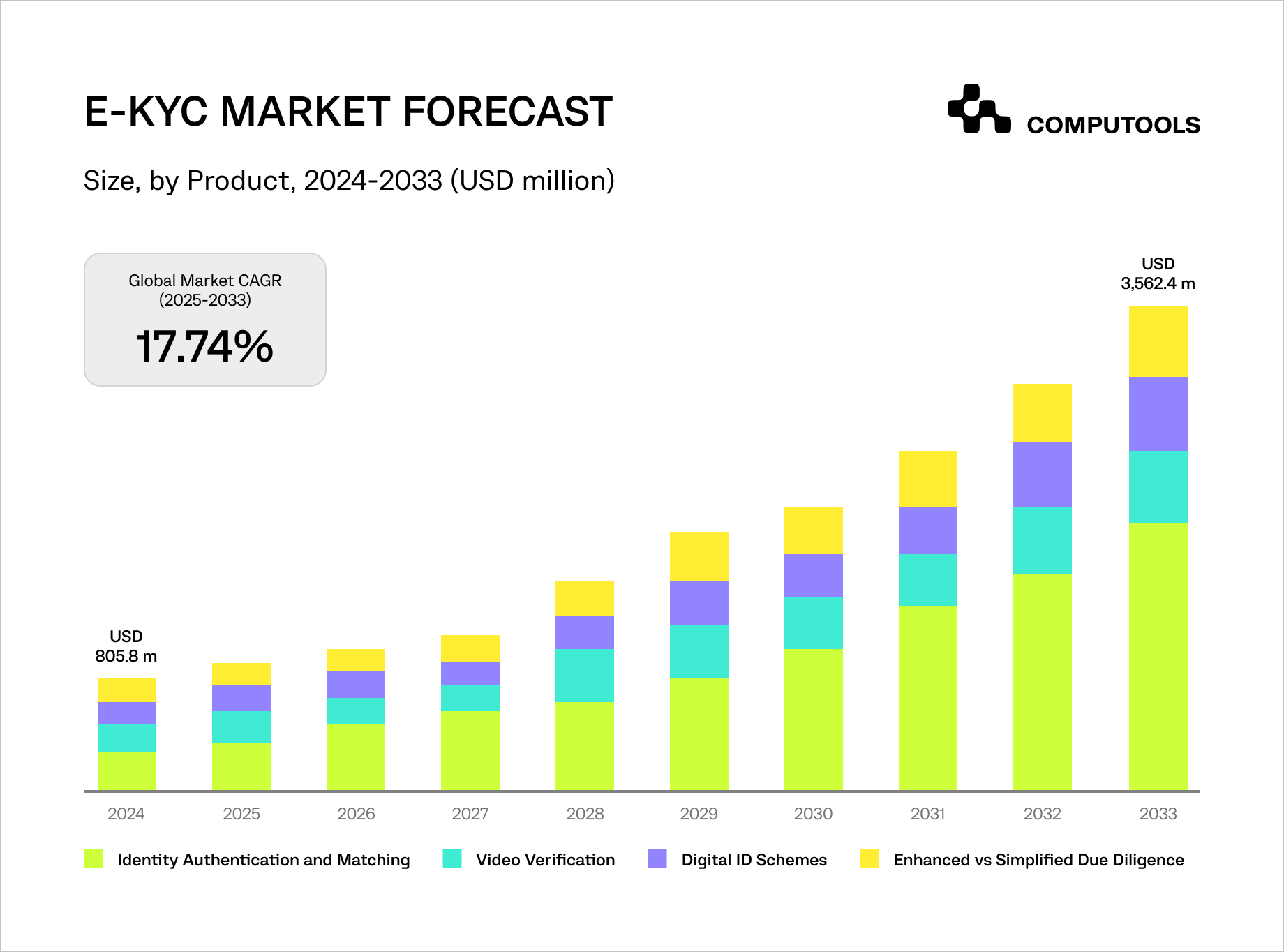

The KYC market is scaling at record speed, making KYC software development companies essential for any fintech platform. The e-KYC segment reached USD 805.8 million in 2024 and is forecasted to expand to USD 3.56 billion by 2033 (CAGR 17.7%).

