FASTER FINANCIAL OPERATIONS

Reported by clients after implementing our custom automation, real-time data processing, and AI-powered decision-making tools.

LOWER OPERATING COSTS

Enabled by smart risk management, compliance automation, and streamlined workflows.

EXPERTS ON BOARD

100% of our financial clients choose long-term partnerships to drive innovation and sustainable growth.

PROJECTS DELIVERED WORLDWIDE

Custom financial software built for leading banks, fintech companies, global insurers, and investment firms driving the future of finance.

Core Banking System Modernization Software

We replace outdated core banking infrastructure with cloud-native, modular systems that improve speed, flexibility, and integration capabilities. Our modernization solutions eliminate technical debt, unlock real-time processing, and empower financial institutions to launch new services rapidly, adapt to regulatory changes, and compete confidently in a fintech-driven landscape.

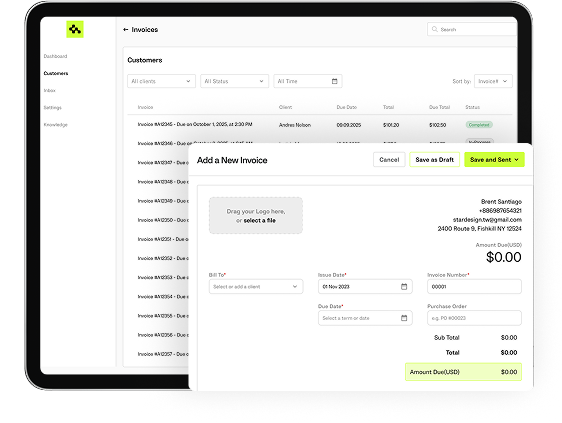

Financial Process Automation Software

We build Financial Process Automation Software that eliminates repetitive manual work by automating core functions like invoicing, reconciliation, reporting, and data validation. This boosts accuracy, reduces operational costs, and enables finance teams to scale efficiently while focusing on high-value tasks.

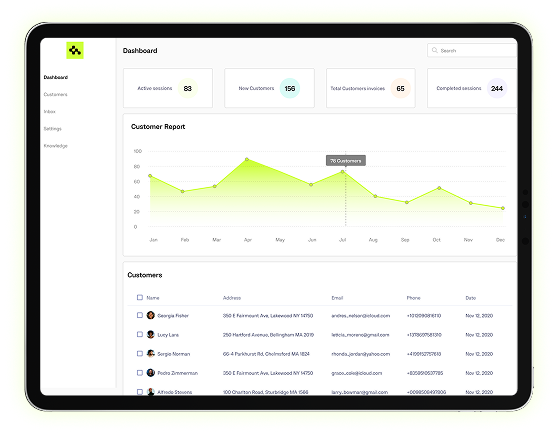

Financial Analytics & Business Intelligence Dashboards

We build powerful Financial Analytics & BI Dashboards that break down data silos and transform disconnected numbers into real-time strategic insight. By consolidating financial, operational, and customer data into a single intelligent platform, our solutions enable faster, more thoughtful decision-making, empower risk mitigation, and unlock hidden growth opportunities.

Financial Cybersecurity & Fraud Detection Software

We develop intelligent cybersecurity platforms that leverage AI and behavioral analytics to detect anomalies, stop real-time fraud, and safeguard sensitive financial data. Our solutions provide continuous monitoring, automated incident response, and full regulatory compliance, reducing risk while maintaining customer trust.

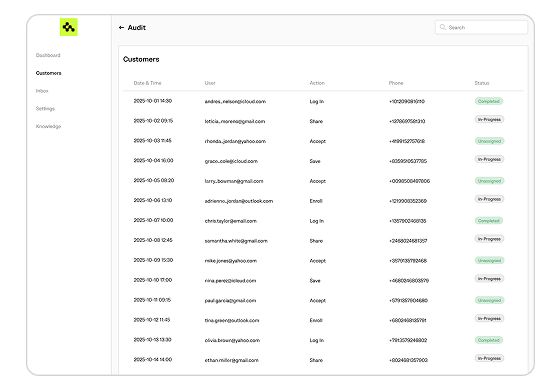

RegTech & Compliance Management Software

We develop RegTech & Compliance Management Software that automates compliance workflows, real-time risk scoring, and regulatory reporting. Our platform streamlines procedures, verifying identities, monitoring suspicious behavior, and flagging anomalies, all while keeping up with evolving global standards like GDPR, PSD2, and Basel III. This helps financial institutions reduce regulatory risk, lower manual efforts, avoid fines, speed up customer onboarding, and build trust through transparent operations.

