The financial industry is said to be the hardest to innovate because of its complex and fragile legacy backed by EMV (Europay, MasterCard, Visa) standards. The recent rise of online payments, digital wallets, and cryptocurrencies, which altogether represent fintech, have marked a new era in financial services. Many experts call it a threat to the traditional global financial system that often remains obsolete at its core and uses outdated technologies to serve its customers.

The gap between traditional and innovative finance is immense. However, we’ve started seeing global banks such as JPMorgan, Goldman Sachs, Santander step onto digital transformation paths in an effort to become more valuable to its customers.

This article will highlight prominent differences between traditional finance vs DeFi vs CeFi and what underpins the existing gap in how financial services are carried out in the oldest banking institutions, centralized and decentralized finance companies. All sides have the same goal which is to enable people to use currency for financial services, but they achieve it in completely different ways.

What is traditional finance?

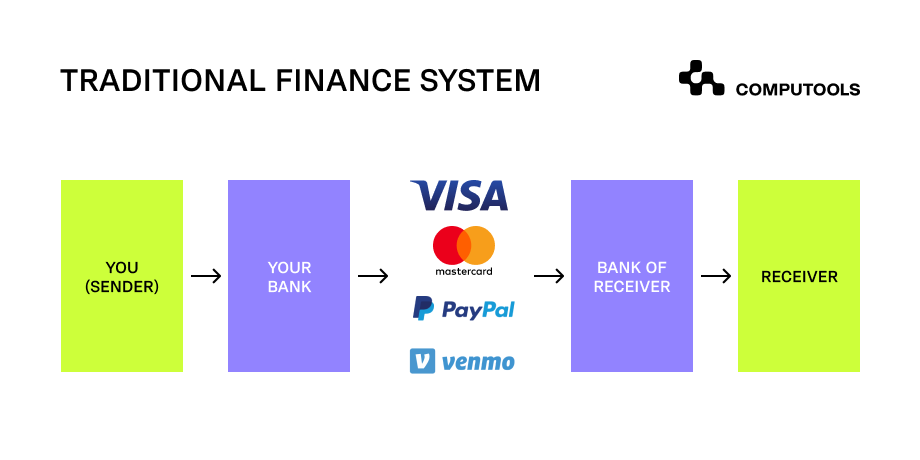

Traditional finance (TradFi) is a system based on a centralized authority that is in charge of all money customers give to it. Traditional finance is represented through multiple financial institutions like commercial banks, investment banks, brokerage firms, and insurance companies that are essentially middlemen between you and your money. These institutions act as third parties that facilitate money movement and each of them charges you a commission fee for their services. Traditional finance is a centralized finance system that works through custodial accounts – funds are held in trust by the bank with a promise that they will give them out whenever you claim for and any transaction is processed by a central authority.

In traditional finance, the main pillar of the system is that you have to trust the company you’re doing business with, you have to trust the bureaucracy that is in charge of your money and people behind it. You don’t have full control of your money. The source of trust is public governance, financial authorities, laws, licenses for financial institutions. In short, the trust is put in people, not code and math. It’s not immutable. They can undo your transactions if you fail to meet their requirements.

Features of Traditional Finance

| BENEFITS: | DISADVANTAGES: |

| Stability and security. Centralized systems are more stable and secure than decentralized systems because there is less risk of fraud or theft in a centralized system. | Less transparent. A centralized authority has more control over the flow of information, which makes other parts of the system less knowledgeable about what may be going on within the organization. |

| Traceability. Transactions are easier to track in a centralized system, which makes it easier to identify and resolve any issues that may arise. | Susceptible to corruption. People in charge may act in their own interests first rather than making sure each member of the system fairly benefits from financial services. |

| Better control and oversight. A centralized authority can manage all the financial operations of an organization in one place. | Less democratic. Traditional finance tends to favor bigger institutions and organizations which turn out to have more privileges than other players in the financial market like less favored SMEs or startups. |

| Cost-efficiency: transaction costs and speed are way higher against CeFi and DeFi. Say, MasterCard processes up to 5,000 transactions per second, while Bitcoin is able to do 7 transactions per second. | |

| Ready-made infrastructure: wide-ranged finance services from different firms and institutions |

Look to innovate your financial services?

Contact us →What is CeFi in crypto?

