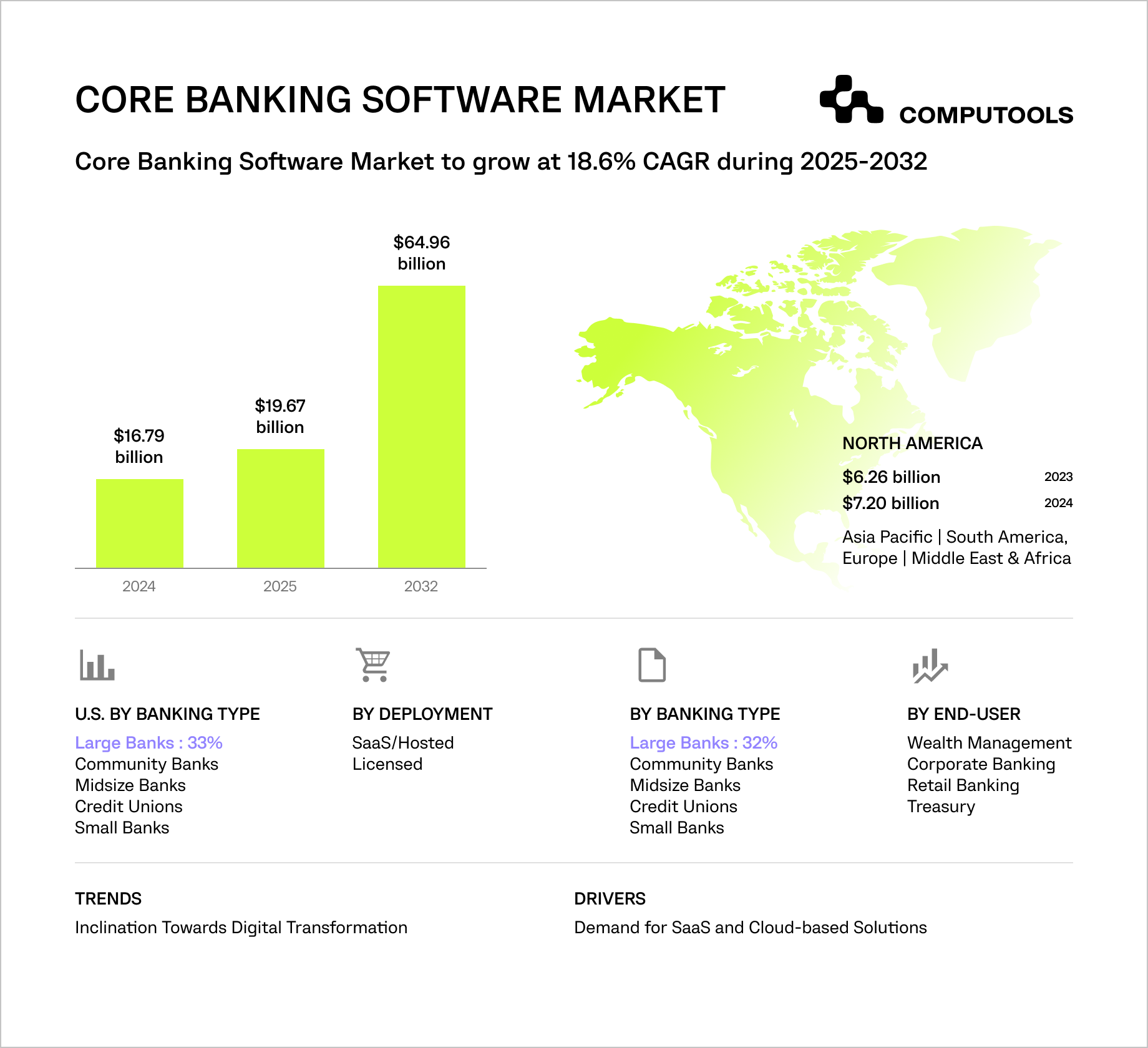

The global Core Banking Software (CBS) market, valued at $16.79 billion in 2024 and projected to reach $64.96 billion by 2032, is driven by the urgent need for modernization, particularly given that 90% of U.S. core systems remain legacy systems.

