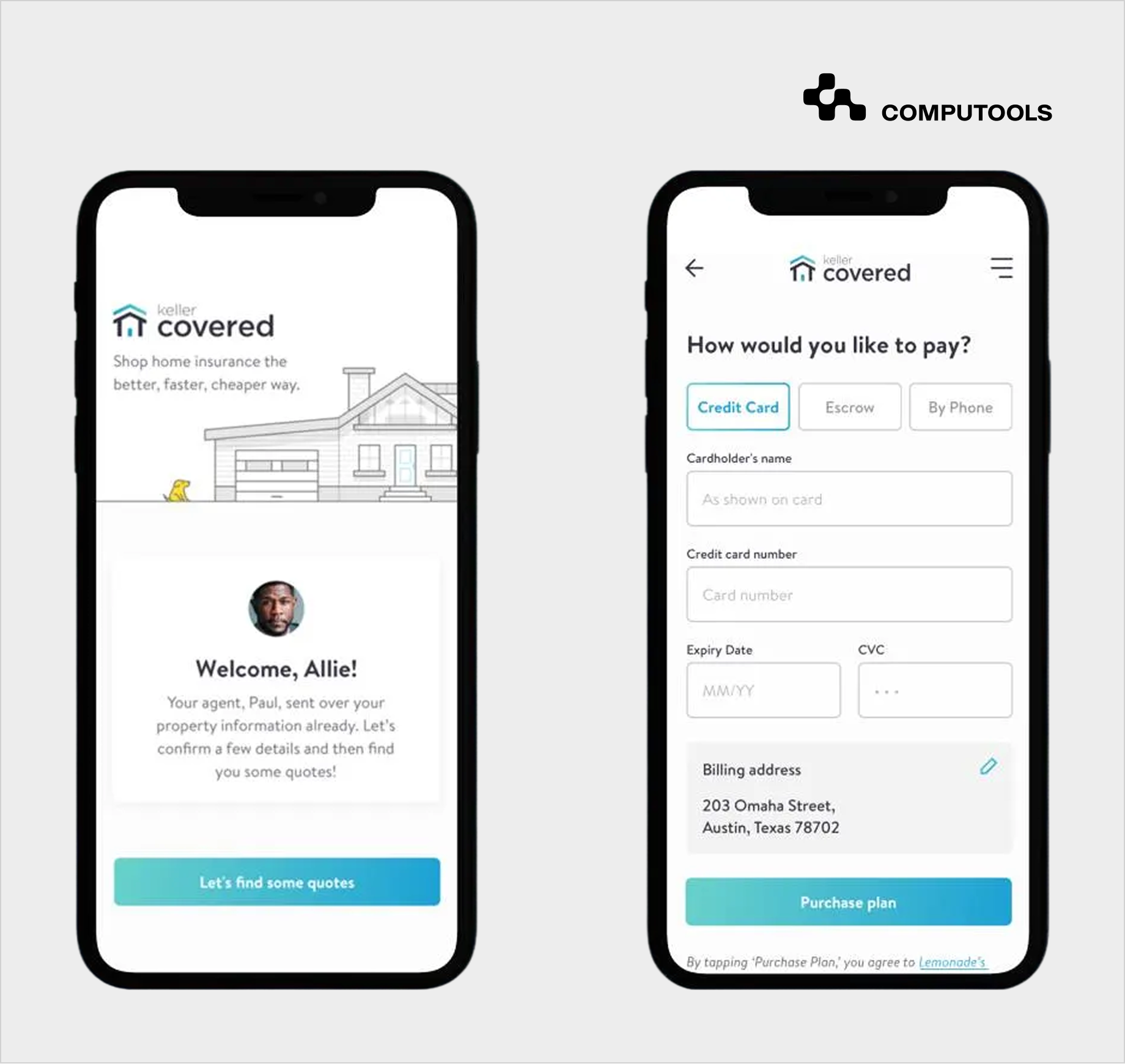

Below, we illustrate how these principles work in practice by walking through the Keller Covered case, where we built a fast, user-centric insurance quoting platform for homebuyers and homeowners.