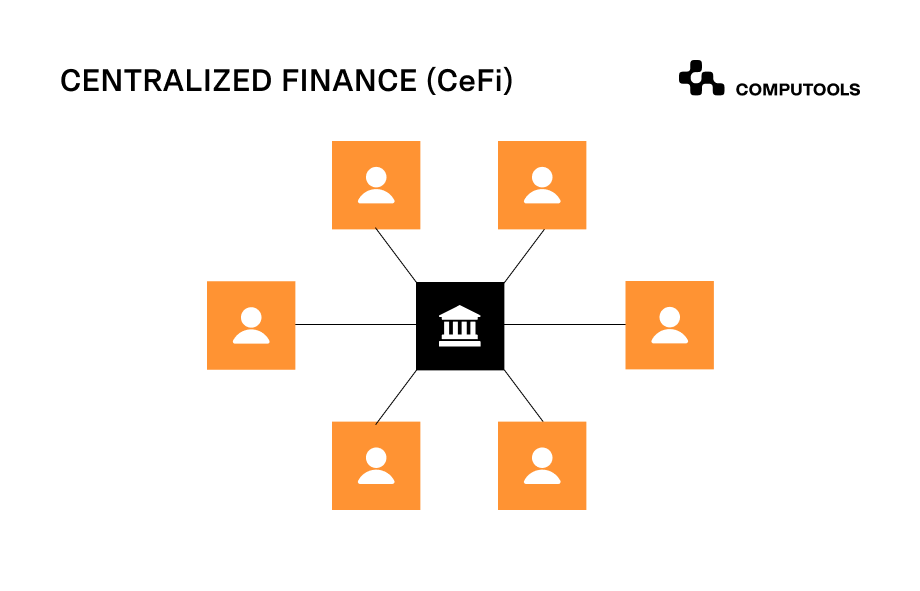

Since the origin of money, all financial systems used by humans have always been centralized. Centralized finance (commonly abbreviated as CeFi) refers to an ecosystem where a central authority manages financial assets and goods, while users are not aware of the rules behind the system they use. This authority can be a single individual, group or organization. The main benefit of CeFi is that it provides more stability and security for investors through standards that require users to verify their identity before being allowed to an exchange platform.

In the world of crypto, CeFi refers to crypto trading activities that happen under centralized finance. CeFi users do not make P2P transactions but need to be verified by a third party that collects and swaps digital assets between traders. Most CeFi systems are privately owned firms that deal with NFTs and cryptocurrencies. The most famous examples of centralized cryptocurrency services include Coinbase, Binance, or Kraken. Even though they tend to be more efficient and organized, the risk is that user funds are still stored and controlled by a central authority that creates its own rules and regulations for how assets need to be traded.

Features of CeFi

| BENEFITS: | DISADVANTAGES: |

KYC security. KYC verification protects CeFi systems from fraud, corruption and money laundering. CeFi is much alike to traditional finance in terms of security and customers believe that their funds are kept in a good place. | Centralized control. When faced with a crisis, most CeFi platforms usually take after traditional finance institutions. They suffer from bad liquidity, which may lead to their bankruptcy with no return of investment for investors. |

| Fiat-to-crypto. Users can easily convert large amounts of fiat money to crypto assets, which leads to high liquidity and good profit margins for traders. | Lack of transparency. It’s hard to know all the rules and policies of a CeFi system. They are at liberty to resort to investing customer funds in high-risk assets, but it’s impossible to control. |

| Cross-chain service. CeFi lets you exchange digital assets and cryptos across independent blockchains incapable of direct exchange. | High fees to middlemen. Depending on a CeFi platform’s rules, commission may impact the ultimate amount of money available at a user’s balance. |

| Infancy of DeFi platforms: as of now without established regulations, most investments remain high-risk and volatile, which doesn’t offer you long-term consistent profits. |

What is DeFi?

