Our client, a bank with over $1 billion in assets operating in 17 countries, needed to expand the range of banking services for individuals with the ability to make card transactions. With our help, the client received integration with Visa based on microservices, access to Visa card processing, and an updated interface for web and mobile banking.

The Caribbean Bank is the largest regionally listed financial services institution with over 500K clients, offering a full range of financial services. It is located in 17 countries around the Caribbean, with 2,700 employees in 54 branches and offices worth US$13 billion in assets and a market capitalisation of US$1 billion. The bank arranges over US$900 million in transactions during the year.

The Caribbean Bank experienced issues with connection to VISA in reasonable timelines for general banking application release. It required comprehensive planning, systems, process improvements and new technology implementation to scale and transform the business. At the same time, the client team did not have a large-scale internal IT department with the necessary engineers to address the issue.

Our team developed and implemented a microservices system to integrate the bank with Visa. This enabled the bank to authorise transactions, process payments, and disburse funds. The bank was able to offer user data protection and PCI DSS compliance. To implement the project, our team defined user personas, product routes, screens, and interface design. After that, we developed a user-friendly and intuitive interface.

The implemented solution facilitated the bank’s expansion into a younger demographic, resulting in a substantial 12% increase in market share among individuals aged 18 to 30. Our redesign of web and mobile banking interfaces contributed to increased customer engagement and satisfaction. Microservices architecture, along with technologies like Docker, Kubernetes, and Terraform, enhanced the bank’s operational efficiency and scalability.

Choosing Computools as a service provider involved a thorough selection process that considered several key factors. The decision-making process followed the initial identification of potential partners, evaluation of their capabilities, and the final decision-making based on various criteria.

The process began with the client identifying potential Software Engineering partners. Then followed a formalized process of a tender, where multiple vendors, including Computools, were invited to submit detailed proposals outlining their expertise, experience, and proposed solutions.

The client’s team included key decision-makers: head of IT change, service owner, business analyst, scrum master. They evaluated the submitted proposals. They considered technical expertise, previous project experience, proposed timelines, and budget considerations.

Computools showcased capabilities through a small-scale project to demonstrate our technical proficiency and understanding of the client’s needs. After weighing all the metrics, the client made the decision to work with our team.

The bank faced a number of challenges that hindered its development. The client did not offer card transaction processing, which significantly limited its opportunities in the retail banking segment. This had a negative impact on the bank’s competitiveness and market share. In addition, it had to comply with strict PCI DSS security standards, which made it difficult to develop and implement new features.

The client understood that it needed a comprehensive modernisation of its banking platform. It considered two main options:

Computools served as a partner to help the client choose the best solution to the problem. We identified key issues and weaknesses. We proposed a comprehensive plan that included the implementation of a microservice architecture, updating the web and mobile banking interface, and integration with Visa. Developed and implemented a microservices system for integration with Visa. Updated the web and mobile banking interface. Ensured the system’s compliance with PCI DSS standards.

This solution enabled the bank to develop and implement new features quickly and easily. As a result, the bank received a modern and flexible banking platform, expanded its range of services and improved security.

