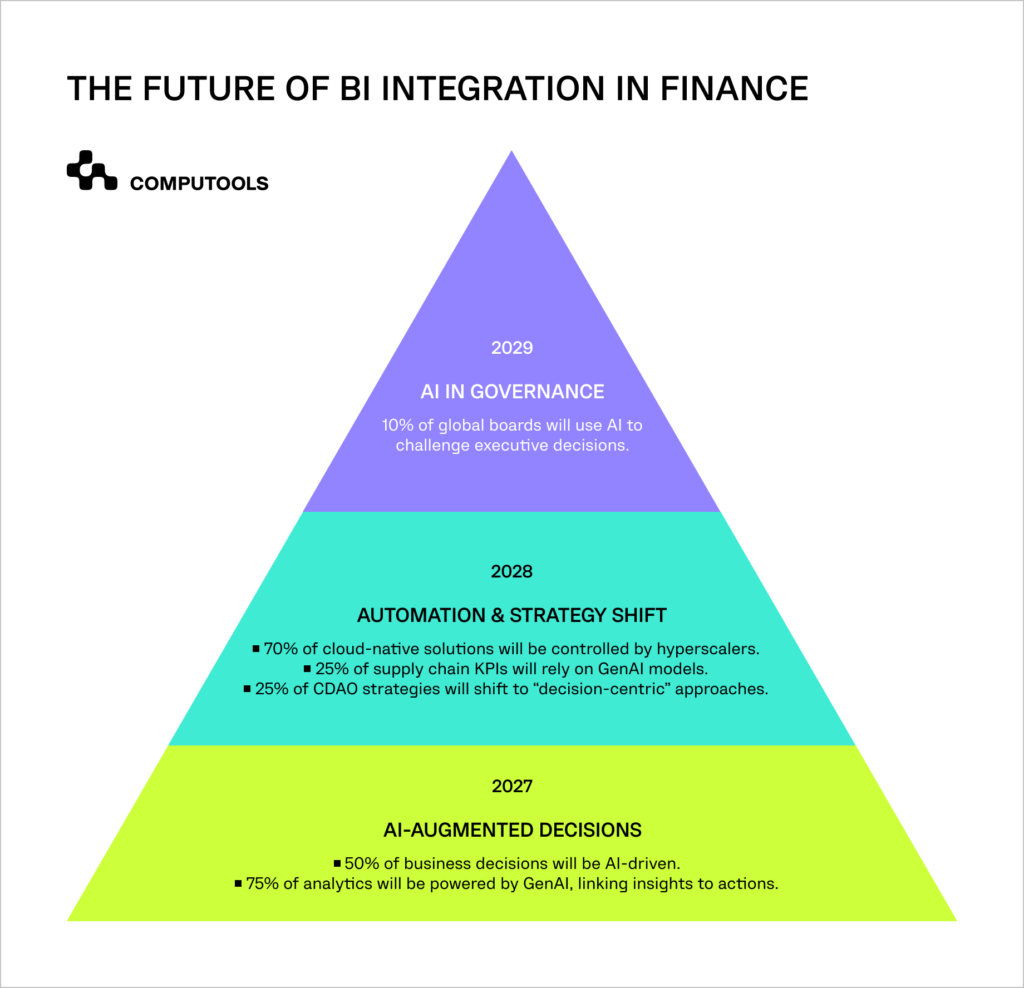

The financial industry is undergoing a transformation driven by data, automation, and AI-powered insights. According to Gartner, by 2027, half of all business decisions will be AI-augmented, while BI integration in finance will become essential for risk mitigation, operational efficiency, and strategic growth.

However, many financial organisations still struggle with fragmented data, outdated analytics, and slow decision-making processes.

To stay competitive, financial institutions must adopt a Business Intelligence development services approach that goes beyond basic reporting.

Leading enterprises leverage Business Intelligence and financial industry expertise to create intelligent, real-time analytics solutions that enhance forecasting, automate risk assessment, and improve financial performance.

As AI and GenAI reshape financial decision-making, organisations that invest in BI integration in finance today will gain a strategic edge tomorrow.

