The surge of embedded finance development companies is reshaping how digital products deliver payments, lending, insurance, and banking. The global embedded finance market is accelerating at an unprecedented pace, projected to reach ~$146B in 2025 and surpass $690B by 2030, with a 31–36% CAGR.

Top 15 embedded finance software development companies in 2026:

1. Computools

2. Redberry

3. Dreamix

4. Digis

5. Cleveroad

6. Fingent

7. BairesDev

8. Zallpy Digital

9. 99x

10. CodeNinja

11. S-PRO

12. Software Mind S.A.

13. Premiersoft

14. TatvaSoft

15. Zoolatech

Adoption is no longer optional: 56% of businesses already offer embedded finance, and 55% of non-financial companies plan to launch these services within two years.

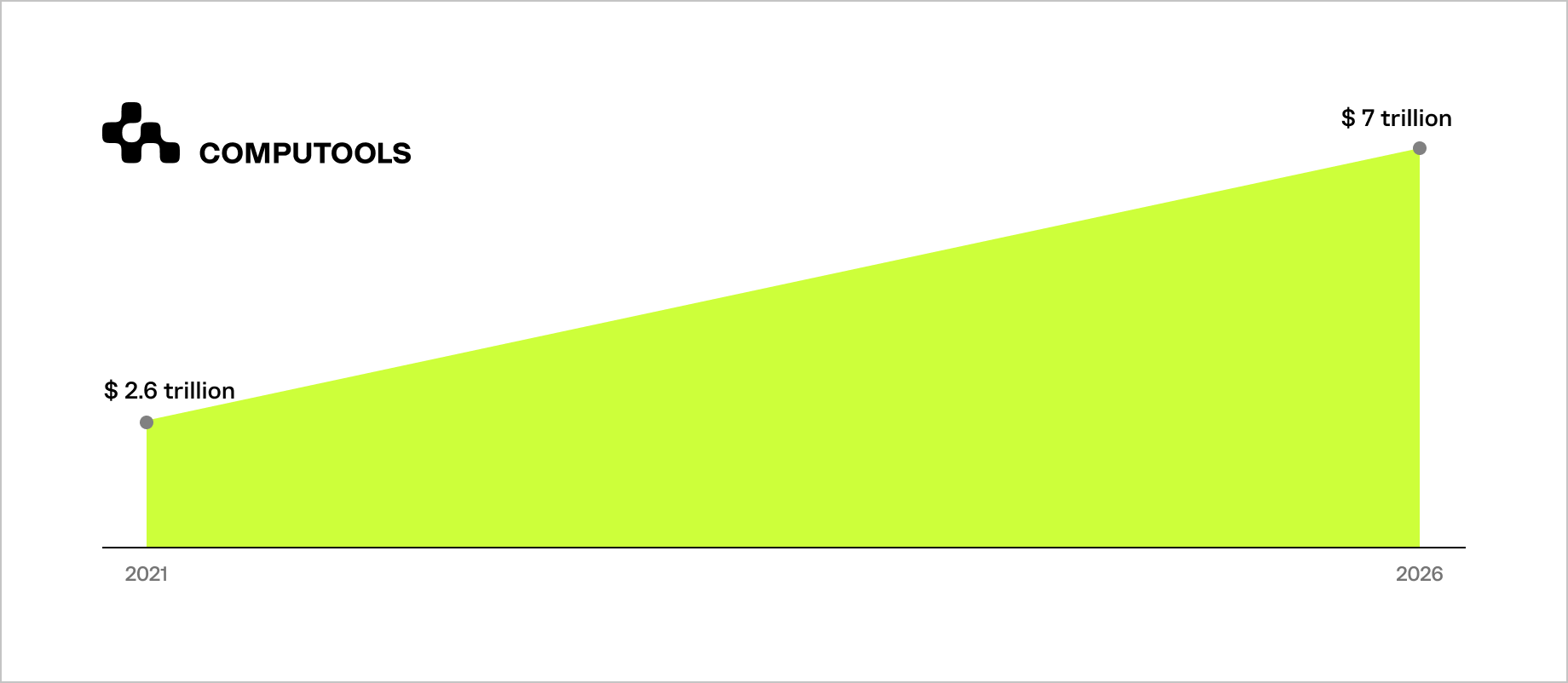

In the U.S., embedded finance transaction volumes are skyrocketing from $2.6T in 2021 to over $7T by 2026, driven by e-commerce, mobile wallets, API-first banking, and the rapid rise of BNPL, which is used by 45% of Gen Z and Millennials.

Growth faces hidden pressures: banks, fintechs, and digital platforms must securely integrate payments, real-time KYC/AML, fraud detection, and lending without harming UX or compliance.

Custom AI systems detect fraud up to 50%, but fragmentation, gaps, and legacy systems slow progress. Companies that don’t embed financial services risk losing users, revenue, and a competitive edge as financial interactions move into daily platforms.

To navigate this complexity, businesses need engineering partners capable of building compliant, scalable, API-driven ecosystems. This article highlights the 15 companies leading that transformation.

How we selected the top 15 embedded finance development companies

To identify the most reliable leaders in the market, we applied strict, measurable criteria that reflect maturity, engineering depth, and the ability to deliver custom financial software development at scale.

Each company included in this ranking meets several essential qualifications.

• First, a minimum of 8+ years on the market, enough time to navigate regulatory shifts, technology waves, and multiple product cycles.

• Second, a team of 150+ specialists, ensuring the capacity to run several large-scale financial projects simultaneously without compromising quality or delivery speed.

• We also required a 4.9 rating on Clutch, supported by verified, in-depth client reviews from the fintech, banking, and enterprise sectors.

• Equally important is compliance readiness: companies must hold relevant ISO certifications, such as ISO 9001 for quality management and ISO 27001 for information security. Industry awards and recognitions, whether from Clutch, IAOP, Deloitte, or sector-specific fintech competitions, serve as additional confirmation of excellence.

