During an economic downturn, companies must navigate through uncertain and tough conditions. Last year, the venture market plummeted by 38% as investors pulled back funding due to rising costs and shrinking liquidity options.

Although most parts of the world experienced a notable decline in venture capital investment, there are signs of recovery, setting key markets up for a better second half of 2024.

This article explores innovative solutions for businesses to protect fintech companies during cost reductions and assist them in drawing in investors.

Dynamics of the Global Investment Landscape

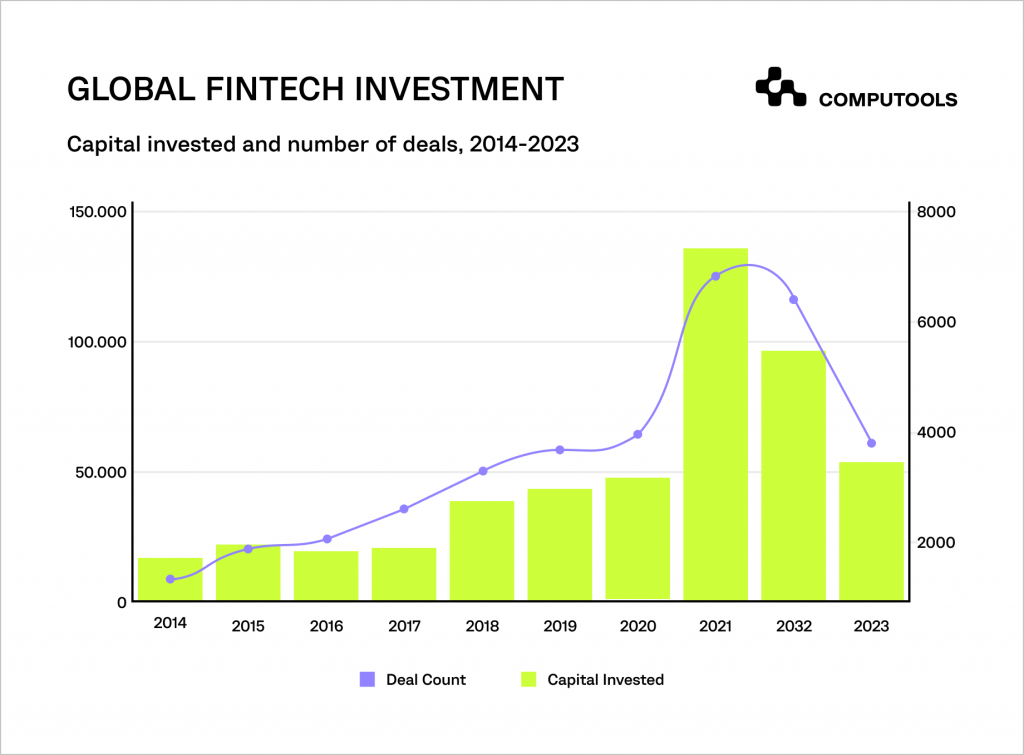

In 2023, investors poured US$51.2 billion into the global fintech sector through 3,973 deals, marking a sharp 48% decrease from 2022’s US$99 billion.

This decline reflects the challenging and non-linear recovery from the COVID-19 pandemic, as highlighted by Innovate Finance.

Despite the general worldwide decline, investment in early-stage fintech continues to thrive, surpassing US$4 billion in seed funding.

However, larger investments in later stages, especially those exceeding US$100 million, are slowing down, showing investors’ hesitancy to inject fresh capital into the market under current macroeconomic conditions.

The number of deals also dropped by 38%, but the average deal size remained steady at US$12.9 million, indicating that investors still have confidence in the fintech funding, despite the economic downturn.

Moreover, while the global investment in fintech has declined compared to recent years, it remains 10% higher than the levels seen in 2019.

For instance, investment in the UK fintech last year was 11% higher than it was 5 years ago.

Although both Q2 and Q3 of 2023 recorded around $10 billion each in investments, marking the lowest figures since early 2020, there was a notable increase of approximately 13% in Q4 2023 compared to the previous quarter.

In the United States, the leading fintech market, fintech businesses pulled in an impressive US$24.2 billion, comprising a staggering 47% of the worldwide sum.

The top fintech hubs within the US are no shockers: California, New York, Massachusetts, Texas, and Florida, collectively accounting for 1001 deals in 2023.

We also observe a significant shift in the global distribution of investment capital in fintech, highlighting the dynamic and widespread nature of fintech advancements, as Hong Kong and the UAE, for the first time, have made it into the top 10.

