Client: Caribbean Bank

Industry: Banks Software Engineering

Services: Platform & Product Engineering and Competency Development

Business size: Medium and Large Enterprise

Project Summary

The Caribbean Bank, founded in 2002, has grown to become the largest financial institution in the region, serving over 500,000 clients across 17 countries. It offers a wide range of services and manages a significant portfolio, with assets exceeding US$1 billion.

With a customer base covering individual and business accounts, Caribbean Bank prioritises customer satisfaction in its daily operations.

However, its efforts to offer a positive and smooth customer experience were hindered by outdated technologies and significant Visa connectivity issues, impacting the bank’s ambition to expand further into the retail banking sector.

These challenges impeded the bank’s ability to become the preferred financial services provider in the Caribbean region, particularly among the younger generation, who prioritise the convenience and simplicity of online transactions.

Understanding the need to embrace modern technology to stay competitive, Caribbean Bank sought a technology partner.

In its quest for improvement, the bank partnered with Computools to overhaul its banking application and develop additional services to enhance customer satisfaction.

The key challenge in this partnership was to resolve all existing issues within reasonable timelines for the general release of the banking application.

Following the implementation of Computools’ solutions, Caribbean Bank successfully increased customer loyalty alongside the performance rates and attracted a younger audience, thereby expanding its user base.

Challenges Identified

Prior to the development stage, the Computools team analysed the client’s business processes. This involved identifying the app’s strengths and weaknesses while establishing development objectives. During this analysis, the team pinpointed three critical problems.

Prior to the development stage, the Computools team analysed the client’s business processes. This involved identifying the app’s strengths and weaknesses while establishing development objectives.

During this analysis, the team pinpointed three critical problems.

1. Limited banking service offering for individual customers

The bank wanted to grow in the retail banking sector to stay competitive in the region. Therefore, it realised the need to provide more diverse functionality to individual users.

The demand for additional services was important, especially due to the low engagement rates among the younger audience, who found the application lacking in convenience.

2. Requirement to enable card transactions

Understanding the key role of card transactions in its business operations, the Caribbean Bank identified the need for integrating with Visa card processing facilities.

The institution aimed to improve the efficiency of transactions, ultimately contributing to a stronger and more user-friendly banking experience.

3. Stringent security requirements

An examination revealed that the app’s existing security features did not fully meet the required criteria for safeguarding user data, financial transactions and the overall system.

This underscored the need for significant improvements in the app’s security to ensure adherence to stringent requirements throughout the development process and the implementation of services and features.

