Profitability in the healthcare insurance sector depends on controlling operating expenses. Health payers are always under pressure to reduce procedures without sacrificing service quality because of their narrow profit margins.

IT solutions and software development have emerged as key enablers in reducing unnecessary operational expenses, improving efficiency, and driving better outcomes.

Key Statistics and Market Trends in the Health Insurance Industry

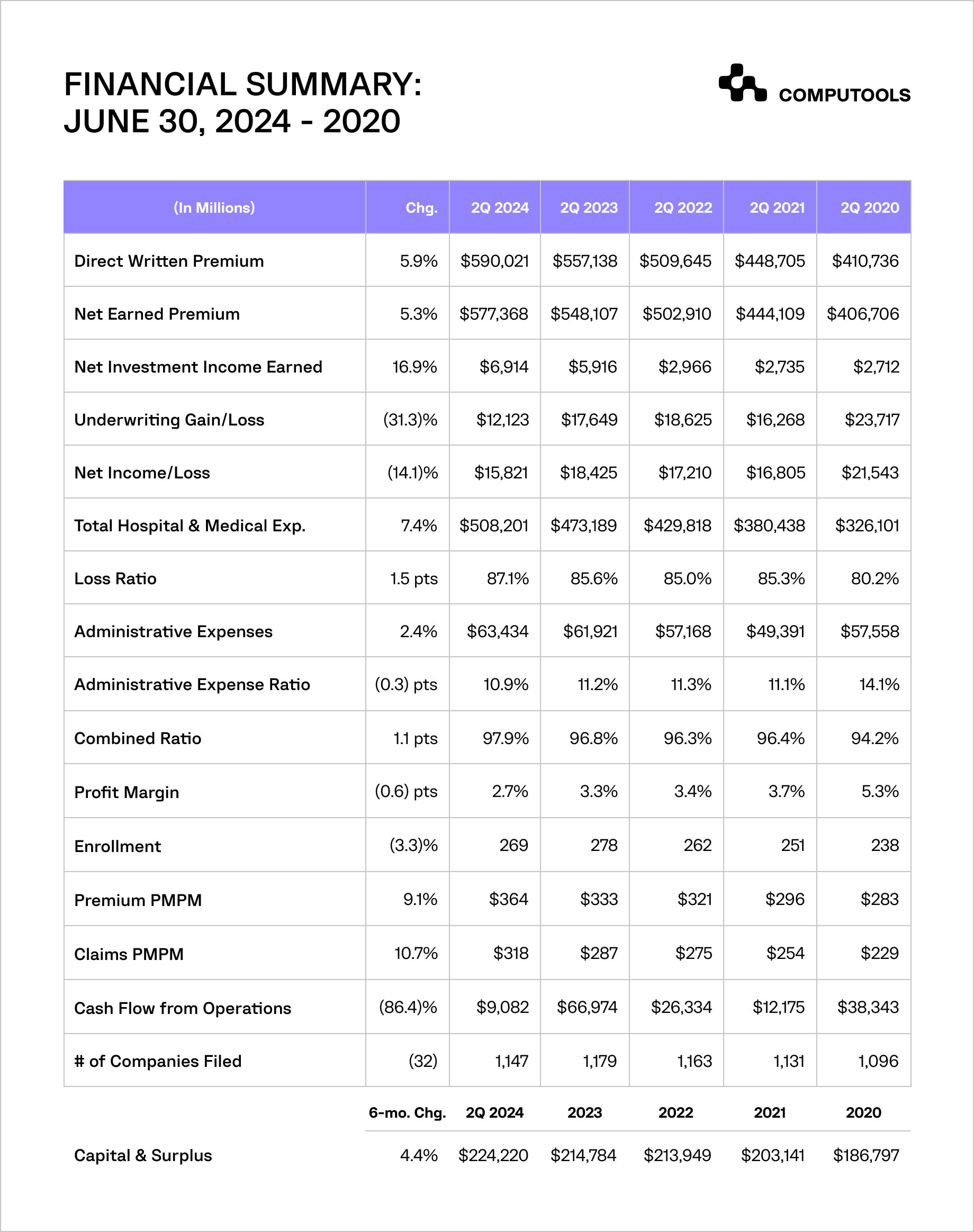

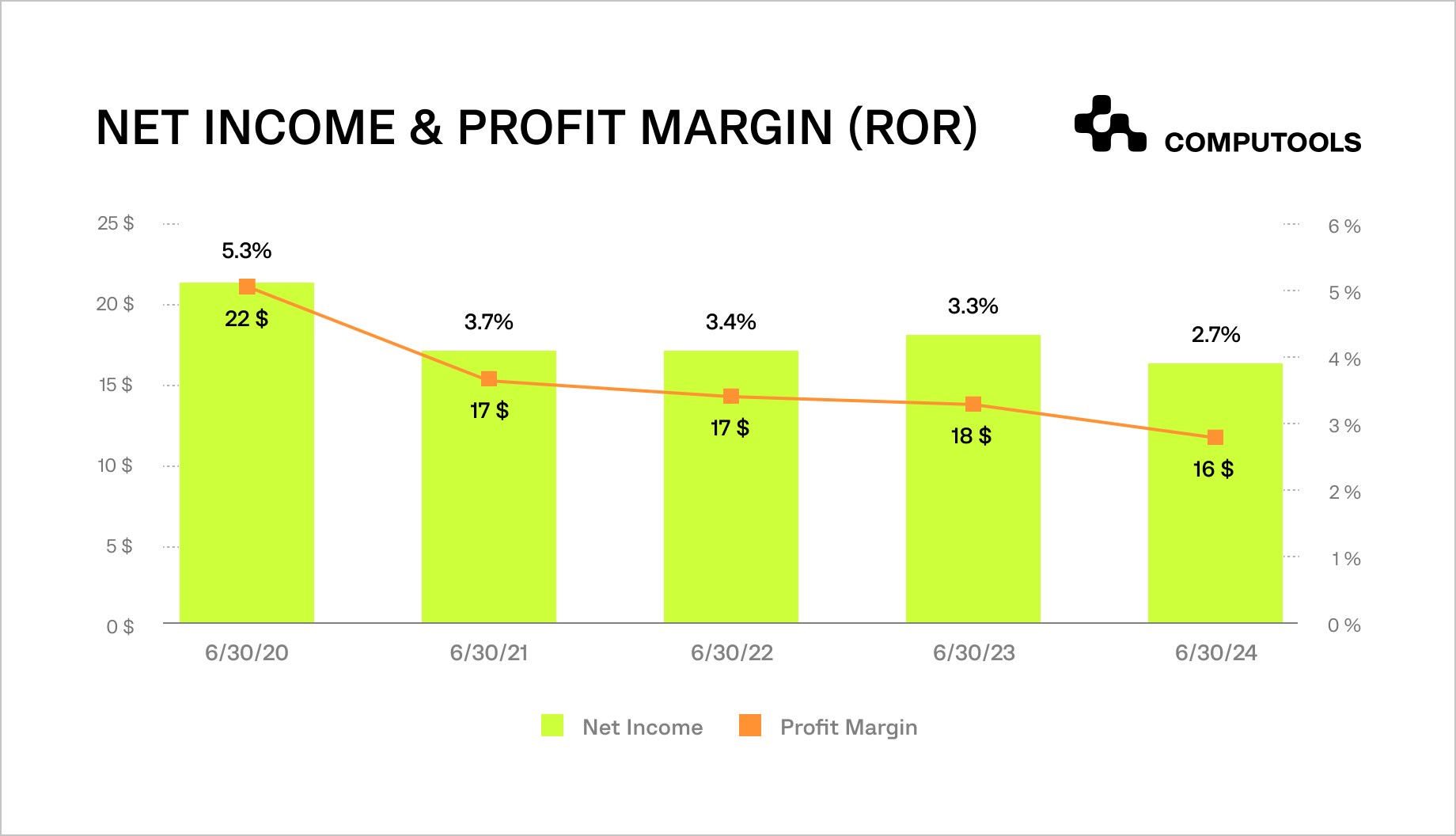

The health insurance industry is going through a transitional and difficult time. The industry’s net profit fell 14% to almost $16 billion in the first half of 2024, according to the NAIC data. A 7% increase in hospital and medical care prices, which raises operating costs, is one of the primary causes of this reduction.

At the same time, premium revenues have grown by 6%, indicating insurers’ attempts to offset rising costs. However, an 86% drop in operating cash flow raises serious concerns about the industry’s financial stability.

Many are looking at ready-made software for insurance to improve productivity and streamline procedures in order to overcome these obstacles.

The growth was mainly due to:

• Net income of $16 billion,

• A $2 billion increase in unrealised gains on investments,

• Additional capital expenditures of $2 billion.

However, some of this amount decreased due to:

• An $8 billion dividend payment to shareholders,

• A $2 billion increase in assets that are not included in the capital calculation.

