Banking applications have continued to evolve over recent years as the effects of technology and the general market demands apply pressure for evolutionary changes.

As we progress through today’s article, you will find the most recent statistics on banking applications worldwide, transaction velocity per continent, and trends, emphasising the significance of mobile banking app design in the financial industry.

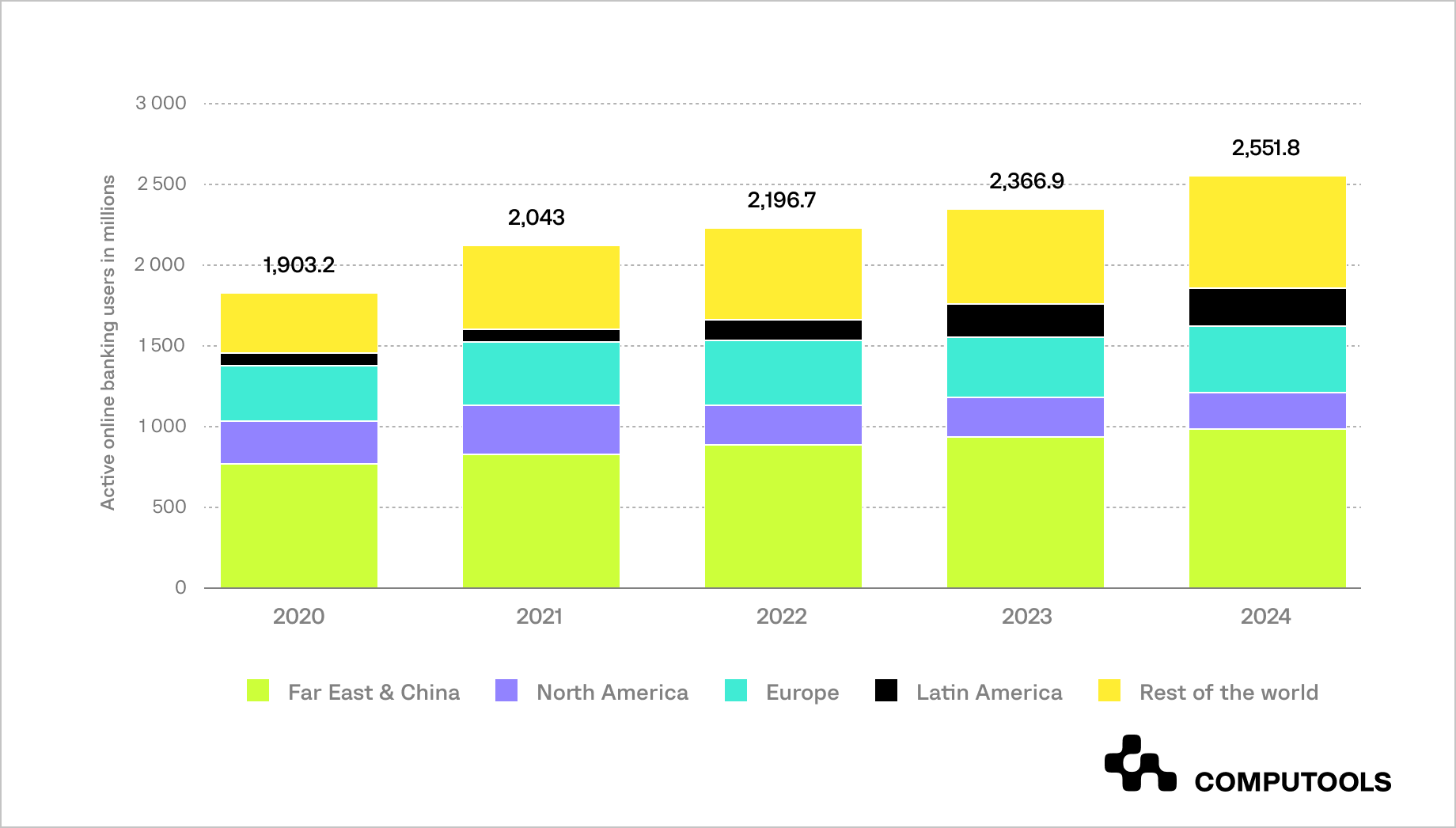

As of the year 2024, it was calculated that about 1 billion users use online banking services in the Far East and China, with a constant tendency that has increased from previous years.

Globally, roughly 66% of the population of the USA, based on the Statista research made in the year 2023, are using online banking facilities, and the projection of a similar study in 2029 is 79%.

This demonstrates a significant trend towards online banking and highlights the essential reliance on apps, whether mobile banking apps or otherwise.