How we built a digital insurance quoting platform for home buyers and homeowners

Our work with Keller Covered illustrates the practical implementation of modern insurance platforms. Keller Covered is a fast, free service that enables home buyers and homeowners to compare and purchase insurance online.

The client set out to remove friction from the insurance selection process, which is often slowed down by complex forms, fragmented carrier data, and non-transparent pricing. Their goal was to create a digital experience where users could quickly provide property details, receive relevant insurance quotes, and confidently choose coverage without navigating traditional insurance bureaucracy.

From a technology perspective, the challenge required a scalable web solution that can manage structured risk data, normalize insurance offers, and support real-time quote generation. This type of complexity is typical for insurance technology solutions, where usability, accuracy, and performance directly influence customer trust and conversion.

We designed and delivered a user-centric insurance platform that combines a detailed, dynamic questionnaire, streamlined UX flows, and efficient data processing into a single system. The solution allows users to input key property information, instantly receive tailored insurance quotes from trusted providers, and compare options side by side.

By applying principles commonly used in custom investment software development, such as modular architecture, clear data models, and performance-focused design, we ensured the platform could scale while remaining fast and reliable for end users.

The following section presents a structured, step-by-step guide on how to build insurance platform, using illustrative examples from our case to explain key architectural and product decisions.

How to build an insurance quote and recommendation platform: a step-by-step plan

Step 1. Design a Client-Centric User Experience and Interface

The foundation of any insurance quote and recommendation platform is a user experience that reduces complexity rather than exposing it. Insurance decisions involve a lot of information. The interface’s goal is to guide users through a structured decision path, making each step feel manageable and purposeful instead of showing everything at once.

At this stage, it is critical to design the platform around user intent instead of internal insurance logic. Questions, form fields, and navigation should reflect how users think about their situation, property details, ownership status, and coverage concerns, rather than how insurers structure underwriting models. This is especially important for a digital insurance platform, where friction in early steps directly impacts completion rates.

Key UX principles at this step include progressive data disclosure, clear step sequencing, and immediate feedback on user input. Long, static questionnaires should be replaced with adaptive workflows that adjust based on prior responses. Mobile responsiveness is not optional: users expect the same clarity and speed whether they access the platform from a desktop or a smartphone.

Our experience used a brief, dynamic questionnaire, collecting only key property and ownership info upfront. It showed extra questions only when relevant to eligibility or pricing, avoiding overload. This helped users navigate confidently without feeling stuck in a traditional insurance form.