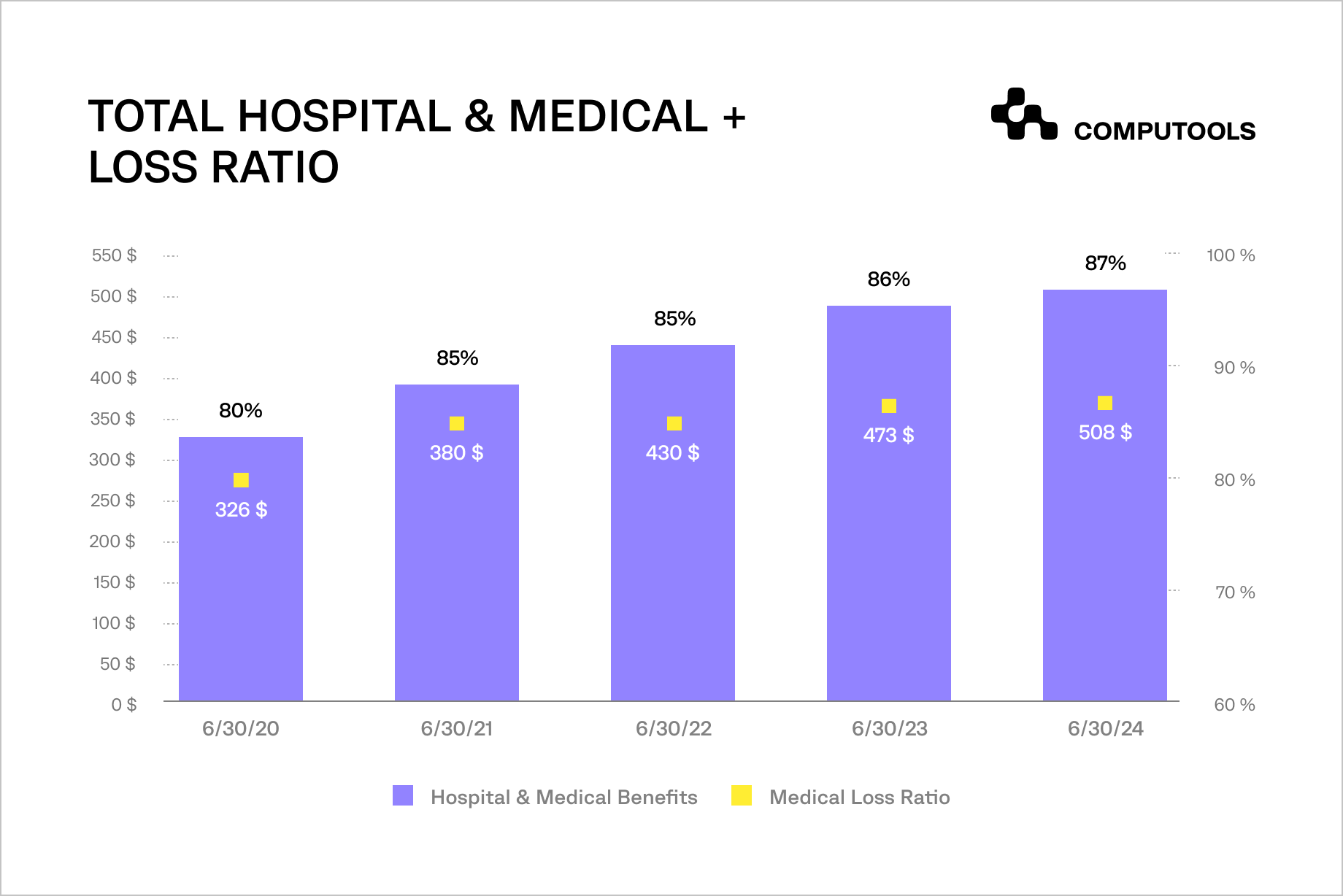

Medical expenses are growing, and the share of losses of insurance companies is also slightly increasing. In 2020, due to the COVID-19 pandemic, the ratio dropped sharply to 80%, but then returned to its previous level of 85% in 2021 and 2022.

It increased in 2023 and 2024, reaching 86% and 87%, respectively.