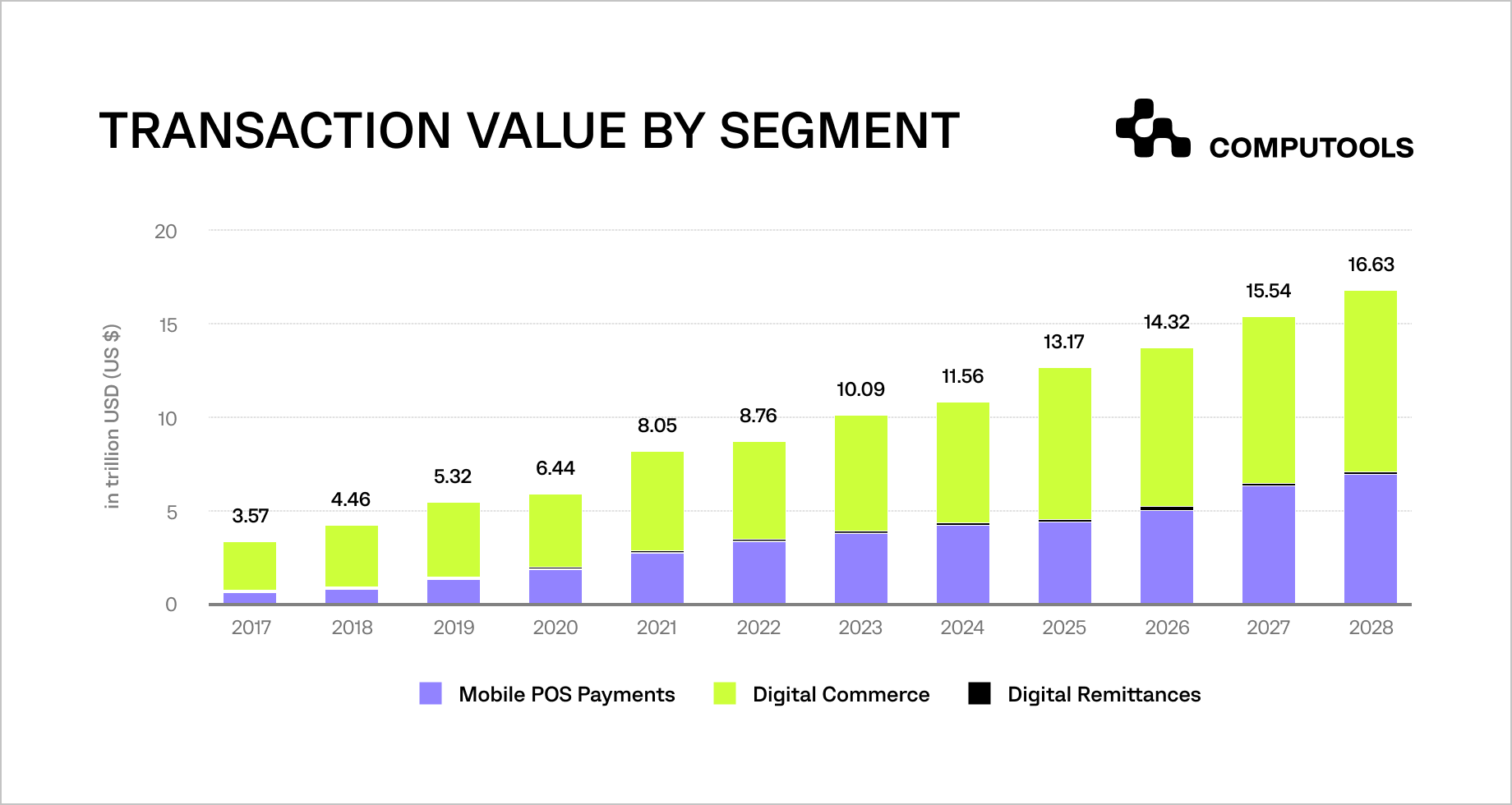

The global B2C transaction values in the digital payment market have reached $11.55 trillion in 2024, with Asia Pacific retaining the highest transaction values, followed by North America and Europe.

This growth is driven by banking software solutions and the prevalence of mobile banking applications, which enable increased ease and demand for financial transactions.

Here’s a breakdown of transaction volumes in 2024:

• Asia-Pacific: Approximately $3.74 trillion of transactions throughout the year.

• North America: Close second with fast growth as the population is relatively technologically inclined.

• Europe: It is sustaining itself, not to mention the increase in regions, including those with high digital banking scores.

Adopting banking app development is a trend and a necessity for the consumer in the competitive financial market. Drivers for this growth include higher smartphone adoption, changing customer behaviour towards mobile interfaces, and improved security features that increase customer confidence. Global transaction value in digital payments is projected to grow 9.52% per annum by 2028, resulting in enormous potential for banking software development services.

