All executives across different sectors view data as an essential asset. Data governance in fintech plays a crucial role in ensuring that financial institutions can leverage data effectively while maintaining compliance and security. Digital transformation requires data because it enables companies to surpass competitors.

However, analytics alone fail to generate new revenue streams, and business operations become unsustainable without a structured approach to data management. Initiatives need data that meets three conditions: ready availability, high quality, and relevance.

A well-regulated data governance framework ensures data possesses these key characteristics, leading to value creation. In this article, we explore the concept of data governance, its value, and its critical role in the Fintech industry.

Read further to gain valuable insights.

A lack of senior leadership understanding regarding finance data governance is often the root of the problem. When C-level leadership fails to recognise data’s value-creation potential, governance initiatives remain restricted to IT departments instead of being integrated across the organisation.

As a result, businesses facing data challenges often attempt to implement technological solutions rather than addressing governance at a strategic level. While technology platforms such as data lakes and governance tools support fintech software development services, they do not resolve the underlying governance issues.

The direct assessment of data governance value remains complex though many examples show substantial unmeasurable indirect impacts. Leading firms erased millions from their information ecosystems while delivering digital and analytical capabilities valued at millions up to billions of dollars.

Data governance stands among the top three factors distinguishing those companies that succeed in extracting value from those that do not. Every company faces potential substantial financial risks from insufficient governance investment because it creates ongoing regulatory compliance issues.

What is Data Governance?

People commonly think of “big data” as mainly involving algorithms and analytic work with numbers. However, what is data governance if not the backbone that ensures data integrity, security, and compliance? Access serves as the essential foundation of the data market, even though insight acquisition follows an important process. The vital topic of increased data accessibility impacts all business sectors, with financial services being one of the most affected.

Companies require data governance to develop an enterprise-wide system that regulates policies and procedures and creates standards for data management in finance throughout its entire lifespan. All business processes that depend on data rely on this governance framework to deliver trusted, consistent, and readily available data. A successful data governance program requires implementing data quality measures, ensuring privacy, and complying with multiple regulatory stipulations.

