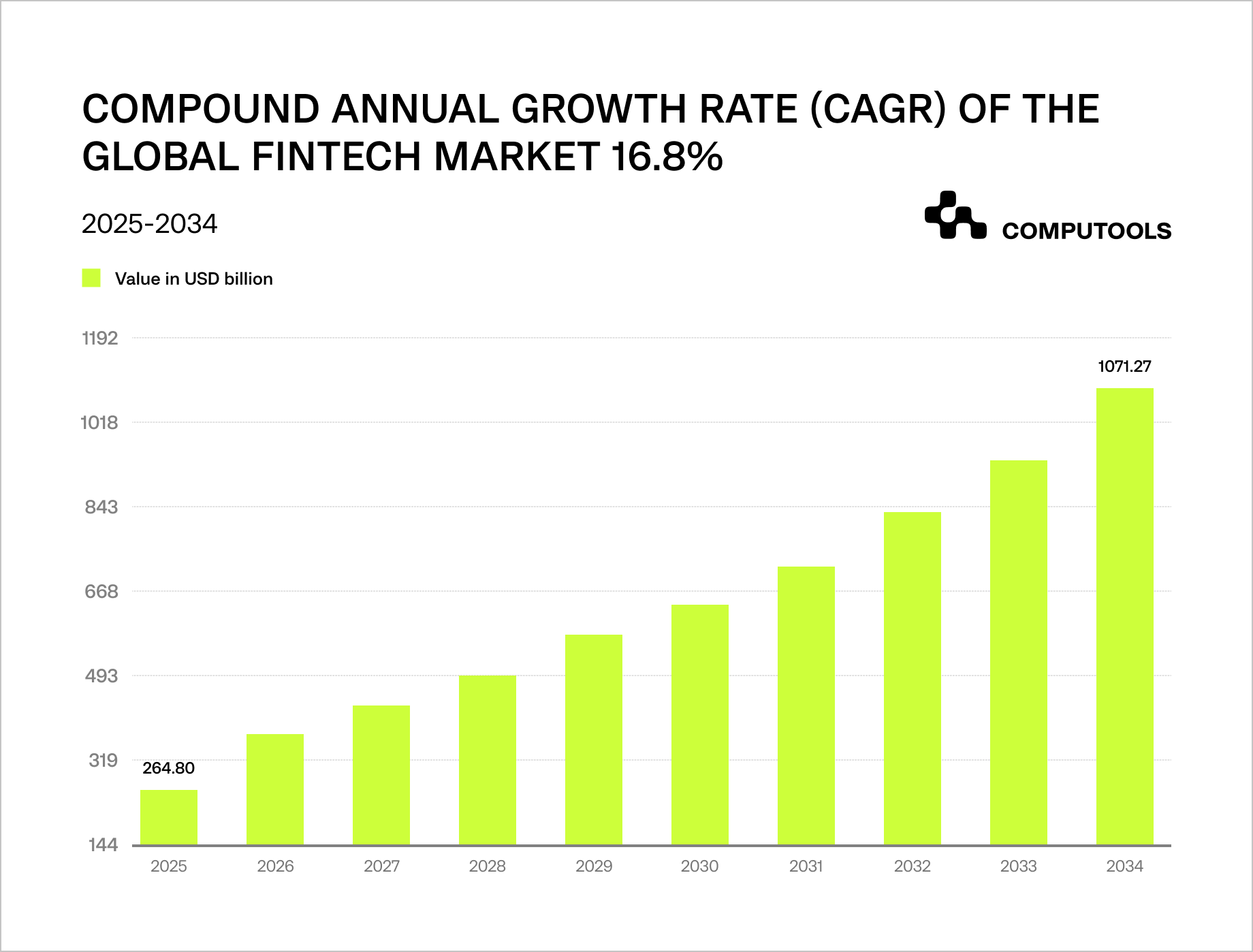

FinTech app development companies are shaping one of the fastest-growing technology markets worldwide. According to BCG, global fintech revenues could reach $1.5 trillion by 2030, while Expert Market Research estimates the industry at $226.7 billion in 2024, projected to hit $1.07 trillion by 2034.