Broader KYC and identity-verification markets show similar momentum: Mordor Intelligence values the KYC sector at USD 6.73 billion in 2025, with growth toward USD 14.39 billion by 2030 (CAGR 16.4%).

Other reports indicate that the global identity verification market reached USD 13.8 billion in 2024 and is expected to continue accelerating.

Top 20 KYC software development firms:

1. Computools

2. Digis

3. Cleveroad

4. Jelvix

5. Empat

6. Dreamix

7. Binariks

8. Globaldev Group

9. Inoxoft

10. Sombra

11. Light IT Global

12. Intellectsoft

13. Langate

14. S-PRO

15. Railsware

16. Forte Group

17. SmartTek Solutions

18. DICEUS

19. Dualboot Partners

20. Kitrum

For fintech platforms, this means one thing: fast, secure, globally compliant onboarding is now a core competitive requirement. Demand for engineering teams capable of building custom KYC systems is surging. Businesses need partners who can align with multi-jurisdiction regulations, integrate advanced fraud analytics, and support millions of checks without performance loss.

This is why we’ve prepared the Top 20 KYC Software Development Firms for Fintech Platforms, highlighting companies proven in delivering scalable banking software solutions for banks, crypto exchanges, payment providers, and neobanks. These firms turn KYC from a regulatory burden into a growth engine and a strategic safeguard.

How we selected the top KYC software development firms

To compile a list of leading identity verification software developer partners for fintech platforms, we applied a clear, transparent set of criteria tailored to businesses building high-compliance AML and KYC software solutions.

• First, we prioritized companies with 8+ years of experience in fintech engineering and a proven track record of delivering identity verification, e-KYC, KYB, and AML automation.

• Deep expertise in global regulatory frameworks, PSD2, GDPR, SOC 2, ISO standards, and data protection laws was essential for handling the compliance-heavy nature of KYC workflows.

• We also evaluated technical specialization in AI/ML-driven verification, biometric authentication, OCR and document processing, risk-scoring engines, workflow orchestration, and cloud-native architectures.

• Vendors with established engineering teams of 150+ experts ranked higher, reflecting capacity for building secure, scalable AML and KYC software solutions.

• Another key factor was each company’s integration portfolio. Strong partners can seamlessly connect KYC engines with core banking systems, payment providers, AML platforms, fraud-detection modules, CRMs, and onboarding pipelines. We assessed their ability to deliver full-cycle engineering services and maintain products post-launch with continuous compliance updates.

• Finally, we reviewed transparency, certifications, and client validation (4,9/5 on Clusth). Verified reviews, proven case studies, security credentials, and compliance audits helped confirm each company’s reliability and readiness to deliver robust, audit-ready KYC platforms for regulated industries.

Top 20 KYC software development firms for fintech platforms

1. Computools

Computools leads this list thanks to its strong track record in solving the core challenges financial institutions face when scaling digital operations: secure onboarding, regulatory pressure, fragmented legacy systems, and the growing need for reliable custom KYC software. As one of the most reliable KYC software development companies, the firm helps banks and fintech platforms replace outdated verification workflows with modern, automated, and audit-ready solutions.

Computools’ Fintech solutions cover the full engineering lifecycle from discovery and UX to backend, mobile, integrations, and long-term product evolution. This allows clients to close critical gaps in operational scalability, onboarding speed, fraud prevention, and regulatory alignment across banking, payments, insurance, and investment domains.

This expertise is reflected in Computools’ collaboration with Caribbean Bank, a major financial institution operating across 17 countries. The team built a modern online and mobile banking platform, integrated the bank with Visa via a microservices architecture, redesigned the product interface, and ensured PCI DSS compliance. The transformation strengthened operational efficiency and contributed to a measurable increase in engagement among younger customers.

Computools also accelerated the launch of Crypthusiast, a global crypto social-trading platform. Acting as CTO-as-a-service, the company developed the system architecture, forecasting tools, and engagement features that helped the platform scale to over 10,000 users and reach 90% of its first-year subscription target.