Understanding Business Intelligence in Finance

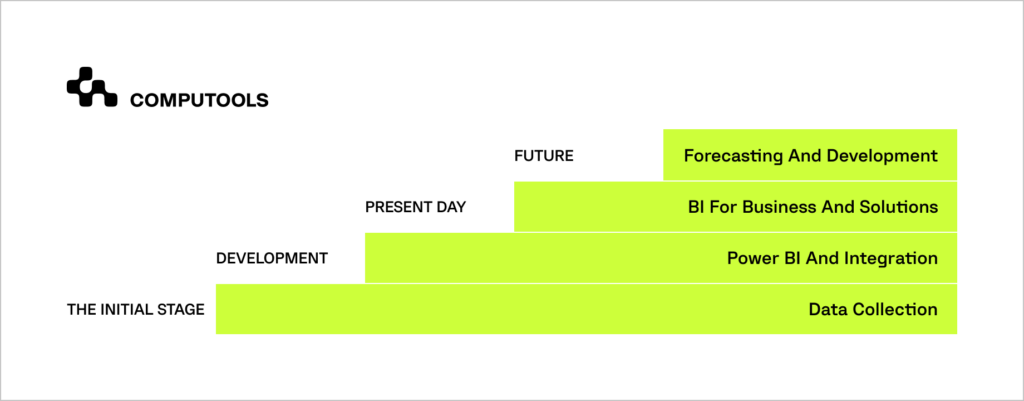

Uncovering the topic of Business Intelligence in finance reveals its transformative potential within the industry. BI in finance has evolved from a nascent concept to a critical tool for institutions seeking to leverage data for improved decision-making and performance.

This evolution is driven by the increasing availability of data from diverse sources and the need to present this information effectively to clients. BI tools, when implemented correctly with the help of experienced BI consultants, enable financial establishments to integrate it seamlessly into their existing systems, transforming it into a regular data processing powerhouse.

Gartner’s definition of BI encompasses the people, processes, and tools used to organise, access, and analyse information for better decisions and performance management. However, for our purposes, we focus on BI as a means to enhance business operations.

Key aspects of BI projects include:

• Identifying and acquiring the most valuable information for both consumers and producers involved in analytical, business, and decision-making processes.

• Presenting information in the most usable formats for business insight.

• Focusing on the efficiency of methods and technologies used to deliver information.

• Ensuring wide acceptance by business users, as even the best information is useless, if not implemented.

The term “analytics” within the BI landscape requires clarification. It can refer to:

• Specific BI capabilities or techniques, particularly advanced ones like predictive analytics.

• Business strategies using analysis to solve specific problems, such as fraud analytics.

• Analytic applications: packaged BI capabilities for a domain or business process, like sales forecasting.

• The entire domain, including hardware, software, personnel, and processes.

Given the varying practices across different areas like financial data, customer data, and demand planning, clear definitions and standardised internal documentation are essential for effectively identifying business opportunities and requirements.

Partnering with Business Intelligence development services can further enhance your company’s ability to effectively leverage BI for its specific needs.

Check If Your Business Needs BI Integration

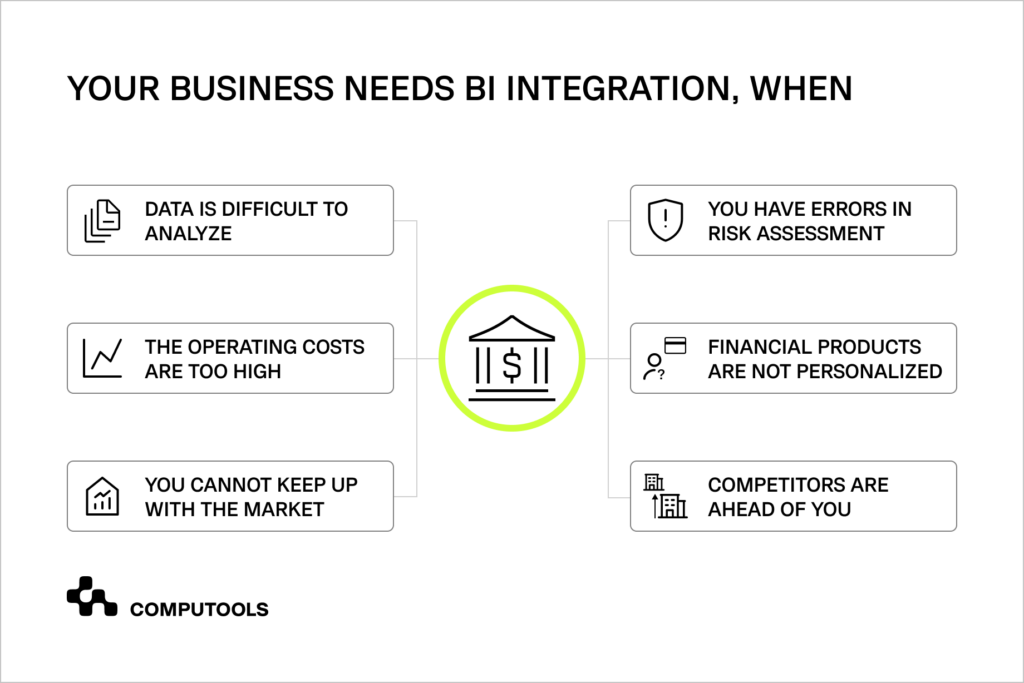

In the financial industry, where the competition is very strong and clients are very picky, Business Intelligence is an essential tool for mitigating risks, ensuring compliance, and fostering strategic growth. But how do you know whether your business needs BI integration in finance?