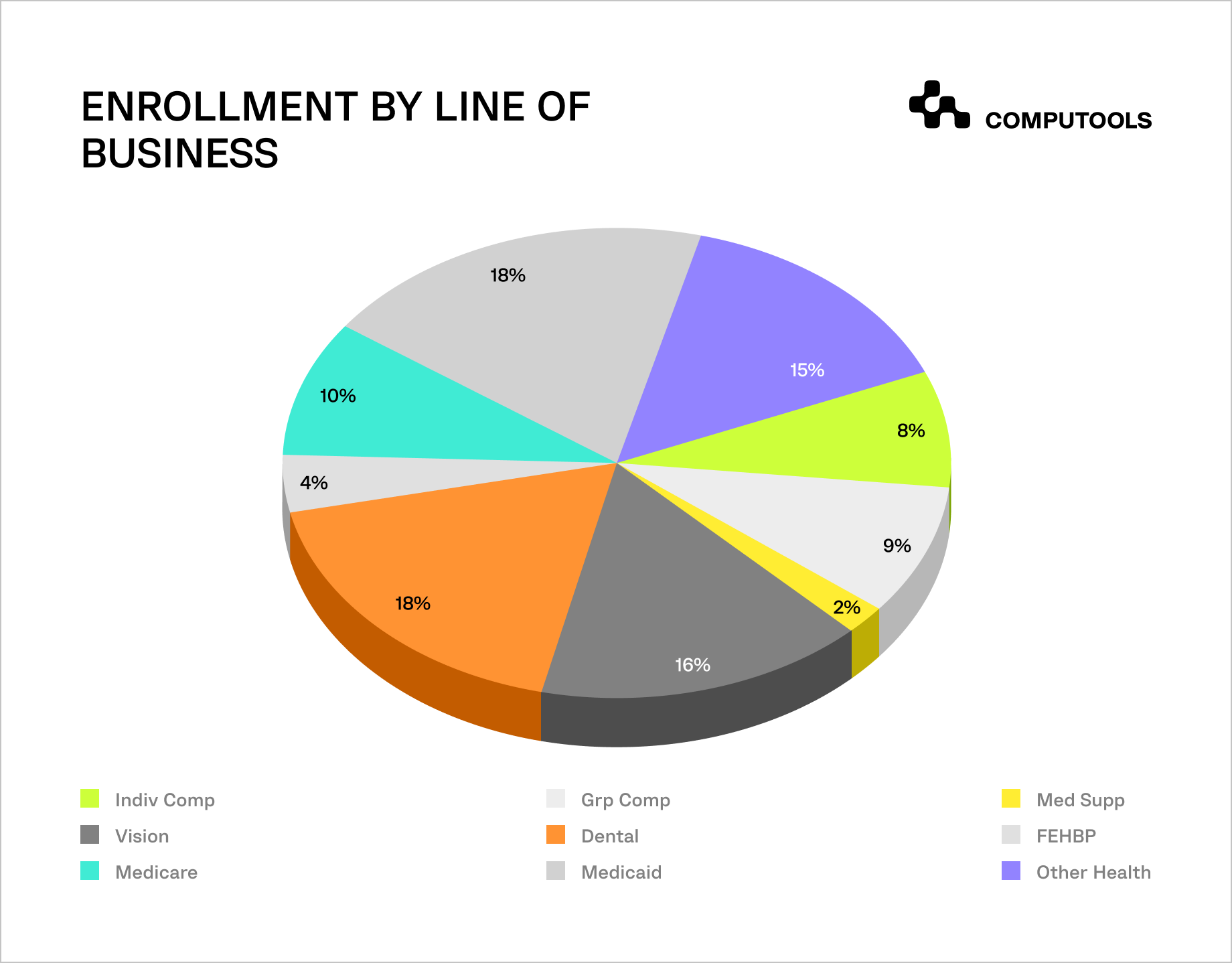

During 2024, the number of people enrolling in government-sponsored health insurance plans has increased. There has been a shift in how people with insurance coverage allocation favour different types of insurance coverage between years.

The number of people who have achieved Medicare senior insurance benefits and Medicaid low-income insurance eligibility grew significantly, and enrollment numbers in these programs have grown due to this evidence.

Analysing this statistic, we can conclude that the ongoing increase in healthcare service costs remains one of the biggest issues for insurers. The “Great Medicaid Unwinding” has led to significant shifts in the number of insured individuals, creating new challenges for insurers.

Expanding healthcare institutions may drive up service prices, further increasing insurers’ expenses. As profitability declines, insurers are forced to seek ways to optimise their operations, including reducing administrative costs and improving operational efficiency.

Implementing business software solutions can help insurers improve workflow automation and financial management. In this article we will research how is it possible. But before that, let’s uncover all the reasons for the challenges of operating costs.

The Most Pressing Operating Cost Challenges in Health Insurance

Understaffed health insurance agencies often grapple with inflated personnel costs stemming from outdated technology and manual routines.

One key pain point in the health insurance industry is the lack of data processing automation and proper software integrations. Without efficient automation, employees spend hours daily on consolidating, validating, and reconciling data across multiple systems, leading to low productivity and significant delays. This inefficiency can force carriers to hire additional staff, further driving up business operating costs.

For instance, an agency might gradually expand its workforce just to handle mundane tasks such as application processing, customer onboarding, and servicing. This situation underscores the importance of insurance software development services to streamline operations and reduce insurance business operating costs.

So, yes, we can name the most pressing challenges for cost reduction, and these are:

1. Inflated personnel costs due to outdated technology.

2. Lack of data processing automation.

3. Inefficient software integrations.

4. Excessive hiring for routine tasks.

5. Operational delays and low productivity.

6. Limited scalability without automation.

7. High costs of compliance management.

How IT Solutions and Software Development Reduce Unnecessary Operational Costs

One of the most effective strategies for cost reduction is automation, but its success depends on the optimisation of existing business processes. In this context, let’s explore how and why IT solutions and software development can lower the expences.