• Geographic diversity was another selection factor. The list includes companies from across North America, Europe, Asia, and LATAM to reflect the global nature of embedded finance and the varied subject matter expertise required to build custom embedded finance platforms for different regulatory environments.

• Finally, every selected company has delivered real, verifiable fintech products: payment systems, card-issuing engines, lending workflows, KYC/AML automation, fraud detection modules, open-banking integrations, and high-security financial architectures. Their compliance experience spans PCI DSS, SOC 2, PSD2/PSD3, GDPR, AML/KYC frameworks, and sensitive data environments.

These criteria ensure that the final list represents only those teams capable of building secure, scalable, regulation-ready embedded finance solutions for modern digital businesses.

Top 15 embedded finance software development companies in 2026

Let’s take a closer look at embedded finance software companies specializing in payments and lending, whose technologies enable seamless transactions, faster approvals, and fully integrated financial experiences across modern digital platforms.

1. Computools

Computools leads this list as a partner that helps financial institutions modernize complex digital operations through Fintech software development services. Instead of adding superficial features on top of legacy systems, the company rebuilds critical workflows of onboarding, KYC/AML, lending, insurance, and investment management into fast, secure, API-driven journeys that work reliably under regulatory pressure and high user load.

With 250+ engineers, ISO-certified processes, and 400+ completed projects, 20+ delivered custom Fintech projects, Computools offers stability, predictability, and deep technical expertise.

One of Computools’ strengths is its ability to create custom embedded finance solutions for banks and fintech startups, integrating payments, lending, insurance, or wealth tools directly into existing customer experiences. These solutions reduce operational overhead, eliminate bottlenecks, and open new revenue channels for digital platforms.

Their project portfolio clearly illustrates this approach. For Keller Covered, Computools built an embedded real estate insurance platform that lets users enter property details, receive real-time, personalized quotes, compare coverage, and purchase policies in a few guided steps. This transforms a traditionally bureaucratic process into a seamless digital flow.