Although their investments might seem small compared to the substantial amounts attracted by the US and UK, it’s still a remarkable increase for these nations.

Even though there’s still uncertainty in the macroeconomic environment, the steady interest rates during the third and fourth quarters of 2023 hinted at a change in how the market feels, leaning towards optimism.

We anticipate rates to stay high throughout 2024 and the first part of 2025, hopeful for increased investment, as confidence grows again in both public and private sectors of the fintech landscape.

Overall, while funding is being allocated more carefully, continued investment in promising ventures could show the market’s gradual adjustment towards sustainable long-term growth.

How Businesses Are Being Affected?

During tough economic times, like when fintech investments get scaled back, the overall economy can slow down, impacting employment rates and disposable income.

This, in turn, leads to less spending from consumers, directly hitting businesses’ profits. Often, companies have to make hard choices like layoffs, budget reductions, and restructuring efforts to navigate through the downturn.

Each recession period brings its own set of challenges as the market changes. For example, after the 2008 recession, interest rates were slashed to historic lows to stimulate borrowing.

But during the pandemic, besides dealing with closures, businesses also faced problems with global supply chains, causing delays and disruptions.

When investment funding is reduced, businesses tend to manage their finances more cautiously, as they must devise contingency plans to navigate the challenging conditions caused by declining revenue and tight budgets.

Alternatively, companies shift focus towards new products or fintech trends to sustain their operations.

While some companies refrain from expanding or initiating new projects, others can take advantage of the situation to grow in less competitive sectors.

Notably, although a majority of deals occur at the seed stage, a larger portion of capital is now being directed towards Series A and B rounds, especially targeting fintech firms with established revenue streams and potential for scalability, showing the need for companies to grow digitally and innovate.

Innovations to Aid Businesses in Reduced Investment Financing

Recently, when examining the big deals that went down, we noticed three FinTech verticals pulling in the most investment: Lending, Blockchain, Payments, and Insurance.

Let’s delve into these and other fresh ideas that could draw in investors for companies and keep them thriving.

1. AI and deep tech

Deep tech ventures, particularly in artificial intelligence, have been a dominant force in the fintech investment market. While AI finds applications beyond deep tech, like in customer service chatbots, investors are keen on leveraging it for innovation in hard tech sectors.

A notable trend in deep tech is the acquisition of unique datasets by companies to advance AI in specific domains. The pursuit of proprietary data to enhance AI’s efficiency remains costly amid the surge in AI investment.

Investment has also risen alongside the increasing costs of computing power and skilled personnel. However, the time to market and commercialisation of certain technologies has also escalated.

2. Peer-to-peer (P2P) lending

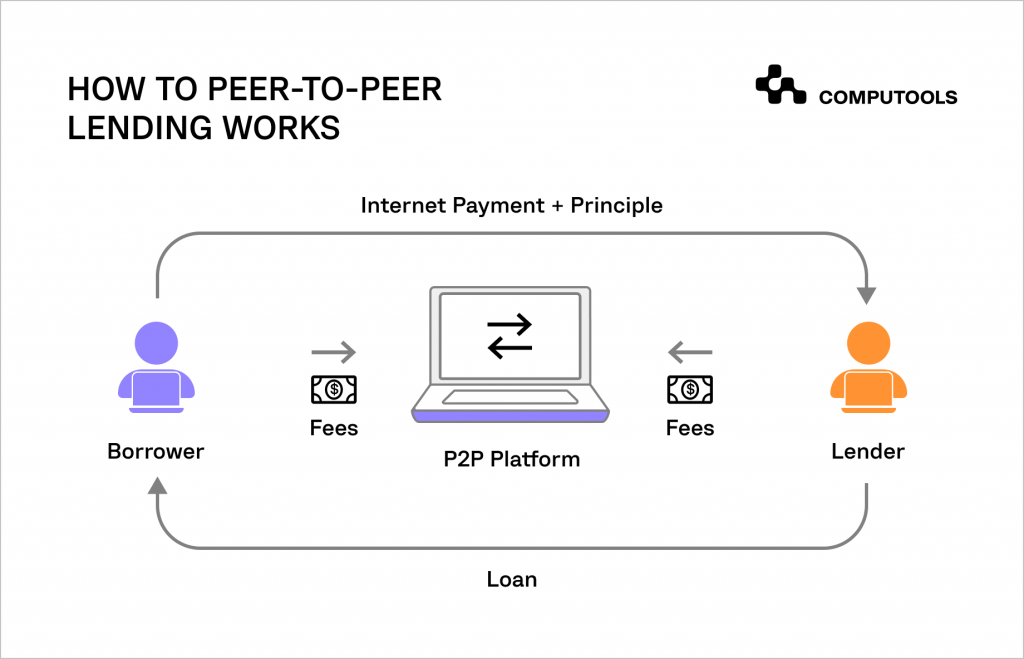

Alternative lending, such as internet-based lending and P2P platforms, offer loans and credit outside the conventional banking system. These platforms act as virtual hubs where borrowers and lenders connect.