This legacy infrastructure struggles to handle the load of modern digital products, leading to critical scalability and security issues. Banks are compelled to adopt cloud-native, API-first platforms to meet demanding customer expectations (mobile, real-time transfers, AI-driven AML/fraud detection) and to adhere to strict regulations (PSD2, DORA).

This imperative shift transforms core system upgrades from optional maintenance into a critical requirement for competitiveness, which is why we have compiled the top 20 core banking software companies globally to identify the best partners for this digital transformation.

Top 20 core banking software companies:

1 Computools

2 Fingent

3 Miquido

4 Newwave Solutions

5 Accedia

6 BairesDev

7 Jelvix

8 Andersen Inc.

9. eSparkBiz

10. Apriorit

11. Vention

12. EB Pearls

13. Spiria

14. WEZOM

15. GLOBALDEV

16. Rare Crew

17. TatvaSoft

18. Dreamix

19. Shaligram Infotech

20. GeekyAnts

Selection criteria: how we chose the top 20 core banking software companies

In compiling this ranking, we adhered to complex criteria to select only those companies truly qualified as best core banking software providers.

Our selection is based on five key pillars that guarantee reliability, experience, and service quality:

• Market Experience: We only considered firms with at least 8 years in IT, indicating financial stability, resilience to economic cycles, and a deep understanding of FinTech evolution.

• Team Size and Resources: We chose companies with teams over 150 specialists to ensure enough resources for managing large Core Banking migrations and supporting specialization in areas like API development and RegTech compliance.

• Proven FinTech & Banking Expertise: Candidates must demonstrate substantial FinTech and Banking experience, with verifiable case studies to confirm domain-specific knowledge in developing modern financial products, including banking software solutions.

• Recognition and Quality (4.9+ on Clutch & Awards): Companies must hold a rating of at least 4.9 stars on Clutch (a leading global B2B review platform) and/or have significant industry awards and recognition from independent analytical agencies.

• Compliance and Specialization: The criteria include the presence of quality certifications (e.g., ISO) and confirmed expertise in critical regulatory standards (PSD2, DORA, AML, GDPR). This underscores their capability to create financial systems that are not only innovative but also legally resilient.

Top 20 core banking software companies globally

Now that we have set the strict criteria for reliability, subject matter expertise, and compliance, let’s examine the top companies leading our list of the top 20 core banking software companies worldwide.

1. Computools

Global footprint & project metrics

• Over 12+ years of software engineering excellence, demonstrating deep industry staying power.

• A large team of over 250+ engineers.

• A significant Global footprint with 9 offices across Europe, the USA, the Middle East, and Asia.

• Specialized in Core Banking Platforms, Digital Banking Interfaces, Investment software, and Regulatory Compliance (PCI DSS).

• Certified with ISO 9001 & 27001, highlighting a commitment to quality management and information security standards.

• Recognized as a Top 100 Global Outsourcing Company (IAOP).

• Trusted by leaders like Visa, EPSON, Dior, Caribbean Bank, and British Council.

Computools leads in fintech software development services, helping banks, insurers, and investment firms overcome challenges such as legacy systems, manual operations, regulatory compliance pressures, and slow customer engagement.

They focus on transforming obsolete IT infrastructure, which often results in data silos, manual, error-prone operations, and slow payment processing, all of which fundamentally hinder customer engagement and sustainable growth.

With 12+ years of expertise and 400+ completed projects, Computools leverages core banking software solutions to modernize systems, delivering secure, scalable, and API-first architectures while effectively addressing intense regulatory compliance pressures.