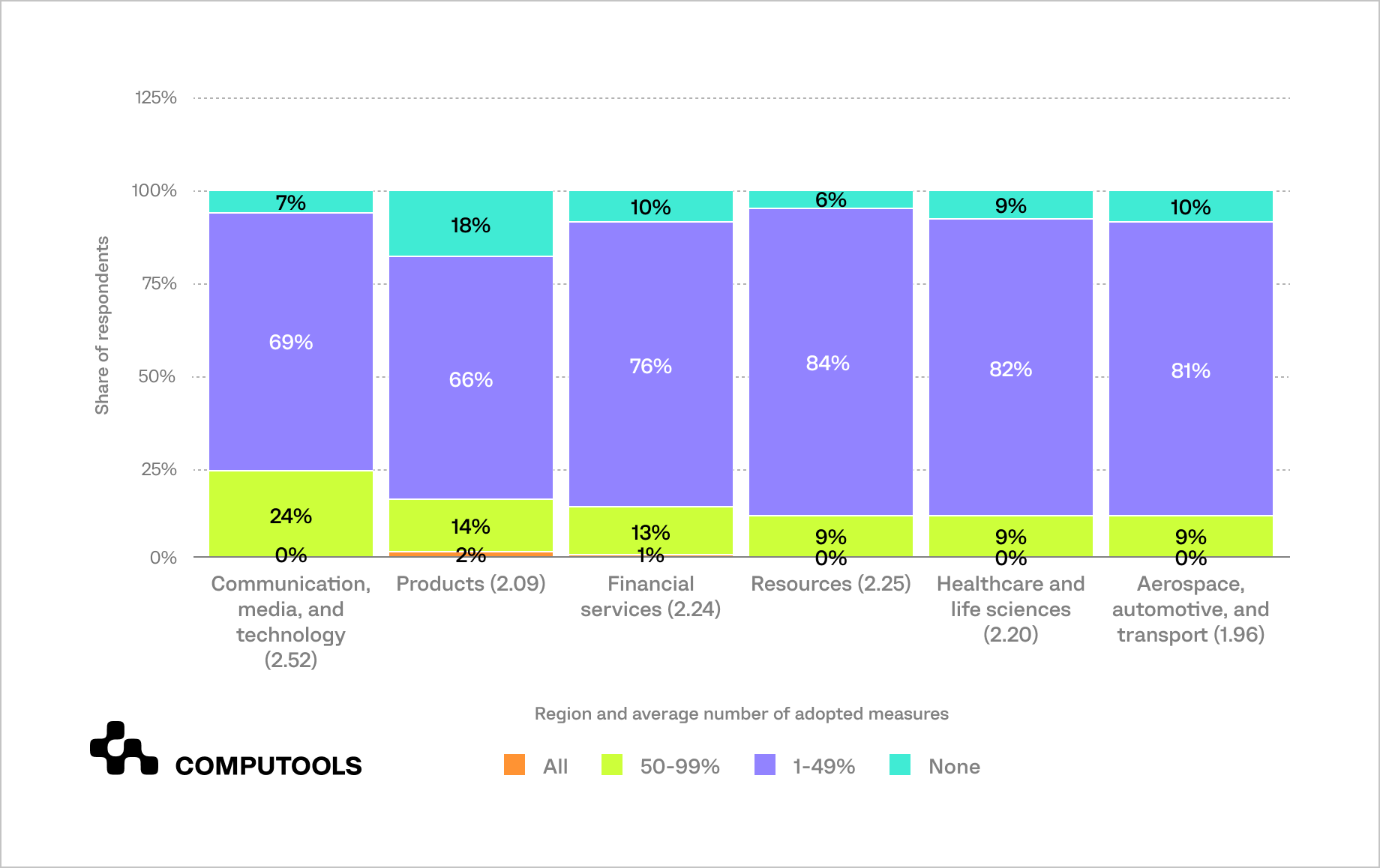

Interestingly, according to Statista research, as of 2024, the communications, media, and technology industry has shown the greatest maturity in implementing data governance measures and mitigating AI-related risks.

24% of businesses in this sector said they had implemented at least 50% of key data governance measures, and on average, companies used 2.52 safeguard mechanisms.

This demonstrates that effective data governance becomes an integral part of successful digital strategies.

In the Fintech sector, where dealing with sensitive customer data and compliance is paramount, data governance in Fintech helps minimise data risks, improve data quality, and use AI more securely and efficiently.

Furthermore, robust fintech software solutions integrate governance frameworks to enhance regulatory compliance and streamline financial operations.