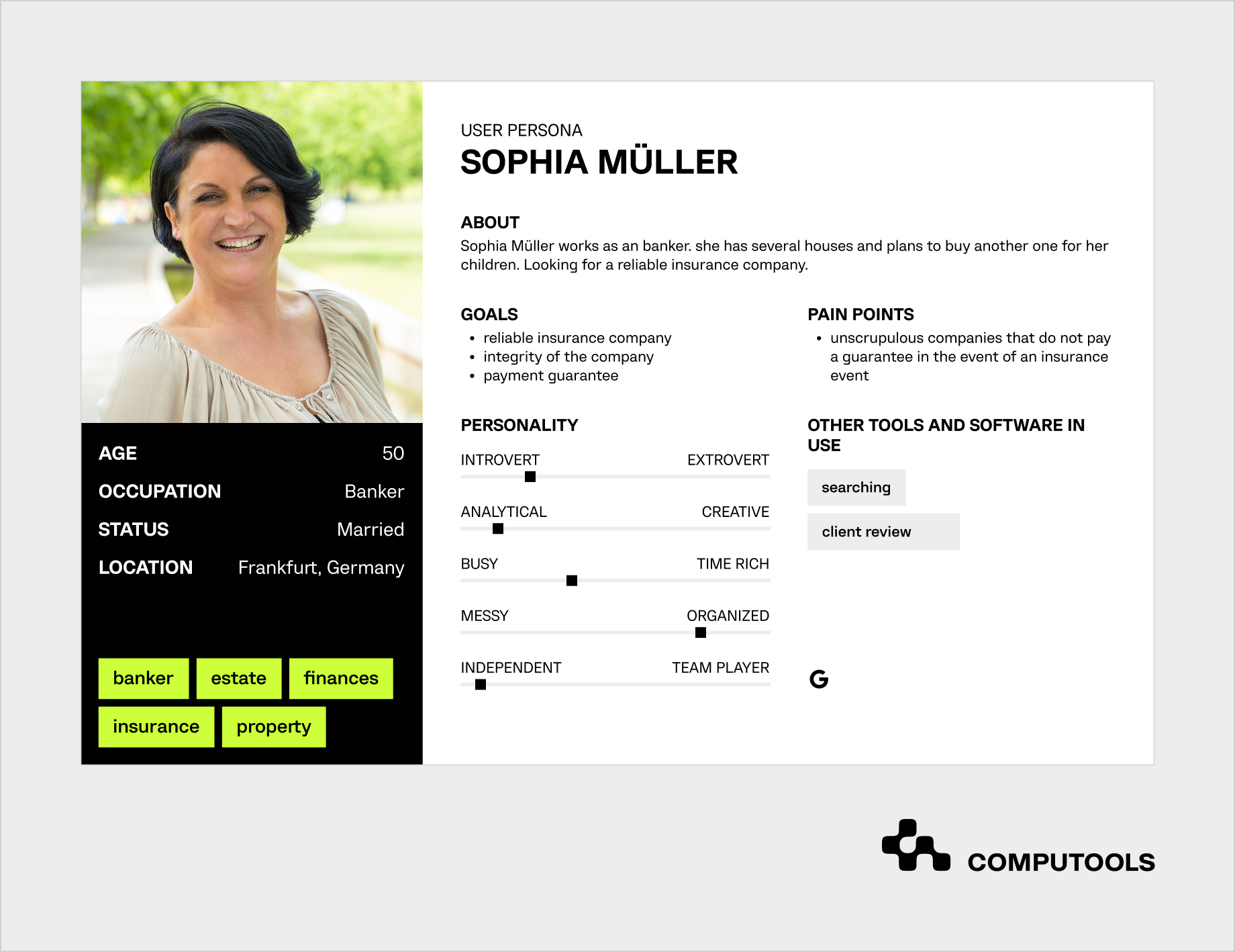

These UX decisions were guided by clearly defined user personas, representing time-constrained, risk-aware homeowners. Such personas influenced how questions were grouped, prioritized, and progressively revealed, ensuring the flow aligned with real user expectations rather than internal insurance complexity.

From a technical standpoint, this step also defines how the interface communicates with backend services. Input validation, data pre-processing, and real-time feedback must be handled seamlessly so that the quote logic remains invisible to the user. When executed correctly, the platform feels simple to the user, even though it is backed by complex insurance workflows and pricing logic operating behind the scenes.

Step 2. Structure the Quote Flow and Data Collection Logic

Once the user experience is defined, the next step is structuring data collection, processing, and transformation into insurance quotes. At this stage, focus shifts from visual clarity to operational accuracy: each data point must serve a purpose and impact pricing, eligibility, or recommendations.

An effective quote flow balances two needs. Insurers need detailed information for risk assessment, while users want speed and effort minimization. The solution is a staged data-collection process, requesting only necessary information at each decision point and deferring secondary details until relevant.

This is where an online insurance quote system must rely on conditional logic. Inputs such as property type, location, or ownership status should dynamically determine which additional questions appear next. This approach reduces abandonment and ensures the system never asks users for data that does not affect the outcome.

In our case, the quote flow was built around a logical progression from general to specific. Users first provided high-level property details, which allowed the system to determine quote eligibility. Only after this initial screening did the platform request additional attributes needed to refine coverage options and pricing. As a result, users could see meaningful quote options without completing unnecessary steps upfront.

Real-time validation and feedback are crucial. Data should be checked during entry, including format validation, logical checks, and risk thresholds. Immediate responses prevent errors and reduce recalculations, streamlining the experience.

Finally, the quote flow must be designed with comparison in mind. The structure of collected data should support normalized outputs, enabling side-by-side evaluation later. This is essential for any insurance comparison platform, where inconsistent input models can lead to misleading or incomplete comparisons.

