Global Accounting Landscape

The accounting industry is undergoing a significant shift as digital innovations are rapidly replacing traditional methods. For those still using outdated accounting software, it’s now vital to upgrade to stay competitive.

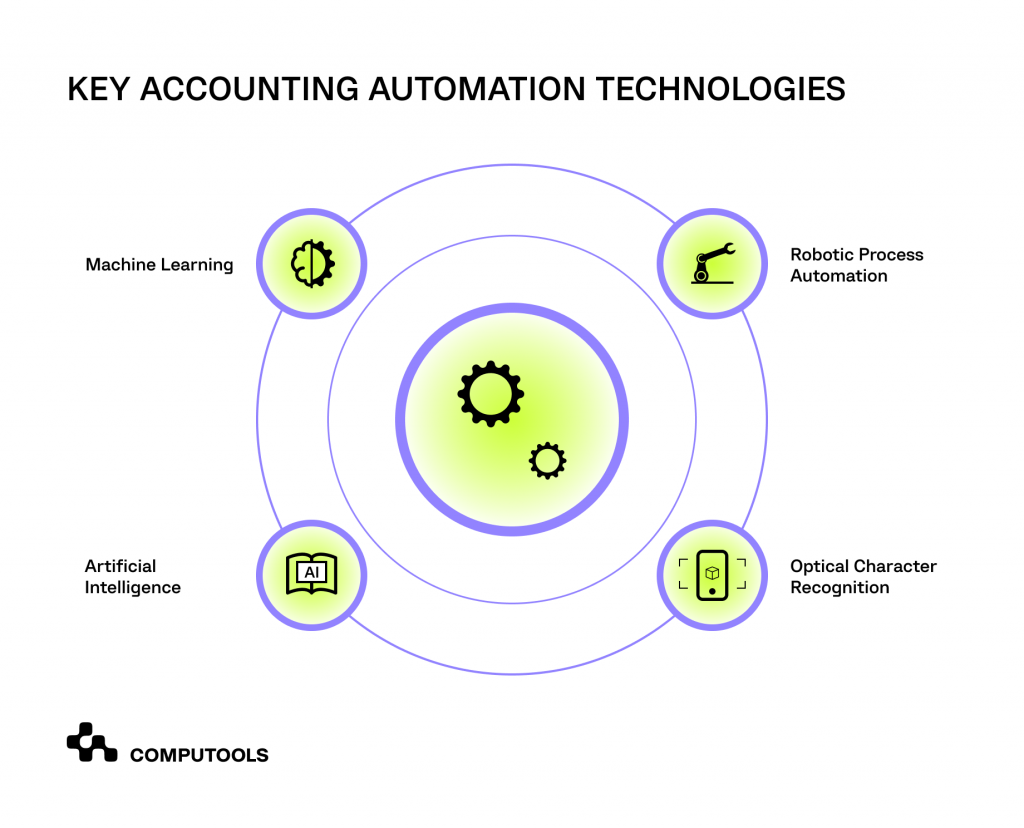

Accounting technology refers to a range of digital tools, ranging from cloud computing to machine learning, artificial intelligence and blockchain that are now essential in shaping the industry’s future. As digital workplaces become the norm, the imperative for the industry to adopt these technologies grows.

A survey by the Association of Chartered Certified Accountants reveals a critical trend: 89% of respondents acknowledge the importance of digital skills in accounting, yet only 63% feel they possess these skills. This gap highlights the need for urgent professional development.

Business owners globally are responding to this digital shift by investing significantly in service automation and new software solutions.

The Workday Global CFO Survey reports that nearly half of Chief Financial Officers (48%) are planning significant investments in the development of intuitive interfaces for financial tasks. This initiative is geared towards attracting emerging finance talent over the next five years.

Not only does the industry recognise technology’s role in streamlining financial tasks and staying competitive, but clients also increasingly expect automated services as standard from accountants, raising the bar for service delivery.

Thus, staying updated with the latest accounting technology trends is more important than ever before. This article explores the trends set to transform accounting in 2024. Keep reading for fresh insights!

Anticipated Accounting Technology Trends for 2024

Modern accounting software goes beyond basic record-keeping, becoming indispensable for streamlined processes, enhanced accuracy and strategic decision-making.