Another example of the company’s influence is the redesign of Finmap Online, a financial management platform for SMBs. Computools improved system security, rebuilt user flows, added multilingual support, and developed native iOS and Android applications, resulting in higher customer satisfaction and stronger conversion metrics.

Through these projects, Computools demonstrates the consistency and technical depth required to deliver complex, compliance-ready products as part of its Fintech software development services.

2. Digis, a Fiverr company

Digis is a fast-scaling software development company and a trusted fintech engineering partner for organizations that need strong delivery and rapid team expansion.

The company’s fintech portfolio spans digital banking, mobile banking apps, digital wallets, risk management systems, equity and tax platforms, trading and investment solutions, and blockchain-based products.

Digis works with a broad technological stack .NET, Java, Ruby on Rails, Flutter, React, Node.js, Python, Rust, and more, enabling full-cycle custom software development, staff augmentation, and long-term product scaling.

3. Cleveroad

Cleveroad is a full-cycle engineering provider specializing in Web, Mobile, Data Science, and IoT solutions, with a strong delivery track record in financial technology. The company is often considered among KYC software development companies thanks to its experience building secure onboarding flows, automated verification, and RegTech components for banks and fintech platforms.

Their fintech expertise includes digital banking and eBanking ecosystems, real-time payments, micro-investment platforms, robo-advisory and trading systems, embedded finance, and AI-driven risk analytics. Cleveroad regularly works with complex compliance frameworks, including PSD2, MiFID II, FINMA, GDPR, PCI DSS, and AML/KYC rules.

Highlighted projects include a cross-platform micro-investment app with automated KYC verification and MFA, and a full replacement of an outdated MVP with a custom eBanking ecosystem for a European investment bank.

4. Jelvix

Jelvix is a global technology company that delivers scalable financial platforms, secure payment systems, lending solutions, and AI-driven analytics for banks, insurers, and financial service providers.

The company’s expertise spans digital banking ecosystems, omnichannel banking, payment and transaction automation, blockchain-based financial products, investment management tools, and risk-management software.

Jelvix holds ISO 9001, ISO 13485, ISO 27001, and ISO 27701 certifications, ensuring disciplined delivery, strict compliance, and mature security practices.

5. Empat

Empat is a full-cycle product development company delivering mobile apps, web platforms, SaaS systems, custom dashboards, and complex backends. Their approach blends research-driven product strategy, UX excellence, and strong engineering, enabling Empat to support both early-stage startups and enterprise-scale transformations.

The company’s fintech expertise includes digital wallets, lending and credit tools, payment integrations, embedded finance SDKs, KYC/AML onboarding flows, personal finance products, and white-label payout automation.

Empat also delivers solutions for healthtech, logistics, retail, EdTech, and PropTech, operating across multiple tech stacks, including Flutter, React Native, Node.js, Python, Go, and Java, and across cloud environments on AWS, GCP, and Azure.

For critical guidance on developing secure payment solutions, read our essential guide on How To Build PCI-Compliant Cash-Handling Software For Financial And Retail Operations.

6. Dreamix

Dreamix is a Europe-based IT services company that delivers end-to-end custom software development and consulting across the full lifecycle: from product discovery and architecture design to implementation, cloud enablement, and long-term support.

In financial services, Dreamix has engineered solutions for leading institutions, including BNP Paribas, Royal Bank of Scotland, and insurance vendors like Fadata (Insis). Their teams design and modernize web banking systems, financial reporting tools, accounting and expense platforms, and event-driven and microservices-based architectures that support high transaction volumes and stringent regulatory requirements.

Dreamix also works with AI-based KYC solutions for fintech, alongside scalable cloud platforms and agile delivery models for insurers and financial institutions.

Discover how modern KYC development approaches integrate machine learning, biometrics, and real-time risk scoring to support sustainable fintech expansion and regulatory confidence.

