The global capital markets have demonstrated impressive resilience and growth potential, particularly in the capital raising sector, which is projected to reach approximately $603.2 billion in 2024.

This dynamic market encompasses various forms of funding, such as public offerings and private debt securities, and is increasingly influenced by technological advancements and evolving investor behaviour.

By using AI solutions for capital markets to evaluate massive datasets, artificial intelligence (AI) is radically changing trading techniques in the financial markets. Financial organisations can now see patterns and trends that they would not have seen in the past.

Capital markets are adopting AI faster; estimates suggest that AI-driven solutions might provide value additions of up to $200 billion to $340 billion worldwide.

Approximately 67% of financial organisations are currently using AI solutions to improve their operations.

The Rise of AI in Capital Markets

Building an organisational AI competency is the only way finance can ethically fulfil its responsibility to verify the accuracy of financial statements while using AI to automate processes and make choices.

Data is a vital resource for using AI in capital markets. Large amounts of data with more precision are useful for creating dependable and efficient AI models.

Opportunities and Challenges

The functions of capital markets include mobilising savings for investment, providing liquidity to participants and facilitating the efficient allocation of resources.

The main types of capital markets are divided into equity and bond markets, each of which plays a key role in raising capital for companies and governments.

The growth of capital markets is fuelled by economic development, an increase in the number of investors and the introduction of innovative financial instruments, ultimately contributing to overall economic growth and stability.

The scope of capital markets’ use of artificial intelligence technology starts with credit scoring for business banking. But the field can be much broader — some banks help businesses create digital avatars and recognise employees by face.

The use of AI by large companies in the corporate segment has been on the industrial rails even before the wave of “hype” around generative models.

Here are some examples of instruments of capital markets:

1 Automate processes with RPA

RPA, or robotic process automation, lowers expenses while increasing accuracy in data reconciliation, transaction settlement, customer support, and compliance.

You can utilise RPA to complete these jobs more quickly and effectively rather than investing a lot of time and resources in them.

Additionally, it facilitates the removal of obstacles between divisions within your business and the preparation of clear reports for regulatory bodies.

2. Cognitive technologies

Cognitive technologies, such as machine learning (ML) and natural language processing (NLP), can handle intricate jobs like anomaly detection, portfolio management, and financial advice.

These AI development services employ data analytics to forecast occurrences, so you may be ready for market shifts ahead of time.

You can then focus on more important tasks, such as developing new ideas and improving client relationships.

3. Sentiment analysis with NLP

Market sentiment can greatly influence market movement, especially in volatile times.

With NLP-based AI, you can analyse sentiment by gathering data from social media, market research and customer feedback. This can help you better understand current sentiment and make more informed decisions.

4. Credit risk evaluation

AI algorithms analyse vast amounts of data to assist you in promptly spotting abnormalities and changes in the market, such as credit concerns.

With machine learning, you may use more sophisticated risk management strategies and respond to possible risks faster.

5. Trading algorithms

AI in financial markets facilitates fast and precise evaluation of consumer behaviour, market circumstances, and new trends.

Trading algorithms enable you to make decisions more quickly and accurately, increasing the return on your investment.

6. Chatbots to enhance client satisfaction

Chatbots are especially helpful in capital markets and are widely used for customer service and sales. They may provide individualized services, promptly respond to clients’ inquiries about market circumstances, and handle common account problems.

AI Software Engineering offers excellent opportunities for capital markets, but it has its challenges.

You need to create efficient and flexible solutions that can quickly adapt to changes in the markets and handle large volumes of data. AI solutions require significant resources, time and in-depth knowledge of finance and technology.

However, the AI benefits for business are clear: you get more accurate predictions, optimise operations and improve customer experience.

To get the best results, it’s important to use custom Software Engineering approaches to address your company’s unique needs.

Computools

Software Solutions

Computools is an IT consulting and software engineering company that delivers innovative solutions to help businesses unlock tomorrow. Our clients represent a wide range of industries, including retail, logistics, finance, healthcare, and others.

