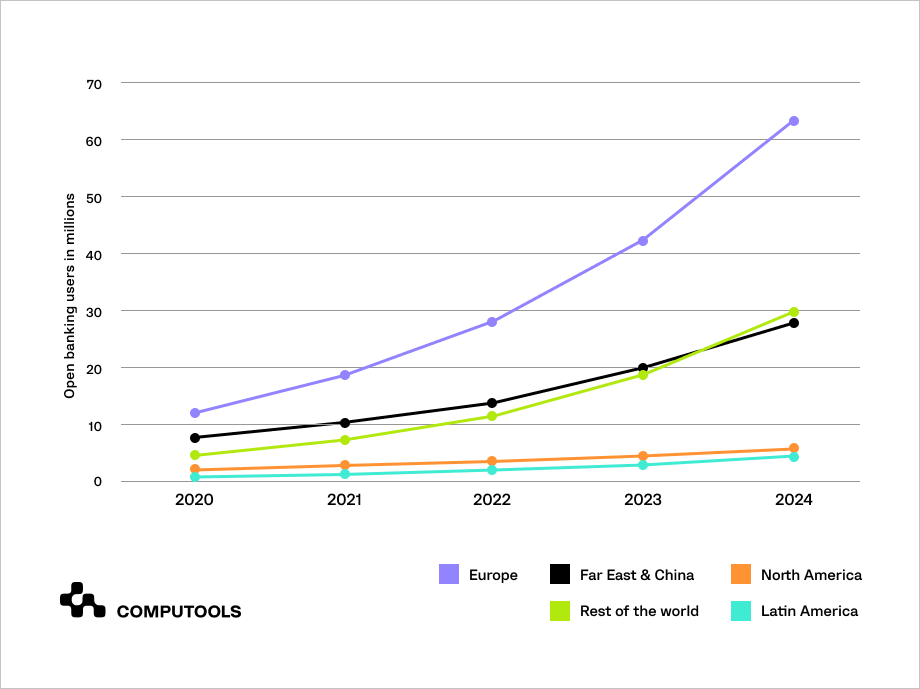

Open banking is a new paradigm of financial services that are gaining more and more traction. Statista predicts that the number of users worldwide could increase by 50% by 2024. The European and Asia-Pacific regions are expected to be the fastest-growing user-type for Open Banking, with a predicted increase of 63.8M and 28.1M users by 2024. The US is expected to grow slower than other regions, with a growth of 5.7M users by 2024.

What is Open Banking?

Open banking is a way financial entities share customer data with other non-financial entities. Shared or open data can be accessed via API and be further used to create innovative products and services. The idea behind this is to provide consumers with a clear picture of their financial situation, gain insights into their spending habits, and based on that, offer a variety of financial services that may be more advantageous and convenient to use.

Say, you would like to start using a budgeting app to track your income and expenses better, but your bank hasn’t shared an open API yet. You won’t be able to connect your bank account to your budget planner because your bank is not open-source and doesn’t let third-party entities access and read their data.

Open APIs are libraries that state what kind of customer data banks are ready to share. With open-source APIs, third-party developers can connect and access shared information without special permission from your bank or any additional software. Mint (money management app) and Cleo (AI financial chatbot) are good examples of open banking that help individuals be more knowledgeable about their finances, thus, helping them achieve savings goals.

What is Open Finance?

Open Finance is a framework built on the principles of Open Banking. However, it’s not limited to data shared by banks. It overlaps with a larger context of a user’s financial life, taking into account data coming from insurance companies, pension funds, investment portfolios, credit scores, purchase history from online stores, and any other sources of information that may give insight into a user’s behavior. With that data, then offers the user relevant products, services, and advice.

Companies implementing Open Finance include startups building innovative FinTech products that look to revolutionize every aspect of finance-related experiences:

• Buy Now Pay Later opportunities for shoppers (Klarna)

• Lower interest rates for borrowers (Zopa)

• Attractive venture capital offers for founders (PropelX)

• Interoperability for crypto traders (Layer Zero)

• Flawless customer experience for bank clients (Revolut, NeoBank)

• Easy and integrated accounting for businesses, and many more.

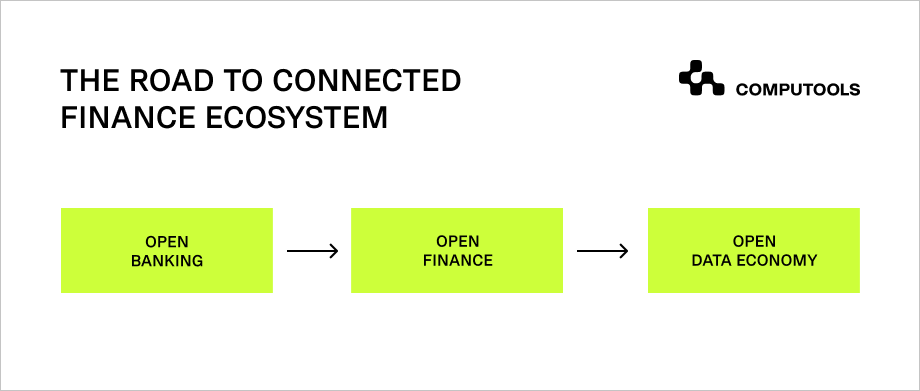

Open Banking vs. Open Finance

Open Banking is about sharing data to enhance customer experience. Open Finance is about creating a financial ecosystem to develop and offer new products and services. Open Banking can simply be described as any open-source API to data, while Open Finance can simply be described as a dashboard of user data and activities. Open Banking forms Open Finance, which can stimulate the development of an entirely new digital finance ecosystem, the Open Data Economy.