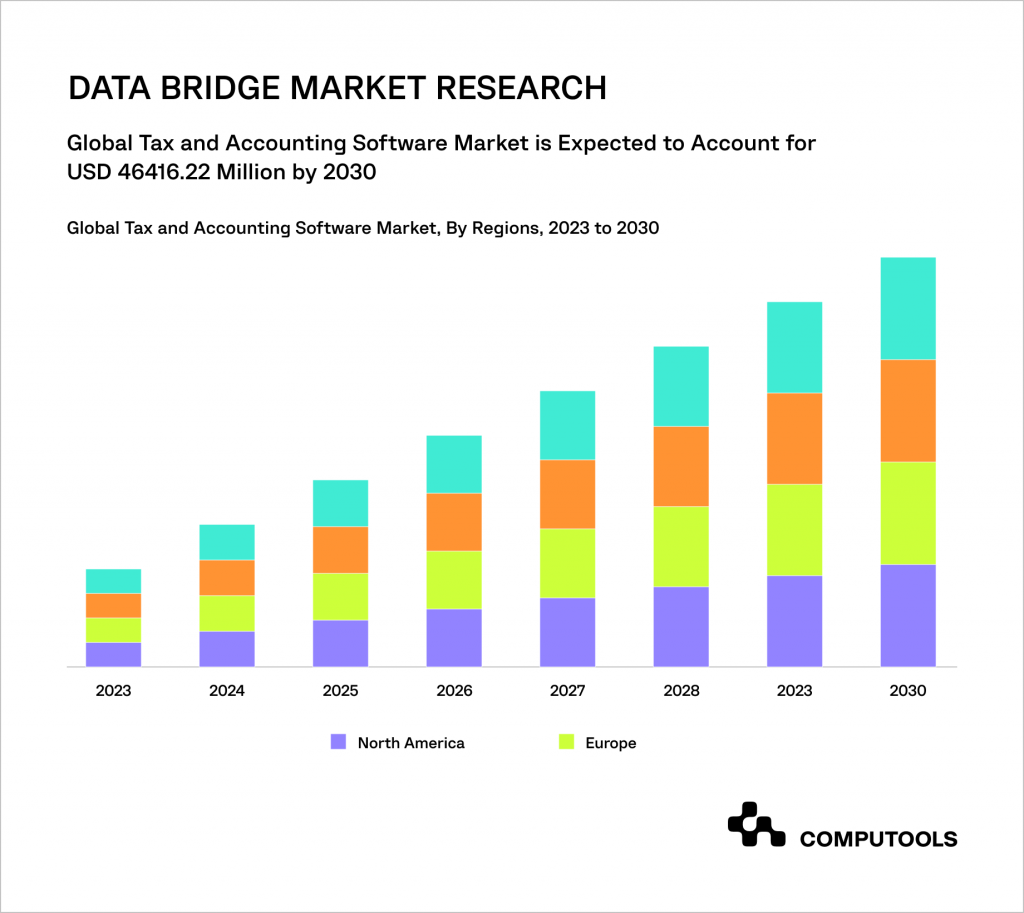

In its analysis, Data Bridge Market Research forecasts that the accounting software market is poised to achieve a valuation of US$46.42 billion by 2030, surging from US$25.08 billion in 2022, with a steady compound annual growth rate of 8% expected.

So, what tendencies can we expect to form the future of accounting technology? Let’s take a closer look at some of the upcoming trends in this field.

1. Accounting Automation

The role of financial professionals involves managing diverse workflows, from client onboarding to year-end reviews and tax filings.

The manual handling of these tasks can be overwhelming, time-consuming and less efficient. According to the Financial Workflows Report by FinancialCents, 66.7% of accountants find workflows to be their most significant challenge.

The necessity for financial workflow automation tools is obvious. Automating routine tasks not only saves time but also minimises errors, enhancing overall efficiency.

While some professionals have fully embraced automation, others remain hesitant about this transformative shift.

Many accountants understand the potential of automation, but they struggle with implementation. It often boils down to not having a well-systematised foundation.

Looking forward to 2024, we anticipate a widespread shift toward systematising processes and embracing workflow automation tools.

The benefits are too evident to ignore, and as accounting firms streamline their foundations, the adoption of automation will become increasingly natural.