By focusing on complex challenges such as card processing integration (e.g., Visa microservices) and ensuring compliance (e.g., PCI DSS), the company guarantees its solutions facilitate real-time operations, faster product launches, and swift market response, directly addressing the need for accelerated time-to-market.

Core Banking & FinTech Expertise Highlights:

• Caribbean Bank: Computools engineered an online banking platform for a leading regional bank, implementing a Visa microservices system to integrate card processing and ensuring PCI DSS compliance. This modernization resulted in a 12% increase in market share among younger demographics.

• Invest Latam: The team crafted an online investment platform focused on reliable KYC, verification, and creditworthiness checks, facilitating over 1,000 business lending transactions within 5 years.

• Moblet: The company developed a financial management mobile app that ensures seamless integration with SWIFT, Visa, and Mastercard and implements comprehensive KYC and onboarding across mobile and web platforms.

2. Fingent

Global Footprint & Project Metrics

• 20+ years in technology partnership.

• 600+ employees.

• Presence across North America, the Middle East, Australia, and India.

• ISO 27001:2013 certified and an official SAP and Odoo partner.

• Recognized by IAOP Global Outsourcing 100 and listed among Inc. 5000 – America’s Fastest-Growing Companies.

• Trusted by Mastercard, Sony, PwC, and NEC.

Fingent helps financial enterprises solve the pain point of slow growth and inefficient operations through AI-driven innovation and legacy systems modernization. They provide secure, enterprise-grade software, with a strong focus on Intelligent Automation (RPA & ML) for high-volume banking tasks and on enterprise digital transformation (including ERP/SAP).

Fingent leverages machine learning and predictive analytics to streamline complex workflows, helping clients such as Mastercard and PwC gain a competitive edge in compliance and operational efficiency.

3. Miquido

Global Footprint & Project Metrics

• Over 13+ years of professional experience.

• A large team of 200+ experts on board.

• 250+ digital solutions delivered.

• Recognized as a Google Certified Agency, covered by Time & Forbes, and an award-winner for app development.

• Key FinTech clients include BNP Paribas, Nextbank, SBAB, and a global Digital Bank.

Miquido is a full-service software development partner focused on building the future of financial services by delivering advanced banking technology and solving complex challenges, including compliance and operational inefficiencies. They specialize in AI-powered solutions for Finance, including intelligent document verification and conversational AI.

As experts in Legacy Systems Modernization and Cloud Migration, Miquido ensures scalable architecture and regulatory compliance (PSD2, GDPR). Their proven track record with clients such as BNP Paribas, Nextbank (AI-powered credit scoring with 97% accuracy), and SBAB confirms their ability to deliver secure, regulatory-compliant FinTech products.

4. Newwave Solutions

Global Footprint & Project Metrics

• 14+ years of experience.

• 300+ professionals across Vietnam, Japan, and Korea.

• 800+ successful projects delivered for 200+ active clients.

• Specialized in Core Banking Systems, Payment Platforms, Risk & Compliance Management, and Blockchain/Web3 solutions.

• Trusted by startups and Fortune 500 brands, including VinID, UNDP, Onkyo, and Daito Trust Construction.

Newwave Solutions specializes in modernizing legacy infrastructure with top core banking systems and high-performance mobile applications. They focus on solving key challenges, such as achieving real-time processing, ensuring regulatory compliance, and maximizing operational efficiency.

Their solutions feature modular, API-driven architectures, cloud infrastructure, and AI-Powered Insights for data analytics and workflow automation, delivering digital excellence for both traditional and modern financial institutions worldwide.

5. Accedia

Global Footprint & Project Metrics

• 13+ years as an IT services company.

• Team scale of 250 – 999 employees, serving clients across 20 countries on 5 continents.

• Recognized by the Financial Times and Deloitte as one of Europe’s fastest-growing tech companies.

• Key FinTech Case: Castle Trust Bank, IBM, Lufthansa

Accedia is an IT services company that specializes in technology consulting and custom software development to drive sustainable growth in the financial sector. Their offering centers on delivering advanced core banking software and personalized solutions by leveraging AI and Machine Learning for risk assessment, fraud detection, and customer personalization.

