Technology is transforming the banking industry. Similarly to retailing, banking is getting more customer-centric and shifting towards digital transformation that allows for a better customer experience.

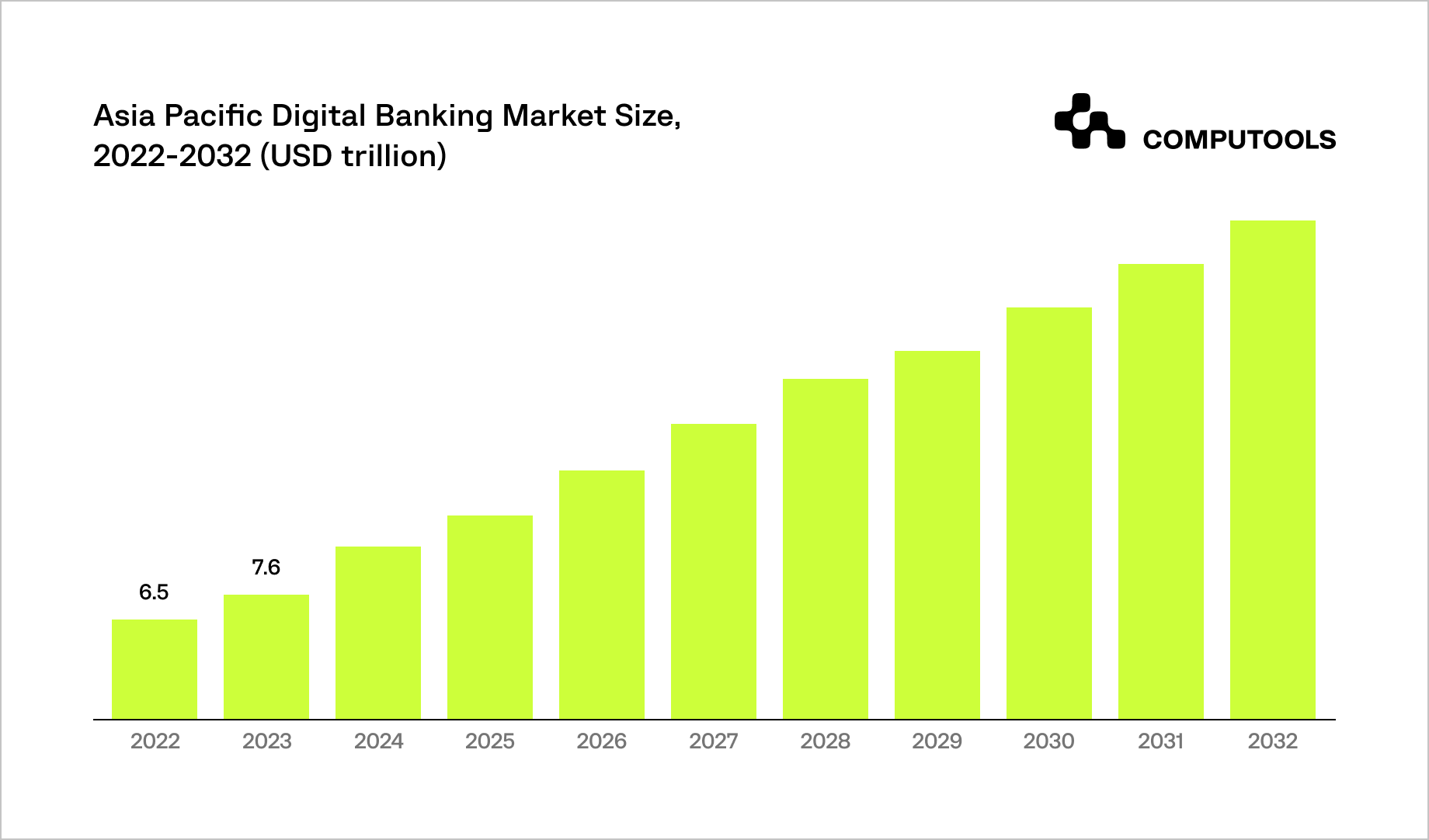

To date, online banking is already dominating the Asia-Pacific region and steadily catching up in Europe:

• Asia-Pacific leadership: The region led the digital banking market with over 69% share in 2023.

• Reasons for growth: This success is attributed to the growing population and widespread access to the internet.