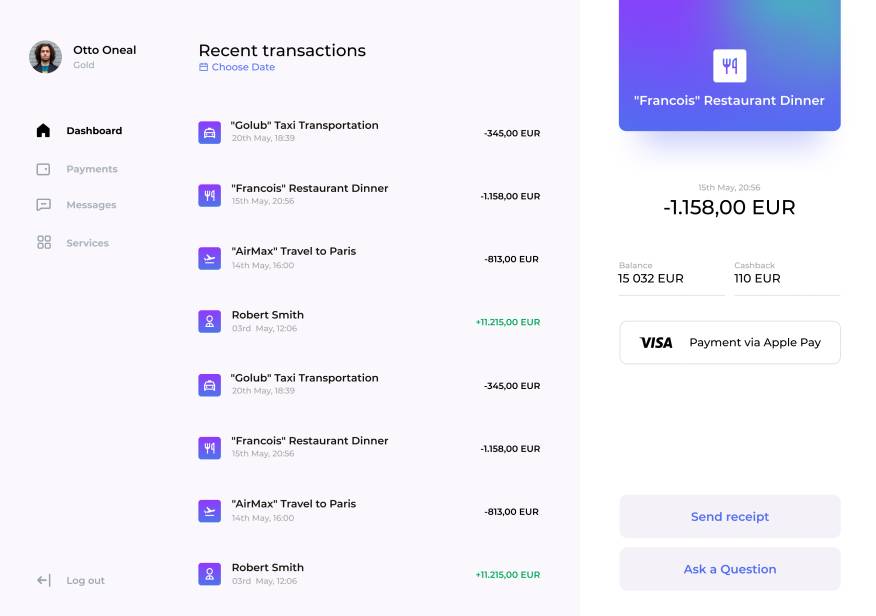

The design team had the task of designing an interface that would be concise, easy to understand and without distracting elements. At the same time, however, the design had to include all the essential operational elements. The focus was on ensuring that the work was carried out dynamically, with ongoing communication with the client, taking into account all individual features of the project.

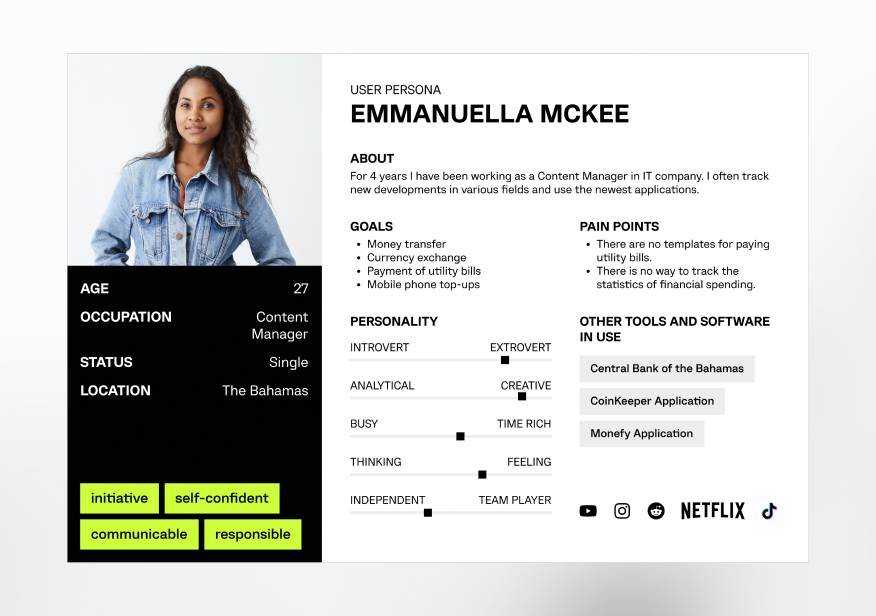

Designing a product based on semi-fictional personas of those who are going to use a product or interact with a brand.

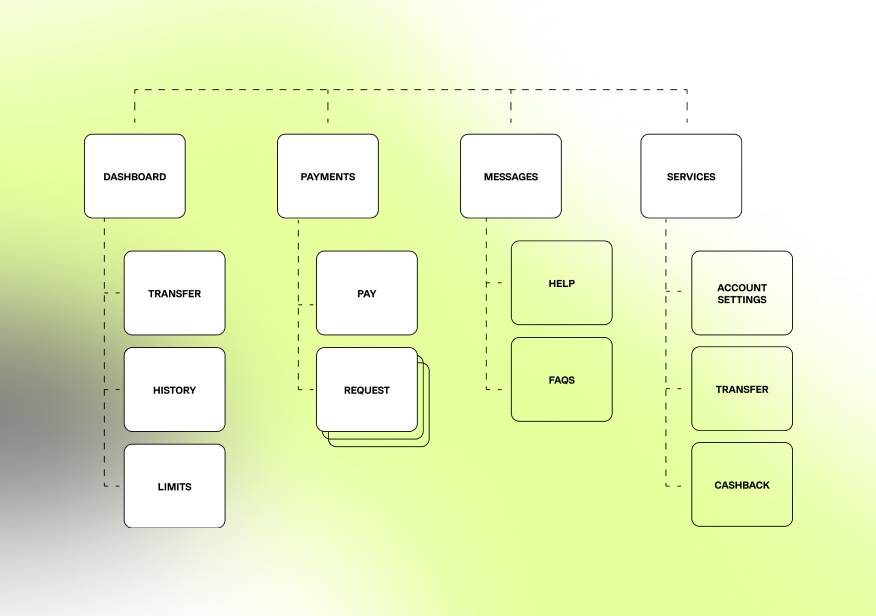

Logically structuring pages and their content within a domain.

