The role of a Chief Financial Officer (CFO) has evolved significantly from its traditional focus on accounting and finance to becoming a driver of strategic growth.

Today, CFOs guide companies through complex challenges, expanding their responsibilities to include digital transformation efforts, strategic planning and technological integration.

As we step into 2024, the role of financial leaders becomes increasingly important in navigating economic uncertainties and complex regulations.

Additionally, CFOs play a major role in integrating artificial intelligence and automation, developing strategies that balance growth with strategic capital allocation.

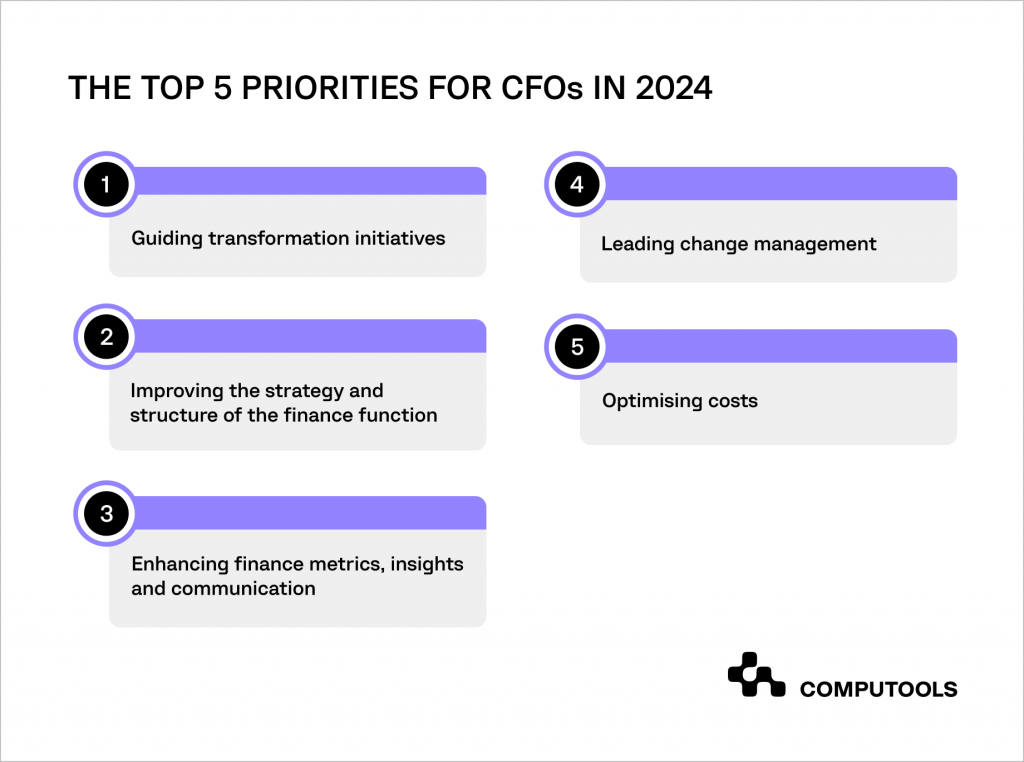

To assist CFOs in preparing for the future, Gartner has released a report outlining the top five finance trends and priorities for CFOs in 2024.

Drawing insights from responses provided by 400 CFOs and financial executives, this article delves into these trends in detail, offering guidance on how CFOs can tackle their most pressing challenges and achieve substantial business growth through flexibility, innovation and strategic foresight.

Top 5 Finance Priorities for CFOs in 2024

1. Guiding transformation initiatives

Guiding transformation initiatives is a key priority for CFOs in 2024, with a particular focus on digital transformation within their organisational frameworks. Digital transformation is not just a trendy phrase but an essential component for maintaining competitiveness in today’s business environment.

To effectively navigate this shift, CFOs must adopt a proactive approach. This involves identifying opportunities for transformation and investing in tools and technologies that enhance financial performance.

Key strategies may include the implementation of cloud-based financial systems, robotic process automation (RPA) and artificial intelligence (AI) tools to streamline repetitive tasks like data entry, adopt predictive analytics for financial forecasting and enhance fraud detection. These solutions empower CFOs to make informed decisions and manage financial operations more efficiently.

Furthermore, collaboration with other stakeholders within the organisation is highly important. CFOs should engage closely with department heads and functional leaders to pinpoint areas where digital transformation can be most useful. This collaborative approach aims to achieve optimisation across various organisation’s functions.