For Invest Latam, the team delivered a lending marketplace with automated verification, credit evaluation, and investor matching, enabling over 1,000 successful transactions and dramatically improving access to capital for SMEs.

An Australian investment company achieved a 46% increase in its customer base after Computools engineered a scalable portfolio and risk-analysis platform capable of handling complex financial calculations.

Across these and other cases, Computools consistently removes the core pains that slow down financial products, legacy constraints, manual decisioning, siloed data, and compliance complexity, turning them into high-performance embedded finance experiences built for growth.

2. Redberry

Redberry is recognized as a full-cycle digital transformation agency based in Georgia, offering significant cost advantages alongside top-tier talent.

The company focuses on speed, scalability, and delivery experience, which are non-negotiable standards for successful embedded finance implementation. Their project portfolio includes designing and building iPaybetter (a dedicated Fintech product), demonstrating their ability to handle complex financial applications.

Redberry acts as a strategic embedded finance solution provider by combining robust software development (Backend/Frontend, DevOps services) with critical product design and UX/UI services, ensuring the final financial product is not only scalable but also highly adopted by end users.

Financial platforms are becoming more open, with data shaping personalized digital services. Many confuse Open Banking’s scope with the broader potential of Open Finance. To understand their differences and which suits your strategy, read here: Open Banking vs. Open Finance: What’s the Difference?

3. Dreamix

Dreamix is a Europe-based IT services provider with 17+ years of experience, specializing in embedded finance software development for FinTech and insurance companies.

The company offers comprehensive custom financial software development services, including web banking, financial reporting, and modernizing legacy systems.

Dreamix leverages cloud infrastructure and microservices architecture to ensure high scalability and security, integrating essential compliance features such as KYC and AML.

4. Digis

Digis is a global software development company founded in 2015, operating with over 200 specialists and recognized for its strong focus on the FinTech industry (35+ successful financial projects).

Digis offers crucial services for embedded ecosystems, including Digital Wallet Solutions, Mobile Banking App Development, and Risk Management Software. They leverage their patented ‘Smart Outsourcing Automation Paradigm’ and advanced technologies such as AI and Blockchain to deliver scalable, secure platforms.

Digis serves Fintech Startups, established Banks, and Payment Solution Providers, prioritizing strict security and regulatory compliance.

5. Cleveroad

Cleveroad is a US-headquartered embedded finance software company (250+ employees, ISO 27001 certified) with a dedicated focus on innovative FinTech solutions.

The company explicitly offers services for Embedded Finance and PaaS, covering the entire spectrum of integration needs. Their core expertise includes developing Digital Payment Solutions (mobile wallets, real-time payments), AI-powered Risk Systems (fraud detection, credit scoring), and Embedded Insurance platforms.

Cleveroad guarantees compliance with major global financial regulations (PCI DSS, KYC/AML) and provides full-cycle support, as evidenced by projects with the European Investment Bank and FinTech leaders such as Mangopay.

Learn what defines excellence in embedded-finance software development and how these capabilities translate into operational resilience, customer trust, and long-term strategic advantage.

6. Fingent

Fingent is an experienced technology partner (22 years on the market, 250+ employees, ISO 27001:2013 certified) specializing in AI-Driven Innovation and custom enterprise software development.

Their work with global financial leaders such as Mastercard, PwC, and OneAZ Credit Union demonstrates their ability to build secure, regulatory-compliant digital ecosystems.

Fingent’s core services, including predictive analytics, intelligent business automation, and legacy system modernization, are key to implementing reliable Embedded Financial Services and ensuring efficiency and resilience through automation and data-driven decision-making.

7. BairesDev

BairesDev is a software outsourcing firm (4,000+ engineers, founded 2009, HQ in San Francisco) trusted by over 500 enterprise clients, including Google and J&J.