7. Binariks

Binariks is a global engineering partner specializing in AI-driven transformation across fintech, healthcare, and insurance. The company builds secure banking applications, payment platforms, trading tools, and financial analytics solutions powered by machine learning and cloud-native architectures.

Their experts also focus on fraud detection, automated decisioning, and intelligent customer verification, helping fintech companies scale compliant digital services. With partnerships across AWS, Google Cloud, and Microsoft, Binariks delivers reliable engineering, dedicated teams, and complex systems integration for organizations, accelerating their digital roadmaps.

8. Globaldev Group

Globaldev Group is a strategic partner providing end-to-end software development and expert team extensions. Certified to ISO/IEC 27001, the company brings extensive experience helping businesses scale their digital infrastructure with cutting-edge technologies such as AI/ML, Cloud, and Data & Analytics.

The company’s core focus is on the Fintech and Banking sector. Globaldev Group specializes in creating robust, compliant, and market-ready solutions for financial institutions. Their offerings include advanced online banking platforms, loan management systems, and mobile applications.

A key part of their expertise is Fintech compliance software development, ensuring that all systems meet stringent regulatory requirements while optimizing operations and enhancing customer experience.

For technical insights on scaling and improving operational efficiency, read our detailed guide on How To Modernize A Legacy Cash-Handling Android App For Banks And Retailers.

9. Inoxoft

Inoxoft is a custom software development company that builds secure, scalable digital solutions across fintech, trading, lending, insurance, and business finance, covering web and mobile engineering, product discovery, UI/UX, QA, cybersecurity, and data science.

Their fintech expertise spans modern online banking platforms, automated trading systems, loan processing automation, banking CRM tools, lending software, personal and business finance applications, and secure verification workflows with real-time fraud detection. Inoxoft also implements AI-powered risk scoring, intelligent document processing for KYC and onboarding, and analytics tools for financial performance monitoring.

As an ISO 27001–certified provider and a Microsoft Gold, Google Cloud, and ISTQB partner, the company focuses on compliance, transparent delivery, and long-term product evolution.

10. Sombra

Sombra is a software development and IT consulting partner with services spanning Data & AI, software engineering, cloud and DevOps, cybersecurity, and customer experience automation. Among KYC automation technology companies, Sombra stands out for its ability to integrate AI-driven onboarding, document processing, and compliance workflows into complex financial ecosystems.

In financial services, Sombra builds digital banking and investment platforms, advisor and back-office systems, onboarding and CX tools, automated reporting engines, risk and compliance workflows, and modern data architectures. The company specializes in replacing monolithic applications with API-first microservices, modernizing legacy stacks, engineering secure cloud-native environments, and enabling real-time analytics for decision-making.

Their expertise also includes BI dashboards, forecasting engines, NLP assistants, AI-powered anomaly detection, ETL pipelines, and system audits for regulated markets.

11. Light IT Global

Light IT Global is a software engineering firm with experience in custom fintech solutions for banks, lenders, insurers, and financial startups. They specialize in online banking, payment platforms, analytics, digital wallets, trading solutions, and automated lending workflows.

The company also offers AI/ML, Big Data, blockchain, and cloud engineering to help financial organizations modernize legacy systems, automate decisions, and improve onboarding and compliance.

A distinguishing feature of Light IT Global is its patented delivery framework (SDPDF™), which reduces development costs, accelerates release cycles, and maintains adaptability without sacrificing predictability. With a strict compliance focus (ISO 9001/27001, PCI DSS, SOC, GDPR, KYC/AML) and deep technical specialization, the company positions itself as a reliable fintech development partner capable of building secure, scalable, and regulation-ready products.

12. Intellectsoft

Intellectsoft is a digital transformation consultancy providing cutting-edge engineering and strategic IT consulting. The company accelerates innovation by managing the full lifecycle of custom software products, with certified expertise in AI/ML, Cloud, and Data & Analytics.

Their core strength lies in the Fintech and Banking sector. Intellectsoft specializes in building robust, compliant, and transformative solutions for financial institutions. Their offerings include advanced online banking platforms, loan management systems, and specialized mobile applications.