The main difference between open banking vs. open finance is how you deal with open data supplied by banks. Open banking apps are entirely focused on improving all aspects of banking services part of which can be performed outside of the bank itself. For example, an app allowing you to access multiple banking accounts from one place is an open banking app. Or an app that lets you “buy now and pay later” for your goods and services.

Open finance apps, in turn, don’t always need to be tightly involved with online banking. Let’s say, a credit scoring app that assesses a user’s creditworthiness relying on how well somebody pays their monthly bills is a good example of open finance. Here, the system works with data coming from non-banking sources, however, the value derived from it may result in more banking services, such as mortgage, loans or insurance.

Open Banking and Open Finance are terms often used interchangeably, but they are different. Open banking is a concept that allows customers to control their data and share it with other financial service providers while maintaining privacy. Open Finance is an approach that uses open-banking principles to create new products and services, for example, an application for investment, based on customer needs by combining different financial data sets.

Want your own investment app?

Contact us →For fintech companies to interact with user data, banks must release an open-source API.

What is PSD2 compliance, and what is its role in Open Banking vs. Open Finance?

PSD2 is an EU regulation that impacts how most banks operate. This standard requires banks to issue an open-source API to share their customer data with third-party companies to speed up innovation and digitalization of the union. This data can be used to build digital products and services.

By issuing open API, banks allow access to data that can then be used to craft unique offers that benefit third-party companies, the banks sharing the data, and of course, the end customers consuming the products and services.

Simply put, knowledge of how a user spends their money daily can be as useful as money itself. It’s important to note that the data does not include personal data.

Let’s go back to our example:

You have a budget planning app. It needs to connect to your bank using your bank’s API, enabling it to send data automatically without having to input this data manually every time. The data being processed by API can include information like utilities, commercial purchases, service payments, etc.

PSD2 introduces two significant changes to banking. First, it requires banks to give third-party developers access to their customers’ account data. Second, it enables customers to authorize third parties granted this access (called “payment initiation service providers”) to initiate payments on their behalf. At its core, PSD2 is about giving customers more control over their finances and making it easier for them to get things done in a way that suits them best.

PSD2 requires banks to promote Strong Customer Authentication (SCA), an authentication process that uses two or more independent factors for secure online payments. The first factor is something users know, like a password; the second can be something they have or are.

Benefits of using Open Banking and Open Finance for business

The opportunities of Open Banking are leveraged in many ways: credit score analysis, data collection, analytics and forecasting, and facilitated checkout across multiple online stores. These advantages have a big impact on how comfortable users are with their buying experience.

Open Banking APIs simplify the work of startups and help them connect new services faster; a company does not need to create its credit or payment module or use intermediaries, such as credit bureaus. In addition, a startup can use open data to enter the market at a minimal cost.

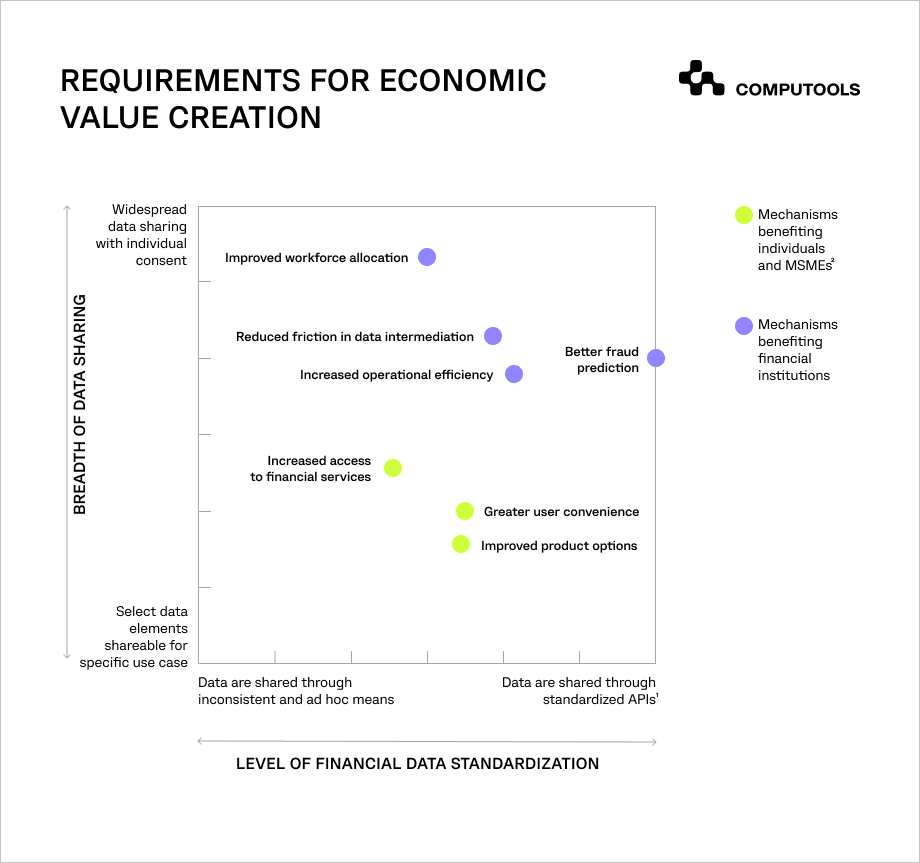

McKinsey Research Agency has presented an analysis that shows specific mechanisms that reveal advantages for small and medium-sized businesses and financial institutions. However, the level of their advantage depends on the degree of data availability.

With the world moving towards the Open Banking and Open Finance landscape, individuals and businesses can access customer data more seamlessly, resulting in improved customer service, faster and more efficient transactions, and more tailored financial services for everyone.

If you have any questions about development-related processes, please email info@computools.com.

Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.