The insurance industry is one of the oldest in the global market. It is complex, multi-layered and highly regulated. With a huge legacy, insurance providers don’t trail behind but seek to innovate their operations, sales and customer service. The most powerful way to do it is by exploiting AI potential.

There are pivotal reasons why insurance companies are willing to transform:

• Eliminate losses and increase accuracy. Understanding the likelihood of an insured event in general and against any insured policyholder is the biggest value to most insurance companies. AI-powered predictive models can give an accurate estimation of how likely one or another event to occur which is at the core of the claims processes and underwriting operations.

The more accurate this knowledge is, the higher chances are that insurers will be able to eliminate losses by safeguarding themselves against high-risk insurance cases.

• Fight back regulatory pressure. Since the financial crisis of 2008-09, more regulations and standards have been imposed on insurers on both national and regional levels. They need to keep up with regulatory change and also reinforce risk management in order to stay continuously licensed.

• Compete with fintech startups. The arrival of innovative fintechs that start putting feet in the insurance space have become a threat to old-fashioned insurance firms that are known for their traditional approach to working with customers and offering standard insurance products to everyone.

• Personalized customer experience. With a variety of insurance options on the market, customers expect to get the best price for their policy based on their specific case and circumstances. Personalized prices are a customer-centric approach good insurers seek to embrace nowadays.

• Reduce costs. Innovation comes at a price. When companies decide to streamline their processes with automation, it may impact their monthly expenses, which poses the question of finding the right software vendor partnering with which will pay off.

This article will explore why insurance companies opt for AI to solve their business problems. We will discuss the various use cases of AI in insurance and support them with viable solutions already put in place in the market.

How large is AI potential in Insurance?

1. Boosting human intelligence

The insurance industry is strongly involved with technical knowledge, data processing and risk management. Insurance staff are generally well skilled in making custom policies (premium, policy limit, and deductible), loss projections, claims processing, underwriting, pricing optimization, etc.

AI, in this context, is called not to replace but rather boost human expertise by supplying relevant information on time and analyzing tons of data within a blink of an eye, which the human eye fails to do.

AI is able to transform key insurance operations, especially those with complex algorithms and lengthy processes (ex. fraud identification, P&L monitoring, reinforcement of key controls such as KYC and AML).

2. Turning data burden into an asset

Working with data coming from massive sources of information is another pain point of many insurers. First off, data needs to be compliant with regulations, and it takes an effort to stick to it. Second, most data comes unstructured and requires standardization that makes them usable and converts into an asset.

Clean and compliant data can be a ground to use insurance policies as financial assets that build cash value, let alone that a customer insurance database represents a business value itself.

3. Enforcing customer centricity across the value chain

Personalized customer service brings with it a problem of adjusting ready-made types of products to thousands of unique needs. AI potential suffices to analyze demands and understand what parts of services should be changed to both fit with a customer’s expectations and not compromise an insurer’s capital.

What are Common AI Use Cases for Insurance?

1. AI Bots (Boost AI)

AI insurance bots are a typical example of self-service in a customer’s finding about promoted insurance products and policies. AI bots are able to support thousands of specific topics and can be updated to increase the conversation coverage. Virtual agents are built with NLU & NLP (natural language processing and understanding) technologies that make AI assistants analyze human speech and predict their next questions.

The insurance industry, in particular, benefits from AI immediately at the start of customer relationships. An insurance AI bot is knowledgeable about all insurer’s products, so it communicates with a user, gathers information to create a customer profile and then can advise the most suitable policies or even come up with an appealing quote offering if enough data has been collected during a conversation. Please, keep in mind that AI bots do not replace human assistants completely. In case with Boost AI’s AI platform, their AI service requires an AI trainee who will update the bot’s knowledge according to the insurer’s corporate policy and product changes.

2. AI Computer Vision (CAPE Analytics)

AI in insurance is actively used to analyze geospatial imagery too. Another example of how insurers benefit from AI is CAPE Analytics, a cutting-edge geospatial imagery and aerial insights solution that brings automation to the process of damage valuations.

The product company uses massive access to geospatial images from satellites and drones to capture data and monitor a given property state. AI analyzes physical property risks and gives insights into efficient quoting and coverage against each applicant. Knowing the true state of property can help insurers mitigate adverse underwriting by avoiding high-risk properties.

How does it work? After looking into geospatial snapshots, AI gives a confidence rating made up of scores of different property parts, such as roof condition, yard condition, presence of pools or solar panels, etc. Essentially, AI replaces the need of doing an in-present physical inspection and provides accurate data about a property for an actuary later to come up with fair valuations and data-driven decisions.