As CIOs and their teams do their hardest to embrace the next significant stage of digital transformation, it is evident from these figures that financial services technology is presently undergoing a significant transition. Financial institutions have a big challenge: they need to update their technology function to meet the growing digitalisation of their companies’ front and back ends in a competitive climate with increasing cost constraints that demand quick action and reaction.

While creating excellent goods and services has clear business advantages, consistently achieving this objective is infamously difficult. Due to the fast growth in customer expectations brought about by websites like Amaon, immediate access to reviews and information from across the world, and the blurring of the distinctions between software, hardware, and services, only the greatest designs are now able to stand out from the crowd. More than ever, businesses must focus on applying best UI/UX practices.

So, how can businesses produce outstanding designs? What is the value of a great app design?

In recent years, various financial institutions have been investing heavily in digital and analytics initiatives to enhance customers’ experience across mobile and web interfaces. Still, most of these large banks are far from where the consumer-tech firms when it comes to efforts to serve and involve customers.

Missed cues beset the prevailing models for bank customer acquisition and service delivery: firms and their incumbents struggle to ‘pick up’ and capture signals from their online customer experiences or journeys.

Leaders in delivering positive experiences don’t just make their journeys easy to access and use; they make these core journeys relevant to the individual’s current context and aspirations. This relevance is especially crucial in banking app design projects, where personalisation and innovation set businesses apart.

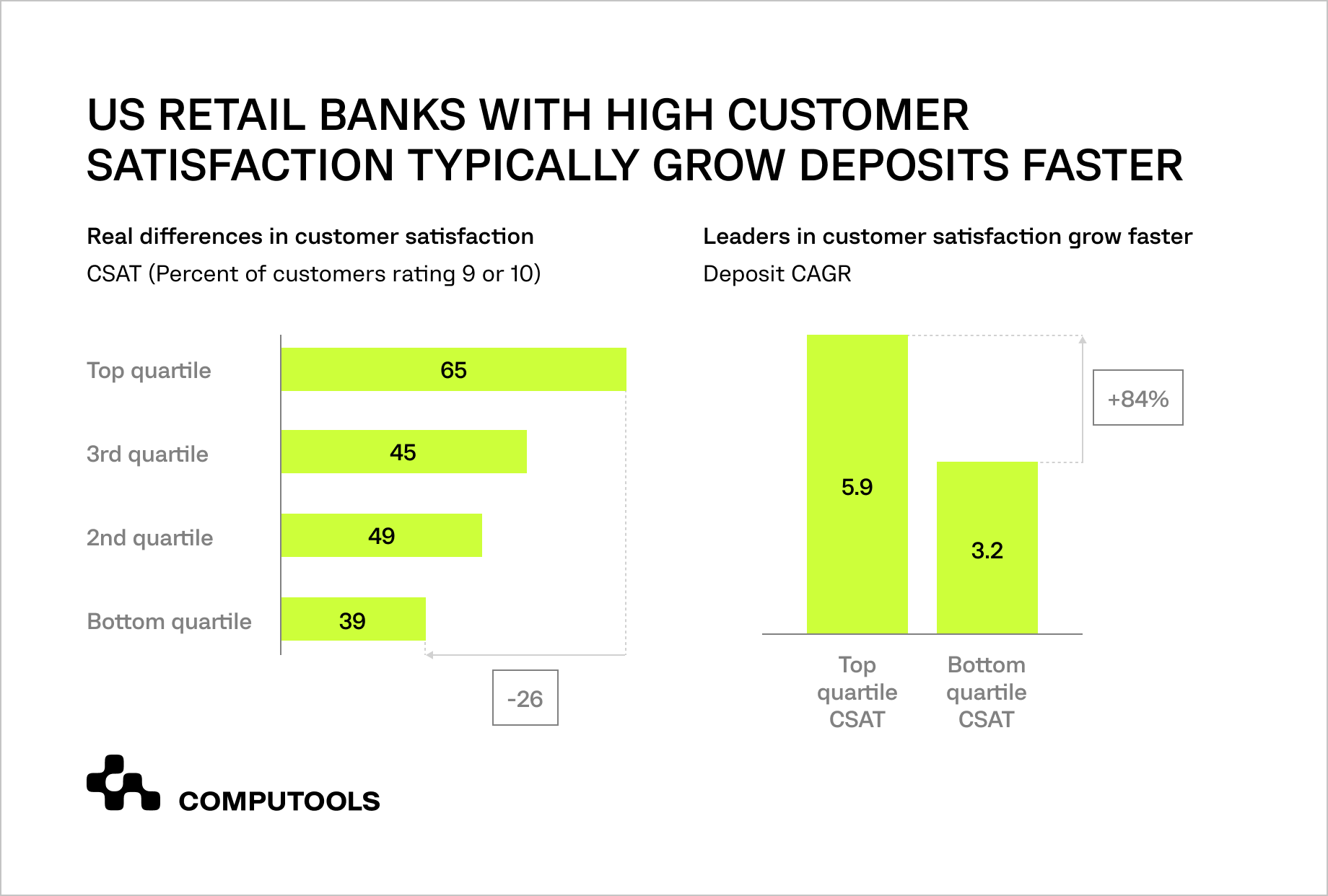

Adding value goes beyond simply delivering an outstanding product; it can yield great value. McKinsey’s survey of US retail banking customers identified that where self-reported satisfaction levels are high, deposits have grown 84% faster than in the banks with low satisfaction scores.