2. Improving the strategy and structure of the finance function

The process of improving finance strategy begins with an in-depth review of the existing function, identifying its strengths and areas of improvement. A key part of this process is aligning the finance operations with the overall organisational goals, potentially requiring adjustments in resource allocation, financial targets or investment strategies.

Equally important is the role of talent management. In 2024, CFOs are concentrating on attracting, retaining and developing personnel with skills in data analysis and strategic finance.

However, finding individuals with the right blend of strategic and technical skills is challenging, a point underscored by the fact that 51% of CFOs are prioritising recruitment in areas crucial for organisational growth.

Risk management, compliance and transparent stakeholder communication are also integral to ensuring that the finance function aligns with the organisation’s objectives and adheres to regulatory standards. This approach aims to enhance the strategic coherence of the finance function.

3. Enhancing finance metrics, insights and communication

In 2024, CFOs are increasingly adopting a data-driven approach, focusing on creating a wide range of metrics to monitor different financial aspects like liquidity, profitability ratios and operational efficiency. This way, CFOs can provide up-to-date and detailed insights into the company’s financial health, which is important for making informed decisions at every level of the organisation.

To achieve this goal, leaders are also integrating advanced analytics and data visualisation – tools that aid in understanding finance trends and priorities for CFOs, potential risks and emerging opportunities.

Moreover, the role of CFOs is evolving to include what can be described as financial storytelling. Storytelling involves transforming complex financial data into clear and understandable narratives, making it accessible to a wide range of stakeholders, including investors, board members and employees.

Overall, CFOs aim to enhance communication within and outside the organisation as well as promote a deeper, organisation-wide understanding of its financial state. This change is a reflection of how the role of CFOs is adapting to meet the modern needs of businesses.

Computools

Software Solutions

Computools is an IT consulting and software engineering company that delivers innovative solutions to help businesses unlock tomorrow. Our clients represent a wide range of industries, including retail, logistics, finance, healthcare, and others.

4. Leading change management

In the realm of finance, leading change management involves implementing changes to financial systems, processes and procedures to minimise disruption and maximise benefits. These changes could range from updating accounting software to revising financial reporting practices.

CFOs’ leadership in change management is key to reducing resistance and enhancing collaboration, ensuring a smooth transition to new processes and systems. Financial executives must strategically identify and address potential challenges, ensuring that the finance department is well equipped to handle market challenges.

This focused approach by CFOs not only aligns with the finance trends but also strengthens the overall financial operations in an evolving business environment.

5. Optimising costs

Cost optimisation, as always, remains the top priority for business leaders worldwide. Nowadays, CFOs are increasingly adopting an enterprise-wide approach to evaluating cost and investment decisions, prioritising profitable growth and digital transformation.

Among the key goals is the effective management of costs by identifying where expenses can be reduced in a way that doesn’t compromise the organisation’s strategic objectives.

Heading into 2024, CFOs will further focus on regularly conducting cost-benefit analyses, streamlining processes, optimising resource allocation and reducing overhead expenses.

Moreover, CFOs will continue to work closely with other key figures in their organisations, engaging with department heads and leaders. Through this collaborative approach, specialists aim to align financial priorities with the operational and strategic needs of different departments, ensuring that cost-cutting measures support the broader goals of the organisation.

Finance Leaders’ Priorities

In addition to the CFOs surveyed, Gartner’s research also included insights from 232 financial executives. This group comprised controllers, heads of Financial Planning & Analysis (FP&A), and other specialists.

The following are some insights into the finance trends and priority areas mentioned by finance leaders.

• Controllers are increasingly prioritising the use of technology to automate processes. They see this as a strategy to enhance the speed, efficiency and accuracy of financial closings.

Controllers rate much more highly than CFOs do the importance of controllership strategy, organisational design and leveraging technology for optimising accounting and transactional finance processes .

• Heads of FP&A place a higher importance than CFOs do on improving personal effectiveness. However, similar to CFOs, FP&A leaders face the challenge of balancing broader enterprise initiatives with the specific needs of the FP&A function.

• Not surprisingly, finance transformation leaders share critical priorities that align with the transformation focus of CFOs – except for cost optimisation, which typically falls outside the responsibilities of finance transformation leaders.

Challenges for CFOs: Internal and External Factors

As the CFO role becomes more complex, the influence of financial executives on how a company grows and develops becomes more significant.

However, this expanded role comes with challenges, especially in the face of constant economic changes that render traditional financial methods less effective. Here are some of the most critical issues faced by the finance directors.

1. Staff capacity

The first among numerous pain points for CFOs is the issue of capacity. CFOs often find themselves struggling with insufficient staff dedicated to technology-related tasks.

This shortage hampers the ability to follow successful digital leadership models and increases the risk of burnout among finance staff.