• China: In China, mobile payment platforms such as Alipay and WeChat Pay have become an important part of everyday life. People use them for shopping and paying utility bills.

• India: In India, digital payment systems such as Paytm and Google Pay are popular. They are convenient for people-to-people transfers and online shopping.

• Indonesia: Mobile banking apps such as GoPay and OVO are widely used in Indonesia. They have become an important part of everyday financial transactions.

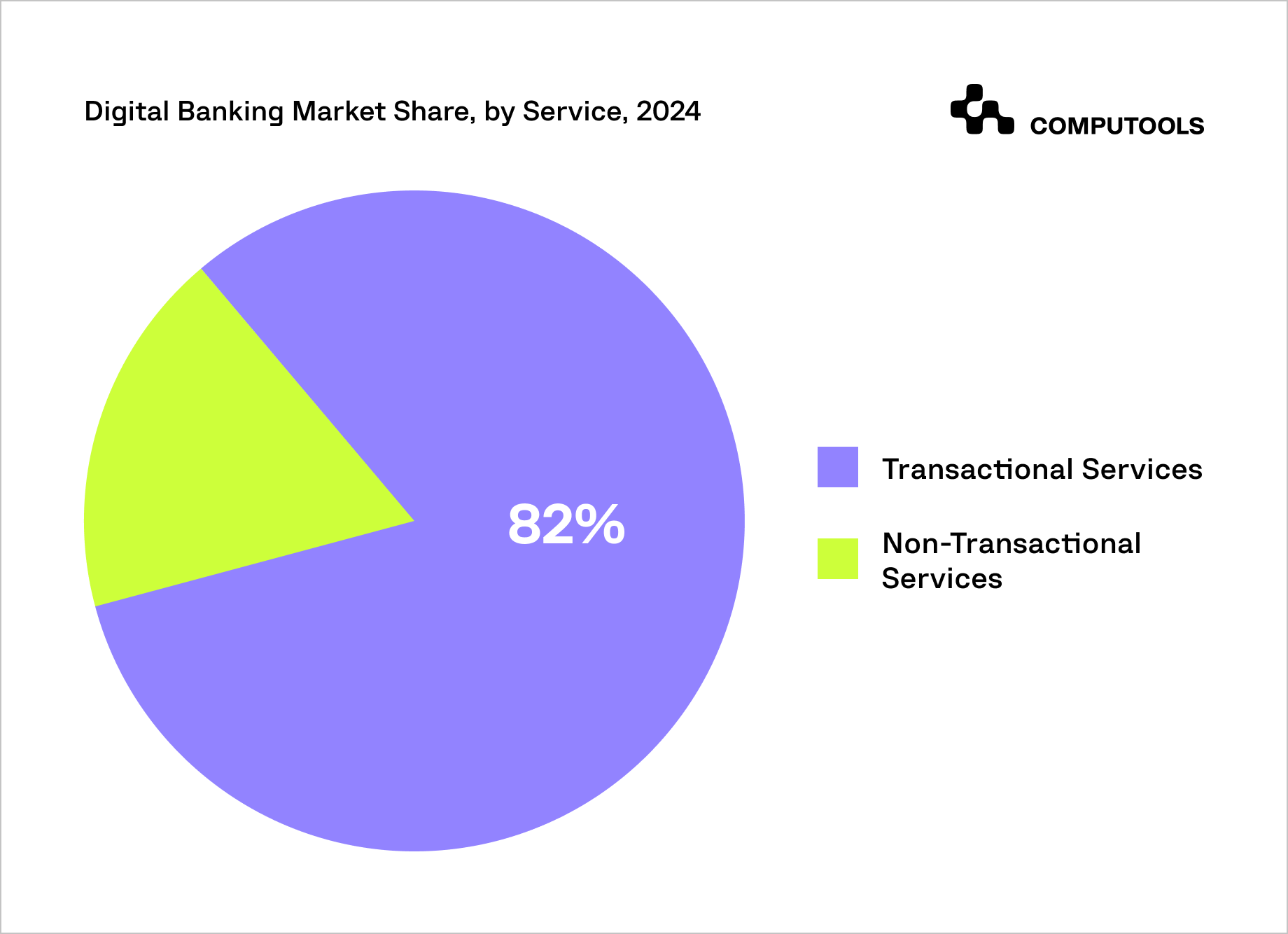

Internet banking is way more flexible and beneficial. The digital banking industry is split into transactional and non-transactional services based on the kind of service.