They are specialists in embedded banking development, providing end-to-end FinTech solutions. Key offerings include developing secure Digital Banking & Mobile Wallet Applications, Payment Gateway & Processing Systems, and Peer-to-Peer Lending Platforms.

They leverage AI/ML, Blockchain, and robust regulatory compliance solutions to accelerate institutions’ financial roadmaps.

8. Zallpy Digital

Zallpy is a U.S.-based strategic nearshore technology partner with a strong presence in Brazil, providing access to a large pool of skilled tech talent in aligned time zones.

With 17 years on the market, they offer scalable expertise for complex IT needs, including Custom Software Development, Systems Integration, and robust Data and AI Solutions (ML, Generative AI).

Their services, which include Cloud Solutions (AWS, Azure, GCP) and Enterprise Software implementation, position them to build and scale the highly integrated digital ecosystems required for embedded finance applications. Zallpy serves both startups and Fortune 500 companies, such as BMW and ADP.

9. 99x

99x is an established global software development group (21 years on the market, 600+ tech talent, offices in Norway, Brazil, etc.) specializing in advanced digital solutions and product engineering for business-critical systems.

Their core services are highly relevant to embedded finance, focusing on Legacy-to-Cloud Modernization (essential for integrating FinTech services), Data Science, AI/Machine Learning (including Agentic AI solutions for automated financial workflows), and the development of robust, scalable web platforms.

Their proven, 20-year history of working with multinationals positions them as a reliable partner for organizations seeking to integrate and scale digital financial products.

The insurance industry is experiencing rapid digital change, with low-code becoming a key tool to accelerate product deployment, improve operational efficiency, and cut development expenses. To see how low-code is practically transforming insurance, read here: How Low-Code Is Transforming the Insurance Industry.

10. CodeNinja

CodeNinja is a leading financial technology development firm (350+ experts, 11 years on the market, HQ in Austin, TX) specializing in AI-driven innovation and enterprise digital transformation.

They provide strategic engineering teams and Global Capability Centers to help businesses scale securely. Their core services, including Application Modernization and Cloud Services, are critical for embedding financial functions, evidenced by their successful work enhancing a Middle Eastern Financial Institution’s Operations and simplifying subscription management with seamless payment experiences (Nexco Analytics).

They leverage hybrid intelligence (AI + Human) to deliver secure, scalable, and domain-tuned solutions.

11. S-PRO

S-PRO is a specialized digital innovation company (250+ engineers, 11+ years on the market, HQ in Switzerland, ISO 27001 certified) with a profound focus on the financial industry, deriving 65% of its revenue from FinTech.

They are experts in Fintech-as-a-platform development, offering solutions for Digital Banking, Payment Services, and Lenders. Key capabilities include deep integration with Core Banking systems (40+ systems experience), building Digital KYC and onboarding solutions, and leveraging advanced technologies like AI/ML (Predictive Analytics) and Blockchain services.

Their client roster includes major Swiss and global financial institutions, including Société Générale, Sygnum, and Amina Bank.

12. Software Mind S.A.

Software Mind is a global digital transformation partner (1,600+ experts, 26 years on the market, HQ in Poland, ISO/SOC 2 compliant) specializing in FinTech. They deliver comprehensive digital banking and embedded finance solutions for retail banks, payment platforms, WealthTech, and insurance companies.

Their core expertise lies in AI-driven legacy system modernization using the Model Context Protocol (MCP), which bridges legacy systems with modern AI/APIs.

They are strategic partners for Backbase and ServiceNow, enabling deep integration with core banking systems and providing high-performance analytical algorithms essential for loan origination and risk management.

13. Premiersoft

Premiersoft is a nearshore software development firm (14 years on the market, 200+ professionals, HQ in Santa Monica/Brazil) specializing in turning ideas into successful digital solutions.

They offer a “One-Stop Shop” journey covering strategy, development (MVP development in 3 months), and support. Their focus on Artificial Intelligence (ML, NLP) and Modernization is highly relevant to embedded finance.