Trends and Forecasts for AI in Capital Markets

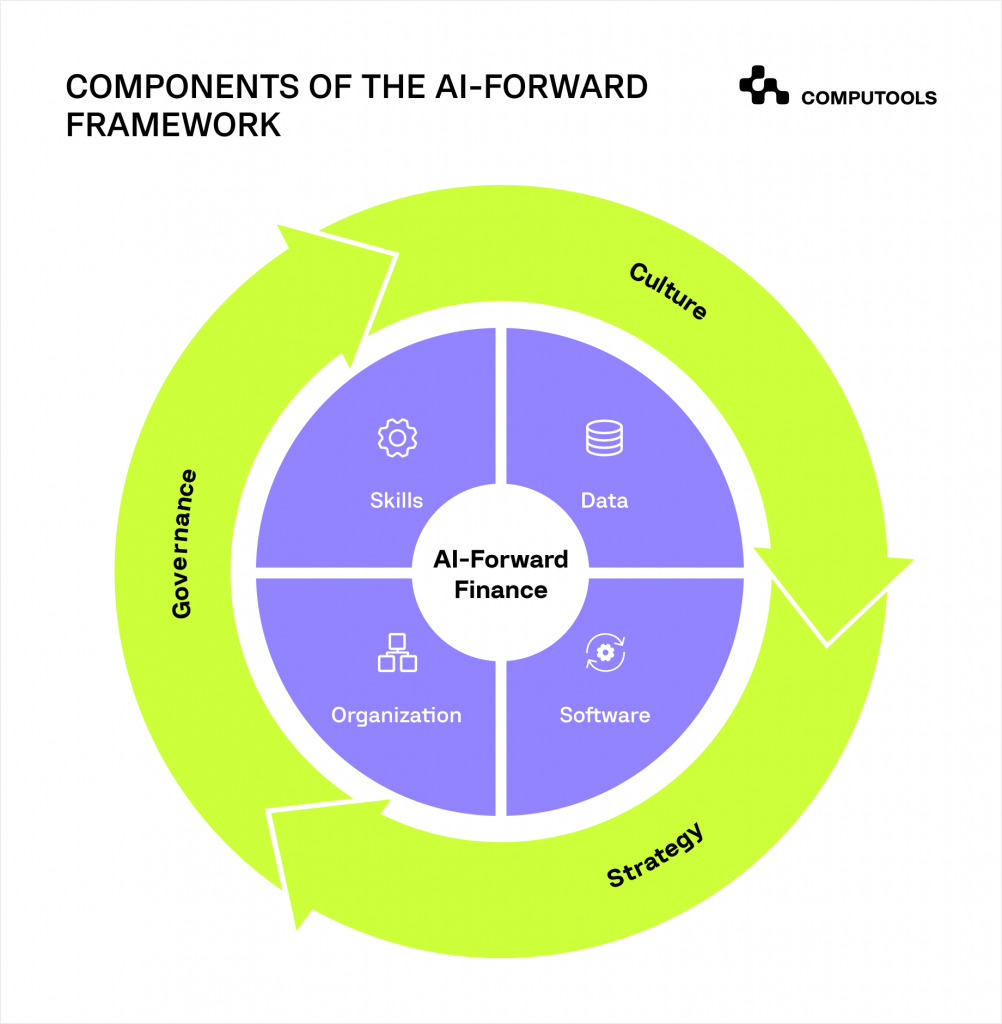

McKinsey states that the capital markets industry is experiencing a shift in how AI solutions for capital markets are leveraged, with a focus extending beyond mere technical implementation.

A key trend is the recognition that capturing value from AI requires addressing organisational and cultural factors alongside technological advancements.

This holistic approach is driven by several factors:

1. Skill Gaps and Change Resistance:

Surveys indicate that 60% of executives face skill gaps as a major hurdle in digital transformations, while 70% report resistance to change.

This highlights a growing trend where successful AI integration depends on developing the right skill sets and fostering a culture that embraces change.