Online lending and peer-to-peer platforms have modernised the loan process, cutting down administrative costs and posing a challenge to traditional banks.

They leverage technology and data analytics to assess risks, expediting the loan approval process.

P2P lending platforms also serve as an avenue for investors to diversify their portfolios. By spreading investment risk across various borrowers and loan categories, they offer a broader investment opportunity.

3. Blockchain and digital currency

Blockchain is the backbone of digital currencies such as Bitcoin and Ethereum, functioning as a decentralised database.

It securely records financial transactions in an unchangeable ledger. Cryptocurrencies, like Bitcoin and Ethereum, are encrypted and distributed digital currencies.

Bitcoin and other blockchain-based cryptocurrencies revolutionise the fintech landscape by enabling direct peer-to-peer transactions, potentially reducing costs and speeding up transaction times by eliminating intermediaries like banks.

Furthermore, blockchain technology enables the tokenisation of real-world assets such as real estate, artwork, and commodities.

This means assets that are traditionally hard to transfer can be divided into fractions and traded more easily using digital tokens on the blockchain to represent ownership.

4. Financial data analytics

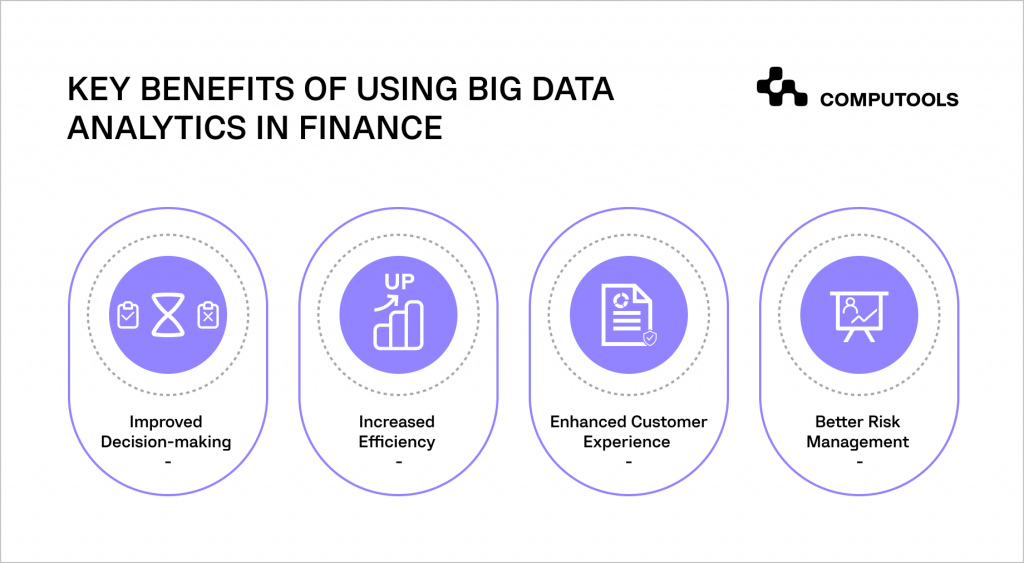

Financial data analytics is the practice of using advanced data analytics and AI in fintech to examine financial data thoroughly, draw conclusions, and take action based on insights gained.

Specialised companies in fintech software development services aim to help individuals, businesses, and financial institutions gain a clearer understanding of their financial status, risks, and opportunities.

Through analysing financial data, experts improve their ability to assess credit risk, market risk, and operational risk.

Related Experience

Worried shareholders can be easily impressed by the team’s foresight in anticipating challenges and finding effective solutions.

The fintech industry has also developed cutting-edge fraud detection algorithms by scrutinising consumer transactions to prevent and identify fraudulent activities, as investors and financial institutions alike are usually deeply concerned about the possibility of fraud.

5. Regtech software

“Regtech,” short for “regulatory technology,” involves technology and data analytics to aid financial institutions and other businesses in meeting regulatory obligations.