2. Cloud-Based Accounting Software

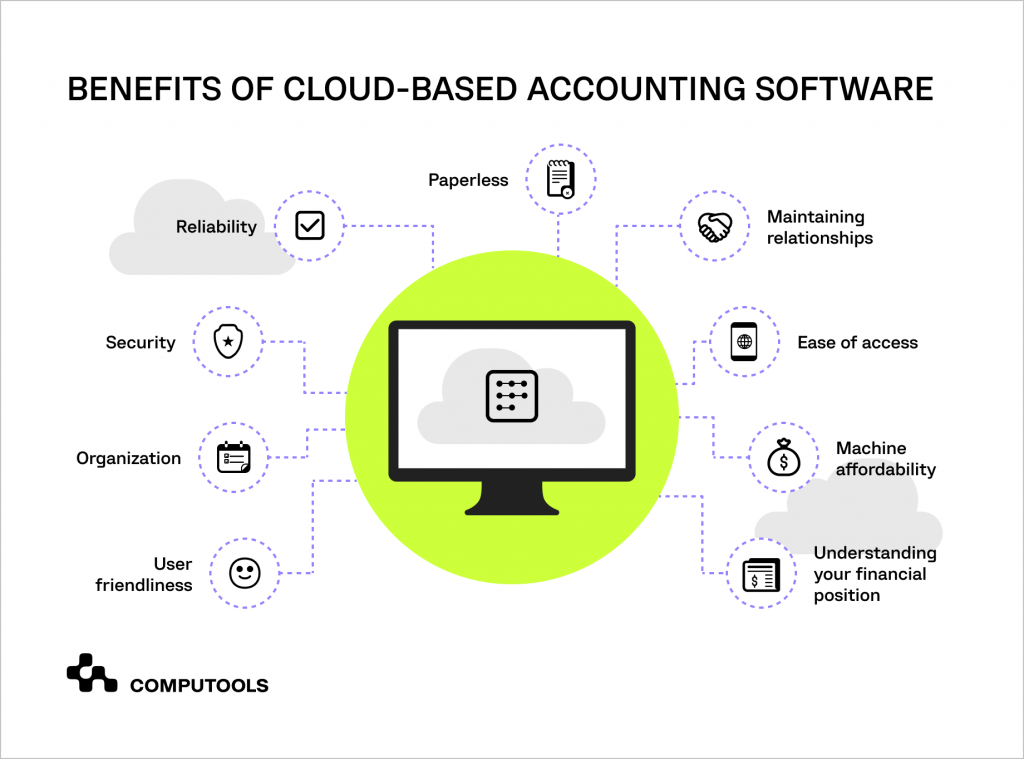

Traditional local servers are proving insufficient for the evolving needs of modern accounting companies, prompting the adoption of cloud computing as a transformative trend in accounting.

Cloud computing, using remote servers to store, manage and process data, provides a secure and accessible platform that removes geographical constraints. It enables information access anytime, anywhere and on any device.

The foremost benefit of cloud services is the ability to swiftly access detailed financial breakdowns and key metrics globally. This accessibility transforms the way accountants work, facilitating remote collaboration on processes.

Efficiency gains are realised as accountants spend less time on data maintenance and leverage the open API of the cloud to seamlessly connect their various tools into a unified platform.

3. Blockchain

Once considered a unique accounting trend, blockchain technology has now become an integral part of everyday financial operations, promising a fresh approach to accounting with increased security, transparency and user satisfaction.

Blockchain technology significantly reduces the risks associated with human errors and data fraud. The chronologically ordered records create a clear story of changes, making financial processes more transparent.

Probably, the most standout feature of blockchain tech is smart contracts. These contracts offer a faster and more reliable alternative for financial transactions, sidestepping the need for intermediaries.

This results in a more straightforward and bureaucracy-free approach, providing a clearer view of financial processes.

Also, with blockchain becoming a fixture in banking organisations, accounting service providers need to equip tech-savvy professionals with the necessary knowledge. As organisations adapt to these changes, they set the stage for a future where blockchain is a fundamental driver of financial innovation.

4. Artificial Intelligence and Machine Learning

A significant advancement in bookkeeping technologies is the incorporation of artificial intelligence (AI) and machine learning (ML).

AI-driven accounting solutions bring several advantages to companies, introducing intelligent automation, data analytics and adaptive learning features.

These technologies empower accountants by automating repetitive tasks and providing real-time insights.

The use of AI in accounting facilitates smooth collaboration between accountants and clients. It enhances data security and allows for information to be accessed and analysed from any location.

The role of AI also becomes important in promoting engagement within accounting enterprises.

The adoption of AI-driven systems acts as a bridge, enabling staff to work across different locations and fostering an environment that supports flexible work arrangements.

This, in turn, allows leaders to encourage increased collaboration and implement various work practices that align with the changing dynamics of the modern workplace.

Learn more about business growth with modern software solutions.

Contact us →5. Cybersecurity

The integration of cybersecurity measures is becoming increasingly important, especially with the widespread adoption of cloud-based accounting software.

Recent shifts in workplace dynamics, such as bring-your-own-device policies and cloud migrations, have prompted accounting practices to reassess their strategies for ensuring the security of sensitive data.

The rise of flexible work arrangements, allowing accounting professionals to operate from home, introduces a new set of challenges.

There’s a growing concern that the increased reliance on remote work could make accounting companies more susceptible to cyberattacks and data theft.

From phishing scams to identity theft, the opportunities for the criminals in the accounting industry are also growing. Consequently, the need for a robust cybersecurity policy is no longer a choice but a mandatory requirement for accounting organisations to safeguard their clients’ confidential information.