2. Strategic Reallocation of Tech Investments:

There’s a noticeable trend of capital markets firms shifting their tech spending from “run the bank” maintenance towards “change the bank” initiatives.

This shift reflects a broader realisation that AI and technology investments should focus on growth and innovation rather than just maintaining existing operations.

However, many institutions still struggle aligning their technology portfolios with long-term value drivers.

3. Comprehensive Organizational Transformation

The publication Rewired emphasises a trend towards comprehensive organisational transformation, where investments in technology are paired with efforts to redefine roles, break down silos, and create compelling visions for stakeholders.

This trend underscores the necessity of investing in change management and organisational strategies to complement technological advancements.

4. Efficiency in AI Model Validation

A growing trend in the industry is the push towards more efficient AI model validation processes.

Traditionally, validating AI models, especially in risk-sensitive environments, can take up to two years.

However, there is a movement towards streamlining these processes to reduce time without compromising risk management.

5. Integrated Approach to Value Creation

There is a trend towards integrating AI not just as a tool for automation or data analysis but as a strategic asset that can drive business value.

This includes using AI to reduce risks, generate new revenue streams, and optimise costs. The focus is increasingly on understanding where AI can add the most value and strategically allocating resources to those areas.

6. Institutionalizing Change Management

Finally, a critical trend is the institutionalisation of change management practices that extend beyond the technology department.

Successful institutions recognise that the benefits of AI are maximised when there is a coordinated effort across the organisation to support these initiatives.

Why is It Important to Have a Trusted Software Development Partner?

We know from talking to our clients that the majority of businesses who are actively utilizing AI in their operations are thinking about how the technology will affect business KPIs in addition to technical ones. NPS, problem-solving times, and customer retention rates are a few examples of these.

They understand that increasing client satisfaction is a major source of income. The company’s success is determined not just by the technical capabilities of AI, but also by its impact on consumer happiness, loyalty, and returning customers.

AI has several advantages for business:

• Modern companies need to be able to effectively analyse large amounts of data to identify patterns and trends. This allows you to forecast demand, anticipate customer behaviour and make informed business decisions.

• Successful technology adoption can automate routine tasks such as data processing and customer service, freeing up employee time for more complex and creative tasks.

Our AI cases and achievements

We have successfully delivered several case studies that demonstrate our ability to apply AI to achieve significant business results:

Dental Health: In this project, we upgraded a dental practice platform that integrated AI to analyse images and create analytical reports quickly. This has accelerated the process of planning medical interventions.

Medirect: A medical records management system we developed for an Australian hospital converted handwritten notes into an indexed electronic format, improving diagnosis and medical recommendations using machine learning.

Metersnap: We created an AI and computer vision-based mobile app for one of Africa’s leading energy companies to manage consumption data. This solution improved data accuracy and allowed us to work in low-connectivity environments.

Auto Union: We developed situational awareness and obstacle detection software for a major European car manufacturer that uses video processing and machine learning algorithms to improve road safety.

Medicare Assistance: Our solution for a Norwegian healthcare provider uses NLP to manage the workload of clinical staff, significantly reducing administrative planning time.

The future of AI in capital markets involves balancing the excitement around new technologies with practical considerations like data quality, model performance, and explainability.

Final words

Technology is the core of CFO initiatives to enable financial transformation operations, budgeting, and forecasting.

Technology solutions are also in demand to effectively complete various daily functional tasks in areas including financial planning and analysis, core finance, financial closure, contract and document management, materials management, and vendor management.

CFOs need to work with their CIOs to broaden the role of AI in business, capabilities, and procedures within the finance team to make value-driven finance technology choices. They could even require a new position — Chief Information Technology and Finance.

Find out how Computools’ AI development services can transform your company. Our knowledgeable staff is prepared to assist you in utilising the newest AI technology to spur innovation and expansion.

For more information on how we can customise AI solutions to your unique demands and maintain our competitive edge in the capital markets environment, contact us at info@computools.com.

“Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.”