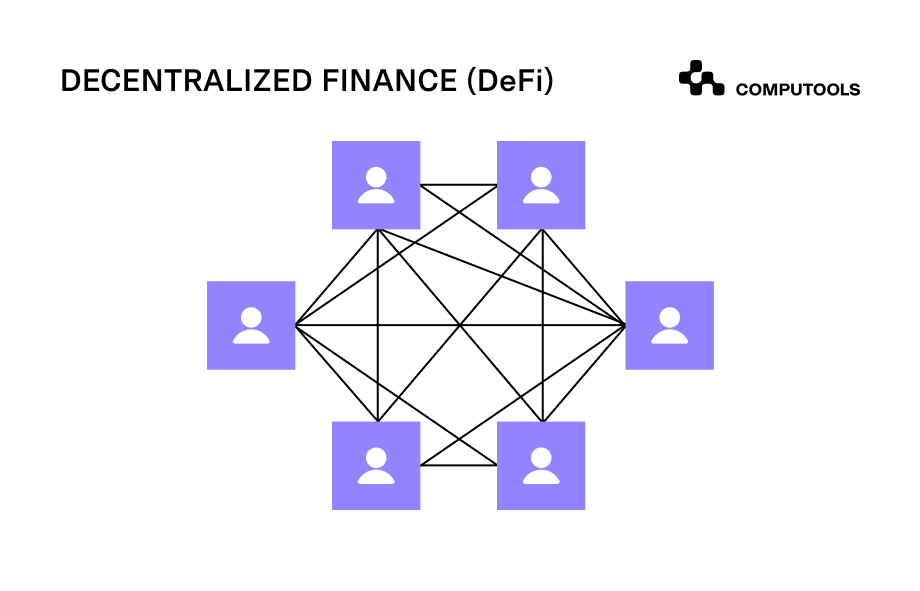

Decentralized financial technology (DeFi, also known as ‘open finance’) is a generic term used for all financial apps built on blockchain technology. DeFi is similar to lego blocks in a way that you can piece together all these different applications and they can all work together. A distributed, decentralized ledger is held by all blockchain users on the network eliminating the need for a central authority. DeFi eliminates intermediaries by allowing people, merchants and businesses to borrow, lend and trade directly. It works through financial software powered by smart contracts that record and verify financial actions in a DeFi platform.

The source of trust for DeFi is public blockchains with records stored across thousands of computers and transactions that are all publicly auditable. There is no court authority. Every participant of the network can access the history of transactions. Decentralized finance is a more open system. It is more transparent and doesn’t have many barriers which allows for innovation and ease of entry. DeFi gives people access to use their money whenever they want. There is no CEO at a bank that can prevent them from doing transactions.

Features of DeFi

| BENEFITS: | DISADVANTAGES: |

| Permissionless. There is no need to abide by KYC regulations because financial services are accessed through a digital wallet. | More volatile and risky. Lack of insurance distributes all the risks equally across all participants. In case of fraud, all blockchain’s users can bear losses. |

| P2P assets swap. Asset exchange happens without middlemen because organizations or individuals can trade directly without commission. | Low interoperability. Each blockchain has its ecosystem and apps. Interaction between different blockchains is not smooth enough yet. |

| More transparent and democratic. DeFi offers access to a large pool of financial services without third-party supervision or central authority. | Scalability. Transactions via blockchain take long to complete. Blockchain still cannot process enough transactions per second to outperform traditional centralized finance. |

| Cost-demanding. Most DeFi products offer finance services at higher commissions or fees against those from traditional finance companies. |

The DeFi ecosystem is growing superfast, with new things being created every single day. One of the great things about DeFi is that no matter who you are, you can have access to the same tools as a top trader at a US financial firm.

Currently most innovation is happening on Ethereum. In the future, it is more likely to be many blockchains running different types of decentralized applications that can all communicate with each other. For example, Ethereum is like a printing press for open financial apps these days. It lets anyone build new financial services on top of Ethereum Blockchain and interact with those financial services via a crypto-wallet.

These are some of the services that can be received through DeFi.

• Decentralized synthetics: democratizes access to financial products (synthetic gold, silver, wheat)

• Decentralized exchanges: allows you to trade between tokens (P2P trading)

• Decentralized insurance: helps you counter ‘black swan’ events

• Decentralized stablecoins: removes volatility associated with crypto-currences

• Decentralized money markets: lending and borrowing using cryptocurrency as a collateral