Accounting professionals must not only prioritise the security of their digital infrastructure but also adapt to emerging threats.

The future demands a proactive approach, incorporating advanced security measures, regular training and ongoing assessment of potential vulnerabilities.

6. Robotic Process Automation

Clients, tired of waiting on the phone or standing in lines at offices for enquiries and complaints, are now turning to brands with better customer service.

To handle their issues, people are increasingly using emerging accounting technology tools like chatbots and FAQs. Over the next decade, this trend of delegating digital tasks to virtual personal assistants and other self-service tools is expected to grow.

In response, accounting firms are increasingly adopting chatbots and robotic process automation (RPA) solutions to enhance customer support.

While RPA handles routine tasks such as invoice processing and data entry, chatbots efficiently manage customer queries through scripted interactions. This shift promises increased productivity, fewer errors and improved customer service for accounting firms.

7. Hybrid Work Model and Collaboration

The rise of hybrid work is reshaping industries. Economists predict its more widespread adoption in the coming years, which is pushing accounting organisations to invest in collaborative tools, including advanced accounting apps.

To ensure productivity for both office and remote employees, businesses are moving beyond traditional accounting software.

A new agile strategy and comprehensive digital workspaces, encompassing project management, reporting and analytics tools, are emerging to support effective performance, regardless of location.

Concerns about work burnout and employee isolation are prompting a focus on innovative collaboration and communication tools.

Employers are implementing well-being checks and regular calls to acknowledge efforts, provide updates and allow employees to voice suggestions, combating isolation and fostering a sense of connection.

As traditional office attendance diminishes, companies are exploring flexible options to improve work-life balance.

This shift goes beyond adapting to the evolving work landscape, it aims to create an environment that prioritises employee well-being and engagement.

The Role of Custom Software Development in Accounting

As technological advancements continue to shape the accounting sector, software development services are becoming crucial for medium-sized and enterprise-level companies.

These businesses are increasingly focusing on creating their own unique solutions, driven by the desire to enhance profitability and employee productivity.

The advantages of custom accounting software are clear. Take, for instance, a retail company struggling with standard, off-the-shelf accounting software.

Although popular, such software often falls short in meeting specific operational needs, particularly in areas like inventory and sales tracking.

Recognising this, the company opts for a custom solution. Though initially more expensive, this bespoke software, designed to align closely with the company’s unique business processes, proves beneficial in the long run. It improves inventory management and syncs effectively with sales strategies.

A tailored approach invariably leads to more efficient workflows and facilitates smoother adoption by employees.

Furthermore, as the company expands, the scalable nature of the accounting software solutions allows it to adapt and grow alongside the business, offering long-term value.

To sum up, the trend towards personalised solutions in the business world is also set to continue, reflecting the growing demand for software that caters specifically to the unique challenges and opportunities of each enterprise.

Forecasting the Future of Emerging Accounting Technologies

To thrive in accounting, it’s essential for business owners to be well-versed in current accounting software solutions and to anticipate future developments.

The accounting profession is evolving rapidly, with a future where accountants are seen more as key strategic advisers. This shift is driven by the adoption of technologies like chatbots and machine learning in workplaces.

As automation takes over routine tasks, accountants can focus more on delivering financial insights, risk assessments and strategic planning. Emerging tools will not only enhance professional capabilities but also improve work-life balance and open doors for entrepreneurial ventures.

Businesses and professionals need to view technology not as a threat but as a catalyst for transformation. Embracing technology can significantly improve operations and give accounting firms a competitive edge.

We have identified several key technological trends that are likely to have a major impact on the accounting industry.

• Blockchain technology will further transform auditing, record-keeping and accountability by enhancing transparency and efficiency.

• Integration of the IoT with artificial intelligence will revolutionise the real-time tracking of financial activities, offer deeper insights and streamline auditing processes.

• The metaverse, incorporating augmented and virtual reality, will open new ways for accounting firms to engage with clients, offering virtual collaboration and business opportunities.

These advancements promise a future where accounting is more than number crunching – it’s about strategic analysis and innovation.

Final Words

As accounting technology trends evolve, leaders should focus on new digital tools but also not forget to regulate how their teams work together, their ability to adapt and the needs of their clients.

Getting advice from reliable digital experts can help ensure a smooth shift to the next generation of accounting software.

This change promises to revolutionise how the industry operates, making processes more efficient and cost-effective.

Prepare for a future where accounting is not just a routine task, but a vital, strategic part of business!

If you have any questions, feel free to contact us at info@computools.com. We’ll provide you with the expertise needed to ensure you are well prepared to navigate the digital realm of accounting technology for your business growth.

Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.