Top 25 finTech app development companies:

1. Computools

2. Suffescom Solutions Inc

3. Empat

4. TechAhead

5. Cogniteq

6. Atomic Object

7. EB Pearls

8. KITRUM

9. JPLoft

10. PowerGate Software

11. Designli

12. BairesDev

13. Newwave Solutions

14. Qubika

15. Webskitters

16. Mercury Development

17. Accedia

18. GLOBALDEV

19. Tech Alchemy

20. iTechnolabs Inc

21. Ancient

22. Jelvix

23. WEZOM

24. Cleveroad

25. TatvaSoft

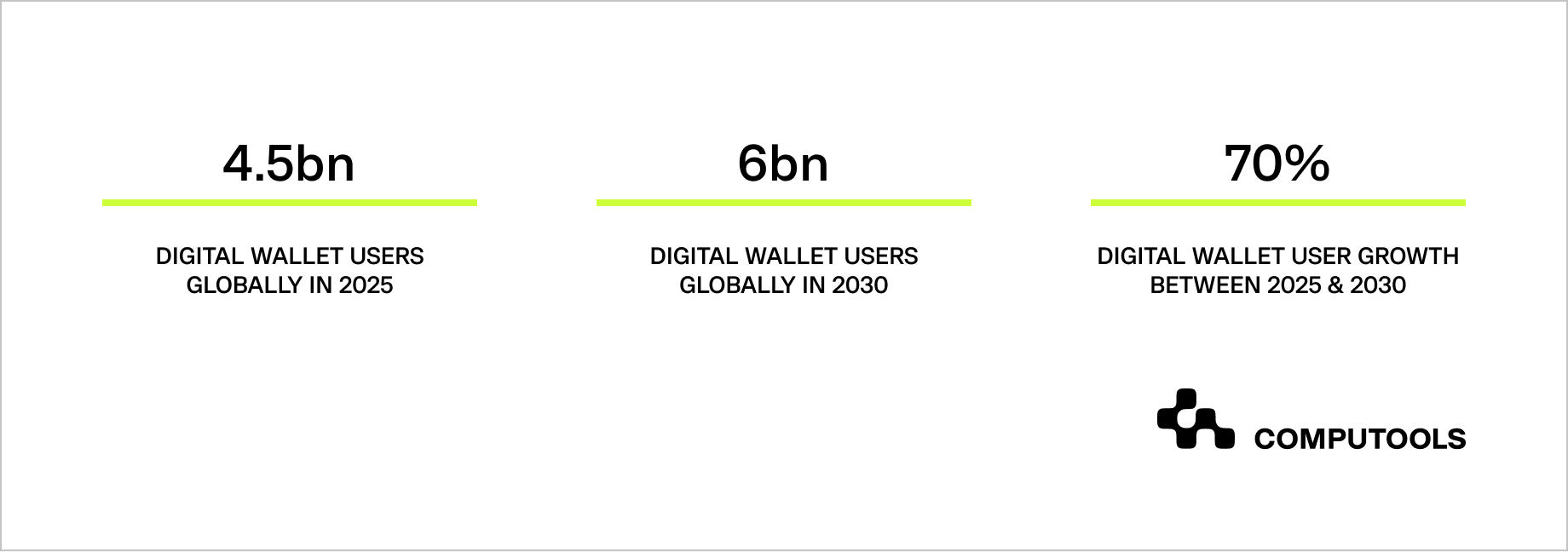

Mobile solutions dominate this surge: over 4.5 billion people already use digital wallets, a number projected to reach almost 6 billion by 2029, making mobile payments the default mode for both e-commerce and point-of-sale transactions.

Regionally, the landscape shows striking contrasts. In Sub-Saharan Africa, mobile money platforms processed around $1.68 trillion in 2024, accounting for roughly 65% of the global value. Meanwhile, in Europe and North America, everyday banking has gone mobile, with users logging into financial apps daily. Fueled by AI-driven personalization, real-time payment rails (UPI/PIX), and open banking APIs, fintech innovation continues to accelerate across continents, impacting how billions of people access, manage, and grow their finances.

This surge in fintech application development is making the market sharper, faster, and far more demanding: competition is rising, quality benchmarks are shifting, and user expectations evolve faster than product release cycles.

In this environment, we selected the Top 25 companies not by loud promises but by what actually matters: consistent delivery of stable fintech products, measurable client results, technical depth, the ability to navigate complex regulatory requirements, and a proven record of launching solutions across regions. From mobile banking to advanced payment platforms, especially among vendors offering reliable mobile app development services.

Selection criteria (Why these 25 companies matter)

This surge in fintech mobile app development is raising the bar for everyone: security requirements are tightening, compliance is becoming non-negotiable, and user expectations are growing faster than release cycles. In this environment, we selected the best FinTech app developers based on indicators that genuinely influence the success of financial products.