Regional banks handle an extensive network of over 1,500 customer journeys, spanning business units, product offerings, and interactions. These journeys generally fall into two categories: those needing optimisation to reduce friction and those ready for innovative transformation.

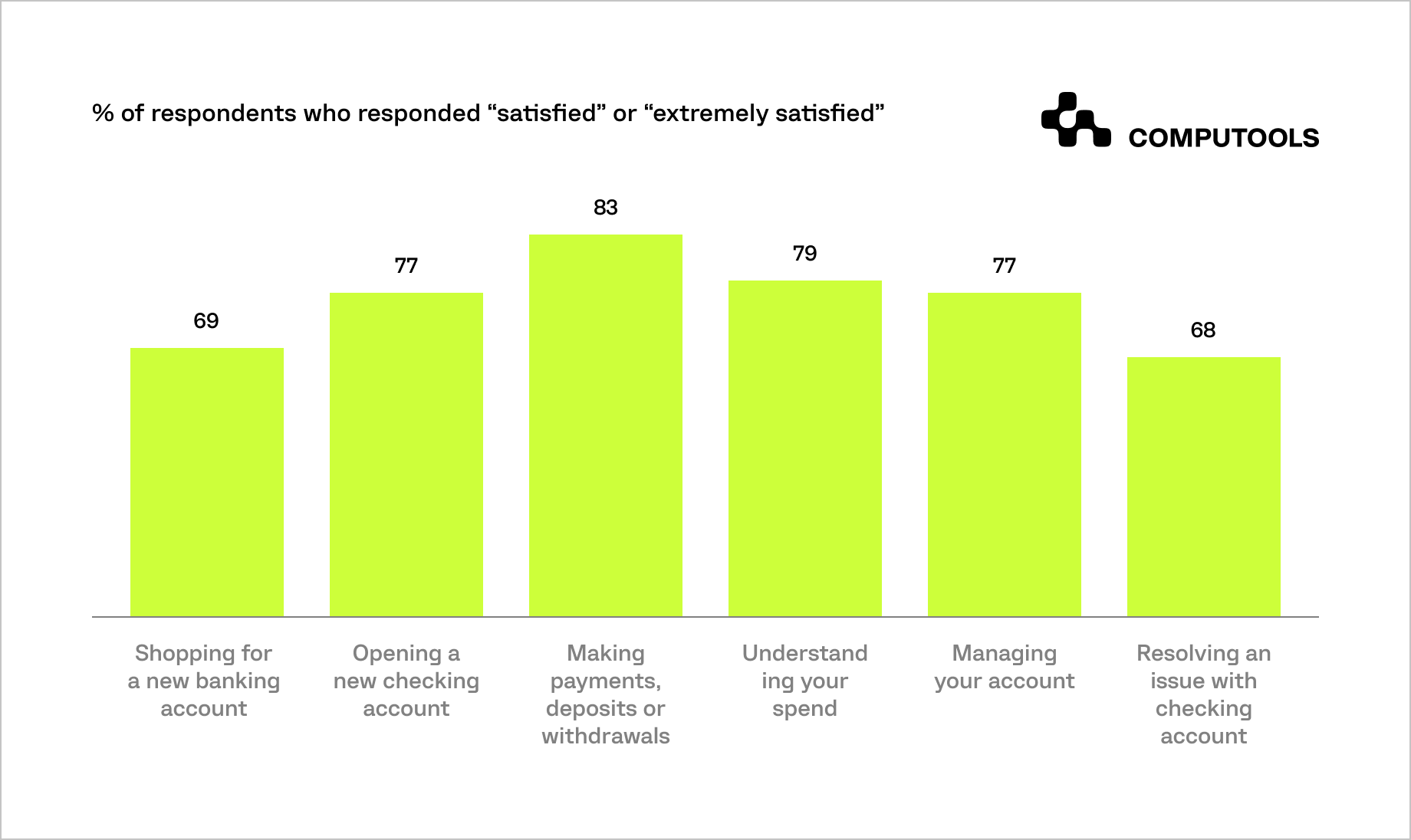

While most journeys benefit from streamlining to enhance satisfaction, research highlights the critical importance of “bookend” journeys—such as shopping, onboarding, and resolving issues. These pivotal moments shape the overall customer experience, presenting banks with an opportunity to innovate and set themselves apart.