Premiersoft stays current with the industry, highlighting key takeaways from major events like Money 20/20 on the future of financial technology and AI, making it a strategic partner for businesses seeking high-quality, results-driven solutions.

14. TatvaSoft

TatvaSoft is an established, large-scale custom software development company (1,350+ professionals, 24 years on the market, HQ in India, CMMI-accredited).

They have over two decades of experience as a Financial Software Development Company, specializing in creating secure, regulatory-compliant, and scalable platforms. Their key competencies for embedded finance include Loan Processing Solutions, Forex Applications, and Fraud Prevention Solutions.

Their ability to deliver enterprise-level solutions is demonstrated by their 2000+ clients, including major global brands such as Sony, NEC, and General Mills.

15. Zoolatech

Zoolatech is a U.S.-based engineering partner (250+ engineers, 8 years on the market) specializing in FinTech development and trusted by Fortune 500s. They provide comprehensive embedded finance integration services by building robust financial ecosystems with internal and external APIs.

Their solutions are highly relevant to the embedded finance space, encompassing Payments Solutions (P2P, ACH), Lending Platforms (BNPL, P2P), Fraud Prevention, and Legacy Reengineering.

Zoolatech focuses on GenAI automation, compliance, and multi-cloud management to ensure their financial solutions are scalable, resilient, and compliant for the global market.

Final ranking and company comparison

Following a detailed analysis of all 15 companies specializing in the development of solutions for embedded finance, we have compiled all the key metrics into a single comparative table.

This ranking of Fintech development companies for embedded finance will help you quickly assess the size, experience, and core competencies of each potential software development partner.

| Company | Headquarters | Team Size | Years on Market | Key Embedded Focus | Top Clients |

| Computools | USA (New York) | 250+ | 12+ | Digital Banking, Core Banking Platforms, Payments, Wallets, Insurance Tech, Investment And Trading Platforms, Neobank Apps, KYC/AMl and Identity Verification, Analytics & Decisioning | Visa, IBM, Dior, Bombardier, Epson, British Council |

| Redberry | Tbilisi, Georgia | 100+ | 11+ | Consumer Finance, Loan Processing, Fraud Prevention, Forex Solutions | Wix, Wolt, ZARA, m², ATHENNO |

| Dreamix | Sofia, Bulgaria | 250+ | 18+ | FinTech, Insurance, RegTech, Legacy Modernization, Cloud Migration | BNP Paribas, Royal Bank of Scotland, Fadata |

| Digis | London, England | 200+ | 10+ | Mobile Banking Apps, Digital Wallets, Risk Management, AI/Blockchain Solutions | BlaBlaCar, Hubspot, SENDY, Connectbase, Raters |

| Cleveroad | New York, NY | 250+ | 14+ | Embedded Finance and PaaS, AI-Risk Systems, Embedded Insurance, BaaS | European Investment Bank, Penneo A/S, Mangopay, Mastercard (Alumni) |

| Fingent | White Plains, NY | 250+ | 22+ | AI-Driven Innovation, Enterprise Digital Transformation, Predictive Analytics, Security & Compliance | Mastercard, Sony, PwC, NEC, TaxSlayer, OneAZ Credit Union |

| BairesDev | San Francisco, CA | 4,000+ | 16+ | Digital Banking & Mobile Wallets, P2P Lending, Payment Gateways, Regulatory Compliance | Google, J&J, Rolls-Royce, Adobe, Pinterest |

| Zallpy | Frisco, TX | 250+ | 17+ | Systems Integration, Data & AI Solutions, Custom Software Development, Cloud (Nearshore Model) | BMW, ADP, Fortune 500 companies |

| 99x | Vitória, Brazil | 600+ | 21+ | Product Engineering, Legacy to Cloud Modernization, Data Science, AI/ML (Agentic AI), Enterprise Web Solutions | Compello, Blomqvist, Forskerforbundet, BagID |