Tech side: Key crypto differences between DeFi vs CeFi

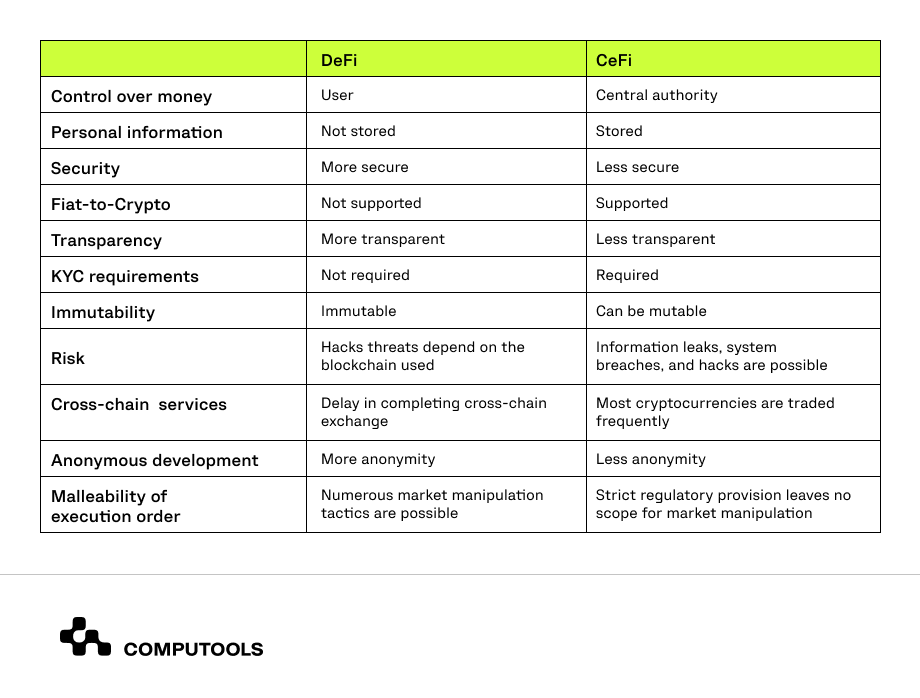

While CeFi expects you to trust a company, with DeFi, you need to trust mathematics and algorithms (protocol). In CeFi apps, you cannot know anything at all that is happening under the hood. You cannot know what rules are applied by platform owners to manage your digital assets. By contrast, all DeFi apps keep their data inspectable on the blockchain, so you can see what’s happening and going on at any moment in time.

Here are the most important differences between CeFi vs DeFi ecosystems.

How to bridge the gap between Traditional Finance vs DeFi vs CeFi

The infrastructure of the finance industry is a mingled one. It is multi-layered and complex. On the one hand, we have seen the inefficiencies of the oldest banking system that doesn’t offer equal opportunities for receiving quality financial services to startups, SMEs, and individuals. On the other hand, we’re still in the early days of CeFi & DeFi evolution when there is no strict jurisdiction for digital assets and decentralized finance as a whole. CeFi and DeFi platforms may be efficient but flawed which can lead to massive bankruptcy if they fail to invest customer funds in secure and properly collateralized assets.

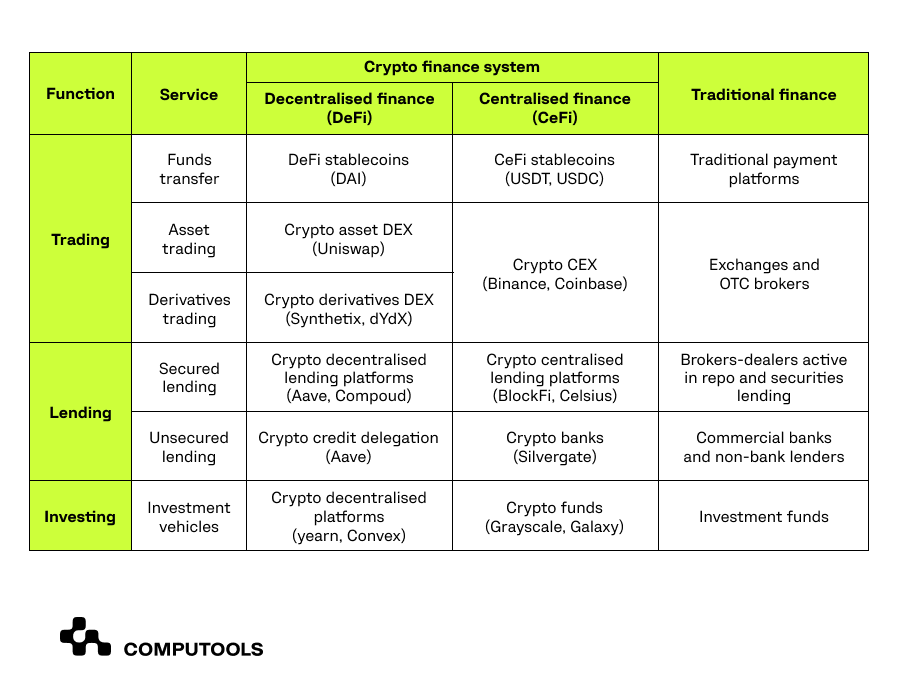

Today, it is possible to receive a variety of financial services in all three ways. Say, a small company can be credited by a banking institution, a P2P lending platform or a crypto decentralized lending platform. Each way to get funded will be different, with its merits and demerits. The point is that the finance industry is becoming sufficiently diversified to let every player on the finance market benefit from wide-ranged financial solutions that can ease their business management and inject more capital into their growth.

Take a quick look at the comparative table below to see how the same financial need is fulfilled in each type of finance.

Wrapping up: Thing to consider during financial software development

The idea that financial technology is meant to disrupt the financial sector as a whole is a misconception. Every innovation is an opportunity as well as a threat. If you’ve faced with a need to improve your accounting department or find a solution to manage real estate portfolios for different clients, it’s high time to kick off custom financial software development that will help you come up with a flexible solution that fits into your business model and eliminates the bottlenecks in your business workflows.

If you are unsure where to start, schedule a consultation with Computools’s experts at info@computools.com.

Computools was selected through an RFP process. They were shortlisted and selected from between 5 other suppliers. Computools has worked thoroughly and timely to solve all security issues and launch as agreed. Their expertise is impressive.