InsurTech is the technology behind the creation, distribution, and administration of insurance business. It is used for collecting and analysing customer data to provide a better service. Big Data, Artificial Intelligence (AI) and the Internet of Things (IoT) are the current focus of InsurTech, with the majority of invested capital going into these areas.

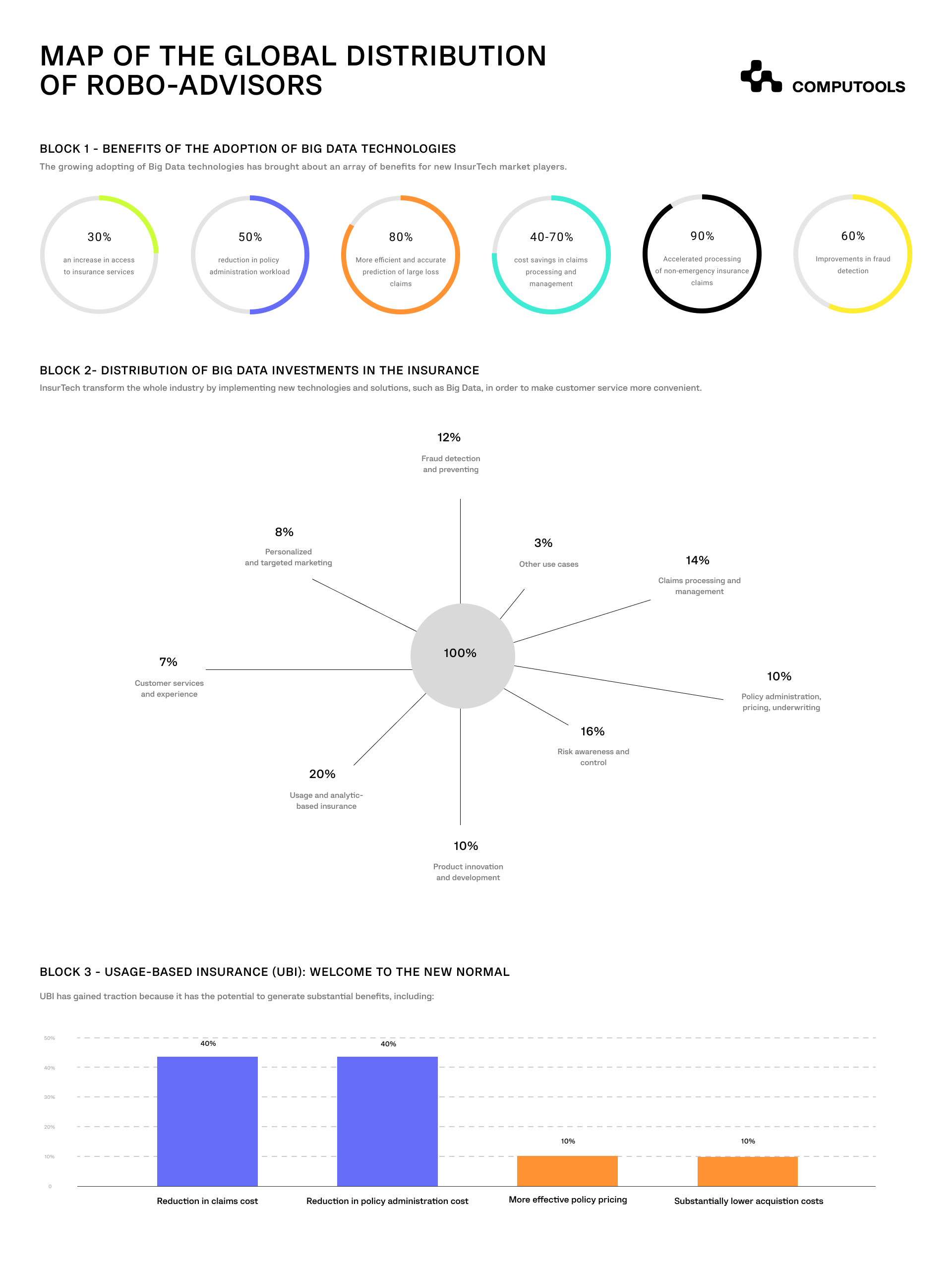

Big Data today is a set of technologies that capture, store, manage and analyze large and variable collections of data, capable of solving complex problems. Within the InsurTech the Big Data offers a host of applications ranging from targeted marketing and personalized products to usage-based insurance, efficient claims processing, proactive fraud detection and beyond. SNS Telecom & IT reports that Big Data investments in the InsureTech are expected to account for more than $2.4 Billion by the end of 2018.

According to the company’s report in 2018, Big Data vendors will gain over $2.4 Billion revenues from hardware, software, and professional services in the insurance industry. Thanks to Big Data technologies, InsurTech startups have the opportunity to exploit their data assets in a number of innovative ways. What is more, Big Data technologies are playing a pivotal role in facilitating the adoption of on-demand insurance models – particularly for automobile, life and health insurance, but also for insurance of such new and underinsured risks as cybercrime.

What makes Big Data so Useful?

Enhanced use of Big Data provides insurers with an opportunity to broaden their customer profile. Wallet share and cyber security solutions which protect customer data and improve compliance, were among the most important digital technology trends of the last three years, according to Infosys.

The true potential of the new technologies, however, unfolds when different elements are combined into a seamless digital infrastructure. Continuous collection and analysis of behavioural data allows for individual and dynamic risk assessment. It also promotes the establishment of a continuous feedback loop involving customers, with no or limited human intervention. Such digital monitoring not only enhances the quality of risk assessments but can also provide some real-time insights into policy-holders’ risk behaviour and offer individual incentives for risk reduction.

Computools

Software Solutions

Computools is an IT consulting and software engineering company that delivers innovative solutions to help businesses unlock tomorrow. Our clients represent a wide range of industries, including retail, logistics, finance, healthcare, and others.

Moreover, combining of new data sources paves the way for the implementation of advanced risk management systems that use predictive analytics as a basis for early intervention and risk prevention.

Related Experience

Computools' Product: Scaler

Systemize and scale your business with our intuitive, secure Scaler Cloud Platform - all by yourself, guided by your own business intuition and our proven methodology

Such powerful new business model recombinations are already being launched or planned in the near future. They include genuine peer-to-peer concepts (such as Bought by Many) and fully digital insurers (such as Oscar, InShared, Haven Life or Sherpa, for example).

Ultimately, they will elevate the insurance role from merely risk protection towards “predicting and preventing”. Using strategic investment, Big Data insurers will become more customer-centric, growing further with lower costs.

Economic and customer benefits

Big Data applied to the InsurTech technology has the potential to generate great economic advantages and benefits to a customer:

• Risk reduction and loss prevention. Better aligning premiums and risk has clear economic benefits. It allows premiums to signal risk and encourages risk reduction. As an example: by establishing a feedback loop to policyholders, digital monitoring allows them to reduce risk by adapting their behaviour.

• Cost reductions. A considerable fraction of premiums is spent on claims handling, acquisition and administration. Therefore, a considerable amount of work time is spent on processing information. Big Data has the potential to enhance market efficiency and lower costs by reducing informational asymmetries. In a competitive market environment, this is reflected in lower premiums, boosting affordability and coverage, and narrowing the protection gap.

• New and enhanced products. The detailed, granular data allows insurers to offer products that are tailored to the needs of the insured, including insurance on demand or pay-as-you-use propositions. Such usage-based insurance ensures that consumers pay based on the actual risk, e.g. when they drive as opposed to when the car stays in the garage.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”