1. Optimising Business Processes Before Automation

Before introducing automation, the first step for healthcare payers is to optimise their business processes. It’s important to understand that automation is the most effective when it is built upon lean, efficient workflows. If a company’s processes are tangled or redundant, automation will inherit these inefficiencies, making the software logic more complex and potentially diminishing its performance. Companies that have optimised their processes first have seen greater success in their automation efforts.

By streamlining workflows, healthcare payers can simplify custom software design, making it easier to implement automation and resulting in more effective, efficient systems. This approach not only cuts down development costs but ensures that automation delivers long-term value, increasing the ROI of digital transformation initiatives.

2. Conventional and AI-Powered Automation

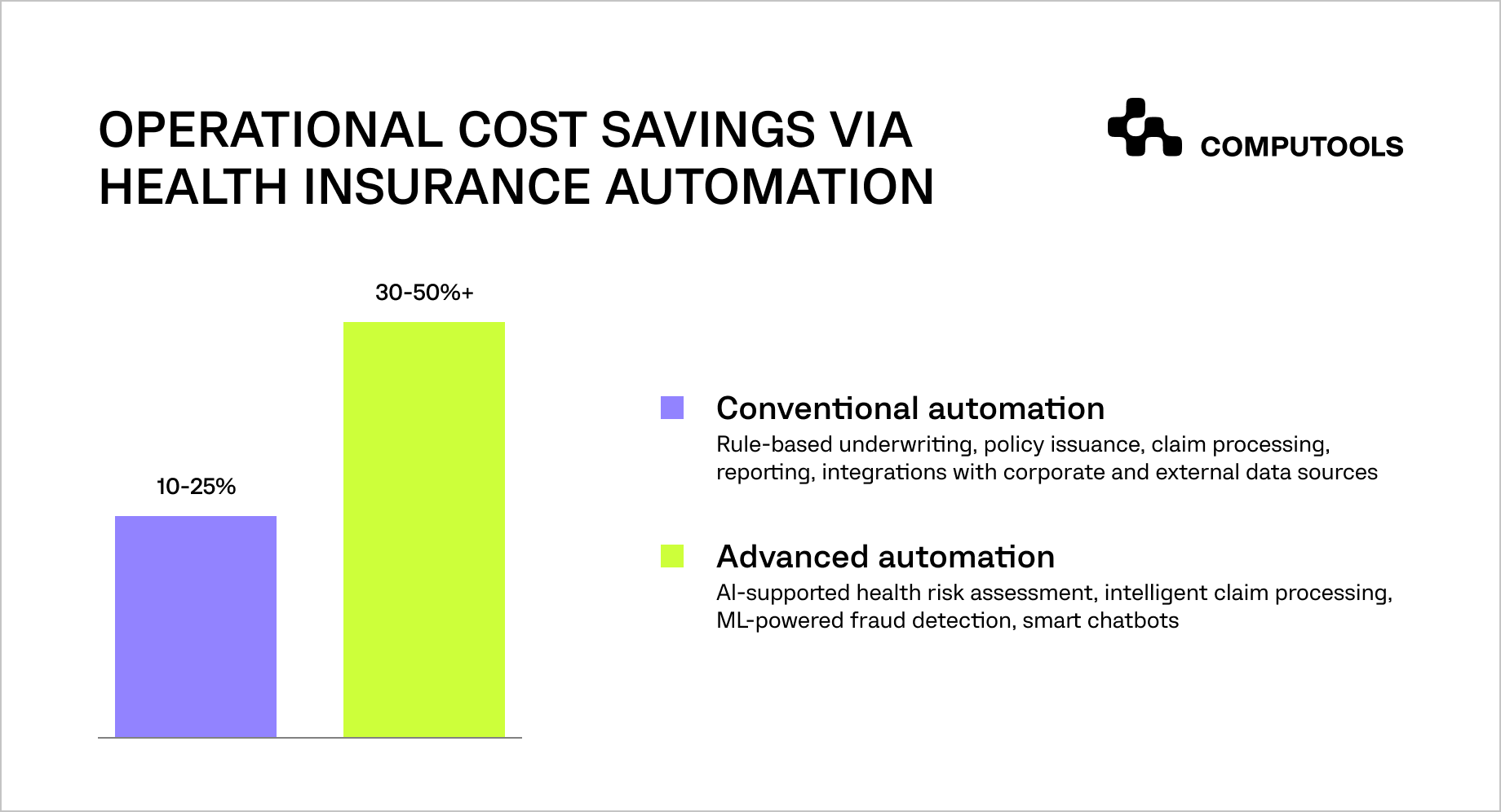

Insurance companies of medium size that introduce conventional automation technology to their underwriting functions, claims processing systems, and reporting operations can obtain cost reductions between 10% and 25%. Cost savings occur because manual regularities such as data entry tasks and approval verification steps no longer need to be performed.

