The pandemic has drastically changed how we interact in every aspect of life, from simple grocery shopping to complex financial transactions. This move towards digital services, while revolutionary, has introduced a series of new challenges.

One significant challenge in digital banking is maintaining genuine, meaningful connections. The shift to online interactions suggests a risk of losing the personal touch, which could potentially weaken customer loyalty.

So, how can digital banks reinforce their relationships with customers and secure their loyalty? This article addresses this question by providing practical tips and strategies to enhance customer relations.

It also explores how financial software development can assist banks in achieving these goals more effectively.

Overview of Banking in the Digital Era

Digital banks are experiencing a surge in popularity across the globe, with countries like the United Kingdom at the forefront of adoption and innovation.

Statista predicts that in 2024, the worldwide digital banks market’s net interest income will hit US$822.5 billion, with the United States projected to contribute the most.

The rise of digital banks is primarily fuelled by the widespread adoption of digital technologies, particularly among millennials and Generation Z, who prefer conducting their financial transactions through digital channels.

Another key reason digital banks are gaining more popularity is their lower operating costs, as they lack physical branches, enabling them to offer more competitive rates and fees.

However, the digital banking industry faces stiff competition, and the technology revolution has significantly raised customer expectations in terms of convenience, speed and transparency.

Nowadays, banks make substantial investments in technology and customer service to meet these expectations.

Other significant challenges in banking include issues relating to security and trust. A security breach or even the perception of risk can result in a significant loss of customer loyalty, which is extremely difficult to rebuild.

Given the competition and the diversity of services available, customers are more inclined to switch service providers, even due to minor inconveniences.

CallMiner reports that businesses in the United States alone lose approximately $136.8 billion annually as clients switch brands.

Given those numbers, building and maintaining customer loyalty in banking is now a key focus for executives worldwide.

Yet, a Harvard Business Review report indicates that only 42% of executives believe their loyalty strategies are truly effective.

This brings us to the question: how can digital banks foster customer loyalty and what role do software development services play in achieving this goal? Let’s explore.

Guide: Building Loyalty in Digital Banking

1. Loyalty Programmes and Benefits

Banks have long relied on customer loyalty technology and the digital era introduces fresh opportunities to boost customer engagement.

Banks can deploy various elements of these programmes, including:

• points for transactions and purchases

• rewards for referrals

• loyalty level benefits

• exclusive early sales or previews

These initiatives aim to recognise and reward long-term customers, fostering a stronger connection between the bank and the consumer.

The notable aspect of loyalty programmes in the banking industry is that even unpopular establishments can launch successful initiatives, attracting new clients and strengthening bonds with existing ones.

Furthermore, in addition to the common loyalty programme, banks can explore:

• offering gifts or bonuses on customers’ birthdays

• encouraging customers to share banking activities or reposting content on social media

• providing discounts for subscribing to email lists or newsletters

2. Data-Driven Decisions

Modern digital platforms have the opportunity to leverage the vast amount of data to significantly enhance customer loyalty.

By collecting data across multiple channels, including mobile apps, and websites and direct customer engagement, through surveys and social media, banks obtain a comprehensive understanding of their customers’ needs and preferences.

Location-based advertising and monitoring activities on digital platforms also provide a rich source of feedback and insights into customer behaviour.

However, having access to data is just the beginning. The key to leveraging this data lies in its effective analysis. This is where data professionals, such as data scientists and analysts, become invaluable.

Armed with these insights, digital banks can tailor their services to better meet expectations, thereby enhancing customer trust. This targeted approach improves service offerings and strengthens customer relationships.