1. Experience: 8+ years in product delivery. Fintech isn’t an industry where teams can “learn as they go.” Companies with long-term engineering experience have already navigated regulatory shifts, crisis scenarios, and multiple technology waves. They bring maturity, predictable delivery, and the ability to design systems that stay stable under heavy load, a critical advantage for organisations investing in mobile banking app development that must remain secure, scalable, and reliable at all times.

2. Team depth: 130+ specialists. A fully functional fintech ecosystem requires far more than mobile developers. Strong teams include backend developers, mobile developers, QA engineers, DevOps engineers, security engineers, data experts, and compliance-aware analysts. Companies with large, structured teams can scale features quickly, maintain consistent velocity, and support products post-launch.

3. Security & Compliance: ISO-certified processes. Financial apps operate under strict scrutiny. ISO 27001, regular audits, vulnerability testing, and GDPR/CCPA compliance demonstrate that a vendor can design and implement secure systems, encompassing authentication flows, encrypted storage, fraud monitoring, and protected API layers.

4. Proven FinTech and mobile expertise. Only companies with real experience in mobile banking, payments, investment platforms, lending ecosystems, risk engines, or RegTech solutions were included. We focused on vendors who understand how to design financial UX, handle sensitive data, integrate with banks, and manage complex transactional logic.

5. Global presence and regulatory adaptability. Fintech behaves differently in each market. A company operating across Europe, North America, the APAC region, and the MEA region understands regional compliance, user behavior, and payment models. This global footprint ensures faster time-to-market and fewer regulatory surprises.

6. Awards, recognition, and industry trust. Awards don’t build software, but they signal reputation, delivery quality, and the ability to compete in international fintech hubs. Recognition also shows that clients repeatedly trust these companies with high-stakes financial products.

Let’s move on to the list itself and explore the FinTech app development companies specializing in mobile banking that earned their place in the global Top 25.

Top 25 fintech app development companies worldwide

1. Computools

Key numbers

• 12+ years in fintech and enterprise engineering

• 250+ product, mobile & backend specialists

• 400+ delivered projects across global markets

• 20+ end-to-end financial and banking solutions launched

• Recognised in the IAOP Global Outsourcing 100

• ISO 9001 & ISO 27001 certified

• Official Microsoft and AWS Partner

• Trusted by financial and enterprise brands including Visa, EPSON, Dior, Caribbean Bank, and the British Council

• Deep expertise across Fintech, Banking, Insurance, and Investment products

Computools heads this list as one of the most powerful and reliable engineering partners for financial institutions building mobile-first ecosystems. The company has built a strong reputation as a FinTech app development company for global financial brands, delivering secure, scalable, and compliance-ready digital products that hold up under real operational pressure.

Their fintech software development services cover the entire lifecycle from discovery and UX to mobile engineering, integrations, compliance, and long-term platform evolution. With more than 20 successful projects in financial services, the team is deeply familiar with the technical, regulatory, and user-experience challenges that define the fintech landscape.

For fintech businesses, Computools consistently addresses three critical pain points:

• delivering mobile banking and payment apps that pass compliance checks without slowing time-to-market,

• scaling financial platforms across multiple regions and regulatory frameworks,

• ensuring stability and security under high transaction loads.

Their work reflects this capability. For example, with Keller Covered, Computools transformed a complex, paperwork-heavy insurance flow into a guided, user-friendly digital experience with dynamic questionnaires and instant policy comparison for U.S. and German homeowners.

With Moblet, an emerging challenger bank, they developed a modern mobile banking app featuring biometric authentication, real-time expense tracking, SWIFT/Visa/Mastercard integrations, and streamlined KYC onboarding, helping the bank enter the retail segment faster and more competitively.

Moreover, for CrypDrift case, Computools built a trading platform supporting crypto, fiat instruments, and automated trading bots, enabling the client to expand from a B2B-only audience to more than 50,000 retail users in the first year.

This combination of engineering rigor, global reach, and proven fintech delivery makes Computools a strong partner for companies that need more than an app; they need a reliable financial ecosystem built for growth, compliance, and long-term product evolution, especially for businesses seeking future-ready fintech mobile app solutions.

2. Suffescom Solutions Inc

Key numbers

• 12+ years in mobile and web engineering

• 250–999 in-house specialists

• 6+ global delivery locations (HQ in New York)

• 1500+ projects delivered across industries

• Recognised by Clutch, G2, DesignRush and other B2B marketplaces

• 6+ global offices

Suffescom Solutions Inc. stands out in this ranking of FinTech app development companies thanks to its strong track record in building mobile-first financial platforms. The company combines deep product engineering expertise with compliance-ready architectures, delivering solutions for payments, digital wallets, financial management, and transaction-heavy systems.