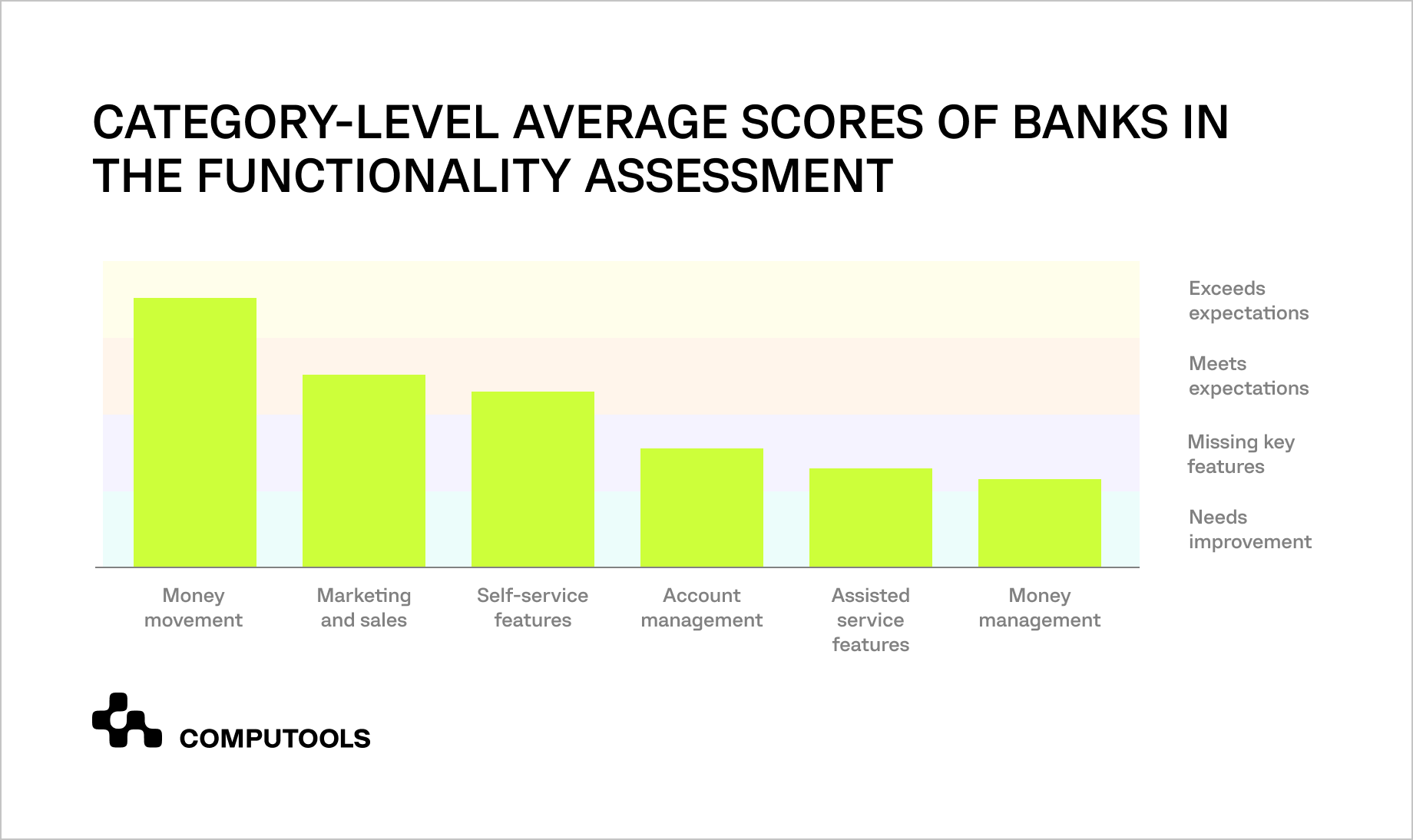

But still, there is work to do when we look at a general satisfaction with functionality survey:

The Importance of UI/UX in Banking App Design

As you can see, User Interface and User Experience in banking app design cannot be overstated. A well-designed banking app directly impacts user satisfaction and trust, which translates into increased customer loyalty and long-term retention.

What are User Satisfaction and Trust?

UI/UX plays a crucial role in shaping the interaction users have with banking applications. A study by McKinsey revealed that 56% of dissatisfied users expressed discomfort with the digital UX/UI or noted insufficient information about products and services.

This showcases how poor design can undermine user trust. Conversely, robust UI/UX expertise in finance can enhance both satisfaction and trust.

For instance, utilising intuitive navigation and clean layouts allows users to find essential functions easily, reducing intimidation when using financial apps.