Here’s a quick checklist to assess whether implementing BI solutions can benefit your financial business:

1. You struggle with data overload

Your bank or fintech company processes thousands of transactions daily, generating vast amounts of payment data, reports, and customer inquiries. However, your team spends days compiling reports from disconnected systems, and getting critical insights on profitability or liquidity takes too long. As a result, key decisions are delayed, and you lose your competitive edge.

2. Your risk assessment process lacks precision

Your company’s credit scoring method depends only on traditional financial components (income and credit) without integrating behavioral data. Although this mistake causes both correct rejected applicants who should get approved and unforgivable acceptance of high-risk borrowers. The lack of analytics may result in risky decisions if you’re in investment services.

3. Operational costs are too high

Your fintech startup is growing, but operational expenses are increasing faster than revenue. The company suffers from delayed operations because its manual procedures force extended loan application processing times, accountants need many hours to match payments, and analysts are burdened by excessive manual data retrieval. When the cost-to-income ratio weakens, profitability declines.

4. Your financial products aren’t customer-centric

You offer standard credit lines and investment options but don’t leverage customer behavioral insights. For example, your system doesn’t analyse purchase patterns to suggest personalised loan options or cashback offers. As a result, customers prefer competitors who provide more tailored financial products.

5. You struggle to keep up with market changes

Your payment service or investment platform lacks real-time market analytics. For instance, your system doesn’t adjust quickly to currency fluctuations or central bank interest rate changes, causing customers to lose money and trust in your platform.

6. Competitors are outpacing you

Rival firms consistently offer better rates, personalised services, or innovative solutions.

If you checked more than two of these signs, it’s time to consider BI integration.

All the Reasons Why Business Intelligence is Beneficial for the Financial Industry

The benefits of Business Intelligence in the financial industry are undeniable. It strengthens financial software solutions and supports the development of innovative banking software development services.

1. You Can Improve Financial Performance

One of the primary BI benefits for financial sector is the ability to track and analyse financial performance in real time. Institutions gain monitoring capability of revenue, expenses, and profitability through BI tools that offer interactive dashboards and extensive reports. Banks’ analysis of customer transaction data through BI enables them to alter pricing structures and service adaptation for better results.

Through analytical insights derived from BI systems, investment companies gain the ability to analyse market patterns, which helps them make adjustments for portfolio optimisation. Business success in the long run relies on financial decisions which use accurate data instead of assumptions.

2. You Can Optimise Risk Management

The financial sector places risk management as a primary duty while BI delivers several effective risk identification and assessment capabilities to companies. The application of BI technology allows them to identify credit risks together with fraud patterns and market adjustments by scrutinising large financial datasets.

BI enables predictive analysis to spot atypical transactions, letting users detect potential fraud before severe damages occur. BI helps financial businesses evaluate credit risk by studying customer payment records to determine borrowing potential. Financial institutions use this preventative manner to reduce monetary losses while adhering to their risk management requirements.

3. You Can Enhance Financial Reporting and Compliance

The financial industry confronts regulatory compliance as a detailed and routine problem that continues to change continuously. Compliance reporting becomes easier with BI systems because they offer automatic reporting alongside accurate, current financial data to institutions. Implementing BI tools enables companies to maintain financial reporting transparency, reducing their risk for regulatory violations.

Without much human intervention, financial institutions use BI technology to produce necessary regulatory reports, including income statements, balance sheets, and tax documents. Through an audit trail system enabled by BI, institutions can monitor data modifications and create complete financial transaction records.

Financial compliance goals can be met through BI implementation while establishing better relationships with regulators and investors.

4. You Can Improve Customer Insights

Financial institutions need to understand how customers behave if they wish to improve their products and build long-term relationships with them. BI allows organisations to process customer data, segment audiences, and create individualised financial products.

For instance, banks can leverage BI to identify customers who travel abroad frequently and subsequently offer them personalised credit card promotional offers with travel benefits. Investment firms can analyse client portfolios to make customised recommendations based on risk tolerance and financial goals.

Using insights derived from BI in the finance industry can enhance customer satisfaction and raise retention rates.

5. You Can Streamline Budgeting and Forecasting

The importance of accurate budgeting and forecasting is key to the stability and planning for the future growth of financial institutions.

The role of BI in finance is to do historical data analysis and predictive modeling and create very realistic financial projections. Finance teams can make use of BI tools that help compare figures budgeted against actual performance, which are the ones that highlighted discrepancies and were adjusted.

The inclusion of real-time market data allows companies to develop better financial strategies. This means an efficient use of resources and monetary sustainability.