Their portfolio features enterprise apps for banks, healthcare payers, mobility services, and big brands, focusing on secure, cloud-native backends, API-first design, AI automation, and smooth mobile experiences. Suffescom’s focus on scalability, performance, and governance makes it a trusted partner for organisations modernising financial operations or launching digital products quickly.

Handling cash in finance and retail requires precision, security, and adherence to PCI compliance standards. This article shows how to create PCI-compliant cash-handling software to protect data, prevent fraud, and support high-volume, downtime-free operations.

3. Empat

Key numbers

• 12+ years on the market

• 250–999 specialists

• 300+ digital products delivered

• Clients across 17+ countries

• 90% of customers are from the US and Europe

Empat works across mobile, web, SaaS, and platform engineering, with a strong emphasis on modular architectures, SDKs, and API-first backends. In fintech, Empat has delivered embeddable SDKs for “financial services as a function” inside B2B SaaS platforms, smart contract–based expense management tools, white-label payout engines for marketplaces, and finance-focused products for companies like Fuel Finance and other data-driven players.

Thanks to a structured discovery process, strong product validation practices, and experience with KYC/AML flows, payments, balances, and approval chains, Empat is a good fit for teams that need not only code but also thoughtful product shaping and a fast go-to-market approach.

4. TechAhead

Key numbers

• 15+ years in digital product engineering

• 2,500+ apps and digital platforms delivered

• 1,200+ global brands and startups served

• 250+ in-house engineers, architects, analysts, and designers

• 500M+ daily active users across deployed products

• 100+ industry awards and recognitions

TechAhead is an AI-first engineering partner that blends mobile, cloud, and data expertise with deep experience in FinTech product development. Their work ranges from instant-loan platforms and multi-currency wallets to rewards and payment solutions for brands like Starbucks (via Pine Labs) and American Express, where reliability, latency, and compliance are as critical as UX design.

The team designs products considering security and regulatory constraints from the start, aligning with SOC 2, GDPR, PCI DSS, and sector-specific standards. This includes secure identity flows, transaction processing, analytics, and reporting.

With ongoing DevOps support and optimization, TechAhead is ideal for financial institutions and fintech startups aiming to launch scalable, AI-enhanced, audit-ready apps from MVP to millions of users.

5. Cogniteq

Key numbers

• 15+ years on the market

• 150+ software engineers

• 300+ successful projects

• 100+ clients across 30+ countries

• ISO/IEC 27001 certified

Cogniteq is a European custom software development company specializing in transforming complex product ideas into stable, production-ready applications. With delivery centers in Lithuania and Poland, the team provides mobile and web development, enterprise solutions, UX/UI design, QA, and dedicated development services, all while staying closely aligned with clients’ processes, standards, and roadmaps.

Cogniteq develops custom banking and fintech solutions for financial institutions, including mobile banking apps, accounting platforms, personal finance tools, prepaid card systems, and tax software. The company prioritizes security (ISO/IEC 27001, encryption, access control), legal compliance (GDPR), and load performance.

With mobile expertise and rigorous testing, Cogniteq is ideal for banks and fintech providers seeking reliable, secure applications over prototypes.

Discover how strategic investment in fintech software development strengthens competitiveness across payments, lending, wealth, and embedded finance.

6. Atomic Object

Key Numbers

• 20+ years on the market

• 130+ in-house experts

• 2,500+ successful projects delivered

• 100% U.S.-based engineering teams

• ISO-aligned delivery and security practices

• 4 offices across the U.S. (Grand Rapids, Ann Arbor, Chicago, Raleigh-Durham)

Atomic Object is a U.S.–based, employee-owned software development consultancy creating custom digital products for web, mobile, desktop, and IoT. The company helps organizations across finance, insurance, healthcare, and enterprise services turn complex ideas into reliable, user-friendly software.

The team’s approach combines human-centered design, iterative development, and transparent budgeting, ensuring predictable delivery and long-term value.

Atomic Object is known for deep technical expertise, strong product strategy, and a collaborative culture that prioritizes clear communication and measurable outcomes.