A critical focus is on regulatory technology (RegTech), with deep expertise in developing Fintech KYC and AML software to ensure rigorous compliance with anti-money laundering and customer identification regulations.

13. Langate

Langate is a custom software development provider that helps clients overcome complex challenges and accelerate innovation by providing highly customized solutions and expert team scaling, leveraging their extensive experience in specific verticals, including Healthcare and Enterprise.

Langate has a strong focus on Fintech within the broader Enterprise sector, offering specialized software development services that blend IT and finance to deliver faster results, secure data storage, and smarter financial analysis.

Their expertise includes developing software for Financial Forecasting (utilizing AI for market analysis and loan payback likelihood), Accounting Software for expense and profit tracking, Budgeting Apps for personal finance optimization, and Tax Management Software for easier compliance and payments.

14. S-PRO

S-PRO is a Swiss-Ukrainian digital innovation and software engineering partner founded in 2014, delivering end-to-end solutions. The company combines consulting, product discovery, and full-cycle engineering to build secure, scalable platforms for fast-growing businesses.

In fintech, S-PRO develops digital banking systems, lending and alternative financing platforms, wealth and investment management tools, crypto & Web3 products, payment services, and automated digital onboarding. Their teams work with 40+ core banking systems and emphasize security, compliance, and modern architectures for high-load, regulated environments.

The company focuses on long-term partnerships, transparent delivery, and rapid time-to-value supported by strong domain expertise and ISO 27001-certified processes.

15. Railsware

Railsware is a global company that covers the full lifecycle from ideation and discovery to MVP, scaling, and long-term growth. Their teams mix product strategy, UX, and mature engineering practices to turn business objectives into measurable outcomes.

In fintech, Railsware delivers BI and financial planning tools, personal finance apps, consumer banking products, mobile payments, P2P lending systems, online trading platforms, fraud management solutions, and automated data-extraction engines.

Their domain work spans data analytics, high-load financial operations, AI-powered automation, and cloud-ready architectures.

16. Forte Group

Forte Group is a global software engineering partner headquartered in Chicago, helping financial institutions modernize systems, improve operational efficiency, and deliver secure, high-performance digital products.

The company’s financial services portfolio spans digital banking solutions, enterprise financial platforms, blockchain implementations, billing and invoicing systems, AI-driven analytics, and RPA for high-volume back-office processes.

Forte Group’s engineers work with strict regulatory requirements in the U.S. and EU, ensuring end-to-end security, audit readiness, and seamless integration with legacy and cloud environments.

17. SmartTek Solutions

SmartTek Solutions is a software development company that helps clients maintain a competitive edge by leveraging cutting-edge technologies and talented global teams.

The company possesses deep domain expertise in FinTech and delivers solutions on time and on budget through a transparent process. SmartTek’s specialized FinTech services include the development of Digital Banking platforms (online and mobile), Payment Solutions (electronic wallets, POS systems, and third-party integration), and Trading Platforms (bespoke intelligent automation).

Crucially, they focus on building Risk Management Software utilizing data analytics and machine learning to assess and mitigate financial risks.

18. DICEUS

DICEUS is a product-driven technology partner and system integrator specializing in software solutions, particularly for the insurance sector, where they offer a robust suite of products.

DICEUS extends its custom development expertise to the Fintech and Banking sectors, providing comprehensive services for Mobile and Core Banking software, Lending, Money Transfers, and Payment solutions. They utilize advanced technologies such as AI/ML, Blockchain, and RPA for smart financial analysis and process automation.

A critical area of focus is their role as a RegTech and KYC software developer, actively assisting financial organizations in navigating and adhering to complex compliance regulations.

19. Dualboot Partners

Dualboot is a software company that develops digital solutions using AI-driven methodology (DB90), combining design, engineering, and product expertise.

It specializes in Financial Services, creating scalable, secure financial software for fintech disruptors and banks. Its services streamline operations, boost engagement, and meet regulatory needs. They develop replatformed debt management systems, digital banking apps, and AI-powered compliance tools.