Through automation, companies can release employee time so their team members can allocate their efforts toward strategic work responsibilities. Insurers who implement automated claims processing achieve document time reduction while increasing precision and shortening the entire claims handling period.

Insurers achieve their biggest cost savings by implementing artificial intelligence to automate operations. AI technologies achieve 30–50% or higher cost reductions by improving operations that include fraud detection, underwriting, and customer service. The combination of machine learning and natural language processing tools makes it possible for insurers to process big data sets rapidly in a highly effective manner.

When AI eliminates the requirement for human intervention it both reduces personnel expenses while enhancing service provision. Artificial intelligence enables chatbots alongside self-service portals to manage many customer inquiries so call center personnel focus on handling intricate problems.

3. Complete Digital Transformation for Holistic Cost Savings

Digital transformation at its most comprehensive level creates substantial cost savings throughout health insurance operations. Financial restrictions prevent insurers from implementing major transformations.

The quickest way to reduce costs is to focus on high-impact areas such as underwriting combined with claims processing operations. Insurers can reap considerable savings from cost-high areas before undertaking substantial changes to their IT infrastructure.

Smaller-scale initiatives within the digital realm generally demonstrate easier project execution, which produces faster financial returns. Digital investments need quick Returns on Investment (ROI) because they serve as the justification for more digital projects.

Insurance companies can reinvest their automation-generated financial savings to pursue more digital projects, which will create business cases for extensive transformations.

4. Evaluating the Total Cost of Ownership (TCO)

The total cost of ownership consists of preliminary costs from development and licensing and regular expenses for maintenance, support, and compliance requirements. The TCO of custom-built solutions includes expenses for developing the solution, integration work, and project management.

Providers of detailed cost estimates to health insurers can use project scope definitions and resource requirements together with timelines for estimating costs.

When adopting off-the-shelf solutions, the TCO includes the price of subscriptions and the costs of customising and integrating these systems. Long-term expenses like maintenance, user training and compliance-related costs must be included during planning stages for custom-built and off-the-shelf systems, particularly when handling sensitive information such as PHI.

Automated system choices can be chosen based on their ability to generate a high return on investment as determined by comparing the total cost of ownership against projected cost savings.

5. Cloud Infrastructure and Right-Sizing

Moving critical business systems to a cloud-only infrastructure is a key area for reducing IT expenses. By transitioning from on-premises or hybrid hosting, health insurers can eliminate hardware maintenance costs, reduce infrastructure management expenses, and streamline software development and deployment.

Leading cloud providers like Amazon Web Services and Microsoft Azure offer on-demand computing resources that allow insurers to scale capacity based on actual usage, paying only for what is used. This model significantly reduces costs compared to maintaining on-premises infrastructure.

Even if insurers are already using cloud solutions, further cost reductions can be achieved by optimising cloud usage. By monitoring cloud performance with tools like Amazon CloudWatch and Azure Monitor, insurers can identify underutilised resources and resize cloud instances to eliminate wasted capacity. This can lead to substantial savings, with some clients saving up to $600 per instance per month by downsizing.

6. Automating Routine IT Maintenance

Routine IT maintenance tasks, such as monitoring infrastructure and applications, backup and recovery, as well as storage provisioning, are prime candidates for automation.

Automating these functions reduces manual intervention, improves efficiency, and cuts costs. In my experience, automation in these areas can lead to cost reductions of 30–45%, making a significant impact on overall operational expenses.

Global Use Cases of Successful IT Solutions in Health Insurance

Let’s look at key areas in the health insurance industry where you can streamline operating costs and achieve significant savings.

1. Streamlining Underwriting with Technology

One of the first areas to tackle is underwriting. Integrating your underwriting system with customer-facing apps, CRM platforms, and providers’ EHRs (electronic health records) will significantly boost your automation and save on manual effort. Automating the aggregation of insurance applications and health risk data alone can save your company between $100 to $800 per application.

AI-powered health risk assessments can provide a costs reduction for health insurance businesses by as much as 10-50%. These systems enhance risk profiling and reduce losses from inadequate risk pricing.

Using large language models (LLMs) and deep learning algorithms, you can extract and summarise risk data quickly, providing your underwriters with decision-ready data in minutes. LLMs can also cross-check this data with EHRs to ensure its accuracy.

As a result, you get faster and more accurate risk assessments, reducing operational burdens.

2. Automating Claims Processing

Automating claims processing can deliver significant cost savings. For instance, one of our health insurance clients has reduced operating costs by up to 70% in the most data-heavy tasks.