7. EB Pearls

Key Numbers

• 20+ years on the market

• 400+ in-house specialists across 3 countries

• 600+ shipped digital products

• 70M+ daily active users across client platforms

• 76% of projects come from returning clients & referrals

• 72+ international industry awards

EB Pearls stands out among leading FinTech app development companies thanks to its strong combination of product strategy, design excellence, and enterprise-grade engineering. Over its 20-year history, the company has developed platforms for banking, payments, lending, wealth management, and financial marketplaces, including projects that support millions of daily users and handle high-load, transaction-heavy workflows.

EB Pearls adopts a “momentum-first” approach: instead of just coding features, it helps startups and financial brands validate ideas, streamline onboarding, improve risk flows, and build scalable, regulation-ready architectures. This includes secure KYC/AML onboarding, multi-wallet systems, payment integrations, analytics dashboards, and cross-platform mobile apps designed to grow.

What distinguishes EB Pearls is its skill in turning complex financial processes into simple, user-friendly journeys, all while ensuring performance, compliance, and scalability.

8. KITRUM

Key Numbers

• 8+ years on the market

• 350+ engineers across 8 global delivery hubs

• 210+ trusted clients worldwide

• 29 countries served

• 20% of all projects in fintech

• 77th place in The Americas’ Fastest-Growing Companies, 2024

• 146 successfully delivered fintech & finance-adjacent projects

Kitrum confidently positions itself among the top FinTech app development companies thanks to a rare mix of speed, senior engineering talent, and domain-specific expertise. The company has built fintech products across mobile banking, payment orchestration, trading platforms, predictive analytics, e-wallets, fraud prevention, and cross-border payment engines.

Kitrum’s fintech practice excels at deploying secure, customizable modules like onboarding/KYC, strong authentication, biometrics, AML, and card-issuing frameworks, reducing time-to-market by 30–40% without losing compliance or scalability. For complex systems, they build full-cycle platforms aligned with GDPR, SEPA, AML, PCI-DSS, and regional standards.

Kitrum’s fintech work focuses on personalization, security, and seamless integrations. Their engineers design solutions capable of handling high transaction volumes, preventing fraud, automating back-office operations, and integrating with core banking APIs, PSPs, card networks, or digital identity services.

9. JPLoft

Key Numbers

• 10+ years on the market

• 1100+ digital products delivered

• 1000+ clients served in 70+ countries

• 130+ in-house specialists

• 1.5M+ end users on clients’ platforms

• $160M+ raised by clients using JP Loft-built products

JPLoft stands out among FinTech app development companies due to its blend of product thinking, strong engineering, and a highly “done-for-you” approach. The company delivers end-to-end solutions for digital banking, mobile wallets, lending and mortgage platforms, personal finance apps, KYC systems, mPOS, and investment/trading products.

Their fintech team works across iOS, Android, Flutter, React Native, web, and cloud. It is comfortable with AI, blockchain, data analytics, and integrations with payment gateways, KYC providers, and core banking systems.

In addition to greenfield product development, JPLoft also offers “clone-style” accelerators (e.g., Cash App, Chime, Robinhood–like experiences) to shorten time-to-market, as well as long-term maintenance and optimization.

10. PowerGate Software

Key numbers

• 10+ years on the market

• 200+ digital products delivered

• 250+ engineers and product specialists

• 96% client satisfaction rate

• 5 global offices (US, Canada, UK, Australia, Vietnam)

• 150+ top technology companies served

PowerGate Software is a global product studio that takes ideas from concept to market-leading platforms for clients ranging from startups to multinational enterprises.

As a FinTech software development firm, PowerGate focuses on building financial platforms that improve visibility, automation, and transaction security: invoice and billing systems processing 150M+ documents a year, cloud-native payment gateways used by banks like Swedbank, SEB, and LHV with PCI DSS Level 1, and financial tools for property and investment management.

Clients can choose between full-cycle product development, dedicated teams, or staff augmentation. At the same time, ISO 27001 and ISO 9001 certifications ensure that both data security and delivery quality are handled to enterprise standards.

11. Designli

Key numbers

• 12+ years on the market

• 250+ in-house specialists

• 1,000+ products delivered across mobile and web

• 97% repeat-business rate

• 2 dedicated U.S. offices (Greenville, SC + one satellite)

Designli is a product studio that often supports companies seeking FinTech software outsourcing solutions, particularly when founders lack a technical background. Their model centers on assigning a dedicated, full-time product team of engineers, designers, and a Product Owner who guides the client through every stage of building or improving a digital product.

For FinTech products in particular, they focus on translating complex financial processes into clear user flows, ensuring stable architecture, and supporting secure integrations.

Their portfolio includes apps with financial tracking, secure transaction syncing, and data-driven coaching platforms, demonstrating their ability to handle sensitive workflows and evolving product logic.