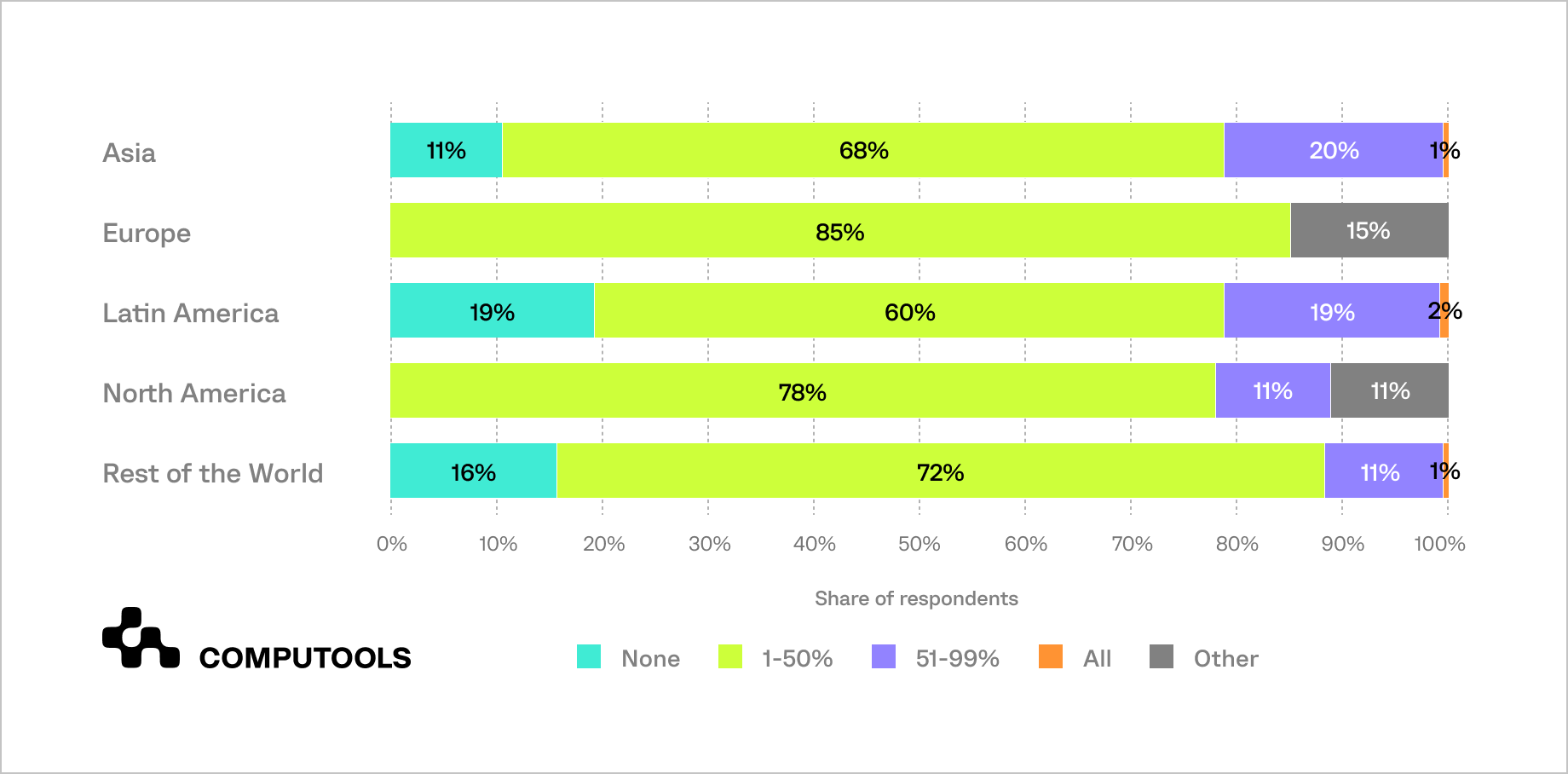

The year 2024 sees effective data governance standing out as a fundamental worldwide priority.

European populations demonstrate the highest degree of concern about privacy matters and data risk because their countries have tight regulations like GDPR.

Asia ranks second after Europe with 55% of companies regarding data governance as a critical concern.