What are Clean Layouts and Intuitive Navigation?

The role of clean layouts and intuitive navigation is paramount when designing banking apps. A study indicated that users open a financial app and feel as if they are walking into a foreign country, emphasising the need for clarity and ease of use.

User interface design should prioritise simplicity to reduce cognitive overload, facilitating easier navigation for users.

Successful banking apps like Revolut and Chime exemplify this principle. Revolut’s app features a clean interface with clearly defined sections, allowing users to manage their finances effortlessly.

Chime, known for its user-friendly experience, showcases how intuitive design can lead to customer satisfaction and trust.

These companies illustrate that a seamless user experience design is fundamental to maintaining competitive advantages in the digital landscape.

What are Accessibility Features and First Impressions?

Accessibility features play a vital role in creating a positive first impression for users. Effective banking app development embraces inclusive design principles, ensuring that all users, regardless of their abilities, can participate in the digital economy.

This approach not only aligns with legal requirements in many regions but also broadens the app’s appeal to a diverse audience.

McKinsey’s research emphasises that a well-crafted customer experience can lead to a significant increase in customer satisfaction, with some studies suggesting a potential rise of 20% in satisfaction through consistent brand experience.

Apps such as Monzo have set an industry standard by integrating accessibility features, allowing users to navigate with ease regardless of their needs.

Current Challenges in Banking App Design

As the adoption of mobile banking continues to rise, various challenges persist within banking app design. Users frequently encounter pain points that hinder their overall experience, primarily stemming from complicated onboarding processes.

Addressing these challenges through effective UX design and UI design becomes crucial for creating competitive and user-friendly financial applications.

1. Complicated Onboarding Processes

One of the most prominent pain points identified by users is the complicated onboarding process associated with many banking apps.

User reviews often detail frustration with lengthy registration forms, multiple verification steps, and confusing navigation that complicates initial setup.

For instance, many users express dissatisfaction when a banking app requires excessive personal information, leading to feelings of mistrust and burden. Such friction in the onboarding phase not only deters user engagement but creates negative perceptions of the banking product design cycle overall.

2. Poor Security Implementations Causing Mistrust

Security implementations in banking apps also pose significant challenges for users, particularly in light of increasing cyber threats.

Many banking applications have faced criticism for their lack of robust security features, leading users to feel unsafe while conducting transactions or accessing personal information. User reviews often reflect this sentiment, with some individuals expressing concerns about data security and identity theft.

A notable example includes users reporting an unease about using an app that lacked multi-factor authentication. Such negative experiences highlight the critical need for secure UI design to foster trust and confidence among users.

3. Lack of Accessibility and Personalisation

Accessibility and personalisation are additional areas where banking apps fall short. Many apps neglect to accommodate users with disabilities or special needs, resulting in a less inclusive experience.

User reviews frequently mention difficulties encountered due to non-compliant features that don’t meet accessibility standards, leaving a segment of users feeling disregarded.

Furthermore, the lack of personalised financial insights leads to a generic user experience that does not cater to individual preferences, causing users to disengage from the app.

4. Introducing Design Thinking as a Solution

To effectively address these banking app design challenges, the implementation of Design Thinking is essential. This user-centered design methodology focuses on understanding users’ needs and pain points, encouraging iterative solution development through empathy and experimentation.

By employing this approach, developers can enhance the UX design by streamlining onboarding processes, embedding robust security protocols, and ensuring that accessibility features are prevalent throughout the app.

As design partners, organisations can leverage Design Thinking to include user feedback in every stage of fintech software development. By engaging users in prototyping and testing, financial institutions can create more impactful designs that accommodate accessibility features, recommendations for personalised banking, and simplified onboarding processes.

The iterative nature of Design Thinking cultivates the optimal UI design, allowing for continuous improvements based on user preferences and behavioral insights.

By adopting Design Thinking principles, financial institutions can transform their fintech software solutions, taking complex challenges and evolving them into intuitive, user-centric experiences.

As the competition intensifies in the banking industry, merging efficient UX design and innovative solutions are vital for crafting successful and trustworthy banking applications conducive to the needs of all users.