| CodeNinja | Austin, TX | 350+ | 11+ | AI-Driven Development, Application Modernization, Cloud Services, Global Capability Centers, Blockchain | Middle Eastern Financial Institution, Nexco Analytics, Almarai, Truffle |

| S-PRO | Zürich, Switzerland | 250+ | 11+ | Fintech-as-a-platform development, Digital Banking, Core Banking Integration, Payment Services, Crypto & Web3 | Société Générale, Sygnum, Amina Bank, Hyposwiss, Clear Street |

| Software Mind | Kraków, Poland | 1,600+ | 26+ | Digital banking and embedded finance solutions, AI/ML, Payment Platforms, WealthTech, Core Banking Integration | Baillie Gifford, Accountor Finago, Mortgage Advice Bureau |

| Premiersoft | Santa Monica, CA / Brazil | 200+ | 14+ | Artificial Intelligence (ML/NLP), Strategy Consultancy, Modernization Studio, Nearshore Model | Serasa, The world bank, Yamaha |

| TatvaSoft | Ahmedabad, India | 1,350+ | 24+ | Financial Software Development, Loan Processing Solutions, Forex Applications, Fraud Prevention, Pension Systems | Sony, NEC, General Mills, Fujitsu |

| Zoolatech | Miami, FL | 250+ | 8+ | Payments (ACH, P2P), Lending (BNPL, P2P), Fraud Prevention, Legacy Reengineering, GenAI | Pandora, Stanford University, Fortune 500s |

In mobile banking, design is more than aesthetics; it’s about trust, clarity, and seamless financial interactions. Correct UX patterns and interface choices directly influence retention and satisfaction. Learn what creates a high-performing banking app here: Banking App Design: Ultimate Design Practices To Build Customer Trust.

Why choose Computools for embedded finance projects

Few vendors can consistently deliver production-ready embedded finance systems across payments, lending, and digital banking. Computools stands out for its ability to turn complex financial workflows into scalable, compliant banking software solutions used by real institutions worldwide.

For a Caribbean bank with $1B+ in assets, Computools engineered a microservices integration with Visa, modernized web and mobile banking, ensured PCI DSS compliance, and enabled full card-transaction processing. This upgrade expanded the bank’s reach among younger customers and increased its market share in the 18–30 segment by 12%.

The company’s experience also includes large-scale insurance software development (e.g., Keller Covered) and advanced mobile banking apps for challenger banks like Moblet. In Moblet’s case, Computools built a secure financial app with biometric authentication, KYC onboarding, real-time account tracking, and integration with SWIFT, Visa, and MasterCard, enabling the client to enter the retail banking market with a competitive product.

As a proven banking-as-a-Service (BaaS) developer, Computools has delivered embedded lending ecosystems for Invest Latam, investment platforms for Australian financial firm, and workflow automation for financial institutions that need regulatory-grade stability and fast delivery.

If you need a trusted engineering partner to design, build, or scale your embedded finance product, contact Computools at info@computools.com to discuss your roadmap and get a tailored project estimate.

Conclusion

Embedded Finance is now a core advantage for any digital product. When lending, payments, insurance, or investment tools become a natural part of the user flow, businesses reduce friction, improve retention, and gain entirely new revenue channels. But this works only when the underlying tech is strong enough to support secure, compliant, and scalable embedded lending and payment development.

Most companies face bottlenecks like legacy infrastructure, slow onboarding, fragmented data, costly compliance, and complex customer journeys across systems. Embedded Finance addresses these issues by unifying processes and integrating financial tools where users operate. And with the rise of automation, AI, and platform-based finance, demand for reliable custom investment software and other embedded components is growing faster than ever.

The key point is simple: companies that adopt embedded finance now will set the standard for digital experiences in the future. Those who delay will be stuck playing catch-up in an evolving, fully integrated, and user-focused financial ecosystem.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”