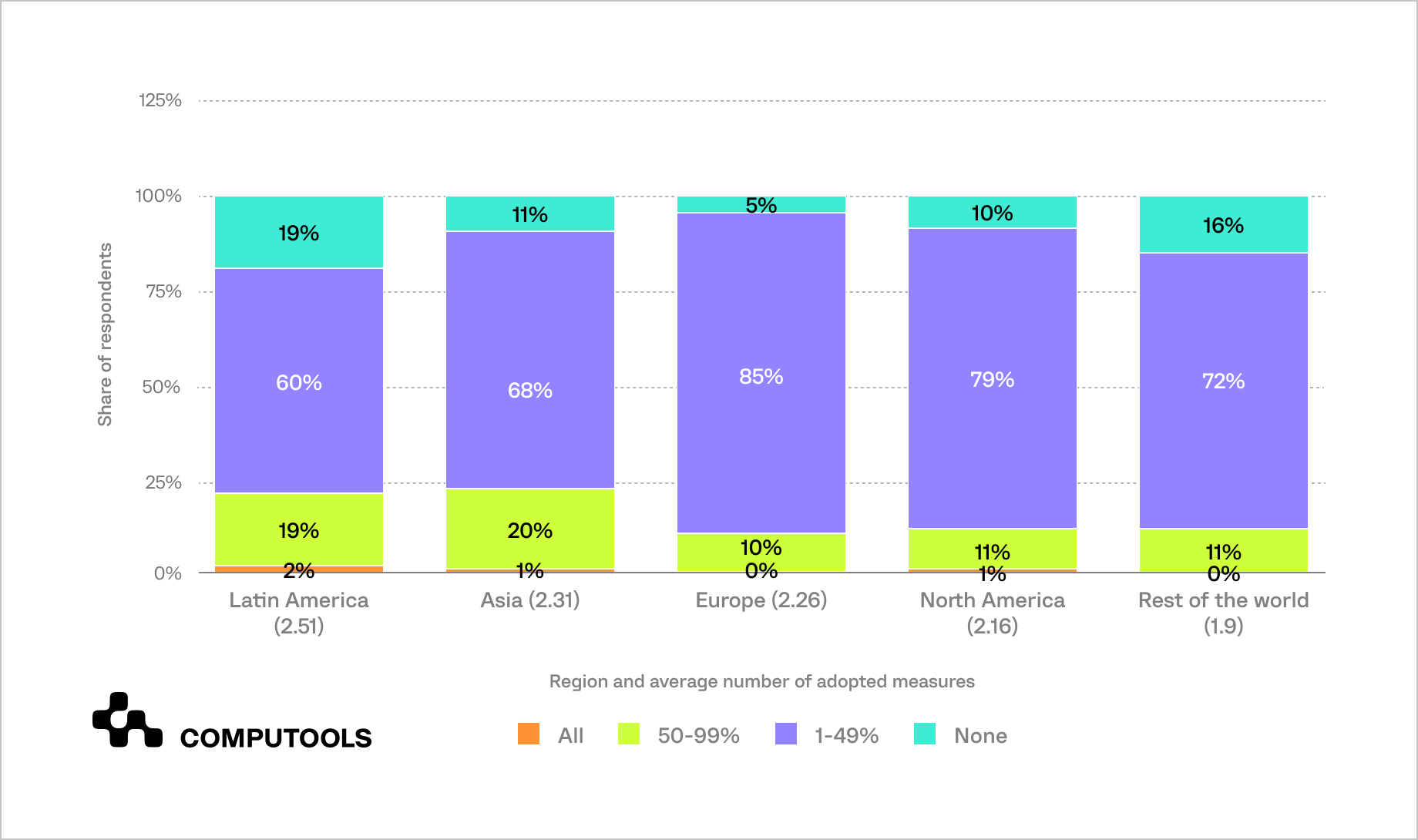

The implementation of risk management solutions in data governance remains actively developed by Latin American countries, particularly in relation to artificial intelligence systems.

A new forensic audit reveals that 21% of regional companies have implemented over 50% of their core risk reduction plans completely, yet another 2% have achieved complete implementation, according to the 2024 data.

Latin American companies maintain an average of 2.51 AI data governance measures, which ranks their implementation at the most advanced level worldwide according to survey data.

The research data shows that proper data governance directly enhances how companies worldwide function.

Key Principles of Data Governance in Fintech Development

At the beginning of this article, we briefly mentioned what principles guide data governance. In this section, we’ll dig deeper.

1. Transparency

Effective data governance in fintech software development depends fundamentally on transparency for proper implementation. Companies must provide stakeholders with complete visibility into their operational data management strategies, established policies, and decision-making processes.

Transparency enables fintech companies to build trust with customers, regulatory bodies, and internal teams. A clear understanding of data collection, usage, and distribution practices reduces the risk of data misuse and strengthens accountability.

Companies that maintain transparency earn greater customer confidence, particularly among those concerned with data privacy and security.

2. Accountability

In fintech operations, data governance requires accountability as a fundamental principle. It provides businesses with a structured method for assigning data oversight and control responsibilities across multiple teams.

Establishing clear roles and accountability frameworks ensures that data governance in banking remains a top priority, maintaining high standards for security, compliance, and data quality. When individuals take responsibility for their data-related duties, businesses experience better data handling and fewer security breaches.

Auditing and performance monitoring further help companies quickly identify governance issues and reinforce regulatory compliance.

3. Integrity

Data integrity refers to data’s accuracy, consistency, and reliability throughout its lifecycle. Data integrity is a critical priority for the fintech industry since decisions driven by imperfect data can have severe financial effects.

The successful protection of trustworthy data requires companies to create strict data validation routines together with cleanup and maintenance protocols.

Fintech companies need a complete data quality management system that uses automated analytics to permanently track and strengthen data integrity levels. This is possible via banking software development.

By implementing proactive data integrity methods, companies can protect themselves from data quality-derived risks and simultaneously strengthen their clients’ faith in their financial technology products.

4. Collaboration

The implementation of robust data governance into fintech software development services depends heavily on cooperative work between separate teams.

Fintech companies achieve data management alignment when stakeholders from IT, compliance, data analysis and product development work together for complete awareness of data governance rules. When teams cooperate, they create a single data management method for the company while reducing the isolation of data and improving information exchange. Inviting different departments into governance participation helps businesses handle new data requirements and compliance regulations with better effectiveness.