A key element of their offering is regulatory fluency, which is integrated from the discovery phase through to deployment. They develop solutions to improve data transparency, automate regulatory workflows, and streamline reporting for Risk & Compliance Teams.

Furthermore, they offer essential technical services such as KYC API integration services to ensure secure, rapid compliance, alongside Legacy Code Modernization and Portfolio Management Solutions for Wealth & Asset Management firms and Private Equity.

To enhance your understanding of digital transformation and how Low-Code tech helps insurers quickly build applications and modernize legacy systems, read the article Low-Code in the Insurance Industry: What Every Insurer Should Know.

20. Kitrum

Kitrum is a custom software development company that builds scalable web, mobile, and AI solutions for fast-growing companies, including those in the Fintech sector.

The company focuses heavily on the financial industry, offering solutions that enhance personalization, business process automation, and AI integration. Their core services cover Banking mobile apps, Payment solutions, E-wallet development, Trading software, and Blockchain-based platforms. Kitrum is an effective KYC software provider, specializing in developing solutions that incorporate dynamic biometrics and advanced onboarding processes.

Here is a curated list of leading partners in custom KYC software development. The table summarizes their experience, global presence, team strength, and clients recognition

| Company | Experience | Fintech focus | Offices worldwide | Team | Recognized by | |

| 1 | Computools | 12+ | digital banking, core banking platforms, payments, wallets, insurance tech, investment and trading platforms, neobank apps, KYC/AML and identity verification, analytics & decisioning | USA, Poland, United Kingdom, Austria, Germany, Israel, Ukraine, Norway, Belgium | 250+ | Visa, Epson, IBM, Dior, Bombardier, British Council |

| 2 | Digis, a Fiverr company | 8+ | digital banking and payment platforms, management systems | United Kingdom, USA, Germany, Austria, Poland, Israel, Ukraine, Norway | 200+ | BlaBlaCar, HubSpot, ZenduIT, ZEWAY, Otoqi |

| 3 | Cleveroad | 13+ | digital banking and eBanking ecosystems, RegTech & automated KYC/AML workflows | USA, Estonia, Norway, Ukraine, Poland | 250+ | Mangopay, Penneo, TBS AG, European Investment Bank, Mastercard |

| 4 | Jelvix | 15+ | digital banking and omnichannel banking, big data & AI for fintech, blockchain | Estonia, USA, Germany, Ukraine, Netherlands, Poland, UK, Israel, Singapore | 250+ | Samsung, Kia, IKEA, Canon, Benzinga, Auchan |

| 5 | Empat | 11+ | embedded finance SDKs, payment integrations, KYC/AML workflows, financial automation platforms | USA, UK, Ukraine, Poland, Portugal, UAE | 250–999 | Porsche, Panasonic, Heinemann |

| 6 | Dreamix | 17+ | online banking, insurance platforms, legacy modernization, RegTech solutions | Sofia (Bulgaria), Europe-based distributed teams | 250–999 | BNP Paribas, Royal Bank of Scotland, Fadata |

| 7 | Binariks | 10+ | digital banking, payments, financial analytics, fraud detection, AI-driven verification | USA, Poland, Estonia, Ukraine, Cyprus | 200+ | Cuende, Idkollen, Optifly, Hue, Quanterix, Be Better Energy |

| 8 | Globaldev Group | 14+ | Online banking, Loan management software, Bank applications | Warszawa, Poland, Israel, Germany, Vietnam, Armenia | 450+ | Coca-Cola, Red Bull, Mitsubishi |

| 9 | Inoxoft | 11+ | custom banking and e-banking platforms, loan automation, CRM for banks, lending software, secure verification & fraud detection | USA, Poland, Estonia, Ukraine | 230+ | Toshiba, Nivea, Vestel, TimeBos, APA Insurance, UCSanDiego |

| 10 | Sombra | 11+ | digital banking portals, legacy modernization, microservices & cloud migration, data engineering & BI | USA, Ukraine, Mexico | 350+ | Studio Ninja, Wineshipping, Waterford |