When the quote flow is properly structured, the platform can generate accurate quotes quickly, maintain data integrity, and set a reliable foundation for pricing logic and recommendations in subsequent steps.

Step 3. Build Pricing, Risk Assessment, and Rating Logic

Once the quote flow and data inputs are clearly structured, the next step is to transform the platform, shifting from interaction design to decision logic. This involves combining risk evaluation, underwriting rules, and pricing models into a single calculation layer to support accurate, defensible pricing decisions.

It must answer three core questions: Is the risk eligible? What coverage options apply? What premium reflects that risk? Pricing logic should be deterministic, transparent, and auditable, based on rules like eligibility thresholds, coverage limits, deductibles, and surcharges, making quotes reproducible and explainable.

A well-designed insurance pricing and recommendation engine typically combines static rating tables with dynamic modifiers derived from user input. Factors such as property characteristics, location, ownership status, and historical risk indicators are weighted and applied in a predictable order.

This sequencing matters: pricing outcomes should never feel arbitrary, especially in regulated environments where traceability is essential.

Risk assessment logic should be separate from presentation. The system must evaluate risk continuously, flagging ineligible cases early and adjusting pricing only when important data changes the risk profile. This avoids unnecessary recalculations and fluctuating quotes.

In our case, pricing was linked to earlier data collection — property attributes and location determined eligibility, then coverage parameters refined the premium. Since the questionnaire was built around key decision data, pricing stayed stable as users proceeded.

Equally important is versioning. Pricing rules, rating tables, and risk thresholds must be version-controlled so that any quote can be reconstructed later for audits, renewals, or disputes. Without this, even accurate pricing logic becomes operationally fragile.

When done right, this step reliably links user data to insurance results, ensuring quotes are fast, consistent, explainable, and compliant with risk models and regulations.

Step 4. Design Recommendation and Offer Ranking Logic

After pricing and risk assessment, the platform must help users decide. The challenge shifts from calculating premiums to translating multiple options into clear recommendations reflecting user priorities and risk. A recommendation layer shouldn’t just sort by price. While cost matters, insurance decisions often involve trade-offs in coverage, deductibles, exclusions, and long-term risks. The platform must evaluate offers across these factors, supporting informed choices rather than guesswork.

This is where an insurance recommendation system becomes critical. It typically relies on scoring logic that combines pricing outputs with coverage adequacy, risk alignment, and user preferences. Weighting rules define what “best” means in a given context, for example, balancing affordability against protection for higher-risk properties. Importantly, these rules should remain configurable to support different products, regions, or customer segments.

Explainability is essential at this step. Users need to understand why a specific option is recommended and how it differs from alternatives. Clear explanations of trade-offs, such as lower premiums versus higher deductibles, build trust and reduce decision fatigue. Without this transparency, recommendations risk being perceived as arbitrary or biased.

In the Keller Covered case, recommendations were framed around clarity rather than persuasion. Instead of pushing a single “winner,” the platform highlighted key differences between options, allowing users to compare coverage scope and pricing with confidence. This approach supported decision-making without overwhelming users with excessive detail.

From a system perspective, recommendation logic should be decoupled from pricing calculations. Pricing engines determine what is possible; recommendation logic determines what is most appropriate. This separation allows the platform to evolve recommendation strategies over time without altering core underwriting rules.

When implemented correctly, this step turns raw quotes into actionable guidance. It ensures the platform does not stop at calculation. Instead, it helps users select insurance that fits their situation, which is a defining characteristic of a mature insurance quote-and-recommendation platform.

Step 5. Enable Transparent Comparison and Offer Normalization

Once recommendations are generated, users still need a clear way to compare alternatives and validate their choice. At this stage, transparency becomes as important as accuracy: the platform must ensure that different insurance offers can be evaluated on equal terms, without forcing users to interpret insurer-specific structures or terminology.

A core challenge here is normalization. Insurance products often differ in how coverage, limits, deductibles, and exclusions are defined and presented. Without a unified comparison model, users end up comparing incomplete or misleading information. This is why insurance product comparison software must translate carrier-specific data into a consistent structure before displaying it to users.