Digital Client Onboarding Software

We build Digital Client Onboarding Software that automates every step of the customer acquisition journey, from document collection and identity verification to e-signatures and regulatory compliance. Our solutions simplify processes, eliminate paperwork, and allow secure, compliant onboarding in minutes instead of days.

Personalized Banking & Financial CRM Solutions

We develop intelligent CRM platforms and personalization engines tailored for financial institutions. By consolidating customer data and applying AI-driven insights, our solutions enable hyper-personalized experiences, dynamic product recommendations, and omnichannel consistency, increasing satisfaction, loyalty, and lifetime value.

AI-Powered Credit Scoring Software

To assess creditworthiness more precisely, we develop advanced AI-driven credit scoring systems that analyze traditional and alternative data, including behavioral patterns, transaction history, and digital footprints. This enables faster, fairer, and more scalable lending while minimizing risk exposure.

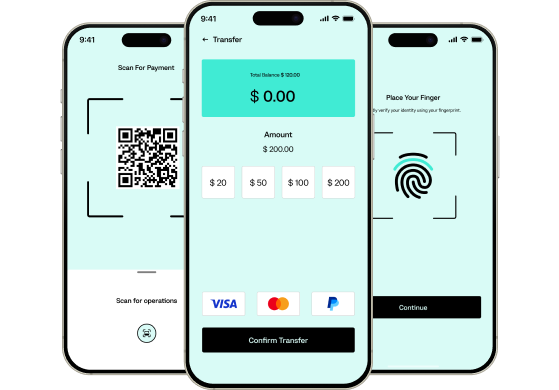

Digital Payment & Transaction Management Platforms

We develop high-performance payment platforms that eliminate delays, minimize transaction failures, and handle real-time, multi-currency processing at scale. Our solutions integrate seamlessly with core banking systems, reduce operational bottlenecks, and empower financial institutions to deliver fast, secure, and user-friendly payment experiences from domestic transfers to global transactions.

Custom FinTech Product Development

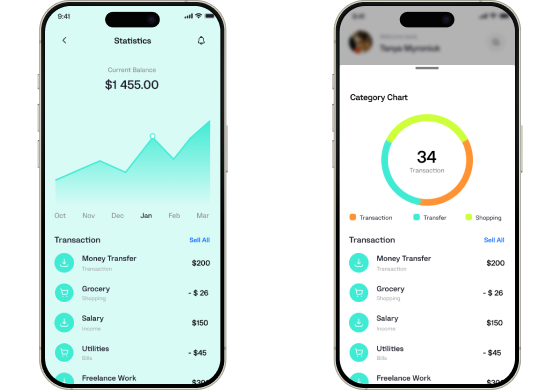

We design and develop cutting-edge fintech solutions for digital wallets, robo-advisors, investment platforms, and BNPL (Buy Now, Pay Later) tools. Our expertise helps financial institutions rapidly prototype, validate, and launch innovative products that drive growth, improve user engagement, and future-proof their market position.

Core Banking System Modernization Software

We replace outdated core banking infrastructure with cloud-native, modular systems that improve speed, flexibility, and integration capabilities. Our modernization solutions eliminate technical debt, unlock real-time processing, and empower financial institutions to launch new services rapidly, adapt to regulatory changes, and compete confidently in a fintech-driven landscape.

Financial Process Automation Software

We build Financial Process Automation Software that eliminates repetitive manual work by automating core functions like invoicing, reconciliation, reporting, and data validation. This boosts accuracy, reduces operational costs, and enables finance teams to scale efficiently while focusing on high-value tasks.

Financial Analytics & Business Intelligence Dashboards

We build powerful Financial Analytics & BI Dashboards that break down data silos and transform disconnected numbers into real-time strategic insight. By consolidating financial, operational, and customer data into a single intelligent platform, our solutions enable faster, more thoughtful decision-making, empower risk mitigation, and unlock hidden growth opportunities.

Financial Cybersecurity & Fraud Detection Software

We develop intelligent cybersecurity platforms that leverage AI and behavioral analytics to detect anomalies, stop real-time fraud, and safeguard sensitive financial data. Our solutions provide continuous monitoring, automated incident response, and full regulatory compliance, reducing risk while maintaining customer trust.