Development Process

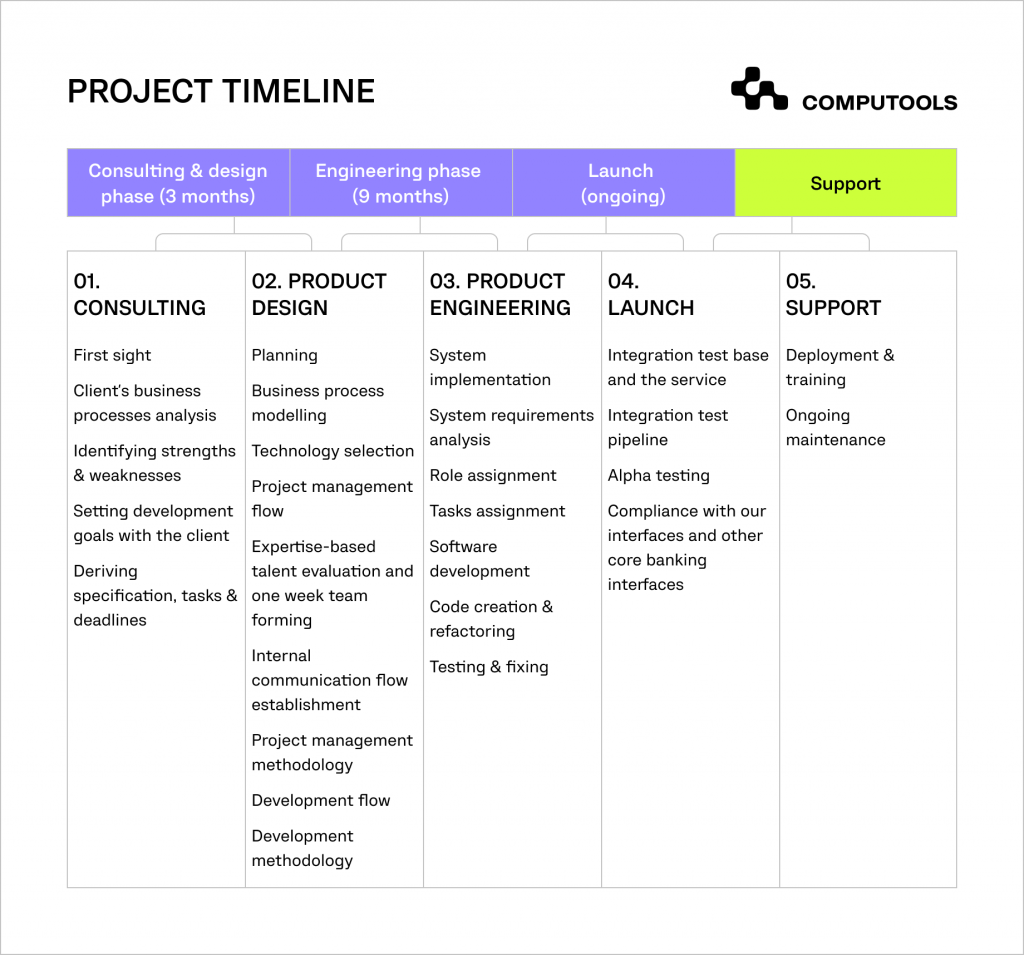

To add new features to the application and ensure smooth integration with the Visa system, the Computools team took a comprehensive approach, carefully analysing the organisation’s key needs.

This included creating a well-organised development plan, using the Scrum Agile framework along with a sprint-based project management approach.

The result of cooperation was an updated, fully functional web and mobile application with improved interfaces and a microservices architecture.

The project covered several important aspects.

Application Design

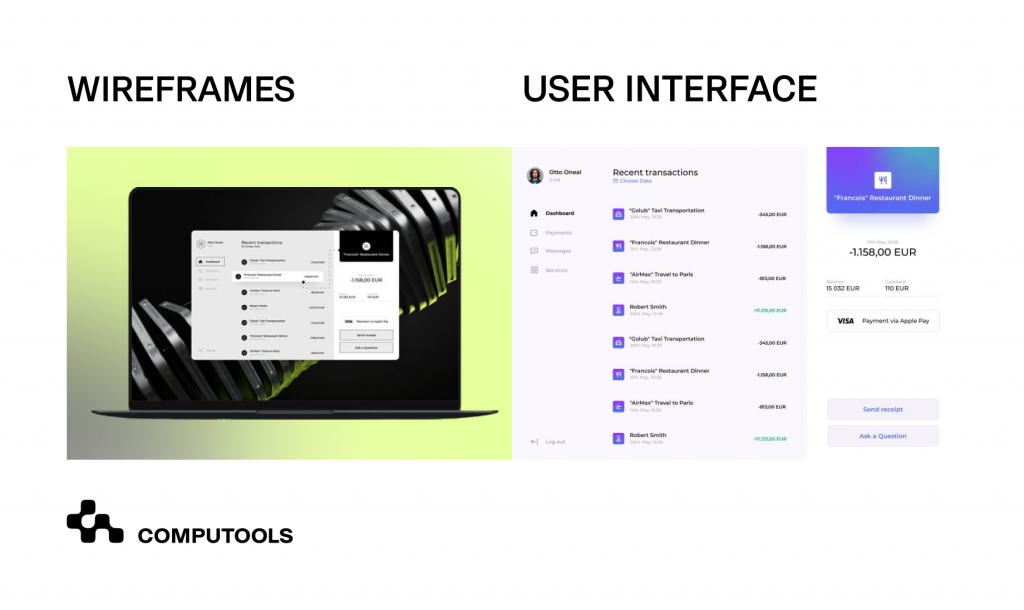

First, the team focused on enhancing the user experience by designing an interface that would be concise, easy to understand for users and without distracting elements.