Accedia excels in Application Modernization, transitioning legacy systems to secure, scalable cloud-based platforms, and ensuring robust compliance. Their expertise is demonstrated by their work with 50+ financial enterprises, including the successful delivery of the OmniPort lending platform for Castle Trust Bank, which automates 80% of loans for rapid approval.

Learn how modern core banking engines enable banks to cut complexity, centralize critical systems, and orchestrate unified digital experiences across channels and markets.

6. BairesDev

Global Footprint & Project Metrics

• 16+ years, providing custom software solutions and staff augmentation.

• Access to 4,000+ Senior Software Engineers.

• 1,200+ projects completed for over 500 clients, from startups to enterprises.

• Specialized in Core Banking Systems, Digital Banking Platforms, Fraud Detection (AI/ML), and Risk Management & Compliance Software.

• Key global clients include Google, J&J, Rolls-Royce, Adobe, and Pinterest.

BairesDev delivers specialized core banking software solutions to address critical industry pressures, including complex regulations and cyber threats. They provide end-to-end outsourcing services specializing in developing secure and scalable Core Banking Systems (CBS), Digital Banking Platforms, and Mobile Banking Apps.

Their expertise also includes advanced AI and Machine Learning integration for instant fraud detection, personalized customer service, and streamlined loan origination.

7. Jelvix

Global Footprint & Project Metrics

• Over 15+ years of experience.

• 450+ tech professionals.

• ISO 9001, ISO 13485, ISO 27001, and ISO 27701 certified (covering quality, security, and privacy).

• Recognized by IAOP Global Outsourcing 100

• Specialized services include Digital Banking, Payment Systems, Lending Platforms, Big Data, AI, and Blockchain.

• Key global clients include Samsung, Kia, Zeiss, Ikea, Benzinga, Auchan, Stihl, and Canon.

Jelvix is a global tech partner and a leading digital banking platform provider, empowering financial institutions and technology disruptors with advanced solutions. They address core industry challenges, including fraud, risk, and inefficient legacy systems, by integrating Big Data, AI, and Blockchain to enable real-time risk prediction, operational automation, and accelerated payment lifecycles.

Jelvix’s high level of proficiency is backed by comprehensive quality and security certifications, ensuring stable, compliant, and value-oriented delivery for clients who need everything from custom banking solutions to legacy software optimization.

8. Andersen Inc.

Global Footprint & Project Metrics

• 18+ years, operating across 13 time zones.

• 3500+ professionals.

• Successfully implemented 350+ financial initiatives, including 200 IT initiatives for financial entities on the Fortune 500 list.

• Key enterprise clients include Siemens, S&P Global, Johnson & Johnson, and T-Systems.

Andersen is a mature technology partner specializing in custom software solutions for global companies and SMEs. They offer a white-label mobile banking app tailored for neobanks and traditional institutions, along with comprehensive custom solutions. Andersen helps clients modernize operations, automate business flows, and ensure compliance.

Their robust expertise, proven through successful projects for Fortune 500 financial institutions, covers core payment functionality, secure user accounts, investment, and insurance software development.

As companies adopt cloud-native systems, leveraging AI and automation is essential for efficiency and scalability in modern finance. Explore the advantages of smart technology in our article. Conversational AI in Finance: Benefits, Challenges, Future Predictions.

9. eSparkBiz

Global Footprint & Project Metrics

• 15+ years.

• Successfully delivered 1,000+ projects globally.

• A team of 400+ highly-skilled professionals

• Core financial offerings include Investment Management, Trading Solutions, Mobile Banking, and Digital Payment Services.