UI and UX Best Practices for Modern Banking Apps

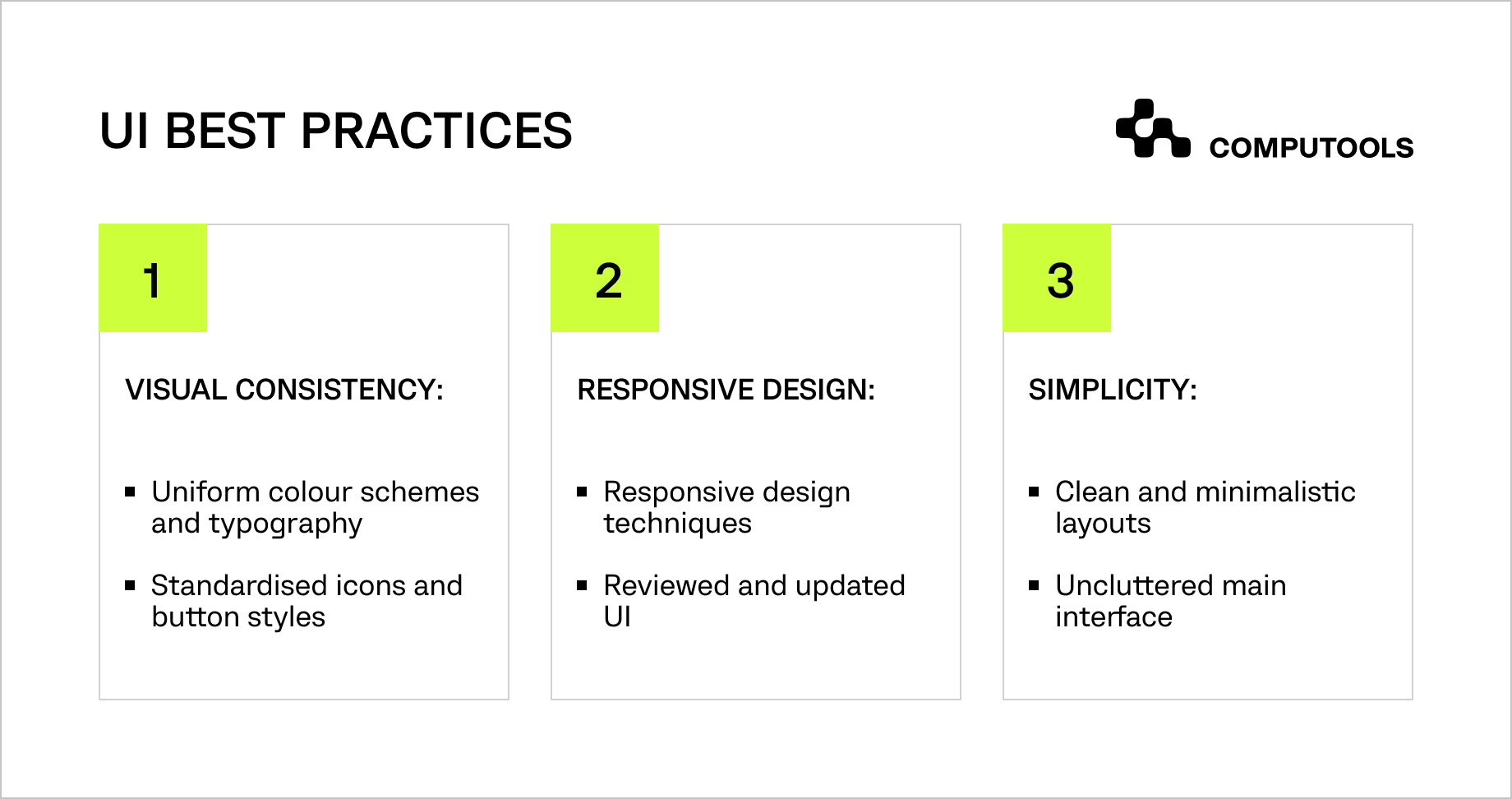

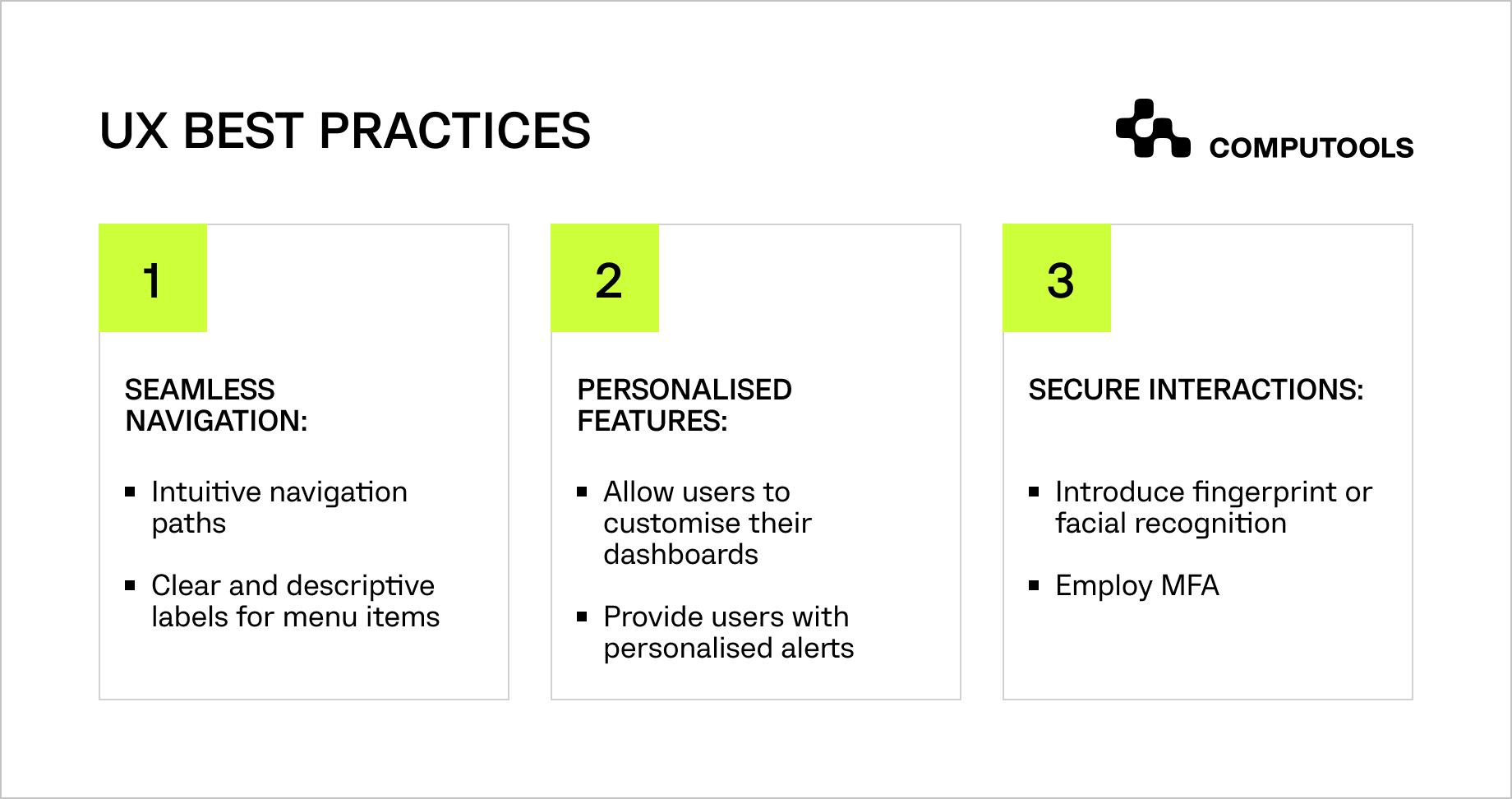

We can sum up all the information above and conduct a practical list. By integrating these UI and UX best practices into modern banking app development, you can significantly enhance user experience, leading to higher satisfaction and trust in your banking software solutions.

UI for banking apps

UX for banking apps

Engaging a CX strategy and design partner can further elevate mobile banking design through tailored approaches that address specific user needs and expectations within the fintech landscape.

How to Implement Strategies and Choose a Trusted Partner

Implementing effective strategies for updating or designing banking apps has never been more essential. Hire banking app development company as Computools and ensure the success of these initiatives through our extensive development expertise in the banking and finance industry.

Essential Steps for Updating or Designing Banking Apps

• Conducting Audits: This process often involves assessing user experience, reviewing security protocols, and evaluating performance metrics.

By identifying problematic areas, banks can prioritise improvements that directly enhance user satisfaction and operational efficiency.

• Regular Updates Based on Customer Feedback: Continuous improvement should be a core focus in fintech software development.

Regularly collecting and analysing customer feedback can inform design iterations and feature enhancements. Implementing a feedback loop ensures that apps remain user-centric and adapt to changing market requirements.

• Integrating Cutting-Edge Technologies like Blockchain: The integration of innovative technologies, such as blockchain, can significantly enhance the security, transparency, and efficiency of banking services.

Blockchain technology can streamline transaction processes, reduce fraud, and provide users with more control over their data. This technology modernises banking apps and positions institutions as forward-thinking leaders in the digital economy.

The Importance of Partnering with Experts

Choosing the right partner for banking app development is critical for success. Computools stands out as a leading software development company with a proven track record in the fintech sector.

Our portfolio showcases a wide range of successful projects. We encourage potential clients to explore our clients’ reviews, where they highlight their satisfaction with our services and the effectiveness of our solutions.

For instance, our case studies demonstrate how we have successfully assisted numerous banking clients, from enhancing security features to optimising user interfaces. Hire banking app designers from Computools and your financial institutions will gain access to specialised skills and innovative approaches.

Partnering with a trusted provider like Computools ensures that banks meet and exceed their goals, as our longstanding development expertise in the banking and finance industry positions us to create solutions that resonate with today’s tech-savvy consumers.

Contact info@computools.com for expert advice and cutting-edge banking software development services. Start your project today!

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”