3. Gamification

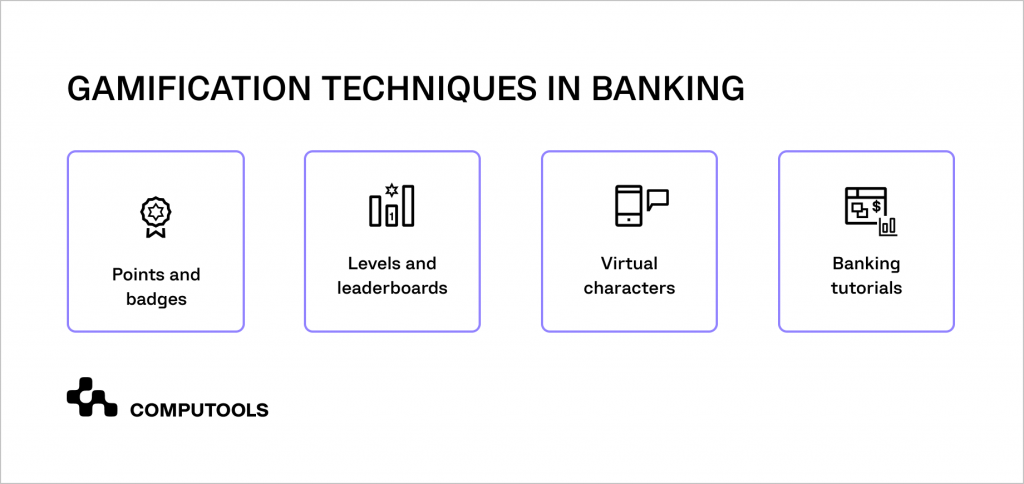

Using gamification in banking apps is a strategic way to make customer engagement and commitment more effective.

Recent reports state that implementing a gamified engagement strategy has the potential to lead to a significant 22% increase in brand loyalty.

By including gamification elements, banks can make various initiatives more appealing to their target audience.

Imagine users getting a pop-up message congratulating them for earning bonuses by maintaining a desirable money balance over a specific period.

In digital banking, gamification not only adds excitement to routine actions but also gives clients a real reason to stay loyal to their chosen bank.

A well-designed points or reward system creates a community of returning customers who feel a strong sense of investment.

4. Security and Fraud Prevention

Implementing robust security measures in digital banking serves a dual purpose: it not only guards against cyberthreats but also contributes to fostering and sustaining customer loyalty.

Proactive security measures, like biometric authentication, real-time transaction monitoring and swift detection and response to fraudulent activities, demonstrate the bank’s commitment to customer safety.

Consistently secure digital interactions lead customers to develop enduring relationships with the bank.

Moreover, customers are more likely to engage with a platform that prioritises their security, making it a key factor in their decision-making process. This loyalty stems from the reliability the institution provides.