Effective comparison logic targets key decision points: coverage, deductibles, exclusions, and premiums. It highlights meaningful differences without overwhelming users with all details, offering deeper inspection when needed. Clear labeling and standardized terms reduce ambiguity and avoid “apples-to-oranges” comparisons.

In our case, insurance offers were presented using a standardized layout that aligned coverage elements across providers. This allowed users to immediately see where policies differed in protection and cost, without having to decipher insurer-specific language. As a result, comparison felt like an extension of the recommendation flow rather than a separate, confusing step.

Normalization needs a dedicated abstraction layer to map carrier responses, pricing, and coverage to a canonical data model before reaching the UI. This simplifies adding providers, adjusting comparison logic, or refining presentation. Proper comparison boosts trust, letting users verify recommendations, explore options, and make informed, defensible insurance choices, supporting both fast quoting and confidence.

Step 6. Support Self-Service and the Quote Lifecycle

After receiving recommendations and comparing options, the platform must support subsequent steps. Insurance decisions typically span multiple sessions, so the system should support the full quote lifecycle, not just a one-time interaction. Users should be able to pause, return, review, and adjust quotes without restarting.

This requires persistent quote storage, clear status tracking, and predictable behavior when inputs change, capabilities typically enabled through well-designed insurance automation software. Even small disruptions at this stage—lost data, expired quotes, or unclear next steps—can erode trust and reduce conversion rates.

A self-service layer includes access to saved quotes, the ability to revisit comparisons, and clear paths to purchase or request more information. Availability is key: users expect the platform to be accessible on demand, across devices, and without manual intervention.

Keller Covered platform lets users explore insurance options at their own pace, review and compare quotes over time, and make decisions without pressure. This promotes control and transparency, avoiding immediate commitments. Managing the quote lifecycle requires well-defined states: draft, calculated, recommended, selected, and completed quotes are treated as explicit entities, enabling revisions, analytics, and extensions like renewals or follow-ups.

Proper implementation makes the platform a reliable decision workspace, allowing users to engage on their terms while ensuring system consistency, traceability, and readiness for future processes.

For a deeper look at how custom platforms reduce operational overhead across insurance workflows, see A Guide to Cut Health Insurance Industry Operating Costs with Custom IT Solution.

Step 7. Ensure Security, Compliance, and Scalable Architecture

As the platform matures from a quoting tool into a decision-making system, security and compliance become structural requirements. Insurance platforms handle sensitive personal, financial, and property data, so every architectural decision must account for data protection, auditability, and regulatory compliance from the outset.

The platform must enforce strong access controls, encryption, and environment separation. Role-based permissions restrict data access by user roles. Maintaining detailed audit trails of quote calculations, pricing, and actions supports regulatory and internal reviews.

From a software architectural perspective, these requirements directly influence how services are structured and how data flows between them. A modular approach allows sensitive operations—such as pricing logic, recommendation scoring, and quote storage to be isolated and secured independently. This is a core principle of custom InsurTech platform development: scalability and compliance must coexist without slowing product evolution.

In our case, security considerations were embedded into the platform design rather than added later. Data handling rules, access boundaries, and traceability requirements shaped how quote states were stored and how interactions between components were logged, ensuring consistency across the entire lifecycle.

Scalability hinges on compliance; as new insurance products, regions, or providers are added, the platform must handle regulatory differences without reworking the core system. It needs configuration rules, versioned logic, and flexible data models that evolve while maintaining historical accuracy.

This step ensures the platform scales risk-free. Security, compliance, and architecture protect users, satisfy regulators, and build a stable base for future features, transforming the system into a long-term insurance infrastructure rather than a short-lived solution.

Step 8. Enable Analytics, Learning Loops, and Continuous Optimization

Once the platform is stable, secure, and scalable, the final step is ensuring it can improve decisions over time. The focus shifts from building core features to learning from user behavior, quote outcomes, and conversion patterns to refine performance.

Analytics are crucial. The system should track user navigation through the quote flow, where they pause, options compared, and recommendations leading to purchases. These insights identify friction points, misaligned assumptions, or gaps between pricing logic and user expectations.