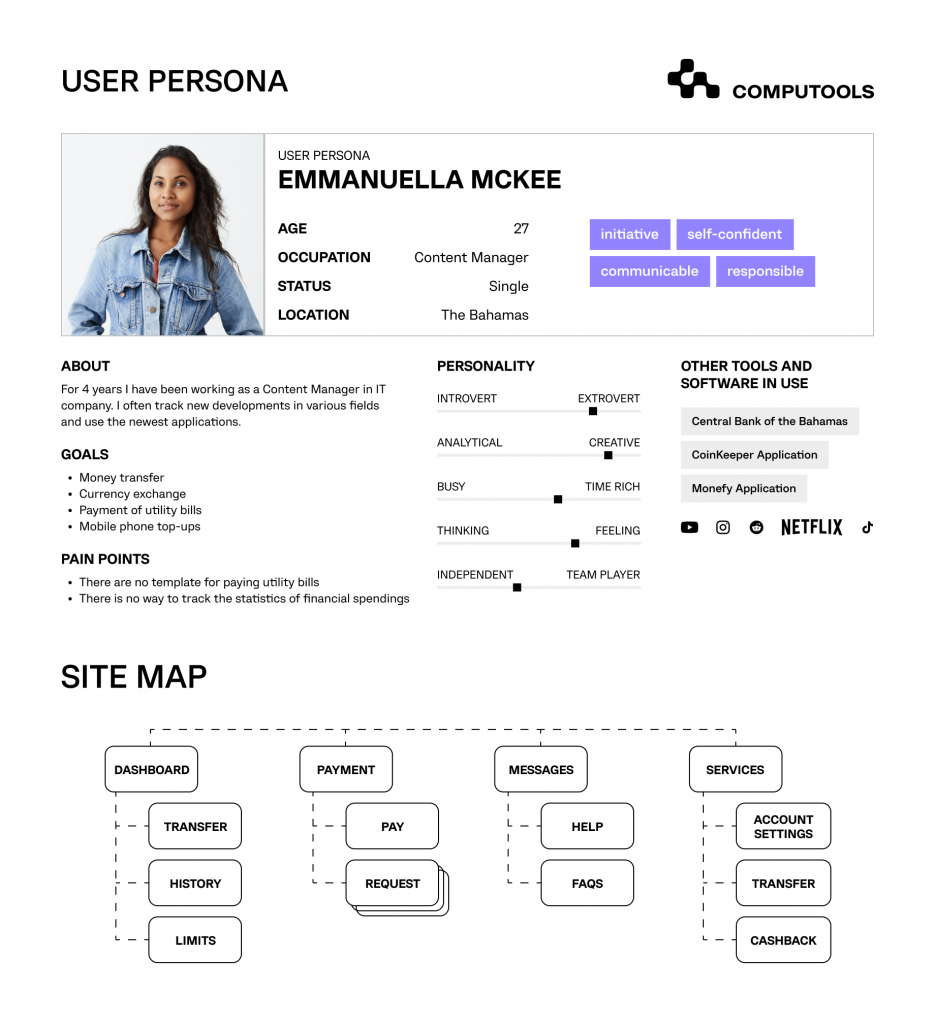

The design team began with defining user personas, product journeys and screen flows to improve both the look and feel of the app, revitalising user experience for web and mobile banking.

Microservices

Next, the Computools team developed the microservices, ultimately enhancing the security of the app, including:

• Control of client’s bank account transactions

Allows clients to lock and unlock their accounts, providing direct control over account access and enhancing security against unauthorised use.

• Parental control and transaction approvals

Adds an extra layer of security by requiring parental approval for transactions, which is especially useful for accounts used by minors.

• Confirmation of payment from the card account for international transactions

Improves security by verifying transactions when the cardholder is located in another country, reducing the risk of fraudulent transactions.

• Managing transactions

Allows clients to create, view, edit and delete transactions from their card to cards of other bank clients, clients of other banks and international bank clients, offering enhanced control and oversight over financial transfers.

Visa Integration

Finally, the team conducted the integration of the microservices architecture with the Visa API, ensuring a smooth linkage between the app’s new features and the Visa system.

This process involved setting up and executing an integration testing framework to verify the compatibility and functionality of any changes made within the core banking services.

Computools also guaranteed 100% compliance between the developed interfaces and those of other core banking systems, ensuring that all interactions were correctly aligned and functioned without issues.

Cooperation Outcomes

This project led to the development of a modernised application seamlessly connected to the Visa system.

This connection ensures stable financial integrations and establishes new data-driven models built around digital client engagement, ultimately ensuring users have an exceptional experience.

Here are some results in numbers:

• The partnership enabled Caribbean Bank to attract younger demographic groups, resulting in a 12% increase in market share among individuals aged 18 to 30.

• Our ongoing collaboration and support led to the automation of 52% of processes, significantly improving the efficiency of the corporate culture.

• After implementing the solution, Caribbean Bank saw a remarkable 79% increase in revenue, largely attributed to the younger demographic.

The modernisation of the Caribbean Bank’s financial app enabled the institution to expand into the retail banking sector, reinforcing its status as a leading services provider in the Caribbean.

To learn more details about this project, explore our case study.

WHAT OUR CLIENT SAID

Curious about expanding into new markets with Computools’ expertise? Email us at info@computools.com to schedule a consultation with our specialists.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”