• Key clients include CISION, ATLANTIS DUBAI, Samata Health, and BIOWAVE+.

eSparkBiz is a leading technology partner specializing in fintech core banking platforms and AI-driven solutions to achieve digital excellence for startups and enterprises. With over a decade of experience, the company focuses on delivering highly secure, future-ready financial systems that address evolving security and regulatory compliance requirements.

eSparkBiz offers significant cost savings through its global delivery model and leverages its deep pool of experts to deliver custom solutions across investment management, financial analytics, and mobile banking.

10. Apriorit

Global Footprint & Project Metrics

• 20+ years, operating across 10 time zones.

• 400+ experts, focusing on cybersecurity and AI.

• Successfully delivered 675+ projects globally, including 40+ dedicated Fintech projects.

• Specialized in compliance with GDPR, PCI DSS, PSD2, and DORA.

• Trusted by Beam Solutions, OPSWAT, HomeWAV, Varjo

Apriorit is an R&D partner specializing in cybersecurity services and AI software engineering, offering comprehensive FinTech Software Development Services. They leverage their strong security mindset to deliver custom solutions across Digital Payments (BNPL, P2P, Gateways), Banking and Financial Systems, and Wealth Management.

Apriorit excels at building AI-powered risk management systems, custom blockchain infrastructure, and ensuring compliance with stringent regulations like GDPR and PSD2.

11. Vention

Global Footprint & Project Metrics

• 20+ years on market.

• 3K+ dedicated developers globally.

• Over 500 industry-leading clients, including PayPal, IBM, PwC, and Postman.

• Contributed to client acquisitions exceeding $15B. Clients typically save up to $600K annually.

• Specialized FinTech clients: DealCloud, StreetShares, Upvest, StoneX, and Barchart.

Vention is a leading global core banking technology firm providing end-to-end software development and expert advisory services to startups and large enterprises. The company offers full-spectrum engineering across AI, Web/Mobile, Cloud, and Blockchain, with specialized consulting across all stages of the financial journey, from defining MVP scope to enterprise-level planning.

Vention’s deep domain knowledge spans key sectors like Wealth Management, Lending & Credit, and Analytics & Big Data.

12. EB Pearls

Global Footprint & Project Metrics

• 21+ years of experience.

• 400+ in-house full-time specialists globally.

• 600+ software projects launched, contributing to $8B+ in client revenue.

• 70+ international awards, ranked #1 Mobile App Developer in Australia with a 4.9/5 Clutch rating.

• Key FinTech solutions include Plenti and Rocket Remit (Money Transfer App).

EB Pearls is a multi-award-winning technology partner specializing in mobile app development and FinTech solutions for startups and enterprises worldwide.

As the largest and most experienced Mobile App Development Team in Australia, they offer end-to-end expertise from strategy and UX design through development to post-launch support, to ensure products are beautifully built and performant.

Their deep industry knowledge helps clients revolutionize the financial sector by building innovative apps for P2P lending, money transfer, and securities management, while prioritizing usability and regulatory compliance.

13. Spiria

Global Footprint & Project Metrics

• 22+ years.

• 150+ experts and 2000+ international projects completed.

• 600+ cross-industry clients served.

• Certified as SOC 2 Type 2 compliant and boasts an Overall Clutch Review Rating of 4.9.

• Key Clients: Nortac Defence, Searidge Technologies, Timber Mart®, And Healthpro.

Spiria is a long-standing software engineering firm focused on accelerating organizations’ digital transformation through custom development, application modernization, and team extension. Spiria is committed to providing high-quality, secure services through a collaborative approach.

Their expertise involves engineering digital products to simplify complexities and drive sustainable growth, including critical financial and insurance projects such as the overhaul of a custom cyber-liability underwriting platform for industry leaders.

14. WEZOM

Global Footprint & Project Metrics

• 26+ years on market.

• 275+ certified full-time professionals on board.

• 3,500+ completed projects.

• ISO 27001-certified.

• Recognized by awards including Inc. 5000 2024 and Forbes Council.

• Key Global Clients: Metinvest, Aptiv, Toyota Material Handling, Cooper & Hunter, And Easyload.