RegTech & Compliance Management Software

We develop RegTech & Compliance Management Software that automates compliance workflows, real-time risk scoring, and regulatory reporting. Our platform streamlines procedures, verifying identities, monitoring suspicious behavior, and flagging anomalies, all while keeping up with evolving global standards like GDPR, PSD2, and Basel III. This helps financial institutions reduce regulatory risk, lower manual efforts, avoid fines, speed up customer onboarding, and build trust through transparent operations.

Digital Client Onboarding Software

We build Digital Client Onboarding Software that automates every step of the customer acquisition journey, from document collection and identity verification to e-signatures and regulatory compliance. Our solutions simplify processes, eliminate paperwork, and allow secure, compliant onboarding in minutes instead of days.

Personalized Banking & Financial CRM Solutions

We develop intelligent CRM platforms and personalization engines tailored for financial institutions. By consolidating customer data and applying AI-driven insights, our solutions enable hyper-personalized experiences, dynamic product recommendations, and omnichannel consistency, increasing satisfaction, loyalty, and lifetime value.

AI-Powered Credit Scoring Software

To assess creditworthiness more precisely, we develop advanced AI-driven credit scoring systems that analyze traditional and alternative data, including behavioral patterns, transaction history, and digital footprints. This enables faster, fairer, and more scalable lending while minimizing risk exposure.

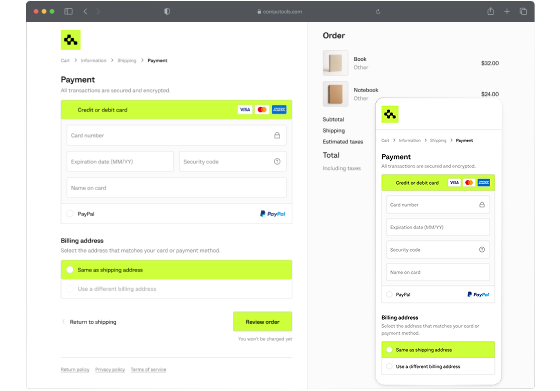

Digital Payment & Transaction Management Platforms

We develop high-performance payment platforms that eliminate delays, minimize transaction failures, and handle real-time, multi-currency processing at scale. Our solutions integrate seamlessly with core banking systems, reduce operational bottlenecks, and empower financial institutions to deliver fast, secure, and user-friendly payment experiences from domestic transfers to global transactions.

Custom FinTech Product Development

We design and develop cutting-edge fintech solutions for digital wallets, robo-advisors, investment platforms, and BNPL (Buy Now, Pay Later) tools. Our expertise helps financial institutions rapidly prototype, validate, and launch innovative products that drive growth, improve user engagement, and future-proof their market position.

We build secure, scalable digital banking software platforms that deliver seamless online and mobile banking experiences, including account access, fund transfers, bill payments, and customer onboarding.

Computools develops robust payment processing software and payment gateway integrations that support multi-currency transactions, real-time settlements, recurring billing, and secure connections with banking APIs and third-party systems.

We deliver intelligent investment management software and wealth management platforms for real-time portfolio tracking, automated financial advisory, and risk management—powered by AI and data analytics.

Computools creates custom financial CRM solutions and client portals to streamline communication, automate document handling, manage service requests, and personalize financial planning.

We build advanced compliance and risk management software to help financial institutions meet AML, KYC, PCI DSS, and GDPR requirements—while improving operational transparency and audit readiness.

Computools delivers custom financial workflow automation software that streamlines approvals, settlements, compliance checks, and client onboarding, eliminating manual tasks to improve speed, accuracy, and operational transparency.

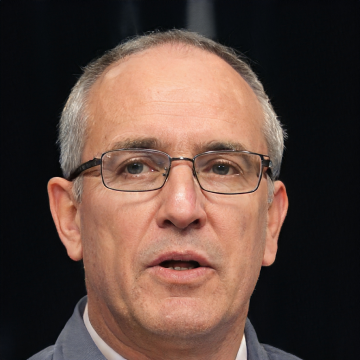

Oleh leads our finance department, specializing in retail banking and insurance sectors. He helps financial institutions launch impactful digital services and deliver real value faster — where compliance and customer trust are critical.

Oleh Stepanov

VP of Customer Success in Finance

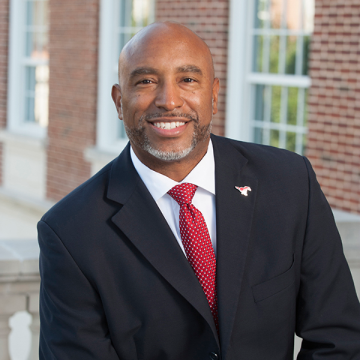

Alex blends project management and business analysis expertise to deliver strategic digital solutions for the financial and educational sectors. He helps trading, investing, and education-focused businesses modernize systems, launch effective software, and unlock business value through a collaborative approach.