Over time, this data can be used to enhance recommendation quality. Rather than relying solely on static rules or predefined weights, the platform can gradually evolve toward AI-powered insurance recommendations, where scoring models adapt based on historical outcomes, customer preferences, and observed decision patterns. This enables more precise recommendations without compromising transparency or regulatory constraints.

In Keller Covered case, the platform’s structure enabled us to observe how users interacted with quotes and comparisons, providing a foundation for future optimization. Because pricing, recommendation, and lifecycle states were clearly separated, insights could be applied selectively—improving recommendations without altering core underwriting logic.

From a system perspective, continuous optimization requires clean data pipelines, versioned models, and clear boundaries between experimentation and production logic. Changes to recommendation behavior should be measurable, reversible, and auditable, ensuring that improvements do not introduce unintended risk.

When this step is performed correctly, the platform becomes dynamic. It becomes a learning system that improves decision quality, conversion rates, and user trust over time—completing the transition from a basic quoting tool to a mature insurance quote and recommendation platform.

Assess the data, integration, and regulatory requirements of an insurance quote and recommendation platform. Engage experts to estimate architecture, timelines, and investment.

Technical architecture in insurance quote platform development

A scalable architecture is critical for insurance quote platform development, as it determines how reliably pricing, recommendations, and quote lifecycles operate as the platform grows. At this level, the goal is not complexity, but clear separation between core decision-making components.

The platform should be structured around distinct domains: data intake, pricing and risk calculation, recommendation logic, comparison and normalization, and quote lifecycle management. Each domain must evolve independently, allowing pricing rules or recommendation logic to change without affecting user flows or stored quotes.

Event-based communication helps reduce tight coupling between components. By reacting to domain events such as a quote calculated or an option selected, the system becomes more resilient and easier to extend with analytics, audits, or downstream integrations.

Versioning is a non-negotiable requirement. Pricing rules, recommendation logic, and data schemas must be explicitly versioned so that any quote can be reconstructed later for regulatory review, renewals, or dispute resolution.

Many teams start with a modular monolith to keep delivery manageable and enforce clear boundaries early. As complexity grows, selected components can be separated without reworking the entire platform. When architecture is designed around change rather than initial launch, the platform remains stable, explainable, and ready to scale across products and regions.

Security, compliance, and risk management for insurance platforms

Insurance platforms handle sensitive data, so security and compliance are top priorities. They must protect data integrity, ensure traceability, and meet regulatory standards across markets. Key measures include encrypting data, strict access controls, and separating user, admin, and system permissions. All critical actions, such as quote calculations and pricing updates, must be logged for audit and investigation purposes.

Security must be embedded into architecture and delivery processes. This is where dedicated cybersecurity services play a critical role, helping ensure secure system design, vulnerability management, and compliance with industry and regional standards.

Compliance considerations extend beyond data protection. Insurance platforms must support explainable pricing and recommendation logic, versioned rules, and the ability to reproduce historical quotes. These capabilities reduce regulatory risk and build trust with both users and partners.

When security and compliance are treated as design constraints from the start, the platform can scale safely. This approach minimizes operational risk while allowing teams to iterate on pricing, recommendations, and user experience without compromising trust or regulatory alignment.

Deployment and build strategy: How to approach platform implementation

Once core functionality and decision logic are defined, the next challenge is choosing how the platform should be built and deployed in practice. These decisions directly affect delivery speed, operational risk, and the platform’s ability to evolve as products, regulations, and markets change.

Common Build Approaches

Insurance quote and recommendation platforms are typically implemented using one of three strategies:

• Buy (off-the-shelf platforms). Faster initial rollout, but limited flexibility in pricing logic, recommendation transparency, and regulatory customization.

• Build (fully custom). Maximum control over data models, underwriting rules, and recommendation logic, but requires strict scope discipline to avoid overengineering.

• Hybrid. Combines ready-made components (e.g., authentication, reporting) with custom-built core logic. This approach often delivers the best balance between speed and long-term flexibility.

From a delivery perspective, insurance platforms share architectural and regulatory patterns with other regulated fintech systems, including solutions built as part of investment software development services, particularly in areas such as scalability, auditability, and controlled data access.