In 2024, the transactional services sector accounted for a significant 82% of the market.

In digital banking, transactional services are crucial for meeting urgent financial demands. For example, cash withdrawals and deposits offer easy access to money and lessen the need for physical branches. Money may move between accounts and countries quickly and securely thanks to fund transfers.

Recurring payments are streamlined by automated systems like auto-debit and auto-credit, which guarantee timely transactions without the need for human participation. Digital loan applications make it easier to apply and expedite approvals, improving credit accessibility. The adoption of digital banking is facilitated by these services as they increase user convenience and efficiency.

Customers may access various banking services anytime instead of dealing with the inconvenience of going to a bank for each transaction or loan. While many smaller institutions lag, major banks like JPMorgan Chase and Citigroup have embraced the newest international banking technology. Since most consumers expect to handle their affairs on mobile devices, this delay might cost them millions.

Forbes says banks must have a digital banking strategy to be competitive and respond to changing customer demands. McKinsey reports that digital transformation can increase bank revenues by 20-30 per cent and reduce costs by 20-40 per cent.

Investment banks face challenges that can be addressed through digital strategies. The text lists 11 strategies that can help banks meet these challenges if approached from a traditional perspective (like a conventional bank with branches).

1. Artificial Intelligence

It is the number-one technology that substitutes the regular middle man for a smart bot that guides a customer on how to perform basic banking correctly and safely. AI bots are excellent at analyzing investments and financial assistance. They greatly simplify decision-making by providing accurate and faultless prospects based on which you can assess your financial position and opportunities.

The use of AI software seems advantageous in terms of security as well. It relies on complex algorithms that provide an increased level of protection and minimize the risk of fraud or hacking into accounts. The adoption of AI tools brings dual benefits to banks as it also permits to reduce spending on personnel.

2. Mobile banking app

With the help of mobile banking apps, users may take charge of their money and handle many problems without having to speak with bank employees. Their appeal is mostly due to their convenience.

The sector has changed dramatically as a result of digital banking trends, which allow users to access accounts and complete transactions via smartphones and other mobile devices. This change has improved banking’s usability and accessibility. Many services may be provided by a well-designed banking app, particularly if the bank serves as a financial supermarket that caters to a variety of customer needs. The app’s worth is further increased by this extensive access.

However, app integration with the banking system requires the engagement of a third-party provider. This collaboration can be long-term and quite resource-intensive, but in the long run, a banking mobile app creates a solid foundation on which financial organizations can build strategies to promote their services and expand their client base.

Another significant advantage of having a mobile app is the opportunity to implement mobile payments. Cashless payment methods are becoming increasingly mainstream because people value their time and strive to spend less time paying their daily bills. This trend towards fast and cashless servicing is prevalent in other industries as well. For example, Honda established in-vehicle payments that allow a driver to pay on the go. It is comfortable, quick, and safe.

3. Data monetization

Data monetization is another effective online banking strategy that banks can use to gain a competitive advantage. Bank data is commonly followed by detailed analytics reports that give a good understanding of consumer behavior. This information can be of great value to banks themselves that are involved with promoting personalized communication and customer satisfaction. Similarly, a bank can use it to guide companies that operate in other industries and need third-party insights to deliver their services on a high level or develop brand loyalty.

4. Blockchain technology

Though many people link blockchain technology with cryptocurrency, it is also one of digital banking trends used largely to ensure secure financial operations and safe data storage. In particular, more and more financial companies adopt it to automate verification processes and speed up digital transactions. Blockchain eliminates the need for intermediaries and makes the banking finance system invulnerable and glitch-free.

5. Extended ecosystem

Today, banking activities are not limited to investments, payments, financing, and cash management. It is vital to go multichannel to be able to offer value to any client logging in their account. This is why financial institutions should extend the core business of their ecosystems by overlapping with adjacent activities, such as cash-flow analysis, accounting, or tax management, that are important for small and medium businesses.

Going beyond banking-related activities can be a good decision for large-scale banks that have enough resources to embark on providing non-banking services, for example, health services, mobility services, or ITO. Therefore, giant banks involved with increasing their market share should transform their ecosystem structure to engage more customers.

6. Advanced marketing

The multi-level structure of the banking ecosystem creates an ideal climate for providing flawless customer journeys. Since a customer usually has multifaceted goals, financial institutions need to organize multichannel campaigns encouraging their visitors to fulfill all their needs in one place, namely using one app.