Mobile cash-handling operations have long shifted into a high-load environment, yet many organizations still rely on Android apps built a decade ago. Our article explains how to modernize them to today’s standards, encompassing updated UI principles, security hardening, modern API integrations, and cloud-ready infrastructure.

12. BairesDev

Key numbers

• 15+ years on the market

• 1,000–9,999 engineers

• 4,000+ senior developers available

• 1,200+ completed projects

• 500+ global clients

BairesDev is a large engineering partner that helps organizations speed up software delivery with flexible models and skilled developers. Instead of long hiring processes or fragmented teams, clients get fully integrated engineers or dedicated units in aligned time zones, fluent in English, and ready to join projects quickly.

The company provides three collaboration formats: staff augmentation for in-house teams, dedicated squads for long-term projects, and full-cycle outsourcing—covering discovery, architecture, QA, DevOps, and support. This benefits fast-moving businesses needing predictable velocity, controlled quality, and easy scaling without extra overhead.

13. Newwave Solutions

Key numbers

• 14+ years on the market

• 300+ engineers across Vietnam & Japan

• 800+ completed projects

• 200+ active global clients

• ISO 27001 & ISO 9001 compliant

Newwave Solutions focuses on cost-efficient delivery, transparent processes, and flexible collaboration models that help clients accelerate product development without compromising quality. The company works across mobile, web, blockchain solutions, enterprise platforms, and emerging technologies, offering both end-to-end product builds and modular support for specific features or integrations.

Their financial and payments expertise makes them a steady choice for FinTech app development for startups, especially when founders need reliability, predictable delivery, and guidance through regulatory and security requirements.

14. Qubika

Key numbers

• 20+ years in digital product and data/AI services

• 800+ specialists across the US and Latin America

• 20+ years of experience in financial services

• 100M+ end users rely on systems built by Qubika

Qubika is a technology partner specializing in data, AI, and modern digital platforms for organizations that require innovation at scale. The company combines a strong engineering discipline with a security-first mindset.

Its studios cover the entire lifecycle of digital products from data engineering and AI model development to platform engineering, web app development, cloud, cybersecurity, and human-centric product design. In financial services, Qubika’s dedicated Finance Studio enables banks, fintechs, and non-financial brands to build next-generation products, including digital banking platforms, credit scoring engines, fraud detection systems, and API-driven financial experiences.

The team uses reusable accelerators and custom development to reduce time to market while ensuring regulatory compliance and reliability.

15. Webskitters

Key Numbers

• 15+ years in digital product development

• 700+ in-house IT professionals

• 1,500+ customers worldwide

• 25+ international awards

• ISO 9001:2015 & ISO 27001:2015 certified

Webskitters is a global digital solutions provider, working at the intersection of web, mobile, AI, game development, and digital marketing. The company combines large-scale engineering capacity with a customer-first mindset, supporting businesses from early-stage startups to established enterprises.

As a FinTech mobile solutions provider, Webskitters helps financial organizations and fintech startups build secure, compliant, and user-friendly products from mobile banking and digital wallets to AI-powered risk tools, blockchain solutions, and regulatory compliance platforms.

Their teams focus on data security, performance, and UX, integrating payment gateways, KYC/AML workflows, and custom financial logic to improve ROI and trust across digital channels.

16. Mercury Development

Key Numbers

• 26+ years on the market

• 180–450+ full-time engineers (depending on unit)

• 2,500+ delivered projects

• 50M+ active users across deployed apps

• Trusted by global brands: Google, HSBC, Fitbit, Burger King, Tonal

Mercury Development is a long-standing software engineering partner with deep expertise in mobile, web, desktop, and emerging tech. Mercury’s teams integrate seamlessly into existing workflows, helping companies increase development velocity, modernize legacy systems, and launch high-performing digital products on time and on budget.

Their portfolio includes consumer health, fitness, fintech, retail, and enterprise apps, with award-winning mobile apps recognized in App Store Trends of the Year. Their engineering stack covers native and cross-platform mobile, IoT, BLE, smart devices, ML systems, and web platforms.

Mercury offers staff augmentation, dedicated teams, and outsourcing models, emphasizing transparency, quality, and predictable execution.