Alex Palieshko

VP of Customer Success in Finance and Education

For over a decade, Oleg has successfully led our delivery department, ensuring every software solution not only aligns with clients’ strategic goals but also unlocks new growth opportunities and long-term value.

Oleg Svet

Chief Delivery Officer

“The team was very friendly and had the highest level of competence, engagement, and project management.”

“Computools predicted all possible points of our business growth and implemented them into the project.”

“We were highly satisfied with their deep understanding of our fintech processes and their project management was really superb.”

“Computools is a highly professional company with a skilled and responsive team. Their ability to propose valuable improvements and their dedication to the project made a significant difference.”

“The most noteworthy value that stood out was their exceptional experience in developing AI software solutions.”

“We were deeply impressed with their technical expertise, transparency, and flexibility. The team was highly skilled, easy to work with, and always proactive in solving challenges.“

“Computools offered non-standard solutions and maximized their investment in our business success.“

“Our company is impressed by their client-first approach and deep niche expertise.”

“A very comfortable collaboration and clear communication on every stage of platform development and maintenance.”

“After all these years, Computools never fails to arrive on time and with a quality that never ceases to amaze me. They work well as a team and are adaptable and communicative.”

“Within the first three months of its use, the designed program by Computools significantly reduced meter reading fraud by over 30%. Additionally, we saw a rise in operational effectiveness. Customer comments highlighted greater billing transparency and speedier service delivery, which contributed to an improvement in customer satisfaction levels.”

“They were professional, adapted to our short-notice needs, documented everything, and were transparent.”

“Thanks to Computools, we have seen a 15% growth in sales and a 40% boost in user satisfaction. Our image management has become more efficient, and our diagnostic capabilities have improved. Overall, the team has delivered a high-quality solution that meets our requirements.”

“Computools has significantly improved our LMS. The team holds regular meetings and provides detailed project reports, keeping us well-informed. We communicate via email, and overall, everything has gone smoothly.”

“Computools worked closely with us to understand our challenges. They developed a platform that integrated seamlessly with our existing infrastructure and Automatic Identification Systems (AIS) to capture private vessel data.”

“Computools’ work has had a positive impact on the client’s business. The team is flexible and responsive to the client’s needs. Their expertise has been key to the project’s success. Overall, the engagement has been positive.”

“Due to the platform’s use, the new products’ generated go-to-market timeline improves by 20%, cutting down on plan costs and, most importantly, enhancing the connection between the departments. The availability of near real-time information and the enhancement of the speed of decision-making are truly remarkable.”

“Thanks to Computools, we have successfully implemented our system and reduced the need for manual inspections. The team works in regular sprints and keeps us updated on progress. Their personalized approach, ability to listen, adapt, and continuously refine their methods are truly impressive.”

“Computools’ team truly impressed us with their dedication to the project, their ability to adapt to our processes, and their exceptional hard skills. This allowed us to identify many risks in the initial development stages and address some gaps in our processes. Professionalism, contribution, and flexibility are what define Computools. Based on my experience, I strongly recommend Computools for Dedicated Delivery and outsourcing project services!”

“Computools has delivered a functional solution that helped us increase revenue fivefold, reduce costs, and boost productivity. The team efficiently manages tasks in Jira and keeps us updated through weekly calls. Their productive approach and strong work ethic truly stand out.”

“Computools’ technical knowledge is impressive.They delivered the product on time, within the agreed budget, and fully aligned with our requirements.”

“Thanks to Computools’ efforts, we have seen compliance with deadlines and budget and team scalability as needed. The team has a confident project manager who delivers a professional and organized project. Moreover, Computools has quickly onboarded to the project and delivered fast results.”

“Thanks to the new solution, we’ve significantly reduced manual marketing workflows. Computools manages the project effectively, using Scrum methodology to execute tasks efficiently. Their problem-solving skills and ability to anticipate challenges set them apart from other providers.”

“Computools has successfully delivered everything as planned, adding value to the app. The team is highly approachable, tracks progress, and provides real-time updates via Slack. They maintain smooth communication through email and messaging apps, regardless of time zones.”