Greenfield vs. Modernization

Another key decision is whether the platform is built from scratch or introduced alongside existing systems:

• Greenfield builds. Provide architectural flexibility but require early alignment on data models, lifecycle states, and integration boundaries to avoid rework at scale.

• Modernization initiatives. Must operate within the constraints of legacy policy administration systems, fragmented data, and phased migration rather than full replacement.

In both scenarios, incremental delivery is critical. Large, monolithic releases increase risk and slow feedback loops.

Deployment Considerations

Deployment strategy must balance delivery speed with regulatory and operational constraints:

• Cloud-native infrastructure to enable elasticity and faster iteration.

• Environmental isolation to protect sensitive data and support audit requirements.

• Configuration-driven rules to support regional, regulatory, or product-level variation.

Hybrid deployment models are common, where customer-facing services scale dynamically while core pricing and lifecycle logic remain tightly controlled.

Architectural Principles for Sustainable Delivery

Regardless of the chosen approach, successful platforms tend to follow the same principles:

• Clear separation of pricing, recommendation, comparison, and lifecycle logic.

• Independent deployment paths, even when starting from a modular monolith.

• Well-defined integration boundaries to reduce coupling and support future change.

In our case, deployment decisions focused on controlled evolution. Core decision logic was isolated from presentation and integration layers, allowing updates to questionnaires, pricing rules, or comparison logic without redeploying unrelated components.

Why Strategy Matters

Deployment and build strategies should be guided by anticipated changes. Insurance platforms need to continually adapt to new products, regulatory updates, and customer expectations. Systems designed for gradual growth, selective replacement, and safe testing are much more resilient than those focused solely on short-term delivery.

Similar architectural and data-handling principles are explored in How to Build an Investment Management Platform With Real-Time Market Data, particularly around real-time processing and auditability.

How to build insurance platform: Custom vs. Off-the-shelf approach

Choosing how to implement an insurance platform is a strategic decision that affects flexibility, compliance, and long-term scalability. The approach defines how well the system can support complex pricing logic, evolving regulations, and differentiated customer experiences.

Off-the-shelf insurTech software solutions enable faster launches by offering predefined workflows and standard integrations. They work well for simple use cases but often limit customization when pricing, recommendation logic, or regulatory requirements become more complex.

A custom approach provides greater control. With сustom insurance software development, organizations can tailor pricing models, recommendation rules, and comparison logic to their specific underwriting strategy and markets. This becomes critical when platforms must support multiple regions, advanced recommendations, or non-standard insurance products.

Because insurance platforms frequently integrate with broader financial ecosystems, custom software development can further streamline data flows across quoting, payments, and compliance systems.

Many teams use a hybrid approach: using ready-made components for non-differentiating functions while developing core decision logic internally. This supports faster delivery without sacrificing flexibility. The choice should depend on expected change, as platforms built for evolution can scale, adapt, and remain competitive as insurance products and regulations evolve.

Why financial companies choose Computools as a technology partner

We focus on building software for regulated financial domains, where accuracy, resilience, and compliance directly impact trust and business outcomes. Our experience covers complex digital platforms operating under strict regulatory requirements, high data volumes, and continuously evolving business logic.

With a team of over 250 engineers and more than 400 delivered projects, we bring hands-on expertise across insurance, banking, payments, and risk-driven analytics. This background enables us to design systems that remain stable as products, regulations, and user expectations change.

Our approach to fintech software development services is rooted in real operational constraints. We build platforms that support complex decision logic, transparent calculations, and long-term scalability without sacrificing performance or usability.

We also specialize in custom finance software development, tailoring architectures, pricing engines, and recommendation workflows to specific business models rather than forcing organizations into rigid, off-the-shelf solutions.

Security, compliance, and auditability are embedded into our delivery process from day one. We design for traceability, regulatory readiness, and sustainable system evolution.

If you are planning to build or modernize an insurance quote and recommendation platform and need a technology partner with deep financial domain expertise, write to us at info@computools.com.

If you are evaluating potential technology partners in regulated finance, this overview of Top 25 FinTech App Development Companies Worldwide provides a broader market perspective.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”