5. Compliance

Data governance needs compliance with applicable laws and regulations as its central standard because fintech companies experience substantial regulatory requirements.

They need to establish governance frameworks which follow regulatory standards from their particular industries such as the General Data Protection Regulation (GDPR) and the Bank Secrecy Act (BSA).

Companies need to build extensive regulations which direct their actions related to data handling alongside privacy measures, security protocols and reporting requirements.

Companies which implement proper compliance systems achieve both legal enforcement protection and customer trust by proving their dedication to securing precious sensitive data assets in their fintech software solutions.

The Interaction of Data Governance, Data Privacy, and Data Security

Three separate yet highly connected areas of data management concern are data governance in financial services, data privacy, and data security concepts. Understanding these elements’ interactions becomes crucial for protecting sensitive data while meeting regulatory requirements as companies make data-based choices more often.

1. The Core of Data Governance

The foundation of business data management exists as an extensive system that explains the complete process of data acquisition and operational control along with usage practices. Data governance in banking creates official frameworks that establish roles and processes and outline policies to effectively govern data resources.

Data governance includes three essential activities that combine data quality management with data stewardship and data-handling standards creation and enforcement. Proper data governance implementation secures data integrity and usability alongside accuracy, making them essential building blocks for productive data privacy and security strategies.

2. Understanding Data Privacy

The protection of personal information through its collection, processing, and distribution is what data privacy entails. Companies must abide by regulations, including GDPR and CCPA, which present demanding requirements for consumer data management.

Data privacy enforcement includes establishing business procedures that give people ownership of their personal information while allowing them to request both information access and data correction or deletion rights.

Data governance and compliance for financial institutions must incorporate data privacy requirements as fundamental elements through regulatory compliance standards, which define appropriate procedures for handling personal data. Companies that fail to demonstrate compliance with applicable standards compromise customer trust and risk substantial financial penalties.

3. The Role of Data Security

Data security defines the practices used to defend databases from illegal access, system breaches, and potential vulnerabilities. The banking software development framework and privacy directives influence all risk management decisions through their necessary role in an overall strategy.

The protection system involves encryption features with added access controls, and it requires periodic assessments to find potential threats that demand defensive action.

For establishing robust data security practices, alignment with data governance in financial services must define user permissions for sensitive data access rates. Poor governance leads to security practice variability, exposing businesses to potential data breaches and increasing their vulnerability to cyberattacks.

4. Interconnections and Best Practices

Data management for banks supports privacy and security through a comprehensive connection. Effective data governance policies help fintech companies achieve both compliance requirements and data privacy protection while strengthening security measures.

Strong data privacy and security solutions reinforce the entire data governance approach by guarding managed information against potential risks.

When fintech companies develop a workplace culture that consolidates governance frameworks with privacy controls and security systems, they achieve better protection of their data assets, enhanced customer trust, and improved risk management in data handling functions.

Leveraging new opportunities and addressing emerging challenges in fintech software solutions remains essential for companies that must maintain continuous adaptability by actively refining their data protection strategies as cyber threats evolve and regulations shift.

Major Challenges in Implementing

Many challenges exist in deploying successful data governance strategies across fintech operations.

1. Siloed Data Environments

Challenge: The existence of specialised data domains poses a major complication for fintech businesses, particularly in their banking software development activities. Volatile business operations and multiple systems controlling CRM and payment reporting processes lead to data scattering across separate departments. Fragmented systems cause bad data quality, hindering important insights and actionable decisions.

Solution: To assimilate departmental data elements, companies must implement a single data hub amidst fragmented data systems. Data lakes, alongside enterprise data warehouses, create efficient management systems that enable effortless data retrieval, thus enhancing both analytical insight quality and strategic decisions.

2. Regulatory Compliance Complexity

Challenge: To operate in the financial technology sector, Fintech companies need to fulfil legal obligations imposed through GDPR, CCPA, and other data privacy regulations. Businesses must carefully handle the complicated regulatory demands because they differ from one jurisdiction to another. A company’s failure to comply leads to significant financial penalties combined with severe damage to its reputation.

Solution: Fintech companies must build regulatory compliance frameworks to track adopted regulations and follow them correctly. The combination of scheduled assessments plus automated compliance management systems enables companies to meet requirements without operational interference while protecting their secure information infrastructure.

