The RegTech ecosystem has been steadily expanding since the financial crisis of 2007-2008. According to the latest version of the RegTech Universe by Deloitte published in October 2018, the number of vendors in the industry is 263. These companies are classified by five niches, including:

– Regulatory reporting;

– Risk management;

– Identity management;

– Compliance support;

– Transaction monitoring.

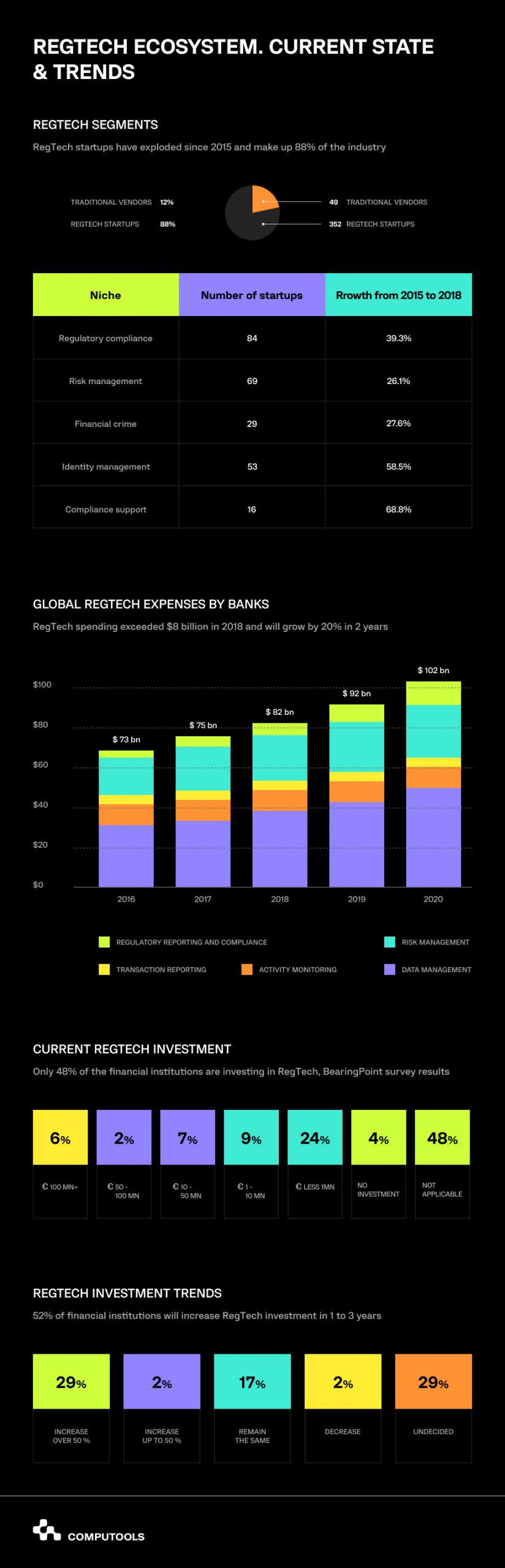

The survey by Burnmark counted 401 RegTech providers currently in business, with only 12% among them represented by traditional vendors. More importantly, the number of the post-crisis RegTech companies is on the continuous rise. All segments saw a growth from 2015 to 2018 by 44% on average.

Global RegTech Investment and Forecast

Since the crisis of 2008, the financial institutions had to increase personnel and consultancy expenses to meet the requirements of the regulatory expansion and minimize the fines and settlements. According to Opimas Analysis, the global talent and consultancy expenses have been steadily increasing from $25 billion in 2008 to $90 billion in 2016. The annual growth of regulatory compliance talent spending reached 15% to 25% over the last four years.

However, in light of the upcoming halt to the introduction of new financial regulations and a lighter touch on their compliance, most of the compliance processes can be automated through RegTech adoption. As a result, the analysts forecast significant savings on talent and consultancy starting in 2019.

At the same time, the RegTech expenses will exceed $80 billion globally in 2018 and will continue to grow through 2020. The global RegTech expenses will surpass $100 billion in two years. The critical expense categories include:

– Data management;

– Activity monitoring software;

– Transaction reporting tools;

– Risk Management software;

– Regulatory reporting and compliance toolset.

The RegTech expenses are expected to plateau after 2020, as banks adjust to the new regulatory climate, accumulate data, and put big data and artificial intelligence solutions to good use. According to the industry analysts at Opimas, in two years banks and other financial institutions will have automated their regulation compliance processes and improved their IT capabilities to address the regulatory expansion.

Individual RegTech Investment Initiatives

Despite the optimistic forecasts, only half of the financial institutions are currently investing in RegTech. The survey by Banking Technology and Burning Point reveals that only 48% of the responders are interested in RegTech initiatives, and half of them invest under 1 million Euro. Regulatory reporting utilities, anti-money laundering (AML), know your customer (KYC), platform integration tools and blockchain are among the primary investment interests for small to medium financial institutions.

Within the next three years, only 52% of the financial institutions plan to increase RegTech investment, while 17% are willing to keep up the same level of expenses. Only 2% of the businesses are ready to cut down the RegTech spending in the coming years.

Traditional vendors and startups join the RegTech universe, expanding the process automation and security capabilities. The rise of niche solutions and customized tools enables financial institutions to capitalize on potential governance, regulation, and compliance savings.

Computools has expertise in this matter as well. For a consultation, contact info@computools.com.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”