WEZOM is a full-cycle software development partner specializing in core banking software for financial institutions and custom FinTech solutions. The company focuses on developing profitable, effective, and scalable digital platforms that cover the full spectrum of financial services, including Payments Management, Digital Banking, and Wealth Management.

WEZOM leverages its deep expertise to significantly reduce time-to-market and help clients achieve their business expansion goals.

Move beyond technical modernization. Sustained customer loyalty is built on exceptional digital experiences. Discover how thoughtful UX and design psychology help banks build trust and loyalty in: Banking App Design: Ultimate Design Practices To Build Customer Trust.

15. GLOBALDEV

Global Footprint & Project Metrics

• 14 years in the IT market.

• 450+ experts working in-house.

• Clients in 20+ countries and 6 development hubs across Europe, operating across 8 time zones.

• ISO/IEC 27001 certified.

• Key Global Clients: BUDGET THUIS, Axon lab, SUBWAY, pliant, and Tarya.

Globaldev Group provides end-to-end software development services and R&D team extensions, leveraging its extensive background to ensure high performance and security. The company offers a full-stack approach, specializing in the financial sector by designing compliant and secure systems for Investment houses, Banks, and Lenders.

Globaldev’s expertise focuses on Cybersecurity (implementing encryption, multi-factor authentication, and blockchain), ensuring strict compliance, and using a microservices architecture for resilient, scalable FinTech applications.

16. Rare Crew

Global Footprint & Project Metrics

• 12+ years of experience.

• 190+ professionals.

• A Microsoft Gold Partner in Application Development.

• Key clients include major companies such as IMG, Learfield, Endeavor, and CLC.

Rare Crew is a custom software development partner that crafts tailor-made solutions to help organizations thrive in the digital world. The company offers end-to-end services, specializing in Custom Software Development, Mobile Apps, and Business Intelligence (BI).

Rare Crew focuses on bridging the gap between business and technology, providing a full service that includes security and comprehensive post-deployment support.

17. TatvaSoft

Global Footprint & Project Metrics

• 24+ years.

• 1350+ IT professionals.

• Created solutions for over 2000 clients globally.

• A Microsoft Solutions Partner and a CMMI-accredited organization.

• Offices in 5 countries (US, UK, Canada, Australia, and India) and operates in 3 Time Zones.

• Key Global Clients: NSW Health, Aramex, FERRERO ROCHER, General Mills, FUJIFILM, NESPRESSO.

TatvaSoft is a full-service Custom Software Development and Enterprise Mobile App company specializing in delivering top-quality, secure, and regulatory-compliant solutions. The firm has built cloud-based core banking platforms for digital banks and FinTech companies for over two decades. Their financial specialization includes loan processing solutions, forex applications, pension systems, and ERPs.

TatvaSoft offers specialized services, including Consumer Finance, Forex Solutions, and Fraud Prevention, to automate business processes and prevent fraudulent banking practices.

18. Dreamix

Global Footprint & Project Metrics

• 17+ years of experience.

• Over 200 skilled individuals.

• Europe-based, serving North America, Europe, and the Middle East. Headquarters in Sofia, Bulgaria.

• Recognized by Forbes, Clutch, the Global Sourcing Awards, and the European IT & Software Excellence Awards.

• Key clients include BNP Paribas, Royal Bank of Scotland, and Fadata.

Dreamix is an end-to-end IT services provider that focuses on developing and accelerating strategic software for leading companies. The company specializes in delivering cloud-based core banking systems through custom financial software development, enabling sustainable growth led by top domain experts and engineers.

Dreamix provides comprehensive FinTech solutions, including modernization of legacy systems, web banking, and financial reporting software. Their expertise extends to using architectures such as Microservices to improve performance and assisting large enterprises in transitioning to agile process management.

19. Shaligram Infotech

Global Footprint & Project Metrics

• 10+ years of market experience.

• 220+ experts.