3. Data Quality Issues:

Challenge: Reliable data represents the essential foundation in fintech because broken information leads to incorrect financial models, subpar business choices, and inadequate analytics. The persistent issue of inconsistent data manifested through duplicated records and missing information, creates problems for companies trying to achieve effective data governance.

Solution: Early detection of and solutions for data problems depend heavily on the implementation of data profiling and cleansing techniques. Standardised data definitions, together with validation rules, help companies achieve dependable data quality across all departments. Automated data quality monitoring tools create a system that keeps information accurate over timeframes.

4. Cultural Resistance to Change

Challenge: Employee resistance is a major obstacle to widespread acceptance of data governance practices and fintech software solutions. Implementing a data governance framework often encounters resistance in company cultures when employees battle against modifications to established ways of working. The lack of understanding about governance value, combined with the perceived disruptive nature, creates employee opposition to newer workplace practices.

Solution: To succeed, companies need to implement change management strategies to overcome this challenge. Data governance training programs that demonstrate their advantages paired with managerial backing will build a harmonised framework. When companies establish data stewardship practices, they pave the way for a simple transition while boosting employee acceptance of new procedures.

5. Limited Resources and Expertise

Challenge: The shortage of resources at smaller fintech businesses, including startups, prevents them from establishing detailed data governance systems. Prolonged budgets and limited operational expertise and human resources make it difficult for companies to implement vital technology solutions and platform setups.

Solution: Fintech businesses need to review their existing data management methods to determine key investment targets. Outsourcing data management needs to specialised vendors allows companies to receive professional data governance solutions without straining their internal personnel.

6. Technological Advancements

Challenge: Fintech companies experience data governance hurdles due to the quick technological progress that makes AI and machine learning implementation alongside cloud adoption possible. Technological innovations create multiple data management challenges by presenting security vulnerabilities and inconsistent governance practices.

Solution: To address new security risks, fintech businesses must develop frameworks matching technological advances. Specific governance policies that target emerging technologies enable better data management, and security are achievable. Ongoing training programs for employees working with new technologies are needed to protect risks related to innovative changes.

Best Approaches for Data Governance Implementation in Fintech Software Development

Within the data governance in fintech software development process, data governance is a critical component to preserve data integrity and security alongside regulatory compliance.

To ensure data security, companies need to implement best practices, which include:

• appointing a data governance committee,

• monitoring governance,

• monitoring privacy,

• tracing security activities.

The committee acts as the strategic decision-making center, ensuring all data-handling activities align with legal standards and company targets.

Employees must receive ongoing training covering data governance fundamentals, privacy enforcement, and mandatory security guidelines. Transparent policies minimise errors in secure data practices, reinforcing compliance among employees who receive proper instruction.

Fintech software solutions with automated compliance monitoring tools enable real-time data tracking and anomaly detection, strengthening security measures.

Partnering with a provider of custom software development services can help fintech companies tailor their data governance frameworks to meet specific business needs. By implementing customised solutions, companies can optimise data management, ensure secure transactions, comply with regulations, and enhance operational efficiency.

How Computools Can Assist with Data Governance in Fintech Software Development

The proven success of our fintech development company is evident in our case studies which highlight how we have successfully assisted numerous fintech clients in achieving significant operational improvements.

For instance, after collaborating with a leading financial institution, we implemented a comprehensive data governance framework that streamlined their data processes, leading to a 200% increase in ROI within a year. Clients have also reported enhanced efficiency in their compliance reporting and data quality management, significantly reducing time spent on manual processes.

Client Testimonials and Reputation

The effectiveness of Computools’ solutions is underscored by the testimonials from our clients on independent platforms. Many clients have emphasised how our tailored data governance solutions not only met regulatory requirements but also provided them with valuable insights to drive strategic decisions.

Our reputation within the fintech sector is further validated by reviews on Clutch from satisfied clients, where we consistently receive high ratings for our professionalism, adaptability, and technical expertise.

Choosing Computools for fintech software development means partnering with a team that prioritises data governance as a critical aspect of project success.

By focusing on tailored solutions, proven results through our case studies, and maintaining a trusted reputation through client testimonials and positive reviews, we ensure that our clients not only comply with regulations but also leverage data as a strategic asset for growth and innovation.

Contact Computools’ team for consultation at info@computools.com.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”