“Thanks to Computools, we now have an app that integrates 2,000 users into a single platform, significantly reducing the time spent on data exchange between systems and applications. The team manages our collaboration effectively and quickly adapts to changes. Overall, our experience has been highly successful.”

“Computools has been responsible for creating a novel database and front-end solution, incorporating both the development portal for digital standards and a modern shop for the sale of these standards. Throughout the course of the project, we have been consistently impressed by the professionalism exhibited by the Computools team, as well as their detailed understanding of our client’s processes. Their expertise, commitment to our objectives, and consistent delivery of high-quality work are notable aspects of their service.”

“Thanks to Computools, the client saw a 35% increase in daily active users and a 25% rise in user retention rates. The Android app also saw a 20% reduction in load times. User feedback indicated high user satisfaction; the feedback highlighted the product’s enhanced navigation and content linkage.”

“They are some of the best software developers I ever had the privilege to work with. Among other skills, their project scope and time estimation are very good and when wrong will work around the clock to make the date especially if it has business consequences. Not only are they amazing software developers, but they are also great people to work with. I am in awe seeing their devotion.”

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”

“After analyzing our requirements, Computools outlined potential solutions and deadlines for each stage. They designed the user flows and defined the user personas. They built the platform infrastructure and oversaw its implementation. Once we finished development, we conducted usability tests to assess their submitted work. Computools led an organized, agile team that adapted to our evolving needs. They listened to our feedback and managed their time well throughout the project.”

“The application perfectly meets the large-scale demands of the project, with the team creating an effective solution that works well and provides the required level of control. They were communicative, responsive, and proactive throughout the project, demonstrating their experience at all times.”

“The Computools team came to us with ideas, and that’s unusual. I’m satisfied that they gave us the right recommendations which are contemporary and relevant for today’s users. Because with other companies on previous projects, it was like pulling teeth to get them to make suggestions. The product received positive feedback even before being implemented and has led to significant customer and revenue growth.”

“We had to meet a significant increase in the development, so we needed to scale up relatively quickly but cost-effectively. The result definitely meets our expectations. The completed project received positive feedback for features and overall design. They’re very organized from a project management perspective and they’re technically competent. We appreciated their innovativeness, professionalism, and great communication skills. ”

“Their team has given us strong learning opportunities, and their developers are accommodating and collaborative.”

“We’re satisfied with the quality of work Computools deliver. They listen and try to understand our needs instead of finding new ways to charge us. We appreciate their transparent work structure. They kept us up-to-date regarding their progress throughout the entire development cycle. Knowing the system’s status throughout the coding process put my mind at ease.”

“They are very accommodating. They have very talented people. I’ve worked with hundreds of overseas developers and it’s not normal to have such excellent overseas developers. I don’t have to babysit Computools. They speak great English. They’ve also really helped with making suggestions on how to improve the product.

When we first launched our product at the beginning of the year, we were at 30,000 users a month and now we’re at 70,000. The bump in users is a result of the increased option rate and the new toys that Computoolls have built for me.”

“Computools developed software for our business to help automate our processes. Their team is very easy to speak to over Skype, where I can speak directly to a designated client manager, project manager, and the development team.”

“They were able to reduce the customer entry acquisition process from 2–3 weeks to 48 hours and have completely optimized all business processes. They’re a trustworthy company, full of integrity and great principles. They also communicate well in spite of the distance and resolve problems quickly.”

“They have a very positive attitude, which I enjoy a lot, and their technical skills are impressive. During this project, I got acquainted with their VP in charge of technical development, and he’s very impressive. Technologically, they are on the cutting edge of what they do. They use a lot of interesting technologies, which is good.”

Chief Delivery Officer

Computools specializes in custom financial software development, including banking solutions, trading platforms, payment processing systems, and risk management applications tailored to meet the unique needs of financial institutions.

Security is a top priority for Computools. We implement advanced encryption, multi-factor authentication, and comply with industry standards like PCI DSS and GDPR to protect sensitive financial data and ensure secure financial software transactions.

Yes, our team has extensive experience building financial software that adheres to regional and international regulatory requirements such as SOX, MiFID II, and Basel III, ensuring your solution is both effective and financial software compliant.

The timeline depends on the project scope and complexity. On average, financial software development by Computools can take between 3 to 12 months, including business analysis, design, development, testing, and deployment.

We use cutting-edge technologies including Java, .NET, Python, blockchain integration, AI and machine learning, and cloud platforms like AWS and Azure to build scalable, secure, and high-performance financial software.