• 1,200+ Projects Delivered Successfully for 720+ Global Clients.

• Award-winning ISO 9001:2015 certified and Microsoft Gold Partner status.

• Adherence to KYC, PCI-DSS, AML, and GDPR.

• Key Global Clients: Panamax, Pilio, and JoggingBuddy.

Shaligram Infotech is an award-winning Custom Software Development Company specializing in solving complex business problems with innovative, reliable, and scalable digital solutions. The company is a technology partner dedicated to building expertise in the Finance & Forex domain for over a decade.

Shaligram focuses on delivering top-tier forex trading software development services, comprehensive Compliance & Cybersecurity measures, and modernization services that upgrade legacy financial systems to cloud-based app solutions.

20. GeekyAnts

Global Footprint & Project Metrics

• 15+ years in the industry.

• 250–999 employees.

• 800+ successful projects delivered for 550+ clients.

• 50+ Fintech Projects

• Core Services: Specialization in Web & Mobile App Development, Digital Product Strategy, and Generative AI Integration.

• Key Clients: Industry leaders including Google, SKF, WeWork, and ICICI Securities.

GeekyAnts is a global technology consulting and product development company specializing in digital transformation and end-to-end app development. As one of the top banking software development companies, they provide specialized Fintech App Development Services to rapidly and securely scale operations.

Their expertise spans Banking, Investments, and Insurance, with a focus on building intuitive financial management apps and secure internal systems. GeekyAnts delivers thoroughly researched solutions with a user-centric approach, emphasizing Maximum Security, Compliance Standards, and AI-powered Bots for high ROI.

As companies adopt cloud-native systems, leveraging AI and automation is essential for driving efficiency and scalability in modern financial operations. Explore the competitive advantages of smart technology in our blog, Conversational AI in Finance: Benefits, Challenges, Future Predictions.

Why partner with Computools?

After reviewing the Top 20, the main task remains choosing a software development partner capable of driving digital transformation and also delivering tangible business results.

While many firms offer generic solutions, Computools provides specialized expertise to solve the most complex industry problems. Leading banks and FinTech companies worldwide rely on us to move beyond simply maintaining legacy infrastructure and toward true innovation through specialized legacy software modernization services.

Our approach is based on strategic and risk-mitigated delivery of core banking modernization services. We don’t just replace systems; we re-architect your business foundation to be API-first, cloud-native, and fully compliant.

This strategy directly addresses key client concerns:

• Accelerating Time-to-Market: By leveraging a microservices architecture and deep platform expertise (Visa, SWIFT, MasterCard), we significantly shorten launch time for new digital products, giving you a crucial competitive advantage.

• Ensuring Regulatory Integrity: Our proven experience with strict standards such as PCI DSS, KYC, and AML ensures your new core systems are legally resilient from day one, mitigating the risk of high regulatory fines.

• Seamless Legacy Transition: We specialize in the complex task of replacing outdated platforms, managing data migration with zero downtime, and integrating new core banking software development services that deliver true scalability and efficiency.

• Deep Domain Expertise: Our track record with neobanks, investment platforms, and regional leaders (as seen in the Caribbean Bank case study) demonstrates our ability to solve real-world financial complexities, not just generic IT tasks.

To ensure your digital transformation succeeds, partner with a leader. Reach out directly to a next-gen banking software developer like us.

Contact our experts today to schedule a strategic consultation at info@computools.com.

Final thoughts

In today’s fast-changing financial landscape, staying competitive means moving beyond basic system upkeep to strategic digital re-architecting. The global Core Banking Software market grows as organizations replace outdated systems, highlighting the need for partners offering secure, API-first, cloud-native solutions.

The top 20 companies, meeting strict standards for experience, scale, and compliance (PSD2, DORA, AML, GDPR), are suited to lead this change. Success depends on choosing a partner that provides long-term value, faster product releases, and strict regulatory compliance to turn tech challenges into market leadership.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”