6. You Can Leverage Advanced Financial Software Solutions

The best thing is that BI seamlessly integrates with financial software solutions and improves their capabilities and outcomes. Banning banking applications and investment platforms would cause many financial institutions to rely more on them to manage transactions, analyse data, and streamline processes.

BI further enhances these systems by simplifying them through advanced analytics, data visualisation, and automation, which consistently improves efficiency and accuracy. For example, BI-powered software can take credit risk in real-time and automate the loan approval process.

Investment platforms also use BI to recommend a personalised portfolio to clients based on market trends and the portfolio’s past performance. Organisations strive for innovation and to keep ahead of the competition; by integrating BI with their existing financial software, they can achieve that.

7. You Can Improve Banking Software Development Services

With the required reliance on digital solutions by banking institutions, which is now growing steadily, BI has become an essential part of banking software development services. Developers can use BI insights to develop applications that provide a smooth user experience, strong security protection, and a good way of data management.

For instance, BI can help developers create fraud detection systems, which can identify real-time transaction data to identify suspicious activities.

Moreover, BI-based applications can also provide insights in a personalised manner to users in order to increase engagement and improve customer satisfaction. In banking software development, BI will allow institutions to build smarter, data-driven financial solutions that address the needs of the changing consumer.

Businesses that Used BI and Succeeded

As it has been adopted, the fintech industry has seen remarkable transformations and a shift in Business intelligence solutions. BI integration in finance has become a decisive factor in operational efficiency and competitive advantage.

In light of the above, this abstract analyses some of the very interesting fintech businesses that have used BI and their actions in relation to employing business intelligence and how it’s affecting their growth and innovation.

1. American Express and Customer Personalisation

American Express (AMEX) is a fintech business example that has used financial Business Intelligence to optimise customer personalisation. AMEX looks at their transaction data, figures out spending patterns, and then adapts to customer needs.

AMEX has used BI to support customer engagement, enhancement of loyalty and supported fraud detection through its anomaly mechanisms. The AMEX’s continued market-leading position could be greatly due to this data-driven approach.

2. Capital One and Risk Management

Capital One demonstrates how BI solutions in financial services can optimise risk management. Utilising such BI analytics, Capital One determines the credit risk for lending, predicts loan defaults, and refines lending processes.

The company efficiently segments customers through targeted marketing campaigns, which helps improve customer acquisition and retention.

The application of BI effectively and strategically has given Capital One a lead in using data in financial decision-making.

3. PayPal and Fraud Prevention

PayPal has taken advantage of BI to improve its fraud prevention mechanisms. With real-time transaction monitoring and machine learning algorithms, PayPal can detect suspicious activities that are outliers compared to the norm user behavior.

This lets the system proactively detect fraud and secure transactions, which in turn reinforces PayPal’s reputation as a trustworthy payment platform online.

4. Square and Customer Insights

Square exemplifies how fintech companies can use BI to gain customer insights and improve financial product offerings. By analysing transaction data, Square identifies spending trends, helping small businesses optimise their payment processing solutions.

This ability to provide data-backed, tailored financial services has enabled Square to establish itself as a key player in fintech software development.

5. Stripe and Business Analytics

Stripe’s BI analytics help track key performance indicators (KPIs) and improve operational performance. Stripe uses BI tools to identify inefficiencies with payment processing and improve customer service.

A testament to the company’s data-driven approach, it is able to create market-disrupting financial solutions that are compatible with market demands and fend off competitors in the fintech ecosystem.

These fintech businesses show the success of Business Intelligence services in financial business operations. By integrating BI into their strategy, fintech companies have been able to enhance every process.

As fintech development continues, businesses are likely to keep the leading edge of innovation by utilising data to drive growth and improve user experiences.

How Computools Can Help You?

At our software development company, we provide end-to-end services for financial businesses that want to use technology for growth.

Whether you need custom financial software development or business intelligence consulting, Computools delivers high-performance, data-driven solutions that enhance decision-making, operational efficiency, and profitability. Our team also developed our own Business Intelligence System Accelerator.

Proven Results with Finance Software Development

Our clients benefit from scalable and secure finance software development that optimises financial operations.

For example, one of our recent projects resulted in a 2x increase in ROI, while another helped streamline risk management, reducing operational costs by 30%.

Why Choose Computools?

• Industry Expertise – We specialise in creating innovative financial solutions tailored to your needs.

• Comprehensive Approach – From BI consulting to full-cycle fintech software development, we cover it all.

• Client Satisfaction – Read reviews from our clients on independent platforms like Clutch.

Explore our portfolio and see how our expertise in financial software development and BI consulting can transform your business.

If you need consultation or implementation of BI services into your business, contact info@computools.com, our team will gladly help you find the matching service or tools.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”