17. Accedia

Key Numbers

• 12+ years on the market

• 250+ engineers

• Clients in 20 countries across 5 continents

• Recognized by IAOP, FT, and Deloitte

• ISO-certified (9001 & 27001)

• 50+ finance enterprises & fintech startups served

Accedia is a European FinTech application development provider with a strong focus on building secure, data-driven, and regulation-ready financial software. Their financial expertise encompasses digital banking, lending automation, analytics platforms, cloud app development, cybersecurity, and AI solutions designed to help banks and fintechs operate more efficiently and intelligently.

Accedia’s teams support organizations at every stage of their digital transformation, from consulting and solution architecture to full-cycle engineering and long-term maintenance.

The company delivers scalable software tailored to the needs of commercial banks, payment providers, mortgage companies, and financial service corporations.

18. GLOBALDEV

Key Numbers

• 14+ years on the market

• 250–999 specialists

• ISO/IEC 27001 certified

• Global delivery across Europe, the US, LATAM, MENA

• Trusted by enterprises, SMEs, and fast-growing startups

Globaldev Group is a full-cycle technology partner specializing in scalable engineering, team extension, and AI-driven product development. Their engineering teams work across cloud, data, mobile, web, and high-load systems, helping clients accelerate time-to-market and reduce operational costs.

Globaldev Group is also experienced in delivering secure mobile solutions for regulated industries, acting as reliable mobile app developers for FinTech startups and enterprises that need compliance-ready, high-performance products.

The company’s global talent network enables rapid team scaling, while its R&D expertise helps product companies introduce new features, improve performance, and adopt AI and automation.

19. Tech Alchemy

Key Numbers

• 8+ years on the market

• 300+ team members

• 120+ portfolio companies

• £100M+ in combined startup funding supported by their MVPs

• 10+ industry awards

• Products featured by Apple, AWS, BBC, Forbes, Red Dot, Product Hunt

Tech Alchemy is an award-winning design and software development studio based in London, with offices in Manchester, Lisbon, and Pune. Their background as founders shapes a delivery style that blends product thinking with technical execution, a combination valued by early-stage ventures and established businesses alike.

The team works across web, mobile, AI, and blockchain, with a reputation for handling complex integrations and supporting clients through rapid scaling.

With a focus on clarity, responsiveness, and long-term product evolution, the company positions itself as a partner that can seamlessly transition into strategic conversations as well as engineering tasks.

20. iTechnolabs Inc

Key Numbers

• 12+ years on the market

• 230+ developers

• 1,000+ delivered projects

• 20+ countries served

• 840+ mobile apps launched

iTechnolabs is an international development partner delivering mobile, web, AI, and blockchain solutions for startups and global enterprises.

With a decade of experience and a strong focus on usability, the company also provides specialized FinTech UX/UI design to help financial products stay compliant, user-friendly, and conversion-driven.

Their teams work across native and cross-platform mobile engineering, backend systems, cloud infrastructures, and full product development cycles from discovery to post-launch support.

21. Ancient

Key Numbers

• 10+ years on the market

• 150+ specialists across LATAM

• 60+ global clients

• 100+ delivered projects

• Full-time zone alignment with US teams

Ancient is a LATAM-based technology partner, combining senior engineering talent with a delivery-first mindset. The company assists financial institutions and digital-first businesses in developing modern payment systems, digital wallets, core banking modules, and cloud-native platforms.

Their model combines nearshore proximity with dedicated technical oversight, enabling organizations to scale their engineering capacity, modernize legacy systems, and accelerate product delivery without compromising quality or compliance.

22. Jelvix

Case Numbers

• 15+ years on the market

• 450+ tech professionals

• 84% mid-level & senior engineers

• 82% client retention rate

• ISO 9001, ISO 13485, ISO 27001, ISO 27701 certified

Jelvix is a global technology partner helping financial institutions, enterprises, and fast-growing companies build dependable digital systems.

With deep expertise in modernizing legacy platforms, designing secure financial applications, and integrating AI, big data, and blockchain, the team delivers solutions that improve efficiency, strengthen compliance, and support long-term scalability.

Their engineering culture, certified workflows, and mature delivery processes make them a reliable choice for organizations seeking robust FinTech application development and end-to-end digital transformation.

23. WEZOM

Case Numbers

• 25+ years on the market

• 3,500+ IT projects delivered

• 275+ certified in-house professionals

• 6 offices across the USA, Canada, Poland, Germany, and Ukraine

• 4 time zones covered

WEZOM is a long-term software development partner that helps businesses transform complex operations into reliable digital systems.

With strong roots in logistics, oil & gas, supply chain, real estate, and e-commerce, the company designs and builds custom platforms that streamline workflows, improve transparency, and support growth at scale. Leveraging its industry background, WEZOM also delivers custom fintech software development, ranging from payment and personal banking solutions to digital banking, wealth management, and core banking platforms.