With the help of intelligent text, image, and video analysis algorithms, insurance companies can process multi-format claim evidence—from medical statements to 3D MRIs—in just minutes. These algorithms can also categorise claims and route them for settlement according to internal policies.

Integrating claims software with healthcare providers’ EHRs for auto-validation of evidence will further optimise the workflow, ensuring accuracy while reducing human intervention and processing time.

3. Combatting Fraud with AI

Fraud is another area where healthtech software solutions can make a huge difference. Machine learning algorithms can detect fraudulent claims in dental insurance. But before choosing an action, each medical provider should decide what kind of digitalisation process to opt for.

Ready-Made Software vs. Custom Software Development: Which Is the Best Fit?

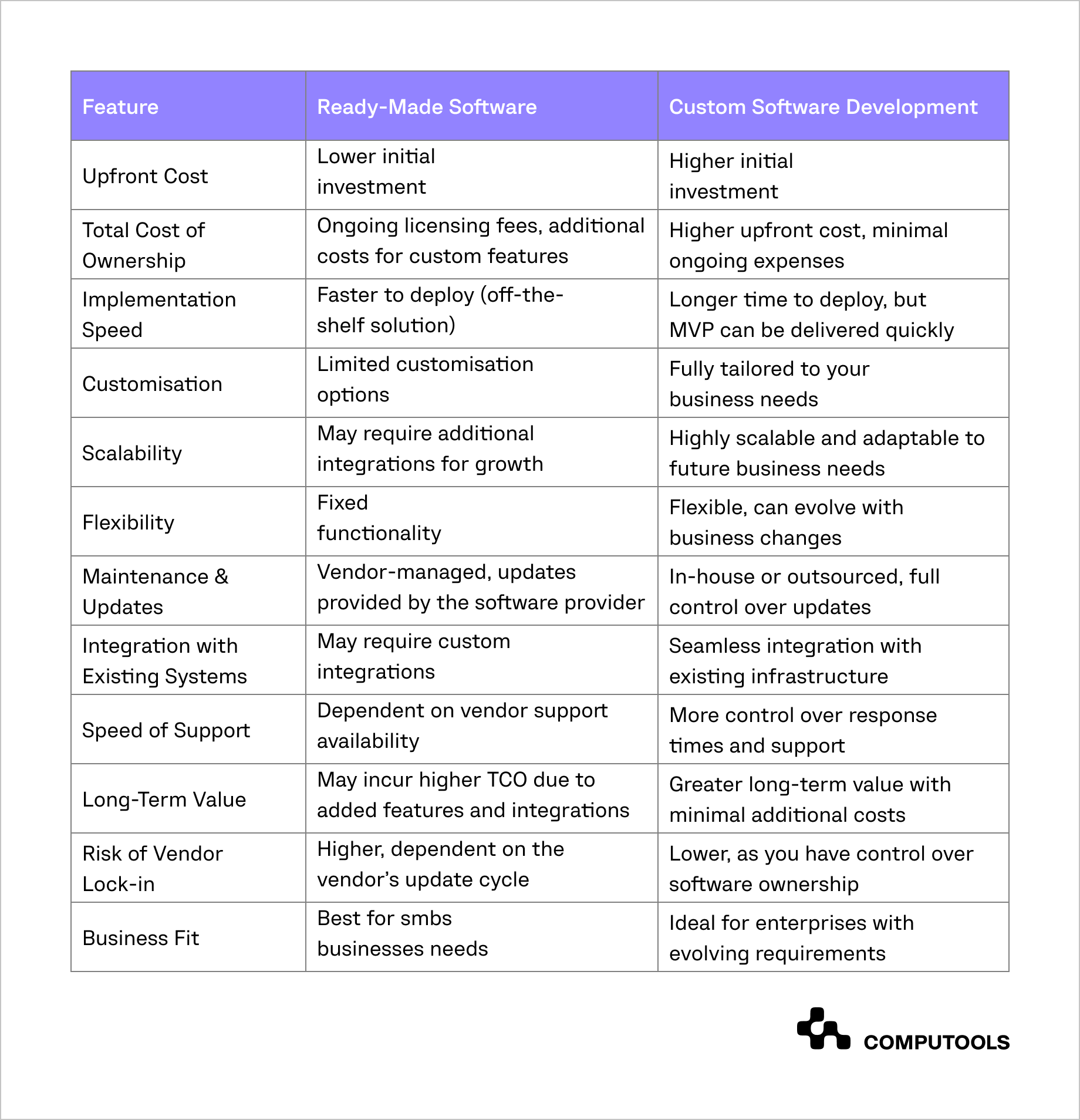

Identifying your insurance business requirements together with funding constraints becomes essential for choosing ready-made software versus custom-developed solutions. Both options offer distinct advantages, depending on your priorities and transformation goals.

