Head of Sales – Insurance

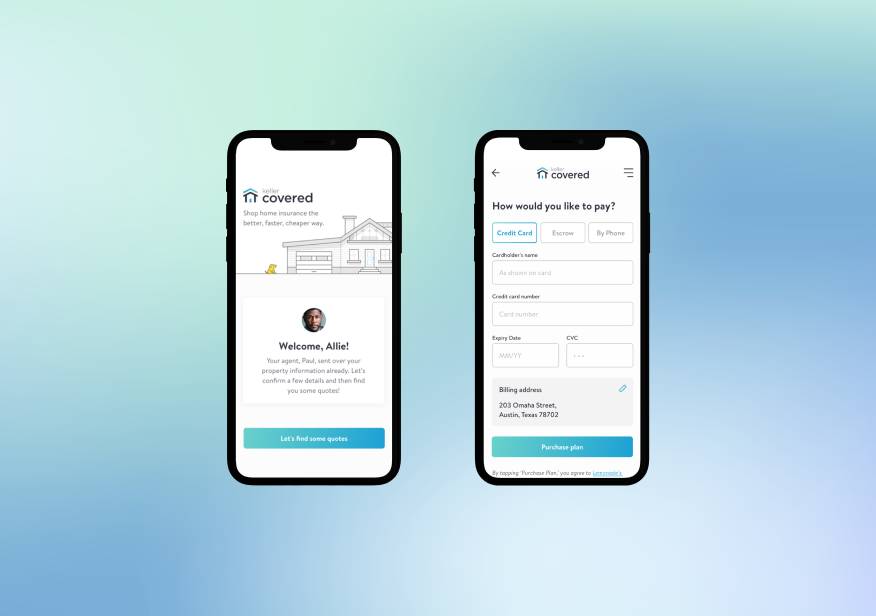

As Head of Sales, you need digital tools that simplify lead generation, track customer interactions, and automate the entire sales lifecycle — from quote to policy issuance. You’re looking for a tech partner who understands insurance customer journeys and can implement intelligent CRMs, omnichannel platforms, and AI-driven sales insights. Your priorities are speed, personalization, and empowering your sales force to convert more with less manual work.

Underwriter – Insurance

As an Underwriter, you need data-driven platforms that automate risk analysis, streamline underwriting workflows, and integrate real-time data sources for more accurate decision-making. You’re searching for engineering services that can deliver underwriting engines, rule-based automation, and predictive models. Your top priorities are consistency, speed, and reducing human error while improving profitability through smarter risk assessment.

Head of Investment Department – Insurance

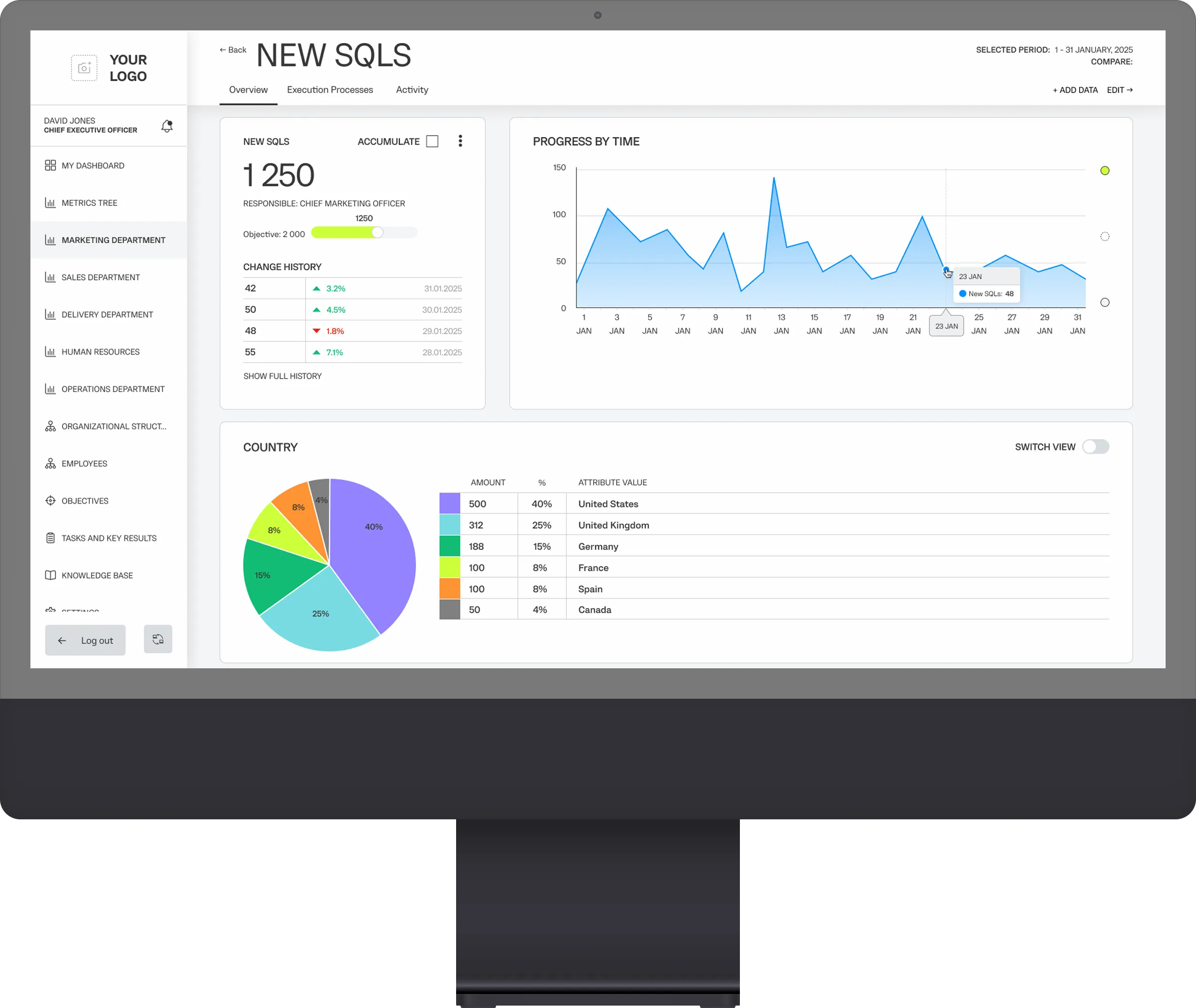

As Head of the Investment Department, you need robust financial software that consolidates data, models risk-return scenarios, and provides real-time analytics on investment performance. You’re looking for a tech partner who can build secure, compliant platforms for portfolio management, reporting, and optimization. Your priorities are transparency, risk mitigation, and extracting maximum returns through automated insights and integrations with financial markets.

Head of Reinsurance – Insurance

As Head of Reinsurance, you need systems that automate treaty management, streamline contract administration, and provide dynamic risk-sharing models. You’re looking for digital solutions that can track exposures, model catastrophic scenarios, and ensure real-time reinsurance accounting. Your priorities are automation, accuracy, and the ability to negotiate and manage complex deals with confidence and speed.

Head of Risk Management Department – Insurance

As Head of Risk Management, you need a centralized risk platform that integrates data across departments, performs scenario modeling, and automates compliance reporting. You’re looking for a partner who can build solutions with built-in analytics, alerts, and visual dashboards to monitor solvency, regulatory adherence, and operational exposure. Your focus is on proactive risk detection, improved governance, and reinforcing financial resilience with technology at the core.

Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.