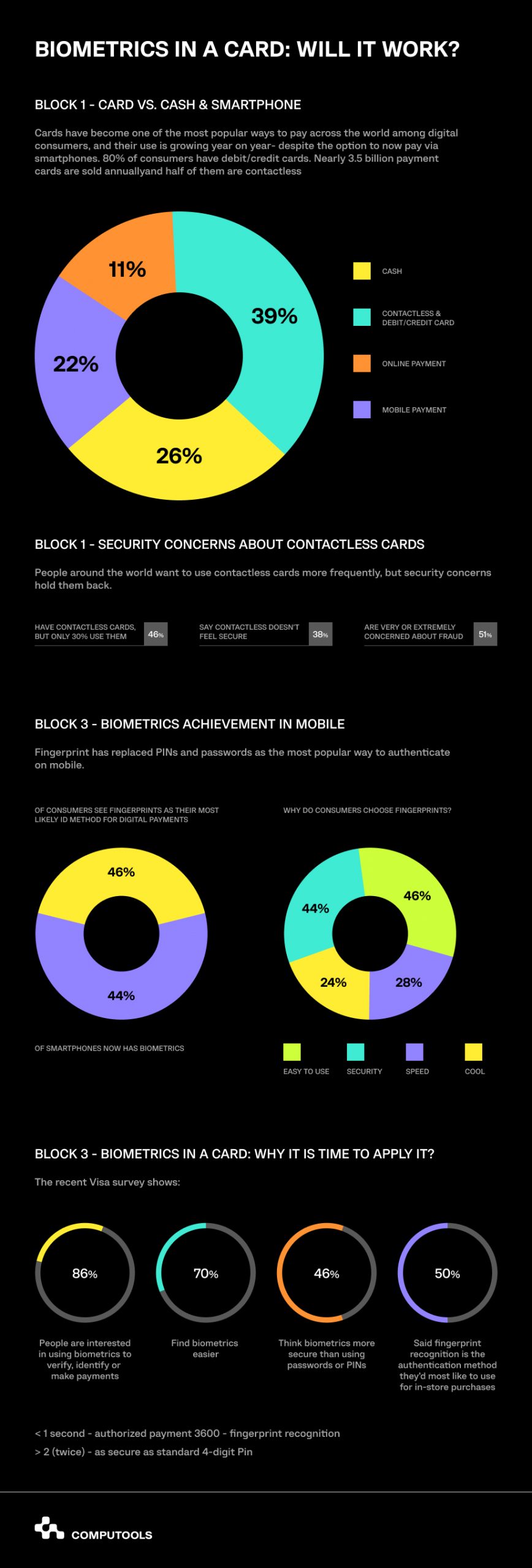

Cards are the most popular way to pay across the world among digital consumers, and their use is growing year-on-year – despite the option to now pay via smartphones. The experts claim that 80% of consumers all over the world have debit or credit cards. Another well-known fact: nearly 3,5 billion payment cards are sold annually and half of them are contactless. A consumer research revealed that people around the world want to use contactless cards more frequently, but security concerns hold them back.

Biometric Security Systems: A New Solution for Contactless Payment Cards

Where contactless payments cards are very popular, recent reports reveal that contactless card fraud is on the rise. However, companies offer a reliable and simple solution: biometrics. What is biometric data and how can it help to prevent card fraud?

Part of the body such as a fingerprint, eye, face or voice is used to verify someone’s identity. It’s been hugely successful in the mobile phone market – 60% of smartphones now have biometrics – with a fingerprint most often replacing PINs and passwords for activities such as unlocking the phone and making mobile payments. The modern technology is now available to bring biometrics to payment cards. Which means consumers can have all the speed and convenience of contactless payments, with the added confidence and security of biometric authentication.

Looking for state-of-art solutions to enhance your financial data security?

Contact us →The types of card fraud prevented by biometrics:

-

- – payments using a lost or stolen card;

- – someone the cardholder knows using their card without their approval;

- – skimming – for example where a criminal uses a payment terminal to scan the card through the cardholder’s pocket;

- – nobody can see over the shoulder what the PIN is;

- – no risk of forgetting the card stuck in the POS terminal.

In all these cases and much more credit card fraud protection will save money of the cardholder and protect his personal data as well.

Biometrics for Payment Security: How Easy to Apply and Use it Every Day?

As inventors claim, a biometric payment card is a credit or debit card that uses the cardholders’ fingerprint to authenticate transactions. It brings a layer of security that’s currently missing in contactless payments, without impacting the user experience of speed.

The biometrics and personal data stores inside the card’s biometric sensor and no one can access it because of the extra-safe encryption. It means if a customer loses his card or someone takes it away, no one else can use it. The card doesn’t need batteries or recharging and can be used with existing terminals designed for contactless or chip-based payments.

The card can be used globally as any other Visa or MasterCard. Embedded in the card is an ultra-thin, low-power fingerprint sensor. A consumer can touch this from any angle, so authentication is fast and simple. Manufacturing biometric cards is straightforward too as the sensors are integrated using existing manufacturing processes.

One of the great benefits of biometric payment cards is that they’re incredibly easy to use. There’s no need to remember a PIN code or provide a signature for contactless or contact payments. There are three simple steps:

1. The cardholder touches the sensor and taps the card onto, or inserts it into, the payment terminal.

2. The sensor takes an image of the fingerprint, which is matched against the images stored on the card.

3. If the image match, the payment is authorized.

If the image doesn’t match the cardholder will be asked to enter their PIN as alternative authentication to prevent unauthorized card use. Identity theft protection is another one benefit offered by the biometrics credit and debit cards.

Nevertheless, other experts claim there are still problems with biometric security. One the most often mentioned fact is that all biometrics is public. People leave voice messages (voice recognition), look at different things, including cameras (eye recognition), leave fingerprints on cups, mugs, and glasses (fingerprint recognition). So anyone can copy your biometrics and use to steal your money. They also talk about greater consequences: since a biometric reveals part of a user’s identity, if stolen, it can be used to falsify legal documents, passports, or criminal records, which can do more damage than a stolen credit card number.

So, summing it up, according to researchers and experts, biometrics provide another level of security, but it’s not foolproof. However, it is a huge step in preventing card frauds. Anyone can try the new technology and decide is it enough secure and easy for usage.

Make your business safe for you and your customers. Contact the experts at Computools at info@computools.com.

Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.