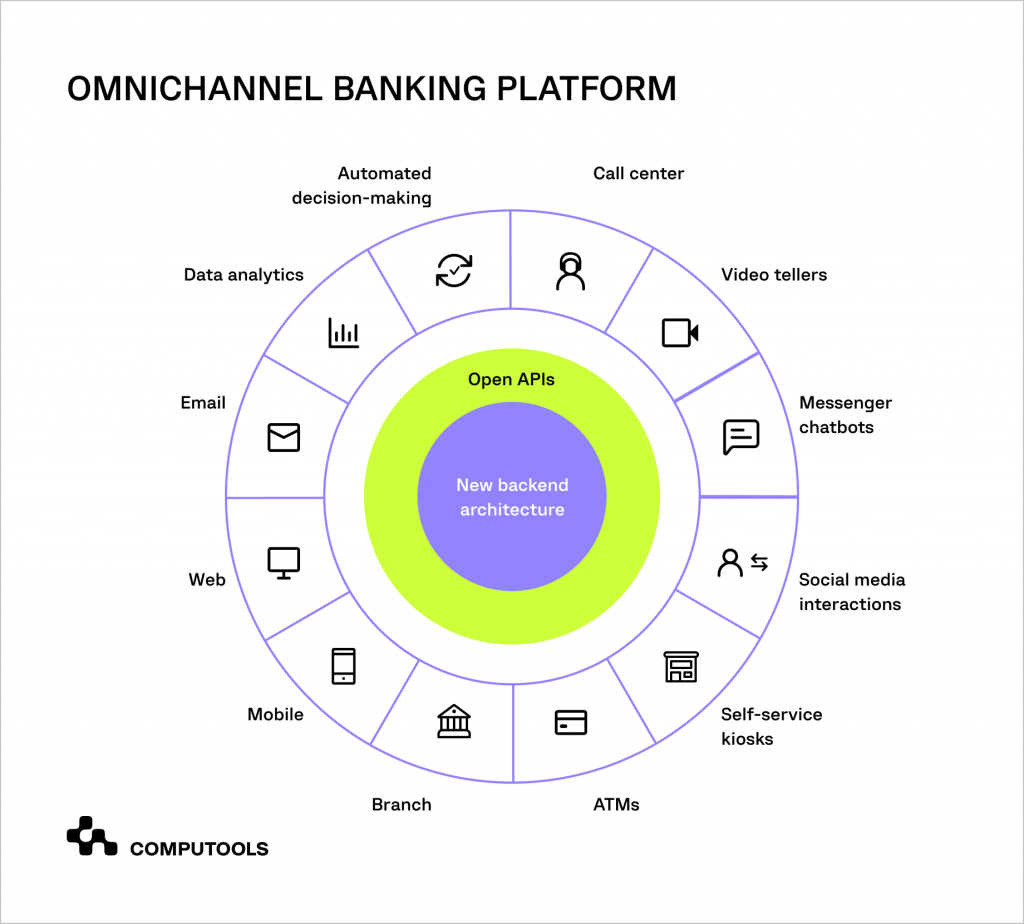

5. Omnichannel Experience

Modern consumers seamlessly use multiple devices at the same time. For financial institutions, it’s important to adapt to this digital banking trend.

This involves developing a communication strategy that effectively connects all touchpoints and establishes a well-integrated network of channels.

The key is in strategically collecting and interpreting data. By doing so, a digital bank can not only enhance its customer communication but also proactively manage risks and services.

This approach enables anticipating individual client needs, providing a more personalised and efficient banking experience.

6. Digital Customer Onboarding

Typically, the onboarding process concludes with a few customer interactions aimed at gathering information and completing a loan application.

However, by adopting a creative approach, onboarding can evolve into much more.

Onboarding is an excellent opportunity for banks to showcase their commitment to customer care.

Consider incorporating an online assistance feature into your mobile banking app, guiding users in the use of new financial products and services.

To streamline the onboarding process, consider the following tips.

1. Focus on creating an intuitive navigation system.

2. Develop a seamless mobile or web experience capable of addressing all customer needs online.

3. Establish a secure online verification process to build trust.

4. Implement autofill functionality to eliminate repetitive customer queries.

5. Provide swift access to the account or product immediately after the onboarding process is completed.

7. AI-Powered Virtual Assistants

The impact of AI on the banking sector has been revolutionary. With the integration of chatbots and virtual assistants, customers now have access to continuous and personalised support.

This transformation has significantly improved the interaction between customers and bank staff, leading to heightened satisfaction and the development of enduring relationships.

Also, AI-powered chatbots allow banks to offer customised recommendations and assistance, creating a mutually beneficial scenario for all parties involved.