1. Costs and Efficiency Considerations

Acquiring ready-made software requires a minimum initial financial investment, which leads people to think this method is cheaper initially. However, the expenses do not stop at the initial point of sale because vendors demand continuing licensing fees, and additional funding is typically needed to obtain necessary integrations, extra users, and custom features.

Insurance organisations that start with ready-made software products will likely end up spending more money on its use than they would on custom software for insurance businesses made precisely for their requirements.

The cost structure of custom software includes a significant upfront payment, yet long-term maintenance expenses are much lower.

The majority of your development expenditures occur initially in custom work, so your ongoing expenses remain low, and your solution remains adaptable to business requirements over time.

2. Speed to Market

Health insurance companies dealing with software development are concerned about lengthy projects because they require quick results. An MVP development strategy provides a remedy to address this concern effectively.

An MVP can be delivered for health insurance automation to clients within three months through its teamwork, which enables clients to achieve benefits without needing complete system replacement.

3. Flexibility and Long-Term Value

Custom software outperforms other solutions regarding scalability potential. The software comes ready-made for your particular requirements since off-the-shelf options need cost-intensive adjustments to adapt to your special operations.

Your business obtains better control of its expansion path and software adaptability to internal needs by investing in custom-built insurance software as health insurance industry operating costs continue to rise.

4. Outsourcing and Cost Reduction

Health insurance firms that outsource their non-core IT support operations, such as help desk services, can manage budgets more efficiently. Outsourcing can achieve help desk cost reductions of up to 40%, enabling them to concentrate on essential activities and access external savings and expertise.

Evaluating your financial needs both now and in the future can help you decide between existing insurance software solutions or outsourced insurance software development services.

Check this table to see the detailed comparison:

Checklist for Choosing a Software Development Partner

Establishing a strong partnership based on clear expectations is crucial in navigating the complex frameworks of healthcare technology effectively.

Here is our complete guide to choose a software vendor:

1. Understand your needs and goals

• Outline your goals, challenges, and functionalities required from the software. For healthcare insurance, you might need claims processing or patient data management.

• Create a detailed project scope that includes timeline, budget, and expected outcomes.

• Understand the regulatory environment your organisation operates within.

2. Evaluate technical expertise and industry experience

• Ensure that the partner exhibits strong technical skills relevant to the health insurance domain.

• Analyse the partner’s experience in developing healthcare software solutions. Look for previous projects.

• Examine case studies, client testimonials, and reviews.

3. Assess the development process and methodologies

• Inquire if the potential partner follows established development methodologies like Agile or DevOps.

• Confirm the existence of testing protocols and quality control measures.

4. Review scalability and flexibility

• Choose a partner who can provide scalable solutions that adapt quickly to your needs.

• Ensure that the partner can accommodate requests for modifications or enhancements.

5. Consider security and compliance

• Investigate the partner’s approach to data security, including encryption standards and overall risk management strategies.

• Ensure that the partner is well-versed in HIPAA and other related healthcare regulations, implementing practices to protect sensitive patient information.

• Ask for thorough documentation of the partner’s security measures and compliance experiences during their previous projects.

6. Analyse Cost vs. Value

• Look beyond the initial costs; consider ongoing maintenance, support services, and potential additional fees associated with the project.

• Focus on the overall value provided by the partner, ensuring that quality and expertise justify the costs involved.

• Make sure the partner offers a clear breakdown of pricing and is transparent about potential hidden charges.

Utilising this comprehensive checklist will significantly enhance the process of selecting the right software development partner for health insurance needs.

Ensuring that partners align on key criteria such as technical expertise, regulatory compliance, scalability, and cost-value ratios will not only facilitate smoother project execution but also enhance patient care and organisational efficiency.

Why Computools?

Businesses require technology partners who understand how to create secure health insurance software solutions that enhance performance while providing expandability. Our expertise in insurance software development allows us to provide businesses with software solutions that decrease operational expenses while streamlining activities and delivering excellent customer interactions.

We have developed a custom insurance software for our clients that delivered automated claims processing, decreasing fraud susceptibility and boosting information precision. Details you can see in our portfolio of case studies. Our software development strategy beats standard commercial offerings because it provides adaptability and the ability to comply with adapting regulations.

Testimonials from our clients hosted on Clutch validates the operational changes accomplished through our solutions. The businesses we serve recognise our insurance software for producing secure advanced platforms and scalable solutions which create quantifiable business outcomes.

Working with our software development company provides insurance organisations access to enhanced business industry advantages. Join us in creating advanced technological innovations in insurance.

Tell us about your business at info@computools.com and we will discuss your business project.

Computools

Software Solutions

Computools is a digital consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”