3. AI fraud detection (SHIFT)

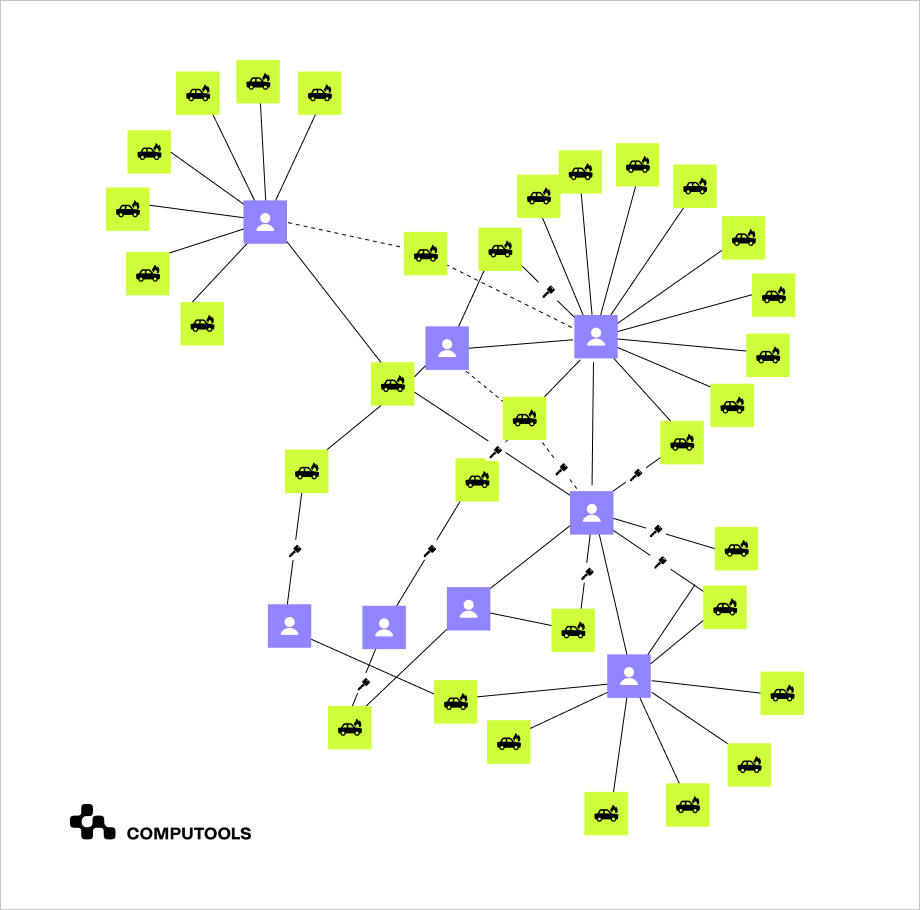

Another fascinating way of harnessing AI in insurance is fraud detection in claims processing and underwriting. Since any insurer needs to work with huge amounts of data, it’s difficult to detect how claims or policyholders are linked to each other.

For instance, a French InsurTech company SHIFT offers an innovative method to detect potential fraud in claims by creating social networks between policyholders. AI aggregates and analyzes the entire insurer’s database as well as external data to detect nods between two and more insurees. With human effort, it would take much longer to clean and structure data and form connections between them.

However, AI does it way faster. So, if two or more individuals are connected with the same bank account, address or police, a node is set. As a result, the system shows you connections between two and more insurees benefitting from one claim even if they didn’t explicitly talk about it when applying for a policy for the first time. Similarly, if one person intends to make two different policies against the same thing under fake names, it will be highlighted in the network too, so you know someone is trying to trick the insurer.

4. AI Underwriting & Pricing (Flyreel)

AI ability to facilitate underwriting and claims processing has been put at the core of other tech solutions like Flyreel. Here, the role of AI is to assist a customer in onboarding and supplying data about the insured thing during an AI-powered conversation. Flyreel’s AI helps users capture the most essential information about their property with their smartphone’s camera.

When snapshots are made, AI analyzes all potential hazards related to a given property’s materials, in-house systems and interior. The user’s self-inspection with AI is way faster for an insurance company to get enough information to understand property and offer a low-risk quote.

The use of AI in underwriting and claims processing creates an informed background with reduced risks of insuring claims that are prone to inflict losses on the insurer.

Wrapping up

AI has revolutionized the insurance industry, allowing companies to better manage risks, improve underwriting processes, and provide smoother customer onboarding experiences. AI can also be used to detect fraud and other suspicious activities, helping insurance companies reduce their losses. With the help of AI-driven data analysis and predictive modeling, insurers can identify potential risks more accurately and develop better strategies for managing them.

Additionally, AI can provide insights into customer behavior that can be used to create personalized products and services tailored to their needs.

Why Computools? The potential of AI is immense not only for insurance but other industries as well. Deep learning and AI algorithms can be applied to many business processes that require processing and analyzing large amounts of data. If you’re thinking about automation in insurance with AI, Computools offers free consultations to help you understand how AI can be best applied to your business operations.

Should you have more inquiries into Computools AI development services, please email us at info@computools.com.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”