It is a known fact that InsurTech can change the insurance industry and make it better and more customer oriented. Insurers across the globe acknowledge the value of InsurTech. Unfortunately, very few actually adopt it. This was confirmed by a survey of FRISS, insurance fraud detection technology provider.

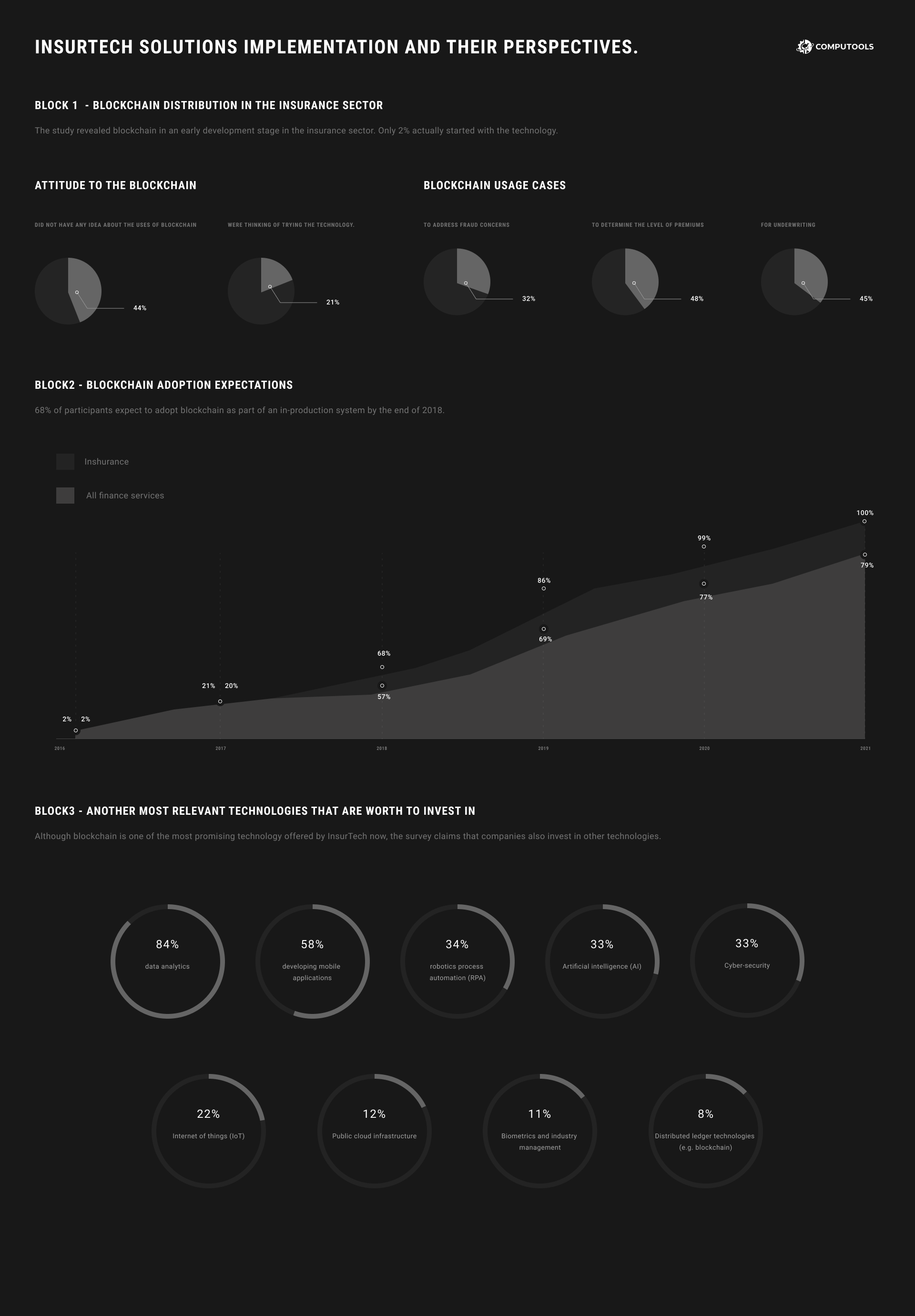

The results of this survey show that only 19% of insurers have already invested in InsurTech. Even though 88% of insurance companies’ owners were convinced that InsurTech adoption offers great opportunities and half of them were found working on InsurTech apps or conducting experiments with the apps, lots of companies still hesitate.

Moreover, the study found the adoption of online channels by insurers more difficult than anticipated. In addition, 69% of insurers currently have some form of online distribution. However, the figure marks a rise of only 4 percentage points since 2016.

What Challenges Impede Adoption of the InsurTech?

The use of Digital transformation technologies, such as the artificial intelligence (AI) has been a game changer in the whole industry. It’s a new way of working with a broker to ensure the best possible policy written for a the company. Some companies also implement apps, which could effectively create on-demand insurance for situations like borrowing a friend’s car. The adoption of a peer-to-peer model can also be used to create customized group coverage and incentivize positive choices through group rebates.

Investing in the InsurTech related projects can be an opportunity for insurers to expand their products and services, increase their customer base, and leverage their analytical capabilities.

Nevertheless, while many of these innovations have been desperately needed, they’ve also come with their own sets of challenges. This industry is stable and isn’t looking for novelty; companies play on caution, which means many of them turn away from all opportunities offered by InsurTech. According to PwC research, just 43% of insurance businesses state that Fintech (and Insurtech as well) is at the heart of their business.

Computools

Software Solutions

Computools is a software consulting and engineering company that delivers innovative solutions to help businesses unlock tomorrow. Our clients represent a wide range of industries, including retail, logistics, finance, healthcare, and others.

Another challenge: many startups still require the assistance of a traditional broker to take over the task of underwriting and to manage catastrophic risk. The experts predict the startups will eventually warm to the hearts of big players in the insurance industry. However, it’ll take a little more time than expected. ” Startups with little or no prior knowledge of the insurance industry struggle to quickly demonstrate their value proposition”, claims Renaud Million, co-founder & CEO of SPIXII. This is where insurance companies and InsurTech startups usually realize they need each other. Despite their fundamental differences.

One more inevitable challenge: regulations. Insurers are faced with two big regulatory challenges. First, new capital regulations that were designed for banks but have been applied to insurance (such as the need to have more capital in reserve to survive a financial crisis). Second, the strong push for global standards. Insurers are often reluctant to embrace new products and services out of concern of navigating these complex compliance and licensing requirements.

The lack of urgency is another challenge meet by InsurTech. “New technologies are reducing losses and costs while saving lives and increasing customer satisfaction, increasing risks and driving new business models and consolidation within the industry. New advances such as driverless cars, machine learning, home sensors and ‘robo-agents’ empowered with artificial intelligence offer a world of opportunity for insurers,” said Gary Reader, Global Head of Insurance, KPMG International. Insurers are slow to move because they, “Lack the hallmarks of an innovative organization, such as dedicated budgets for innovation, formal strategies, executive-level support, and performance metrics.” The challenge, as pointed out by Clay Christiansen in his book “The Innovator’s Dilemma” is that those who resist change, or rest on past approaches are on a slippery slope to mediocrity and a slow decline.

New technologies, and those that adopt them rapidly, are shown to maintain the highest profit margins.

Adopt insurance tech solutions with a reliable partner. Contact info@computools.com for more details.

Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.