Clients choose WEZOM for its seamless delivery process, focus on business goals, and ability to bring products to market quickly while maintaining security, scalability, and ease of evolution.

24. Cleveroad

Key numbers

• 10+ years on the market

• 280+ in-house engineers

• 170+ successful projects

• 3 international offices (USA, Norway, Ukraine)

• Recognized as Top Financial App Developers 2024 and Top Fintech Software Development Company 2024

Cleveroad is a web and mobile development company helping startups and financial institutions turn complex ideas into digital products.

Focused on transparency and predictable delivery, the team builds custom B2B and B2C solutions in fintech, banking, trading, insurance, and related fields, including native and cross-platform apps, cloud backends, and data services.

Combining domain expertise with AI, data science, and IoT development, Cleveroad creates secure, compliant, scalable platforms like digital banking ecosystems, micro-investment apps, payment solutions, trading tools, and RegTech.

Clients turn to Cleveroad to audit legacy code, modernize systems, integrate AI, and deliver new fintech products meeting market and regulatory needs.

25. TatvaSoft

Key numbers

• 20+ years on the market

• 1350+ IT specialists

• 2000+ clients served globally

• 5 international offices (US, UK, Canada, Australia, India)

• CMMI-accredited & Microsoft Solutions Partner

TatvaSoft is a global custom software and app development partner known for building scalable digital products for enterprises, SMEs, and fast-growing startups.

TatvaSoft has a strong track record in finance, banking, and insurance, where stability, compliance, and performance are essential. Its teams build secure digital banking systems, payment solutions, lending platforms, wealth management tools, and custom platforms tailored to each institution’s operational and regulatory requirements.

AI is transforming capital markets at every level, from trading and risk to compliance and client analytics. In this article, we break down the key trends, the biggest opportunities, and the real challenges financial institutions face when adopting AI solutions.

Why Computools stands out among leading fintech app development companies

Choosing a technology partner for a financial product involves more than just speed and cost. It’s about effectively managing complex financial processes, complying with regulatory demands, and developing solutions that stay stable as they grow. This is why Computools is often chosen by companies seeking a long-term technology partner rather than a temporary outsourced team.

One of the company’s strengths lies in its ability to run deep analysis before development begins and translate that into a clear, future-proof architecture. This matters especially for products where transaction logic, risk models, authorisation flows, or calculation rules change frequently. These challenges cannot be solved with a template approach; they require a flexible approach combined with an engineering discipline. This balance is what makes Computools a strong partner in financial software development.

The case studies in this domain show that the team doesn’t simply execute a technical task; they rethink the product itself.

For Finmap Online, a financial planning platform for SMBs, the team carried out a full redesign, strengthened data protection, launched mobile apps, and added tools for synchronisation, automated reports, calendar modules, multi-currency features, and extensive API integrations. Following the update, the platform experienced significant growth in conversions and received strong feedback from small businesses that had previously struggled with fragmented financial management.

For FDA Operator, the team built an investment platform capable of processing large volumes of financial data, running risk calculations, enabling purchases of local and global stocks, and providing multi-layered analytics in real time. The platform entered the market with higher processing speed, stability, and user logic tailored to investors with varying levels of experience, contributing to a 46% increase in the client base.

Another advantage of Computools is its systematic approach to security, focusing on environment isolation, encryption, Zero-Trust principles, third-party checks, and stable infrastructure. This makes it reliable for secure mobile FinTech development, like banking, insurance, or trading platforms.

This approach offers predictability, a quicker time-to-market, and lower risk, providing companies with a scalable digital ecosystem for introducing new features and navigating diverse regulations. Email us at info@computools.com, and our fintech engineering team will review your needs and propose the most effective next steps.

To sum up

As digital finance accelerates worldwide, the pressure to choose the right technology partner grows just as fast. Mobile payments now dominate everyday transactions. Statista forecasts 5.48 billion digital payment users by 2027, with global transaction value set to reach $10.52 trillion by 2025. Additionally, 53% of U.S. consumers already prefer digital wallets over traditional methods.

In this rapidly expanding landscape, selecting a reliable partner for custom FinTech app development becomes a strategic decision. The right company should combine strong financial domain expertise, modern engineering practices, and user-centred product thinking to help you build solutions that scale, comply, and compete.

This is especially important for businesses investing in secure and future-ready banking software development, where precision and regulatory alignment have a direct impact on long-term success.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”