As companies invest more in digital transformation, which demands greater support from finance teams, one of the primary challenges will be to expand team capacity to manage multiple transformation initiatives.

2. Skills and Capabilities

For organisations to successfully navigate digital transformation, it’s crucial to acquire new skills, and CFOs play a significant role in this process. A fundamental part of this transformation involves addressing the skill gap within finance teams.

This skill gap challenge requires organisations to reassess and restructure their existing finance operating models to ensure they are in line with the requirements of a modern, digitally-focused business environment.

Balancing human capital with technology, particularly in areas like AI and machine learning, is another critical aspect of this transformation. The goal is to use technology to complement and augment the capabilities of the human workforce, rather than simply replacing them.

Moreover, the success of digital transformation is largely dependent on the abilities of the leadership team, including the CFO, who must be proficient in carrying out the company’s overall strategy and providing insightful, accurate analysis that aids in decision-making.

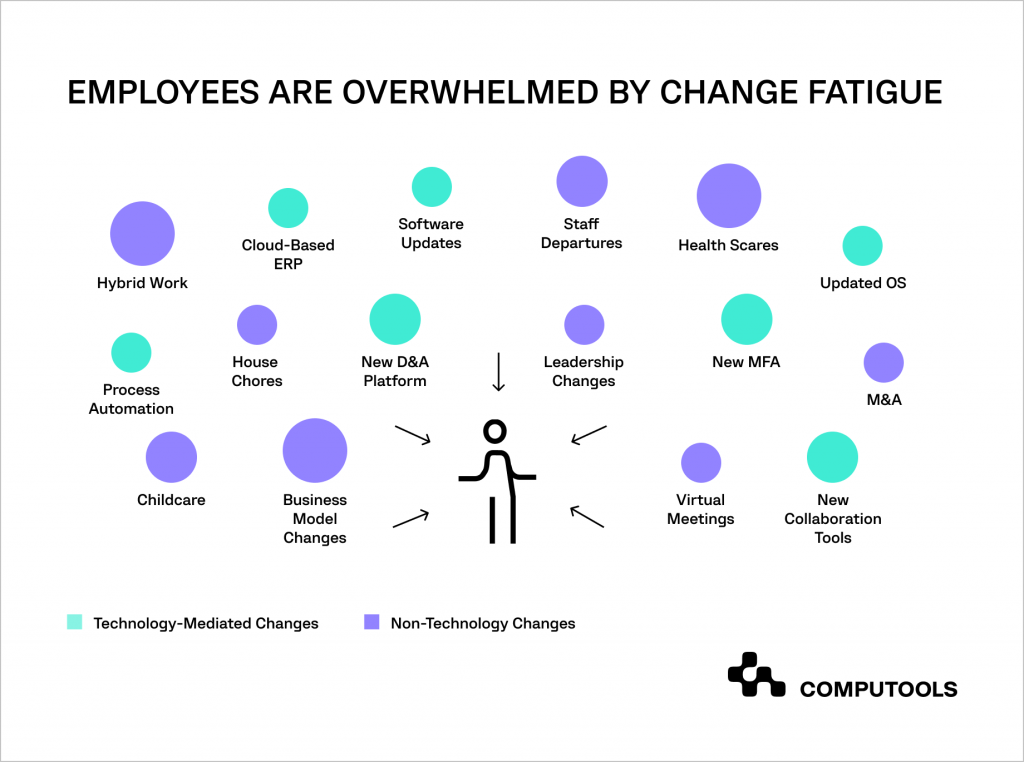

3. Change Fatigue

Rapid and continuous changes can lead to what’s known as ‘change fatigue’ among employees. This is where people become overwhelmed by the pace and scale of change, leading to a drop in their ability to handle these changes without feeling stressed or tired. Change fatigue arises mainly from the exertion of adapting to these changes and the disruption they cause to everyday workflows.

Conclusion

The CFO plays a key role in steering the success of an organisation and achieving strategic goals. As 2024 unfolds, CFOs face various challenges, including economic uncertainty, rapid technological changes and complex regulations.

To solve these issues effectively, CFOs need to focus their efforts on key areas that contribute to long-term success. Whether it involves strategic planning, effective risk management, embracing digital transformation or improving stakeholder engagement, these priorities provide a clear framework for CFOs to enhance financial performance and support organisational growth.

Nowadays, CFOs must be adaptable and responsive to changing market conditions and emerging trends to ensure their organisations are well positioned for success in the years ahead.

If you want to gain further insights into the financial sector and enhance your business growth, feel free to contact us at info@computools.com.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”