Creating a prototype for a product presenting future layout of different interface elements and their interaction: navigational systems, search forms, newsfeeds and other components.

Designing a product’s interface and accomplishing final steps to move a product to the development stage.

Java

Java is a popular programming language that is flexible, scalable, and secure. It has a wide range of libraries and frameworks that can be used to develop microservices. Java is also well suited for developing systems that need to run in the cloud.

JAX-RS

JAX-RS is a microservices development framework that is built on Spring Boot. It offers a wide range of features that make it easy to develop and deploy microservices. JAX-RS also integrates well with other tools and technologies used for microservice development.

MS SQL

MS SQL is a relational database used to store data. It is well suited for storing data used by microservices. MS SQL also integrates well with other tools and technologies used to develop microservices.

Docker

Docker is a virtualisation platform that is used to containerise microservices. Docker makes it easy to deploy and scale microservices. Docker also integrates well with other tools and technologies used to develop microservices.

Kubernetes

Kubernetes is a container orchestration platform used to manage microservices. It makes it easy to automate the deployment, scaling, and monitoring of microservices. Kubernetes also integrates well with other tools and technologies used to develop microservices.

Terraform

Terraform is an infrastructure management tool used to automate the creation and management of infrastructure for microservices. It makes it easy to build and manage infrastructure in the cloud. Terraform also integrates well with other tools and technologies used to develop microservices.

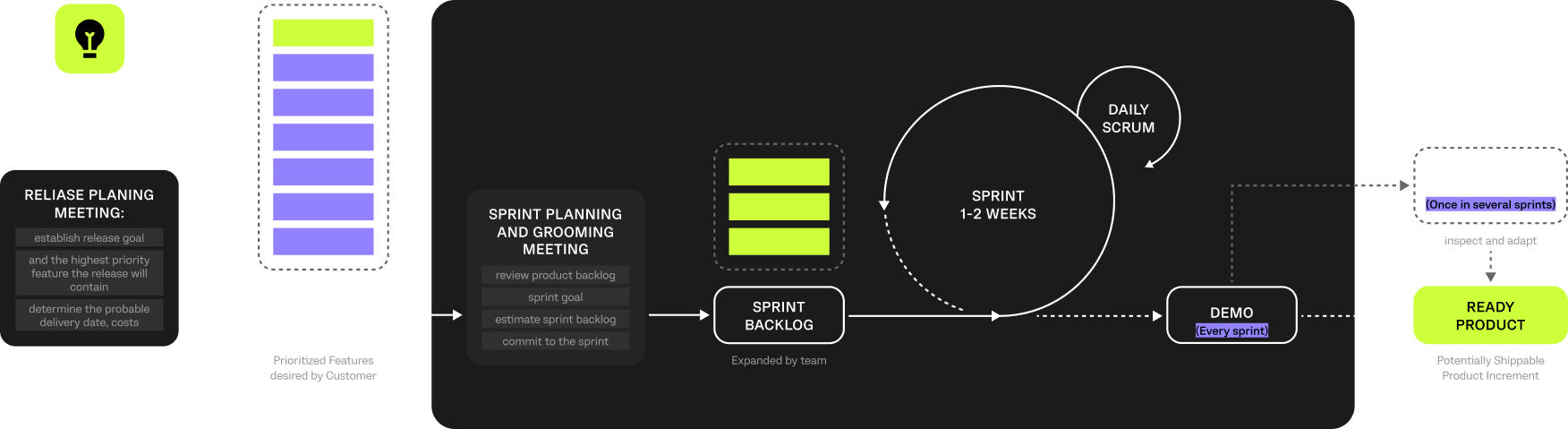

To manage a globally distributed international team, the Scrum agile framework was implemented. Sprint-based project management methodology with daily scrums allowed the team to follow the development plan and stay flexible in the face of unexpected roadblocks. The client-side scrum master provided access to Jira and used it to distribute the roles, manage resources and track the tasks. This cohesive approach enabled the team to successfully address the challenges of the project.

Choosing the right partner was crucial for our project. We carefully evaluated several vendors, conducting deep research and holding workshops to define our needs and assess their capabilities. Computools stood out with their competitive bids, clear understanding of our requirements, and well-prepared architecture. We felt confident entrusting them with our project, and the decision paid off.