8. Customer Relationship Management (CRM) Systems

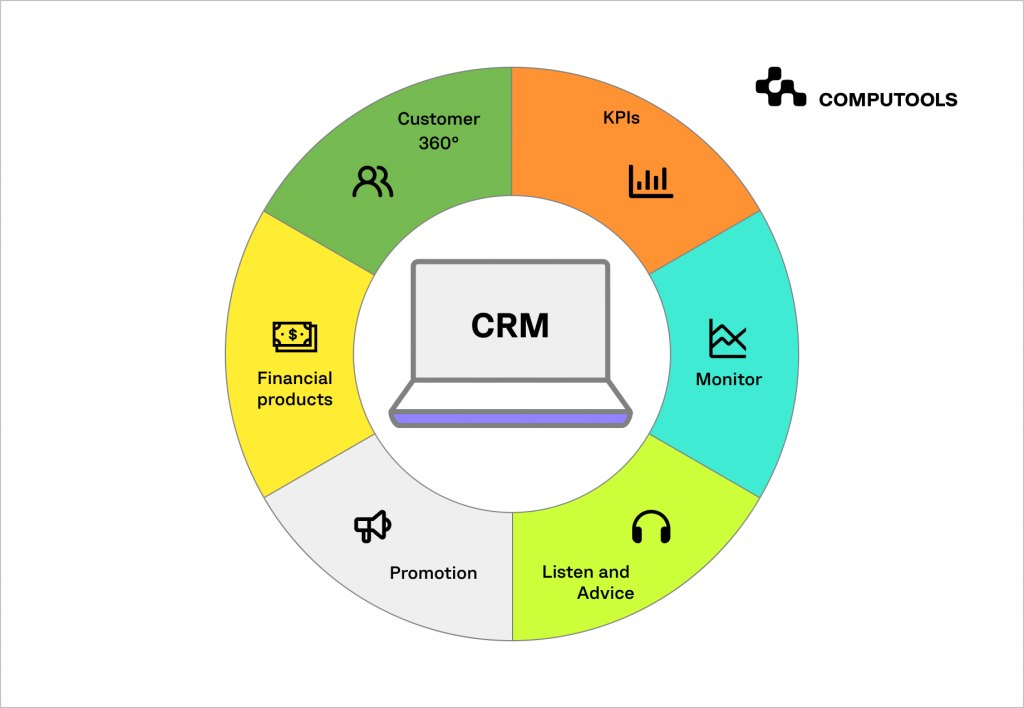

Customer relationship management (CRM) software plays a key role in building and maintaining customer loyalty.

Contrary to common belief, a CRM platform is more than just a basic database.

It goes beyond simply storing customer information; it involves analysing how customers interact with the company, creating strategies to boost brand awareness, streamlining processes, providing actionable analytics and offering detailed insights.

CRMs also help classify customers based on their engagement levels and value to the brand, automate targeted email marketing and offer various functionalities to improve customer relationships.

9. Digital Wallets

The rise of digital wallets holds significant implications for banks. Managing loyalty card programmes through digital wallets simplifies the user experience, providing greater convenience.

According to Forbes, more than half (53%) of people prefer using digital wallets over traditional payment methods.

Digital wallets offer banks a way to strengthen connections with customers, as they leverage various digital technologies, including augmented reality, to create a distinctive digital experience. This has the potential to increase customer engagement, boost revenue and encourage loyalty.

Moreover, digital wallets empower banks with control over payment data, improving user protection and securing transactions against potential fraud.

10. Personalised Banking Experience

To secure a high market position, banks need to shift their focus from product-oriented messaging to a customer-centric approach.

This entails placing clients, their needs and requirements at the forefront of the marketing strategy.

Banks can tailor their digital banking interactions by sending personalised messages, exclusive offers and targeted product recommendations aligned with their customers’ financial history and goals.

For instance, if a customer has recently shown interest in saving for a deposit on a home, banks can provide them with valuable information on mortgage options.

This personalised approach showcases banks’ awareness of client’s unique needs, fostering a sense of trust and loyalty.

Enhancing Customer Loyalty with a Software Engineering Partner

Building customer loyalty depends significantly on having a reliable software development partner who can help maintain a reputable image, thereby fostering trust among customers.

Here are our criteria for choosing a software vendor that can assist businesses in tackling banking challenges and achieving loyalty goals.

1. Agile Business Practices

In the realm of digital banking technology, every software company needs to be well-versed in agile development practices.

When choosing a development firm, make sure it can adapt effectively as the business grows. This includes aspects like scalability, incorporating new technology, offering various pricing models and gaining new skills.

2. Strong Subject Matter Expertise

Solid expertise in a particular industry equips a development team with comprehensive knowledge of the specific compliance and regulations governing that business vertical.

Regardless of the nature of the product your institution intends to develop, seek a partner with strong subject matter expertise to architect a reliable software solution.

3. Relevant Portfolio

Before partnering with a specific vendor, it’s important to make sure the company has practical experience in similar projects. So, when you’re in the process of choosing a software vendor, take the time to thoroughly examine the portfolio of your potential partner.

For example, Computools recently provided technological support to the leading bank in the Caribbean, serving over 500,000 clients. The bank faced significant challenges in connecting to VISA within reasonable timelines for the general banking application release.

After implementing Computools’ solution, the Caribbean Bank experienced a 12% increase in performance rates. Moreover, it successfully reached a younger audience, expanded its user base and improved customer loyalty.

Conclusion

Digital banking institutions have recognised the critical need for innovation to remain competitive.

They aim to inspire a shift away from traditional banking systems towards more creative strategies for building long-term customer relationships, and incorporating innovative processes is essential for staying relevant.

A great customer experience can make a big difference, even for smaller banks.

By reshaping the bank’s image through exceptional service, institutions can establish strong connections with their customers, fostering loyalty that transcends the conventional banking experience.

Please don’t hesitate to contact us at info@computools.com to learn more about how we can assist you in building customer loyalty for your business.

Computools

Software Solutions

Computools is an IT consulting and software development company that delivers innovative solutions to help businesses unlock tomorrow.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”