Fintech firms have devised regtech solutions for businesses to simplify compliance procedures and bolster risk management, enabling businesses to navigate regulatory demands more efficiently.

The already intricate regulatory landscape becomes even more convoluted with the proliferation of rules that banks and other financial entities must adhere to.

In response, companies seek innovative solutions to comply with these evolving requirements swiftly and effortlessly.

By utilising regtech solutions, compliance operations stand to benefit from both time and cost savings. Automation and data analytics technologies can assist financial institutions in fulfilling regulatory obligations more efficiently, ultimately saving time and resources.

Regtech systems facilitate real-time monitoring of transactions and activities, enhancing the ability to detect suspicious behaviour or compliance breaches early on.

Real-time reporting mechanisms are essential for ensuring timely and accurate reporting to regulatory authorities.

6. Neobanking

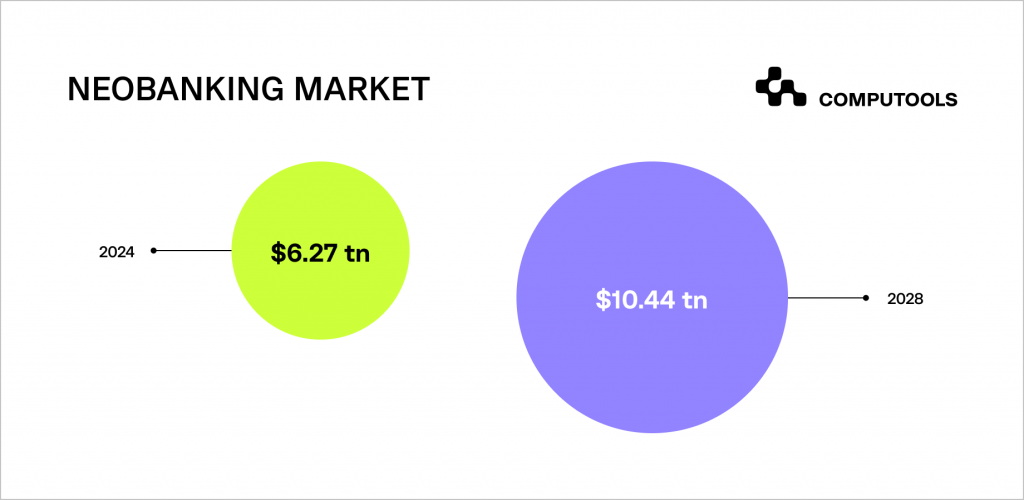

The pandemic has shown us the power of remote work, a lesson not lost on the financial banking sector. Fintech has played a key role in the rise of neobanks, which mimic traditional banks but operate solely online, without physical branches.

Neobanks offer all the services of traditional banks, minus the brick-and-mortar setup. Many new fintech startups are embracing this model, seeing it as mutually beneficial for both businesses and customers, cutting costs while enhancing accessibility.

Neobanks aim to make banking services more affordable. While they may offer fewer services compared to traditional banks, they focus on delivering high-quality options within those categories.

In 2024, the neobanking market is projected to reach US$6.27tn, a number expected to skyrocket to 10.44tn by 2028.

Neobanks’ appeal lies in features like instant transfers, quick sign-ups, and the provision of online banking access through IBAN and ACH accounts, especially valuable during the era of widespread remote work.

7. Robo-advisors

Artificial intelligence advancements have opened up avenues for investors to receive personalised financial guidance through computerised systems.

Robo-advisors and personal financial managers leverage AI principles to suggest optimal ways for investors to allocate their funds.

These applications are causing significant disruption in the industry and proving highly lucrative.

Robotic process automation, in particular, is gaining popularity among novice investors who lack access to traditional financial counselling.

This is because alternative investment instruments have substantially reduced entry barriers and enabled almost anyone to generate returns, even with minimal capital.

A Final Thought

During times of reduced investment funding, fintech companies need to see crises as chances to revamp how they manage innovation.

Leaders should seise the urgency for swift outcomes by introducing new methods that speed up innovation projects, effectively steering towards ROI targets.

Improving processes in innovation across finance, legal and compliance, procurement, and addressing IT backlogs are critical areas.

Working closely with IT companies in these fields is important for making enduring adjustments that go beyond the crisis period, guaranteeing continuous innovation and resilience.

Want to kickstart your digital evolution and safeguard your business? Connect with our team at info@computools.com for personalised guidance.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”