| 11 | Light IT Global | 17+ | Digital banking, payments, lending, trading & investment platforms, RegTech/KYC solutions | Estonia, UK, Poland, Spain, Ukraine | 170+ | Toshiba, Nivea, Vestel, APA Insurance, Rhenus Logistics, Shelf Synergy, Risk&Life |

| 12 | Intellectsoft | 18+ | Online Banking, Blockchain & Cryptocurrencies, Digital Wallet, Trading and Securities | USA, Ukraine, UK, Norway | 220+ | Mitsubishi power, Harkins, Pocket dentist, Young living, Skroote |

| 13 | Langate | 20+ | Financial Forecasting Accounting Software, Budgeting Apps | USA | 150+ | Approved Admissions, Bunaddler, rater8 |

| 14 | S-PRO | 11+ | Digital banking, wealth and investment management, crypto & Web3, KYC/onboarding, payments | Switzerland, Poland, Ukraine, USA, Netherlands | 250+ | Societe Generale, Sygnum, Amina Bank, Maverix Securities |

| 15 | Railsware | 17+ | BI for financial planning, consumer banking apps, mobile payments, P2P lending | Poland, Ukraine, USA, UAE | 200+ | Calendly, BrightBytes, 4Finance, Quorso, |

| 16 | Forte Group | 20+ | digital banking platforms, enterprise blockchain, billing & invoicing systems, AI & big data for finance, RPA for BFSI | USA, Argentina, Colombia, Ukraine | 650+ | BMO Harris Bank, OppFi, Interfirst, Magnifi |

| 17 | SmartTek Solutions | 8+ | Digital Banking, Payment Solutions, Risk Management Software, Digital onboarding KYC solutions | Ukraine, USA, Romania, United Kingdom, Canada, Israel | 160+ | Black Ice, LLC, United Spirit Games, Bluesky Solutions Ltd, Wholesale |

| 18 | DICEUS | 15+ | Payments, Lending, Money transfers, Blockchain, Regulatory compliance | Denmark, Poland, Ukraine | 250+ | UNIQA, VIG, Fairfax Group, WTW, Kniazha |

| 19 | Dualboot | 8+ | Digital Banking, Debt Management, AI-powered Compliance, Payment & Lending Platforms | USA | 280+ | Continental Tire, PrizePicks, PetScreening, DebtBook |

| 20 | Kitrum | 8+ | Banking Mobile Apps, Payment Solutions, Trading Software, E-wallet, Financial Analysis | USA, Ukraine, Poland | 290+ | United24, Washington Guardian, Financial Times |

Why choose Computools among KYC software development companies

Computools is chosen by financial institutions that need reliable engineering rather than fragmented tools. The company delivers stable, compliant architectures that address core operational issues, such as slow onboarding, legacy verification flows, cybersecurity risks, and scalability limitations.

Its experience involves large banks and fast-growing fintechs: supporting regional expansion for Caribbean Bank, building scalable product foundations for Crypthusiast, strengthening analytics and security for Finmap Online, powering Moblet’s market entry through high-quality custom mobile app development, and reinforcing cyber defenses for Generation Group’s international banking operations.

For organizations seeking a partner capable of integrating secure verification workflows into banking, payments, crypto, and financial management products, Computools provides disciplined delivery, regulatory awareness, and the technical depth required to scale without compromising security or user experience.

Reach out to our team at info@computools.com to discuss your verification and compliance challenges.

Conclusion

FinTech software firms now blend engineering skill with strong regulatory knowledge to create solutions that balance speed with security and compliance. This necessity fuels the rise of RegTech software, specialized technological solutions designed to manage regulatory risks.

Leading developers provide comprehensive platforms and integration services covering the entire client lifecycle: from Digital onboarding KYC solutions, and Fintech KYC and AML software to automated risk management and financial reporting systems.

Consequently, the success of a FinTech platform today is impossible without a strategic partnership with a company that is not merely a developer, but an experienced RegTech software developer. It leverages AI, Blockchain, and RPA to build resilient, legally compliant financial ecosystems.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”