Multichannel campaigns are aimed at ensuring a customer will be notified of banking assistance on most of their devices and thereby get motivated to learn more about a specific service being part of their needs. Such campaigns also require measuring optimal ROI, defining the best cadence, as well as investigating the target audience. Based on these metrics, banking analysts can build a perfect digital marketing strategy.

7. Smart management

At last, any digital transformation strategy should be coupled with smart management that cultivates a growth mindset and assists in the smooth implementation of strategies. Managers are also responsible for keeping the spark in employees to compete and outdo their rivals. Likewise, they should instil the idea that customer satisfaction is the main value of banking. If a customer fails to get their best banking deal, their loyalty falls sharply, and no digital tool can fix it. By contrast, a couple of digital strategies backed by sound management can drive amazing transformations and promote a bank to the international market.

Therefore, all the digital strategies offer efficient and reasonable solutions to traditional banks that are threatened by trends in online banking services developing rapidly but still need a good management approach to pull it off.

8. One-stop Shop

Today, there are too many applications installed on smartphones and it becomes difficult for users to support multiple financial applications at the same time. That’s why they choose providers that offer all the services they need on one platform. According to the latest research on digital banking, 73% of customers ask banks to open digital accounts for them, 59% prefer P2P payment options and 63% demand loan processing features. Options such as cryptocurrencies, voice/chat banking and financial wellbeing are also popular.

The trend of creating all-in-one platforms has been around for some time, but in 2024, it is a must. Multi-functional apps such as Chime or Ally will replace digital solutions that only offer individual financial services. For example, in the Chime app, users can search for the nearest ATMs, automate savings, make P2P transfers, receive their salary two days early, use credit programmes, connect digital wallets and much more.

9. Transparency

Banks are increasingly realising that their success depends directly on implementing an effective digital strategy. In this process, customer trust becomes a key element, and therefore it is important for financial institutions to make their work as transparent as possible. Today’s competitive marketplace requires banks to be not only convenient but also honest.

Radical transparency is now among top banking trends. Companies seek to openly share information with customers, admit mistakes and be extremely honest. This approach helps not only to meet customer expectations, but also to build trust in the bank.

Current top banking trends show that traditional banking business methods are gradually giving way to more open and honest practices. New financial companies that have made transparency their core value are rapidly gaining market share, even competing with banks that have been around for hundreds of years.

10. Cloud computing

Cloud technologies are becoming an important part of digital banking and are rapidly gaining popularity. Essentially, they provide financial institutions with services such as specialised banking software development, data storage and networking solutions. With these capabilities, cloud technology is becoming increasingly attractive to banks.

Their adoption in the banking industry grew significantly in 2024. This is due to the many benefits they offer: global scalability allows banks to easily expand their systems, overall productivity is improved, processes are accelerated, and service is made more convenient.

In addition, cloud technologies play an important role in data protection. They help banks minimise the risk of data loss in physical disasters, eliminate the need for bulky data storage and significantly reduce the need for physical servers and staff to manage them. All of this makes cloud solutions indispensable for today’s financial organisations.

11. Banking-as-a-service

Modern banks operate like car dealerships, where customers can walk in and choose the product they want, whether it is a loan, instalments, a debit card or a share in an investment fund. Businesses and banks have long co-operated for mutual benefit: for example, electronics or furniture shops could arrange bank loans to buy goods. Today, both traditional companies and fintech startups want to offer banking services directly to their customers.

The concept of banking as a service (BaaS) has opened up new opportunities for this approach. In the next five years, business leaders in Europe expect BaaS-based services to become as much the norm as mobile payments or online banking. The growing cost-of-living crisis will accelerate this process. Companies will be able to reduce customer acquisition costs, enabling them to offer more attractive terms and conditions and increase sales. In addition, improving customer interaction and creating a better customer experience will give them a significant competitive advantage.

How to stay relevant to customers?

Technology evolves faster than any financial company can embrace it. To stay afloat, a physical bank should be poised to implement several of the strategies above and collaborate with third-party providers that assist in integrating technology quickly.

Though it might seem that right now it is not such a need, online banking in Europe is on the same level with regular banking and expected to surpass it within a few years. So it is all about trends in online banking or nothing at all.

Contact us at info@computools.com, and we will build your perfect digital banking strategy.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”